-

Please adjust the volume.

1H22 Business Results

Greetings.

I am Peter Kweon, the Head of IR at KBFG. We will now begin the 2022 first half business results presentation. I would like to express my deepest gratitude to everyone for participating today. We have here with us our Group CFO and Senior Managing Director, Scott Seo, as well as other members from our group management. We will first hear the 2022 first half major financial highlights from CFO and Senior Managing Director, Scott Seo, and then have a Q&A session. I would like to invite our Senior Managing Director to deliver 2022 first half earnings results.

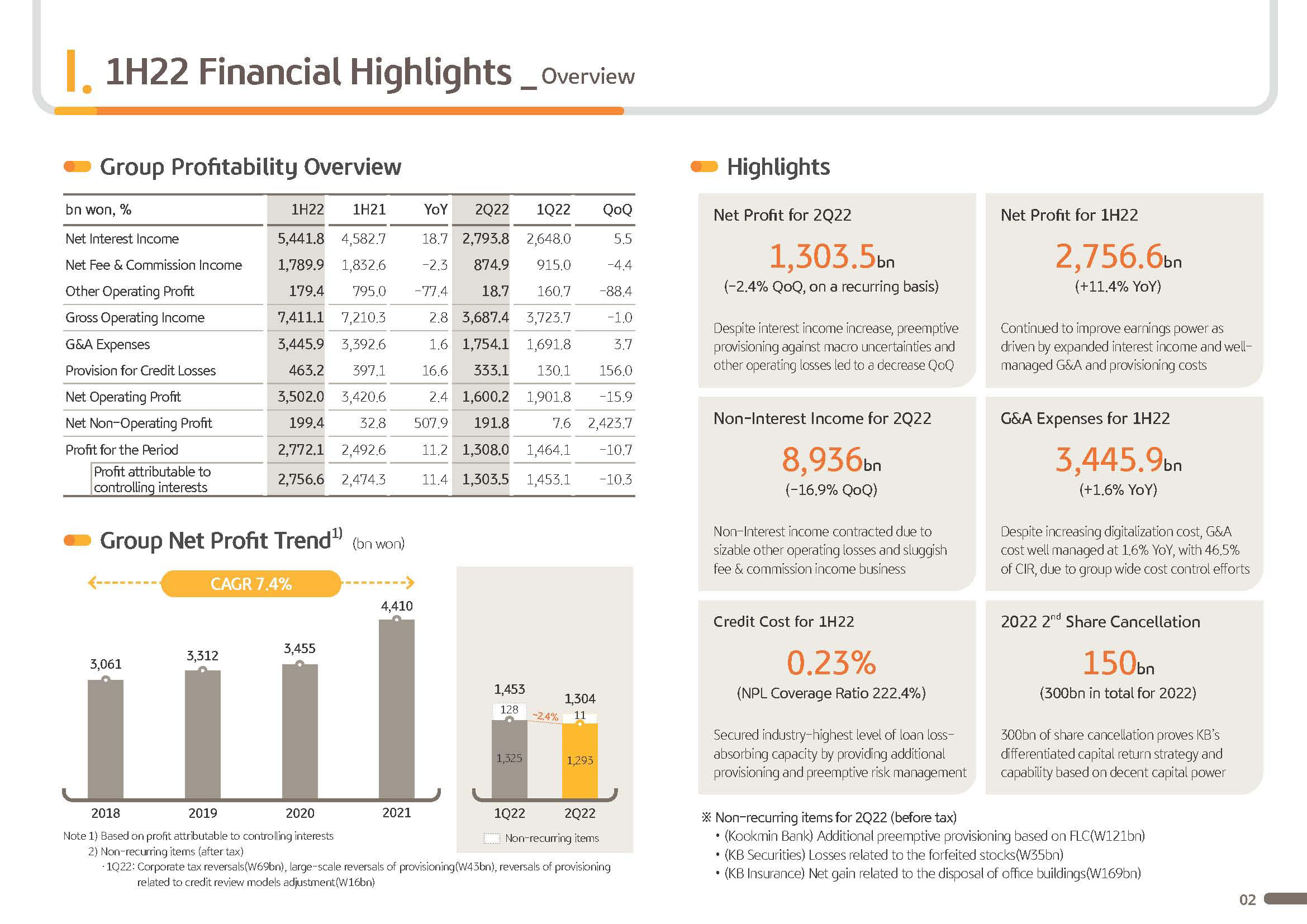

