-

Please adjust the volume.

First Quarter 2022 Business Results

Greetings and Summary

Good afternoon. My name is Peter Kweon, the Head of IR at KB Financial Group. We will now begin the 2022 first quarter business results presentation. I'd like to express my deepest gratitude to everyone for participating today. We have here with us our group CFO and Senior Managing Director, Scott Y. H. Seo, as well as other members from our group management. We will first hear the 2022 first quarter major financial highlights from CFO and then have a Q&A session. I would like to invite our CFO, Mr. Seo to deliver our 2022 first quarter earnings results.

Good afternoon. I am Scott Y. H. Seo, CFO of KB Financial Group. Thank you for joining KBFG's first quarter earnings presentation. Before moving on to earnings results, I will first run through key business highlights for KBFG for Q122.

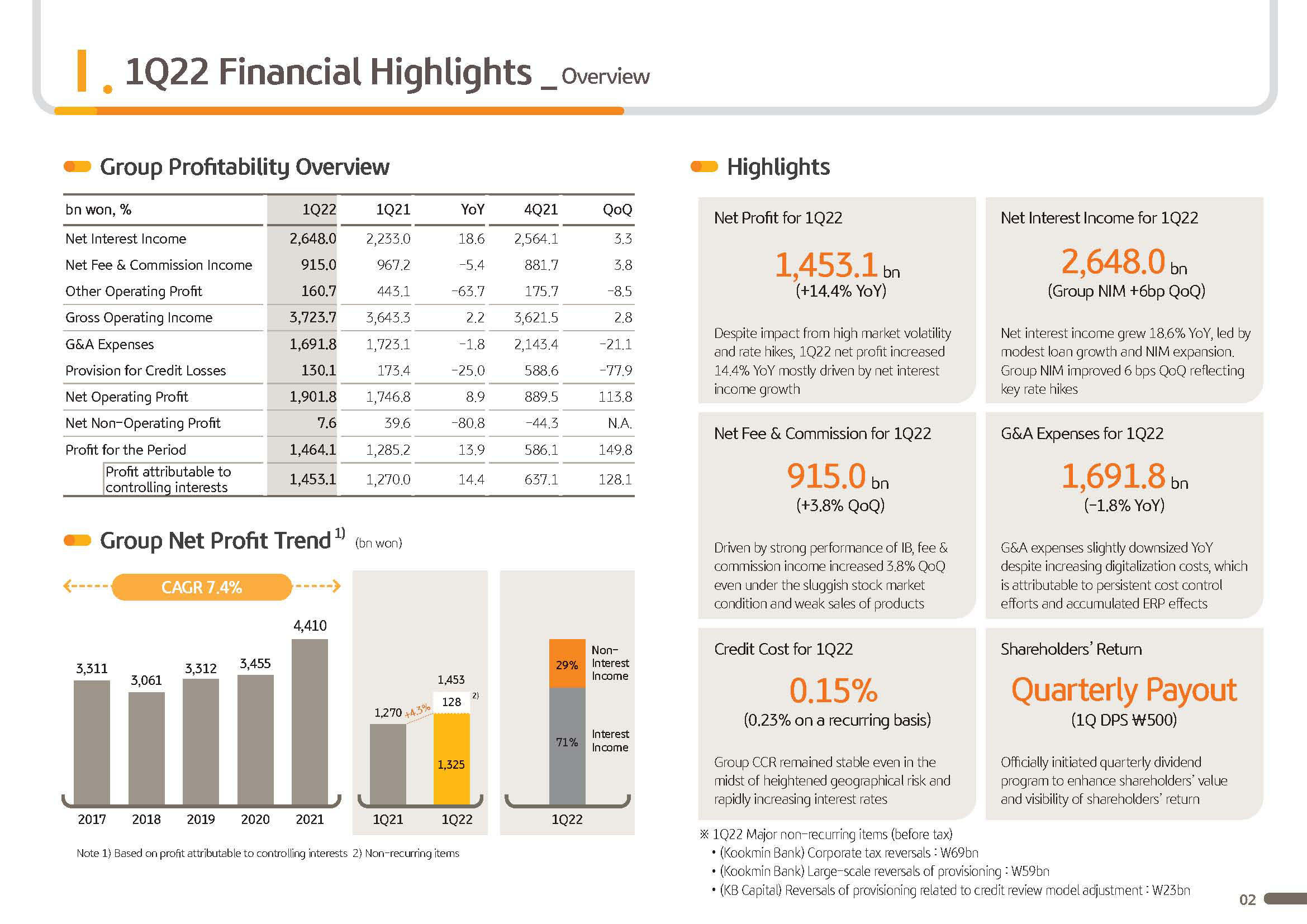

First, Q122 net profit based on profit attributable to controlling interest was up 14% year-over-year to KRW 1.45 trillion, outperforming market consensus by 13%. Annualized EPS was KRW 14,892, up 14% over year, while ROE came in at 13.2%, improving 0.7 percentage points year-over-year.

Q1 profit, net of one-off factors on a recurring basis was up 4% year-over-year, which shows KB Financial Group's robust earnings capacity despite market uncertainties and lower trading and retail commission income following the rate hikes.

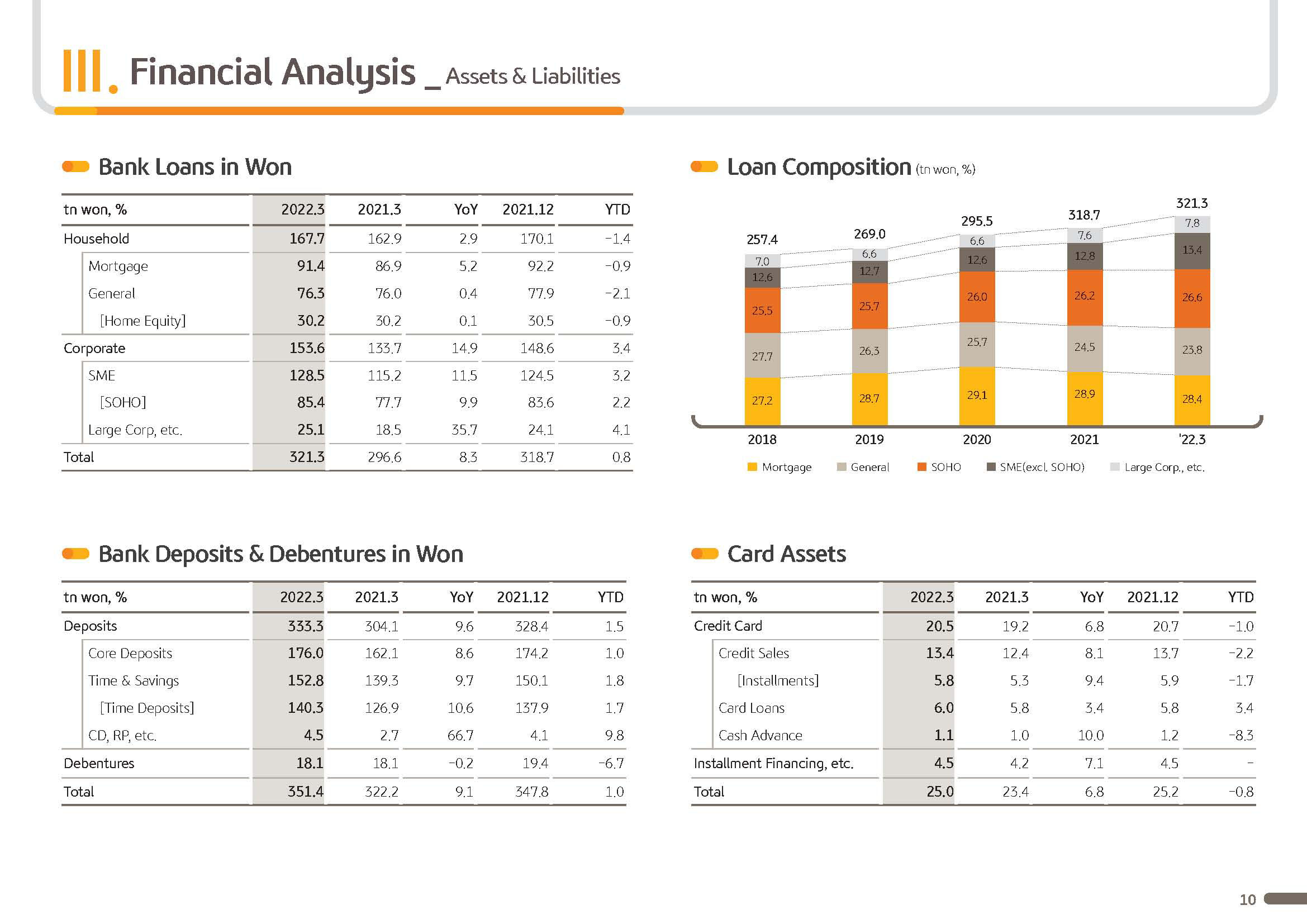

Second, despite declines in household loan balance, thanks to market dynamics over rate hikes, there has been strong demand for SME and CIB lendings. And as a result, group's loans in won was up 9.7% year-over-year.