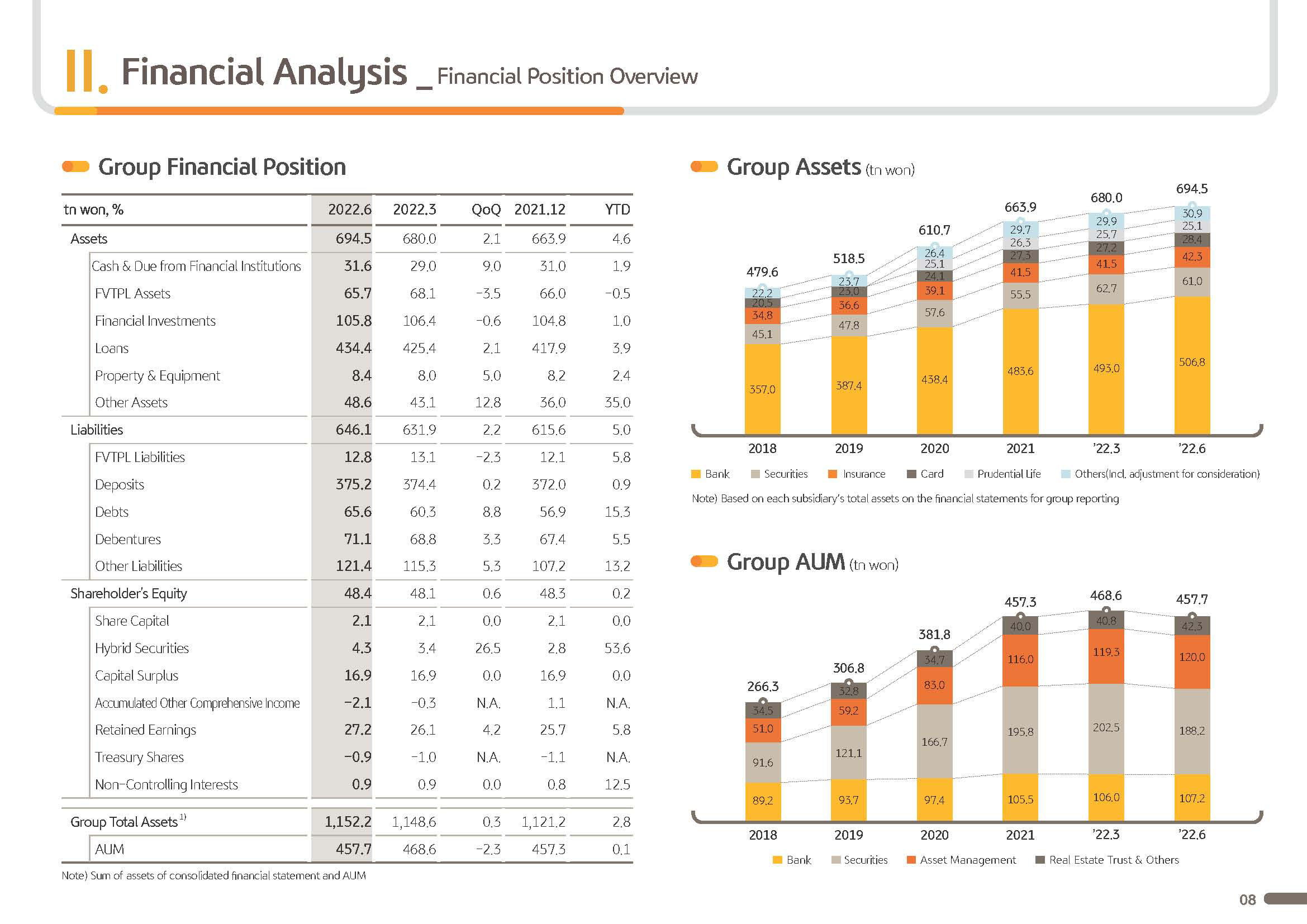

Good afternoon. I am Scott YH Seo, CFO of KB Financial Group. Thank you for joining the company's first half 2022 earnings presentation. Before moving on to our earnings results, allow me to briefly run through key business highlights of the group. Q222 group net profit was KRW 1.3 trillion, up 11.4% YoY as of the first half, reporting KRW 2.8 trillion. Group ROCE was 12.5%, being kept at a steady level as ofthe first half, while annualized EPS, earnings per share, was around KRW 14,000, up 11% YoY on a robust uptrend.

Also, today, KBFG's BOD approved KRW 500 per share as the quarterly dividend. And following last February, we decided to do share cancellation of KRW 150 billion of treasury shares and, as such, do KRW300 billion of total share cancellation this year. In the midst of the spread of macro uncertainties and difficult business backdrop underpinned by our outstanding capital adequacy and stable earnings capacity, we have been consistent and differentiated in implementing our shareholder return policy.

Globally, there is growing concern over stagflation while Korean economy is mired with 3 highs, high interest rate, high inflation and high exchange rate, which may undermine profitability of the banking business and widen credit risk. We therefore are focused on the fundamentals and preemptive risk management.

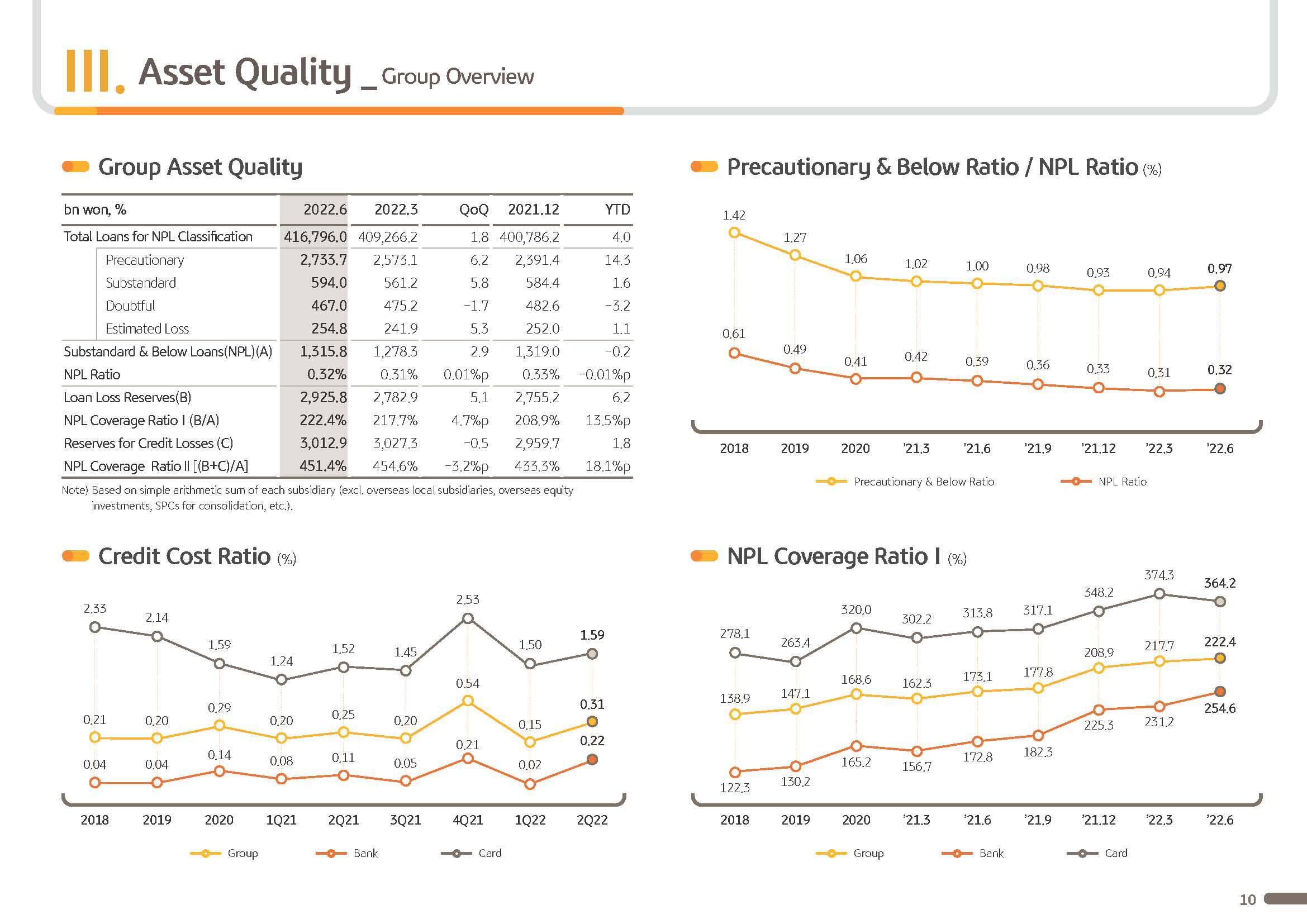

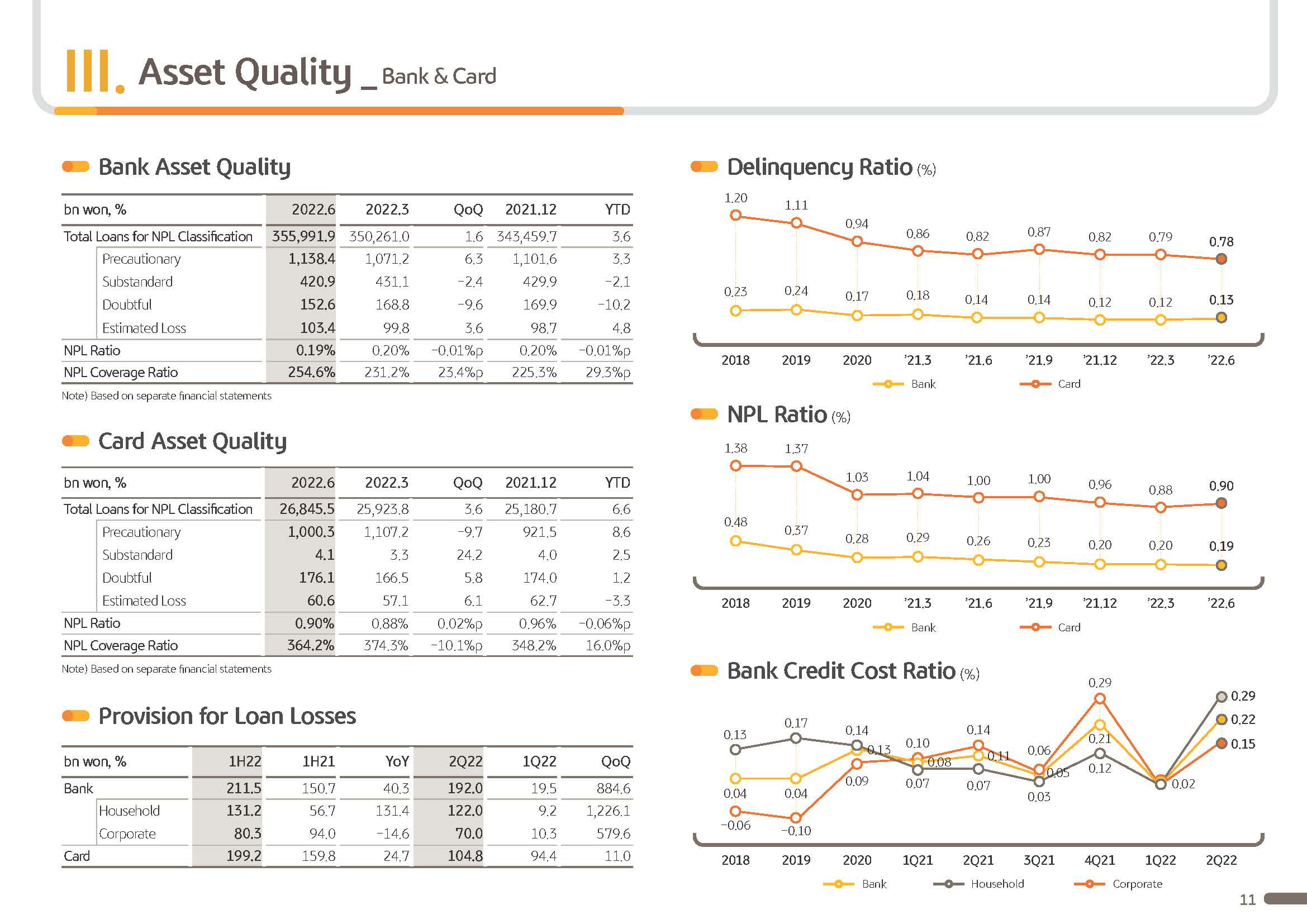

For example, this quarter, based on conservative projections for GDP growth, policy rates and the FX rate as well as other indicators and scenario analysis for crisis, we made around KRW 121 billion of additional provisions. By way of such conservative provisioning stance, we've been enhancing loss-absorbing capacity, bringing group's NPL coverage ratio to 222.4%, which is the industry's top-notch level as well as top-notch in terms of the global standards.

Also, we ran a group-level stress test based on internal and external economic conditions and probable future risk factors. And even under a severe recession scenario of negative 6.3% GDP growth of the IMF, the group's capital adequacy will be above the regulatory requirement, yet again attesting to KB's sound financial prudence.

Meanwhile, as a leading financial group fulfilling its social responsibility, KBFG is extending various different financial support for the vulnerable and the less privileged who are suffering from economic slowdown and rate hikes. Also, ahead of the end of COVID-19 financial forbearance program in May, to alleviate burden for small businesses and the self-employed, depending on the borrowers' repayment capacity, we allowed up to 10-year extension for amortization and introduced COVID-19 special long-term repayment amortization program offering grace period for repayment of the loans to allow for a soft lending.

And out of all of the commercial banks, Kookmin Bank was chosen as an affiliated bank for Citibank Korea for rollover of unsecured retail loans. This has proven KB's distinctive expertise in household loans and customers' trust, and we expect there to be some growth in household loan growth going forward amidst somewhat of a sluggish first half growth.

Next, I will move on to the details of the company's earnings.