Despite strong corporate demand and weak capital markets and quarterly dividend payout, 2022 end of Q1 CET1 ratio was 13.4%, on par with 2021 year end level, and Tier 1 and BIS ratios compared to end of last year was up by 14 to 23 basis points, respectively. KBFG is proud to say that it has the industry's best capital adequacy ratio.

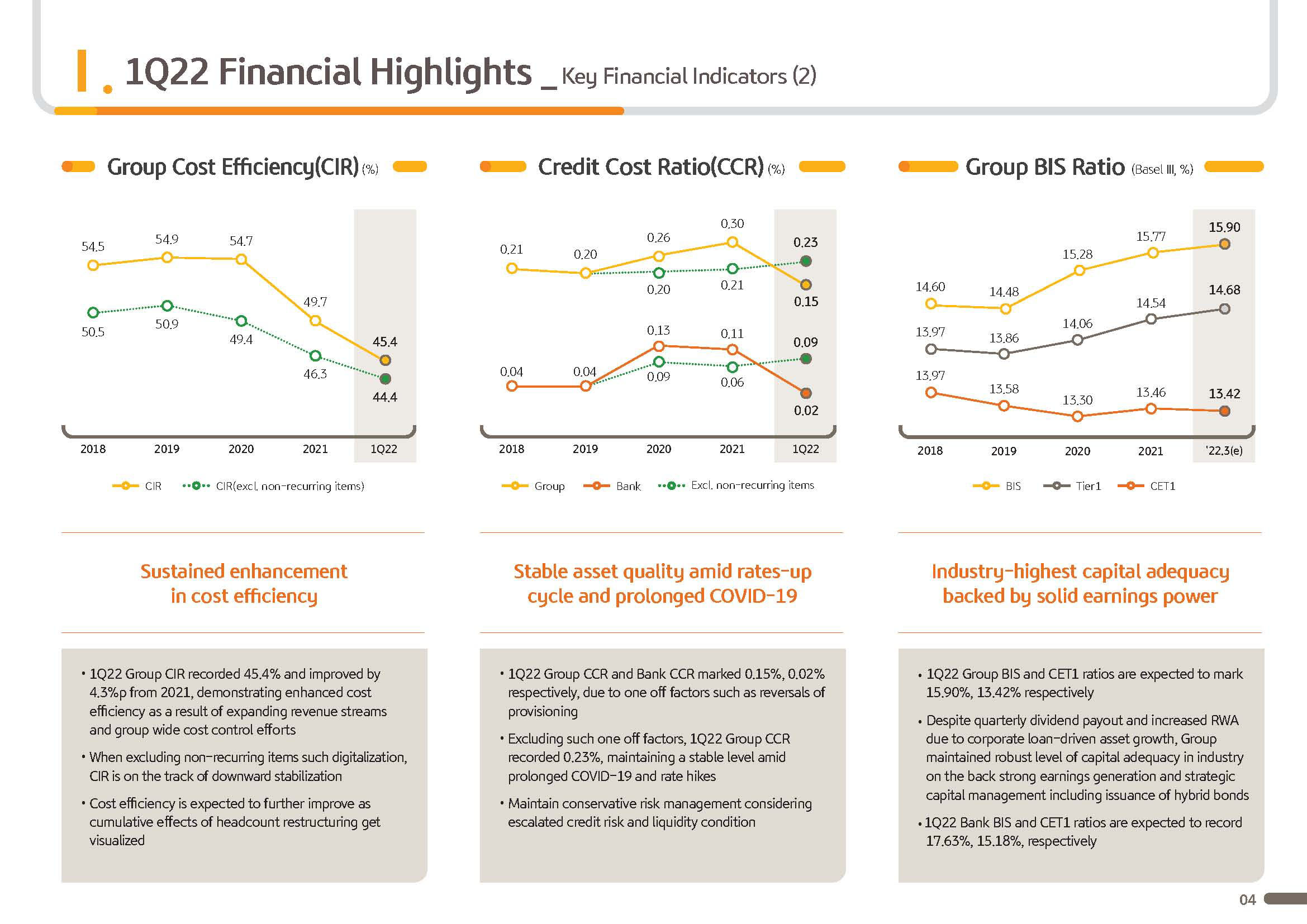

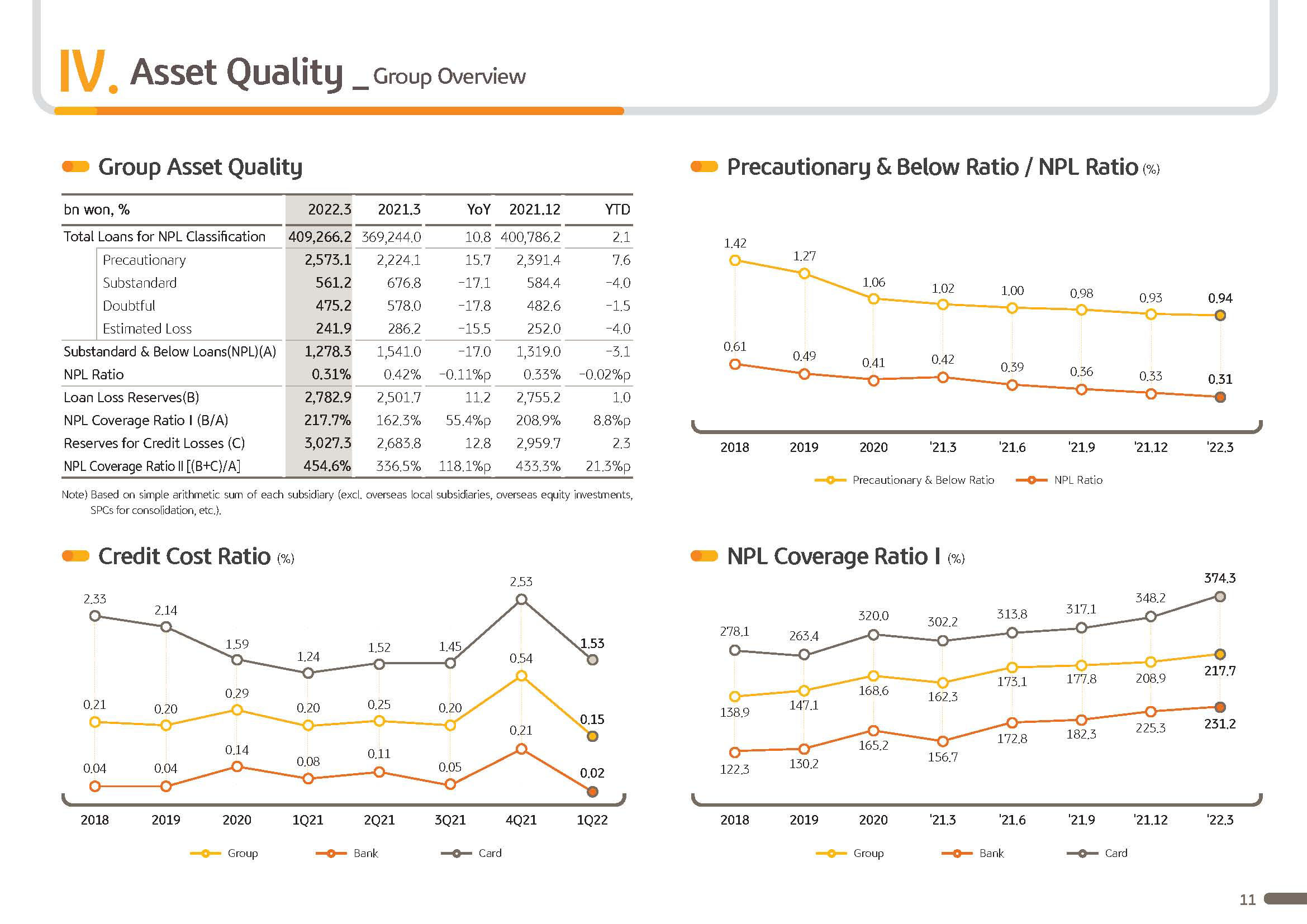

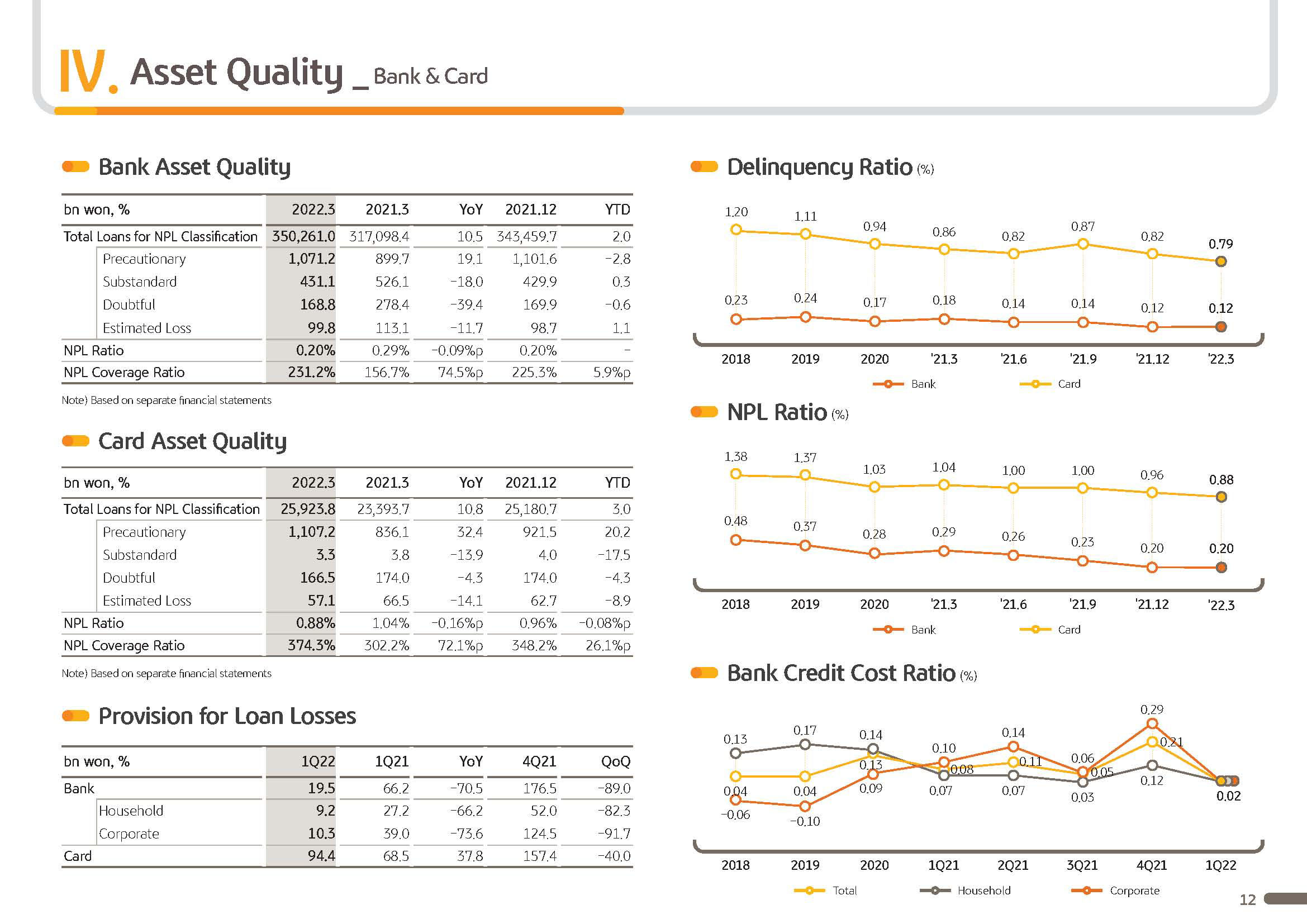

Third, nominal credit cost for the group in Q122 was around 15 basis points, but credit cost on a running basis, after considering for one off reversals, was 23 basis points, as we maintain conservative provisioning stance above the average of 3-year period before the pandemic. Also, NPL coverage ratio in Q122 was 218%, up 71 percentage points versus before the pandemic. And NPL coverage ratio had been uptrending for the past 4 consecutive quarters.

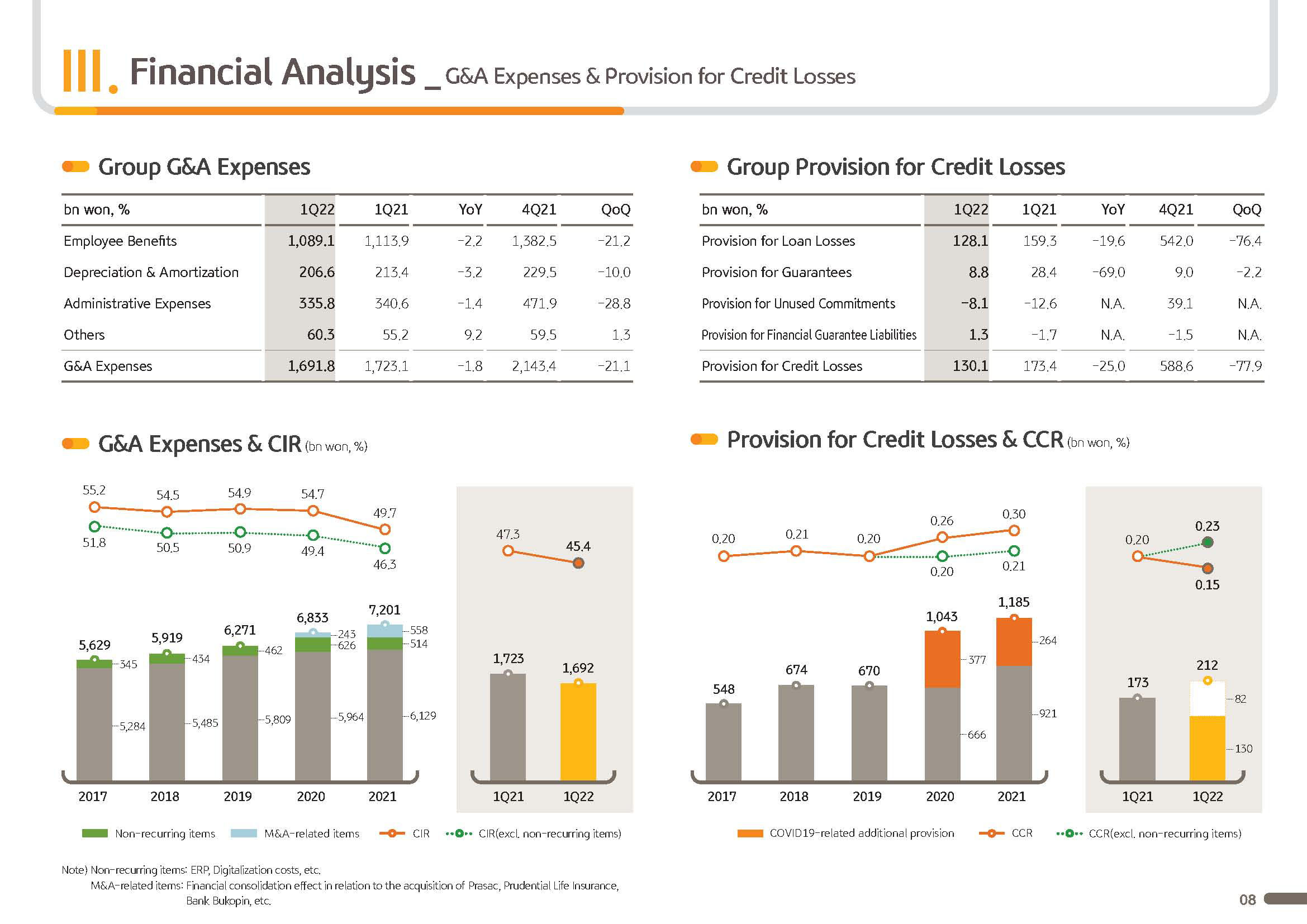

Fourth, despite group's investment into digitalization and rise thereof, on the back of corporate-wide cost control efforts and built-up effect of headcount efficiencies, G&A was down 2% on-year with cost-to-income ratio reporting 45.4%, which is down by 4.3 percentage points compared to CIR of 21.

Fifth, following share cancellation of KRW 150 billion last February, the BOD today made a resolution on Q1 quarterly dividend of KRW 500 per share and set in place quarterly dividend payout program. Quarterly dividend program helps to enhance visibility of dividend payout and shows the commitment of the BOD and the management to develop and advance shareholder return system. KBFG will consider various other approaches to enhance shareholder value and will implement them in a consistent manner.