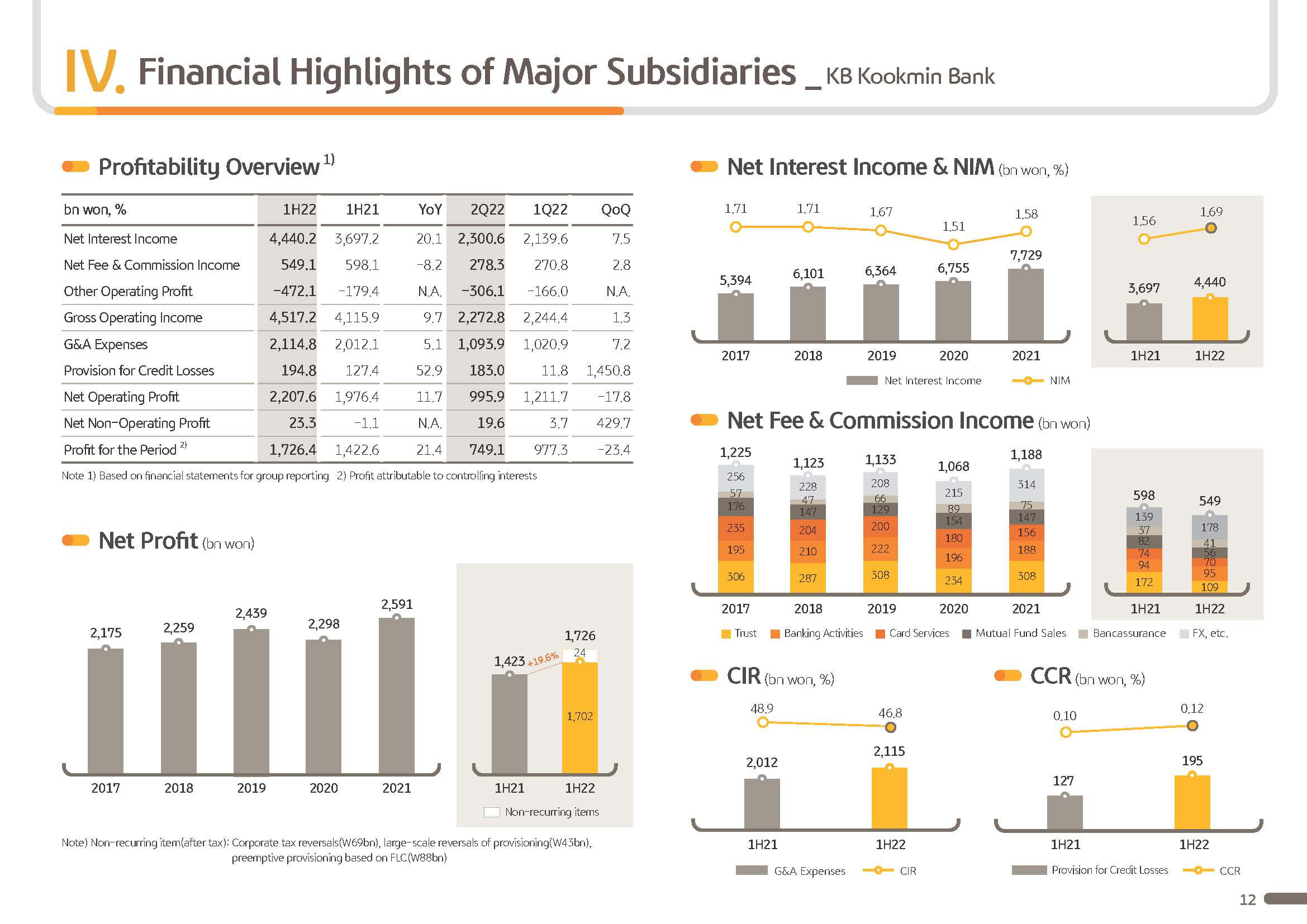

KBFG's Q222 net profit was KRW 1,303.5 billion, up 11.4% YoY to KRW 2,756.6 billion on the first half basis. On greater macro uncertainties and financial market volatilities and despite such difficult operational backdrop, we have shown the group's solid earnings capacity. However, Q2 net profit was down 10.3% QoQ as conservative FLC, forward-looking criteria, was used to preemptively book provisioning. And due to the lack of one-off gains such as the bank's corporate tax reversals in Q1, excluding the impact of such nonrecurring items, net profit is down 2.4% QoQ.

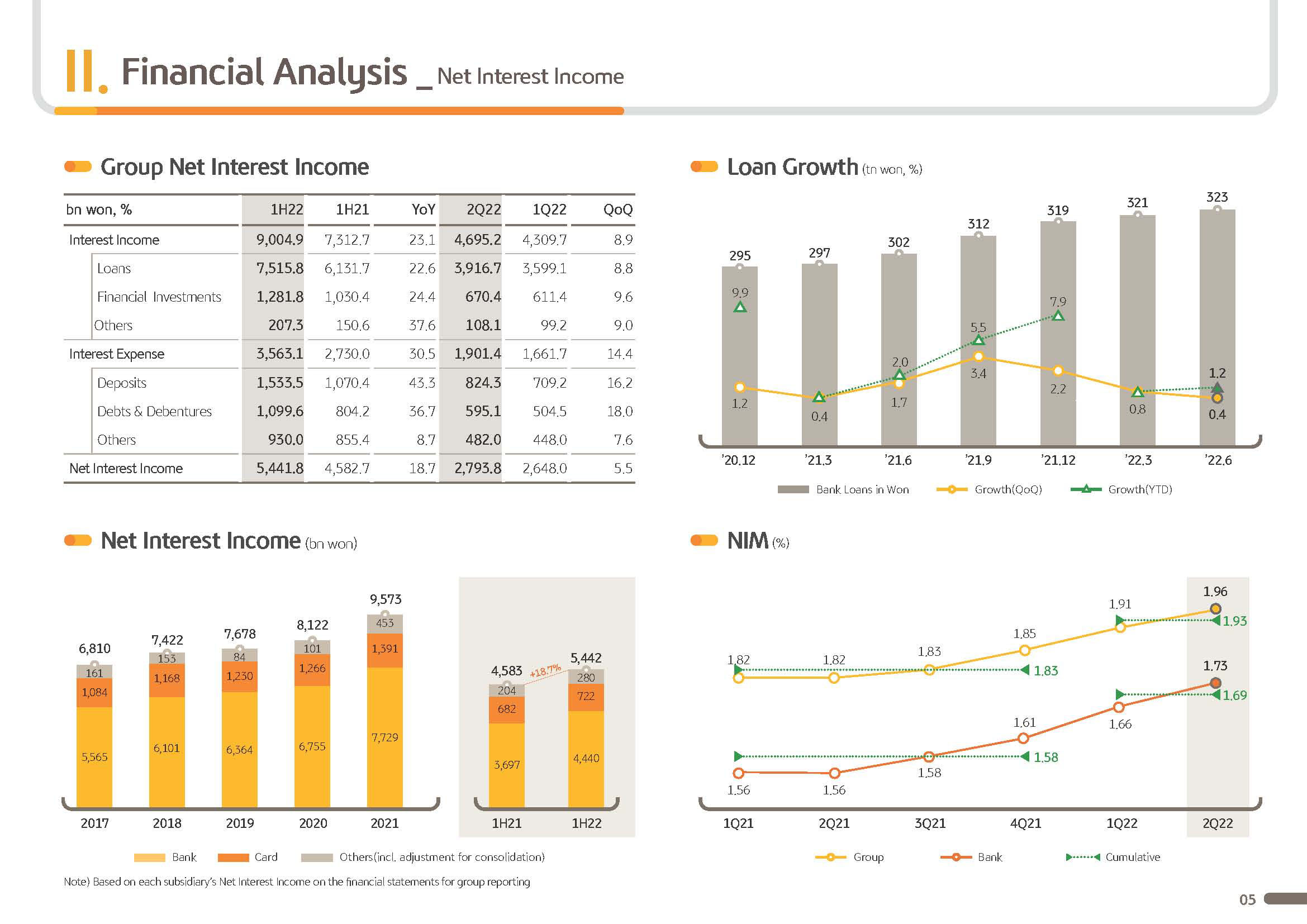

In more detail, first half 2022 group net interest income was KRW 5,441.8 billion. And Q2 net interest income was KRW 2,793.8 billion, up 18.7% YoY and 5.5% QoQ. This is driven by rising rates leading to repricing of loans which ended up widening the NIM as well as due to the loan growth.