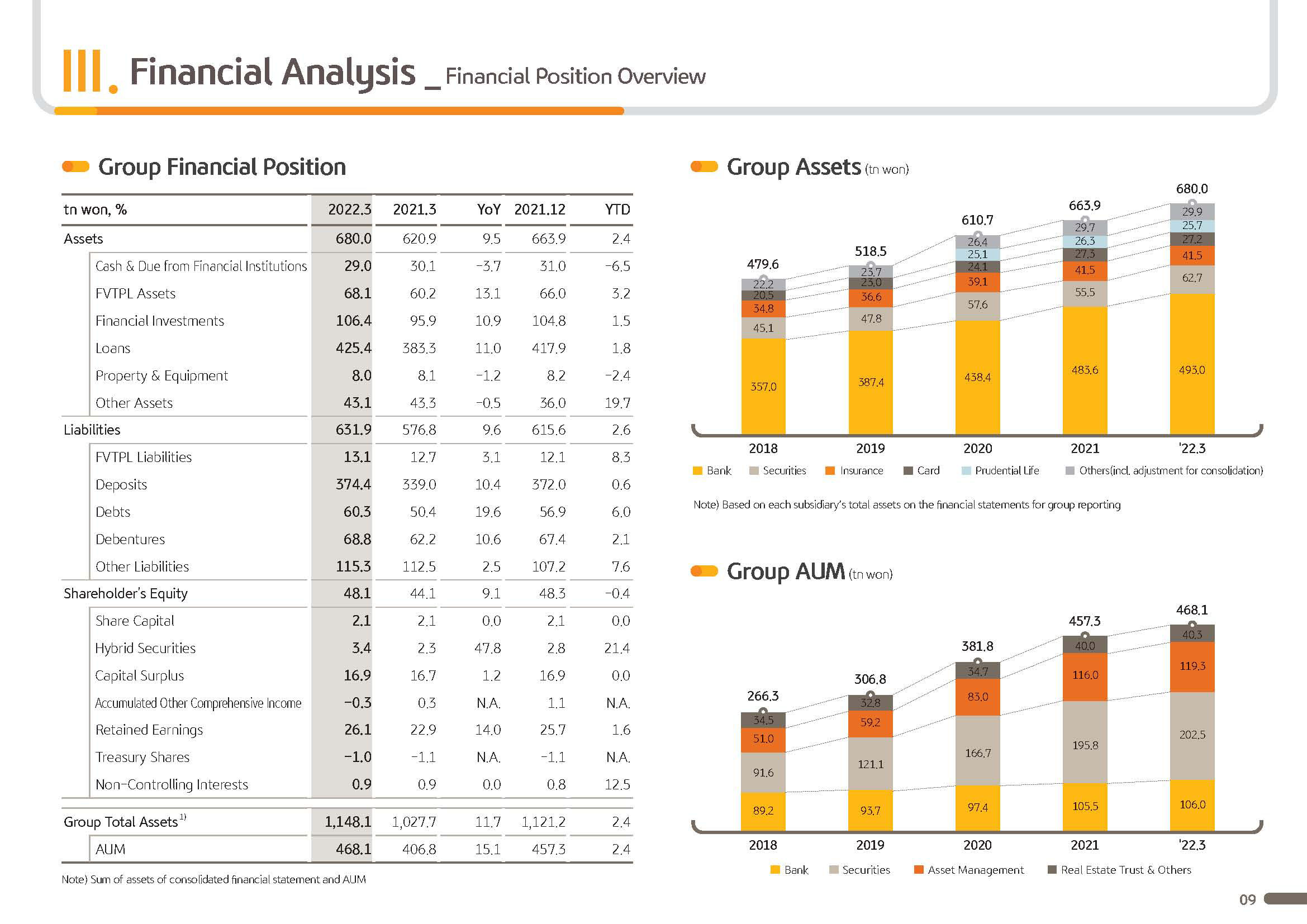

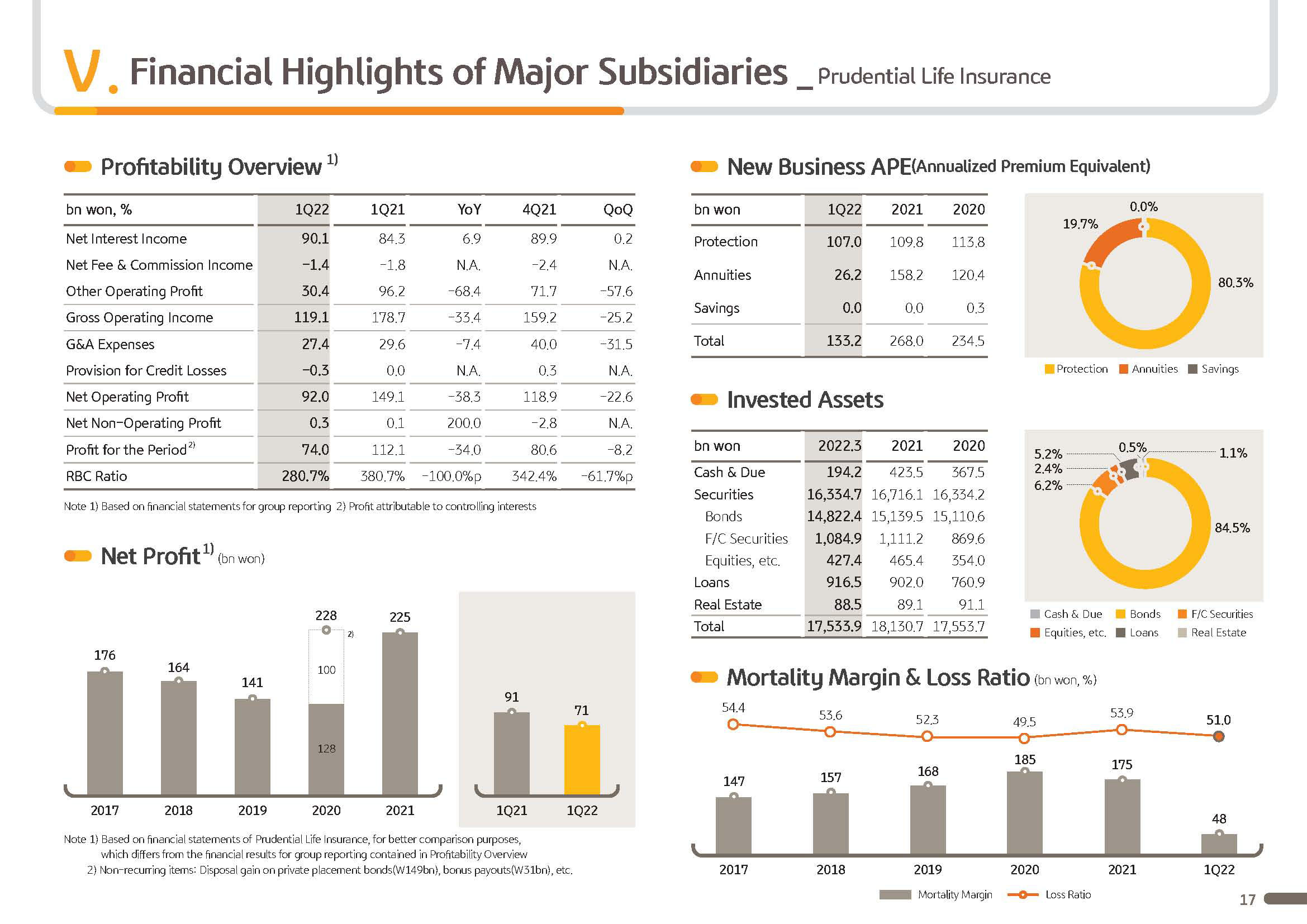

Lastly, we plan to integrate Prudential Life, which was managed on a stand-alone basis so far, with KB Life Insurance and complete the merger process by the end of the year. Integration of the two subsidiaries will help improve capital adequacy in time for IFRS 17 implementation and bring economy of scale for the life insurance business and enable differentiated and comprehensive financial consulting services. As an integrated life insurer, we expect to gain greater market competitiveness.

Now let's move on to the details of Q122 results, Page 2.

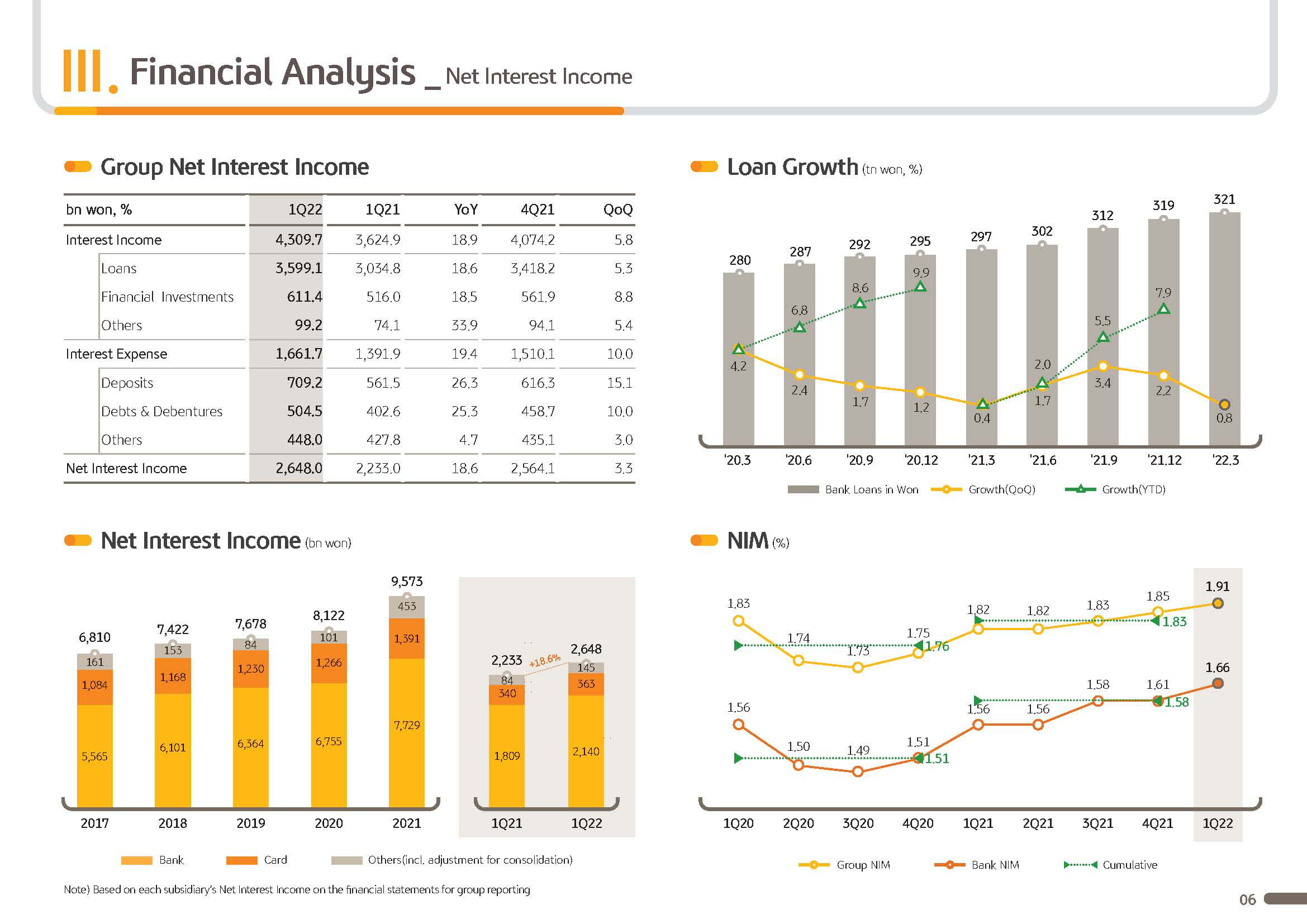

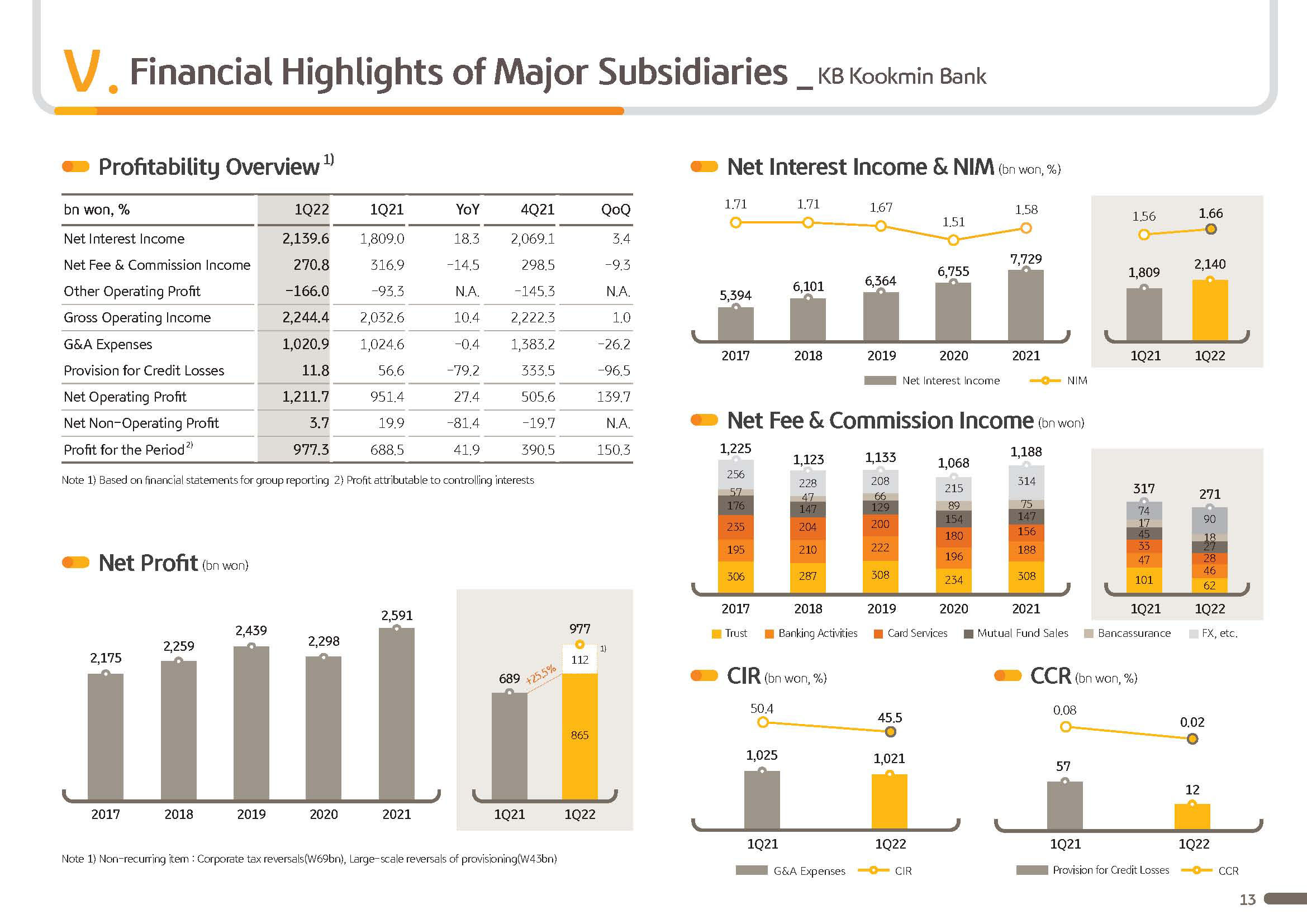

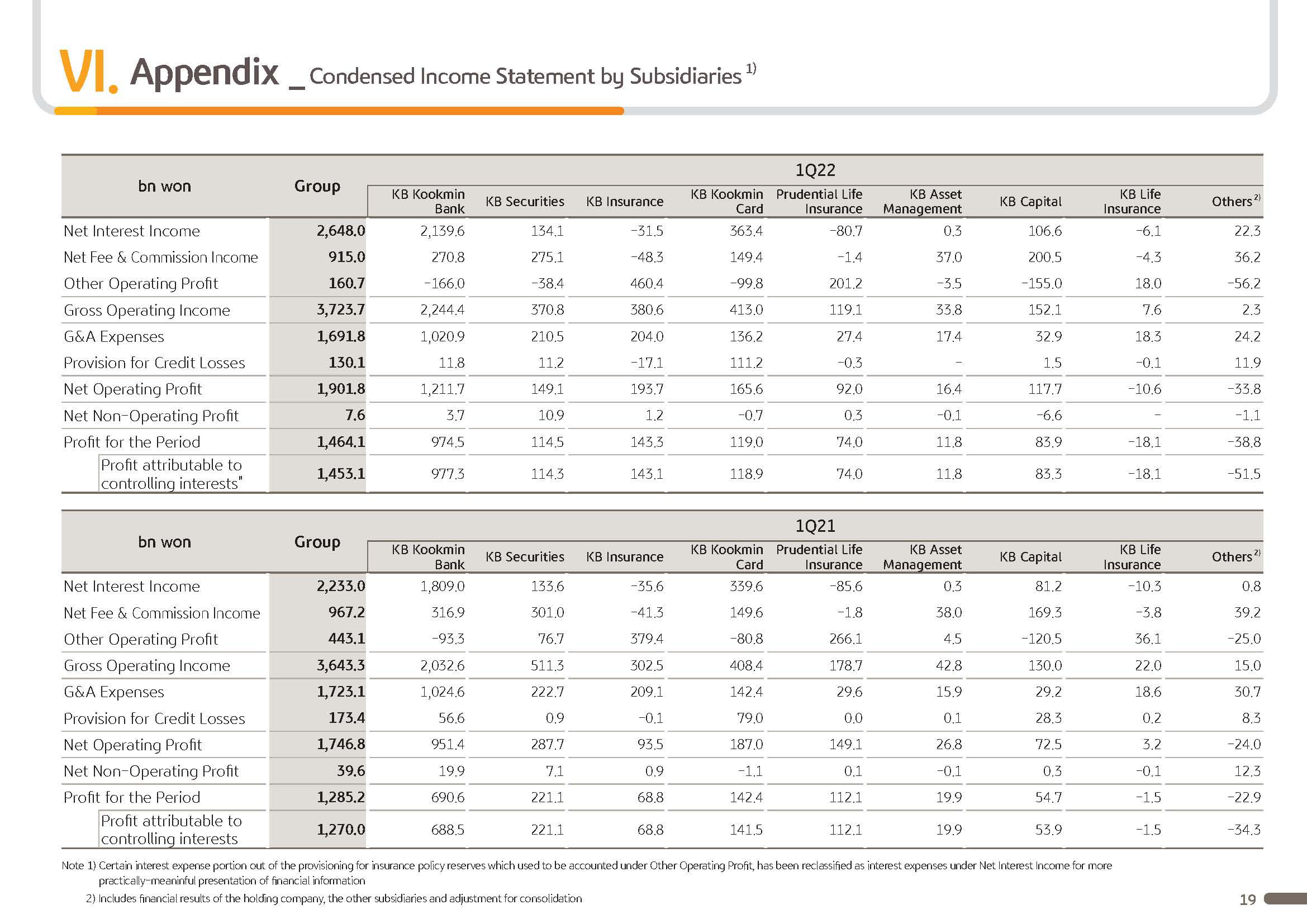

Q1 group net interest income was KRW 2,648 billion, up 18.6%, or around KRW 400 billion year-over-year.On rate hikes, which led to asset repricing, group NIM was up 6 basis points, driving up NII up 3.3% on quarter. Please note that to provide financial information for better practicality, starting this earnings call, out of the provisions for insurance liability reserve, we reclassified interest expense paid out to policyholders as interest expense under net interest income and restated historical performance through retroactive treatment.

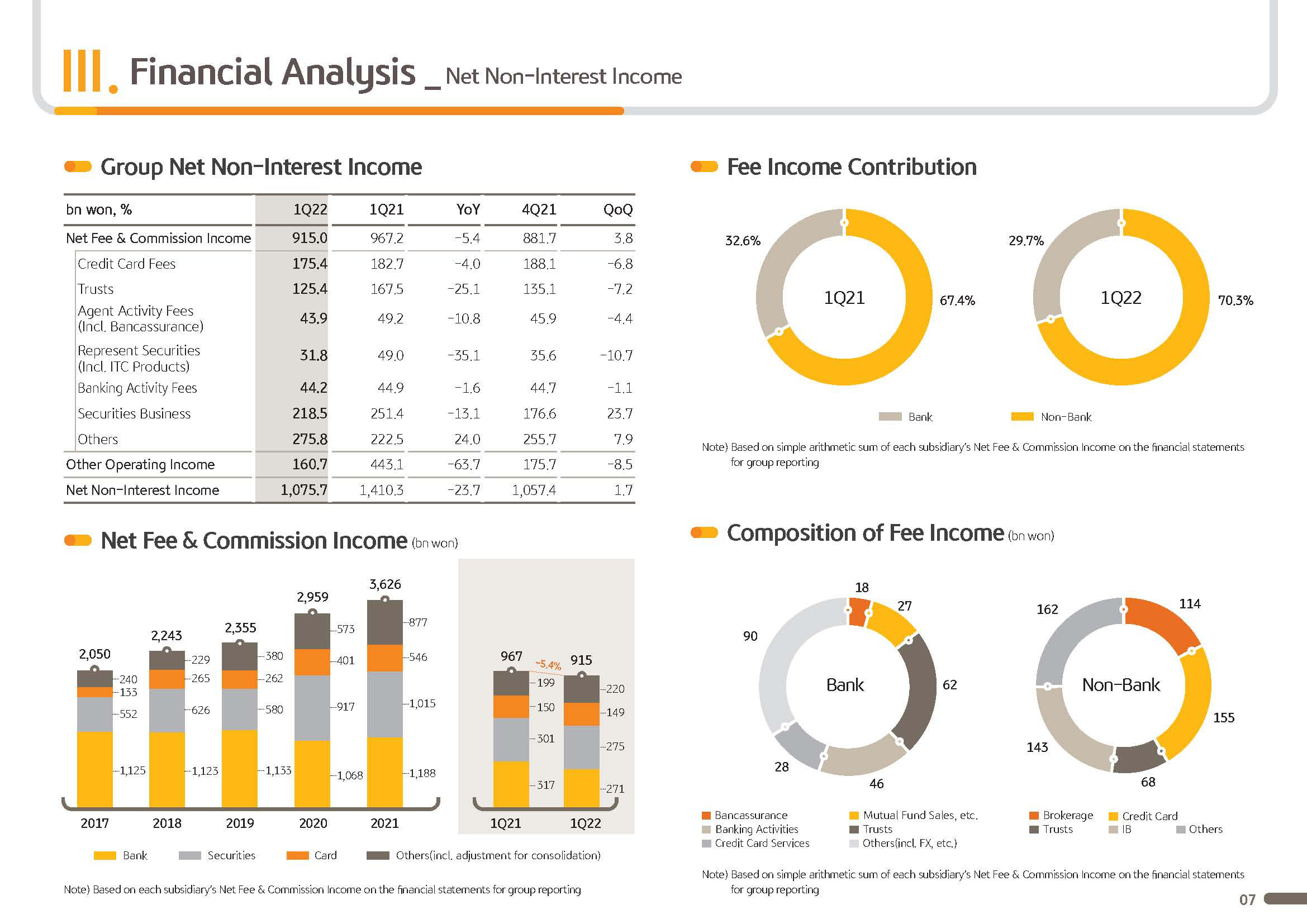

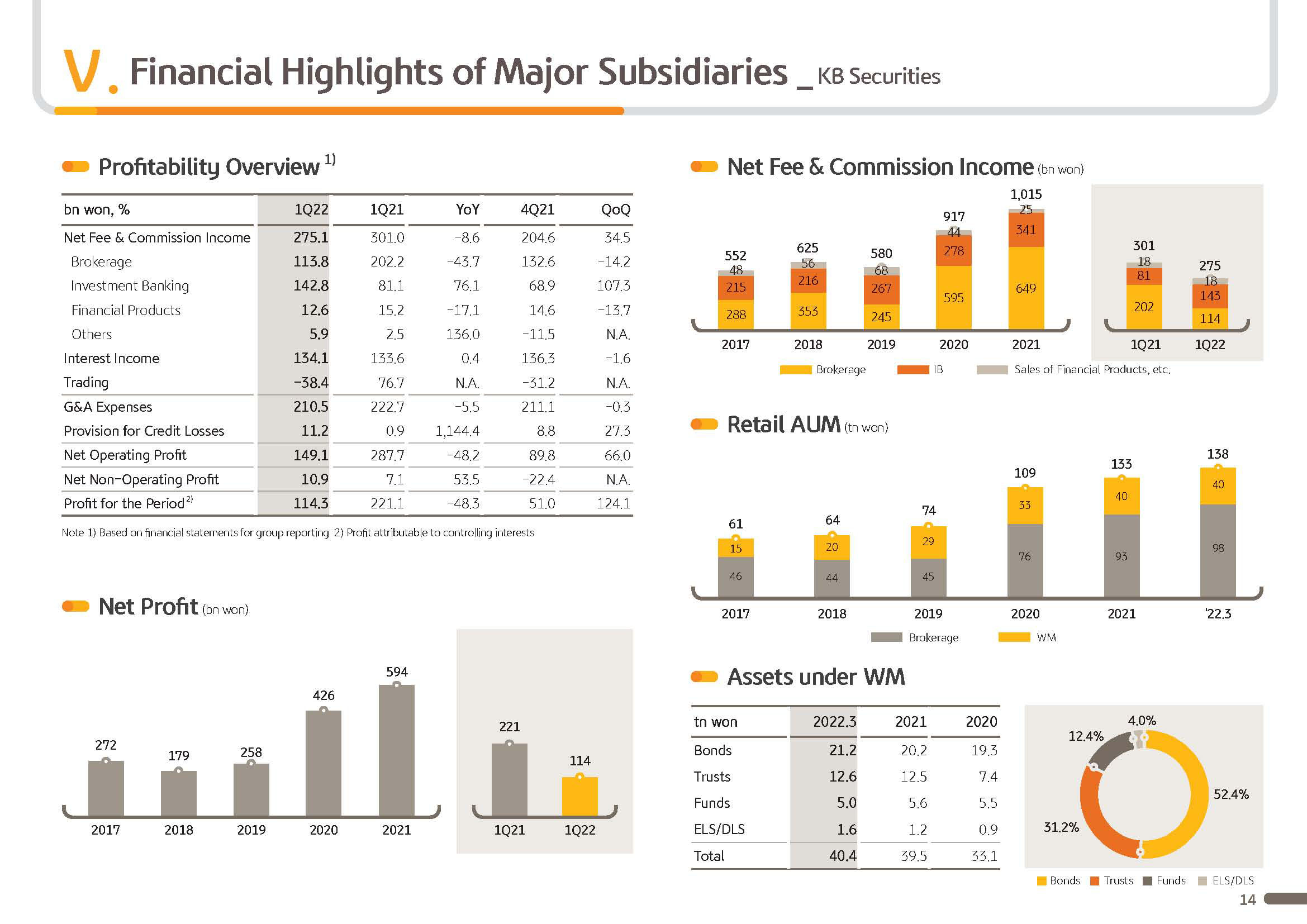

Next is on fee and commission income. Group's Q1 net fee commission income was KRW 915 billion. And despite sluggish stock market and financial product sales and difficult operational backdrop, performance was strong with 3.8% Q-on-Q growth. This is a result of continuous effort put in to gain competitiveness in not only DCM, but also ECM of the securities business, which resulted in a solid and dominant positioning in the IPO market. On a year-over-year basis, net fees and commission income dipped slightly due to the base effect from Q1's high base of brokerage fee income last year and weak performance from the bank's trust business.

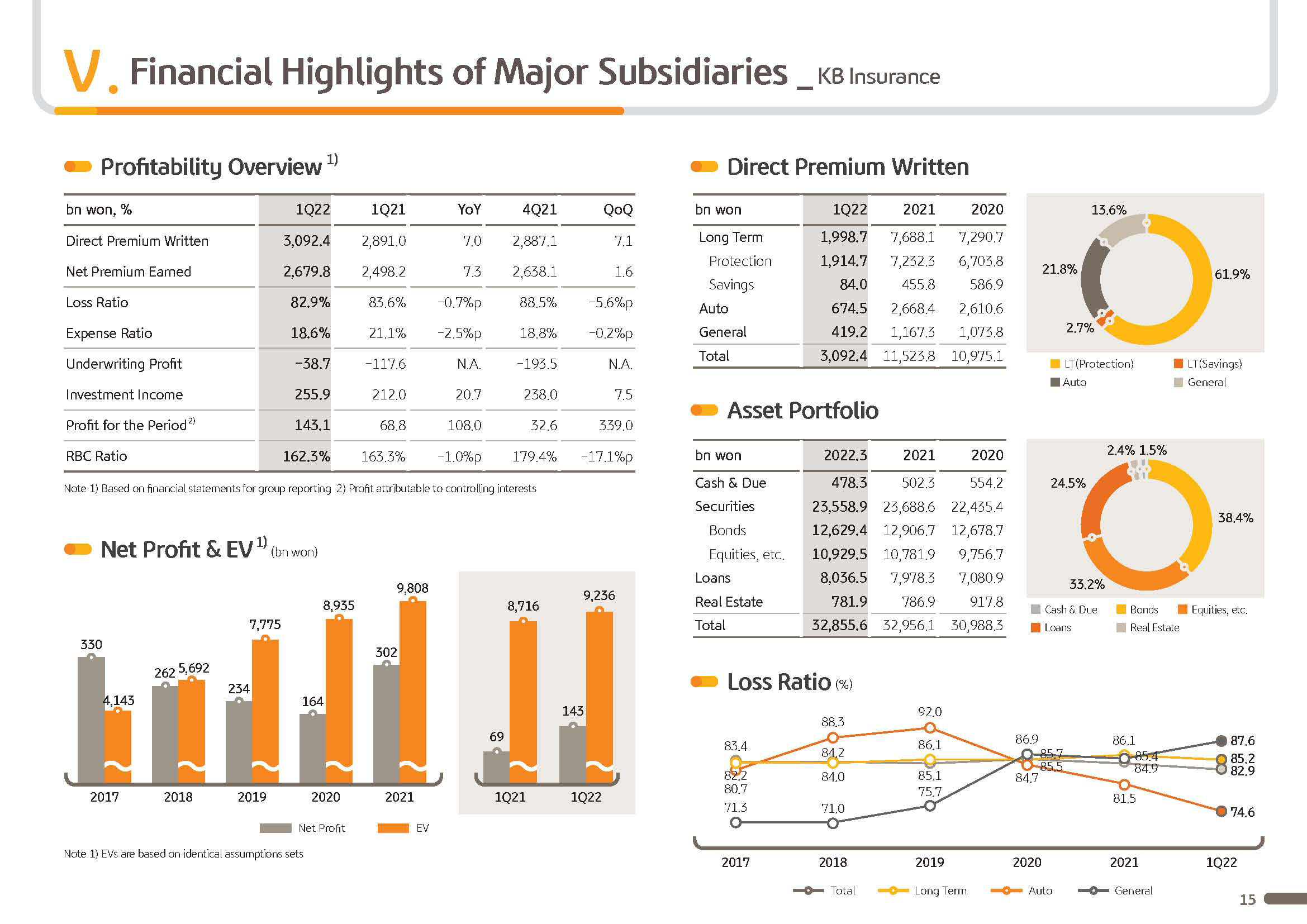

Q1 other operating profit recorded KRW 160.7 billion, and rise in bond yields and sluggish stock market, Securities and derivative performances were weak, which led to overall subdued result on a year-over-year basis. But with loss ratio improvement for the P&C insurance business, insurance income was up, keeping other operating profit flat Q-on-Q.

For your reference, for KB Insurance, driven by loss ratio improvement, mostly around auto insurance and rise in net premium earned, it reported a net profit of KRW 143.1 billion in Q1, continuing the recovery trend.

Next, on G&A expense. Q1 group G&A was KRW 1,691.8 billion. Although we are expanding digitalization investment at the group level, our cost saving efforts, including for labor costs, have paid off with G&A down around 2% year-over-year. Except for investments for future, we plan to review our cost base from point zero and thoroughly manage costs and continue to revamp our headcount organization.

Q1 Provisioning for credit losses(PCL) was KRW 130.1 billion, down 25% year-over-year. The bank recovered large sum of bad loans, reversing KRW 59 billion in provisioning. And through upgrading the formula for calculating the loan loss provisions, there was around KRW 23 billion of write-backs. And excluding such one-off impact, provision on a running basis reported around KRW 210 billion. Recurring PCL slightly inched up year-on-year on the back of asset growth, but on credit cost basis is at 0.23%, sustaining a steady level.

Next is on key financial indicators, Page 3.

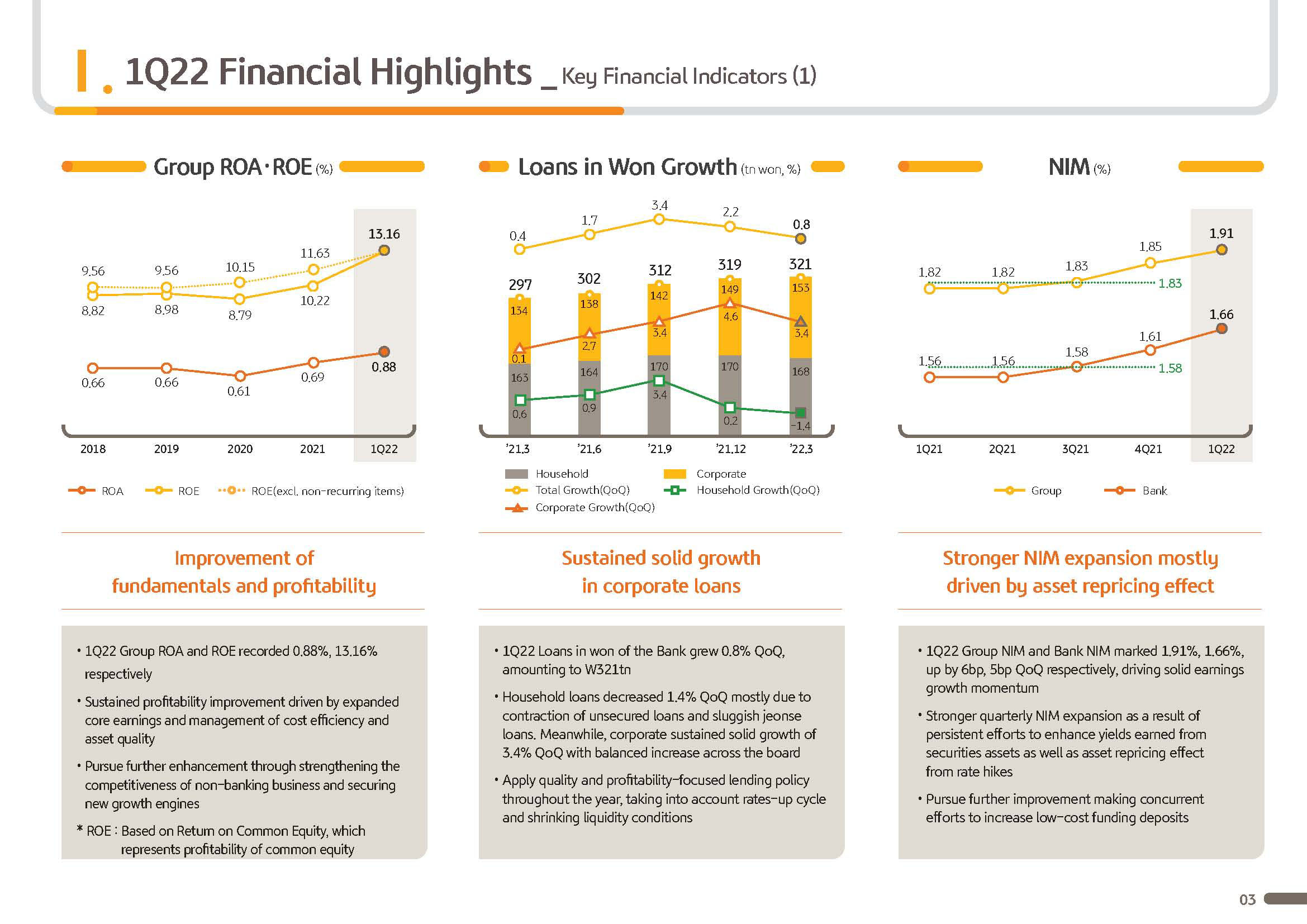

In the first quarter 2022, the group ROA and ROE recorded 0.88% and 13.16%, respectively, showing a continued improvement in the group's profitability. If we look at the loans in won growth graph, as of the endof March 2022, the bank loans in won stood at KRW 321 trillion, which is a 0.8% growth YTD. In the case of corporate loans, thanks to a balanced increase in SME, SOHO and large corporate loans, corporate loans grew 3.4% YTD, which is a growth of approximately KRW 5 trillion, sustaining robust growth.

Household loans, impacted by the rise in interest rate and regulations, decreased by 1.4% YTD, mostly due to the contraction of unsecured loans. This year, the group will continue to focus on profitability and quality in its lending policy. But with respect to household loans, to protect end borrowers and secure a solid presence in the market, we will apply a flexible interest rate policy in some cases, and agilely respond to changes in household loan regulations.

Next is the NIM. In the first quarter 2022, the group NIM increased by 6 basis points quarter-on-quarter to 1.91%. This is an 8 basis point rise compared to the 2021 annualized NIM, which shows the group's strong profit growth momentum is reinforced even further this year. Such strong quarterly NIM expansion resulted from not only the bank's asset repricing effect of the three hikes in the key interest rates since August last year, as the future monetary policy direction was reflected in advance in the market interest rate, but also our persistent efforts to enhance yields earned from securities assets.

Next page, the group cost efficiency, the credit cost ratio, and the group BIS ratio were explained earlier.

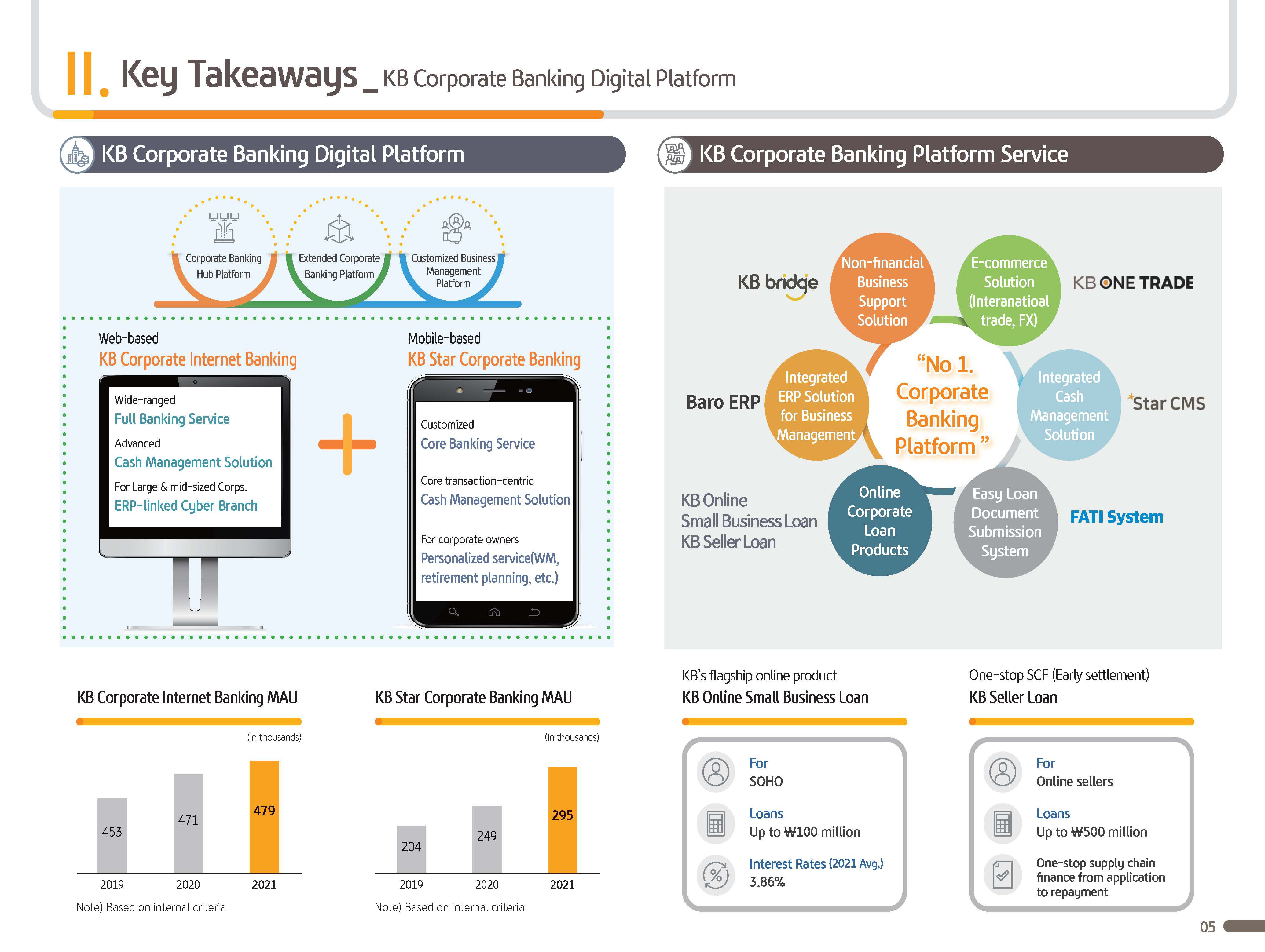

Next, in this page, I'd like to address the competitiveness of KB Financial Group's corporate banking digital platform that sets us apart. Based on our expertise in corporate banking, we have built the corporate banking digital platform that features various business support services and product lineups. And internally, we have been continuously advancing the platform since quite long ago. Recently, with Internet-only banks entering in the corporate loan market, there has been heightened market interest and the competitiveness of corporate banking platforms.

We have two types of platforms that are optimized for the different needs of various types of corporate clients. The web-based KB Corporate Internet Banking provides full banking services, while the mobile-based KB Star Corporate Banking supports not only core banking services, but also asset management needs as well. We are reinforcing the differentiated competitiveness of each of these platforms.

The KB Corporate Banking platforms supports not only corporate banking transactions, such as deposits, loans and FX transactions, but also features Star CMS, an integrated cash management solution; and KB One Trade, an e-commerce solution for international trade and FX; and KB Bridge, a nonfinancial business support solutions such as recommendation of customized policy funds and professional advisory services. As such, we offer industry-leading differentiated services to meet the various needs of our corporate clients.

As banking services and corporate management activities are intricately linked, we have been able to develop corporate client relationships that go beyond just simple loans. For your reference, the KB Corporate Internet Banking MAU is recorded at about 480,000 as of the end of last year, and KB Star Corporate Banking MAU stands at about 300,000 currently, which is the highest level in the industry. Recently, this growth trend has accelerated, and we soon expect it to be the main corporate banking platform of KB.

Lastly, in terms of products as well, in line with the growing online channel and changes in the competitive landscape, we have preemptively and proactively addressed these changes. The KB online small business loan is KB's flagship online known product for sole proprietors that features an loan limit of up to KRW 100 million and competitive interest rates. The KB Seller Loan, launched in 2018 was the first early settlement loan product offered in the banking industry in Korea. Since its launch, it has become very well received by online seller clients and maintains market leadership in supply chain finance.

We will continue to collaborate with external platforms to launch loan products based on alternative credit information, develop differentiated product lines in corporate banking, and lead the corporate banking market. Moreover, we will establish an extended corporate banking platform to offer various corporate banking services of our subsidiaries on KB Star Corporate Banking to become the #1 banking platform in corporate finance.

The following pages are detailed information on the earnings results I have just covered, so please refer to them at your leisure. This concludes the KB Financial Group's 2022 first quarter earnings results presentation. Thank you for your attention.