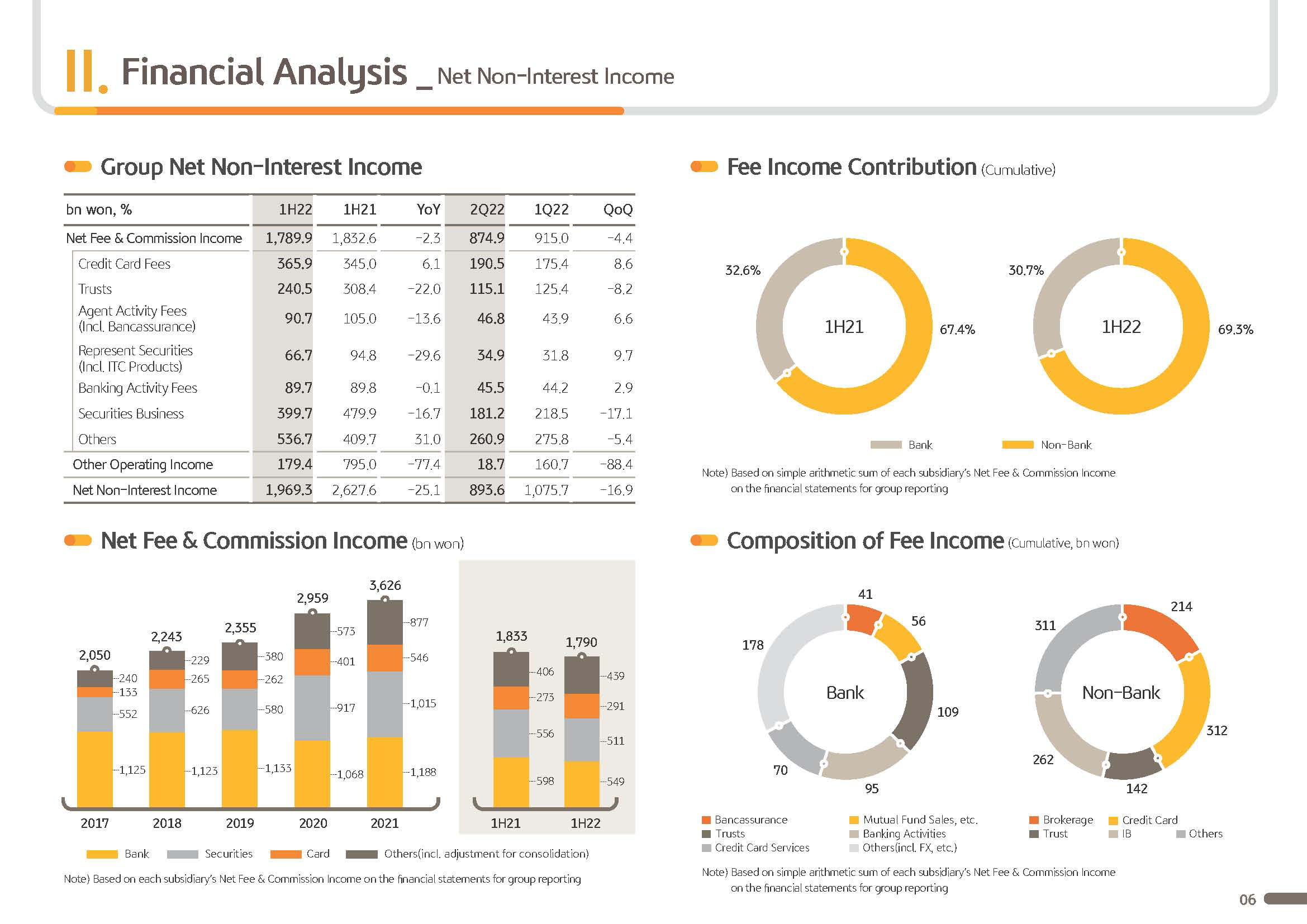

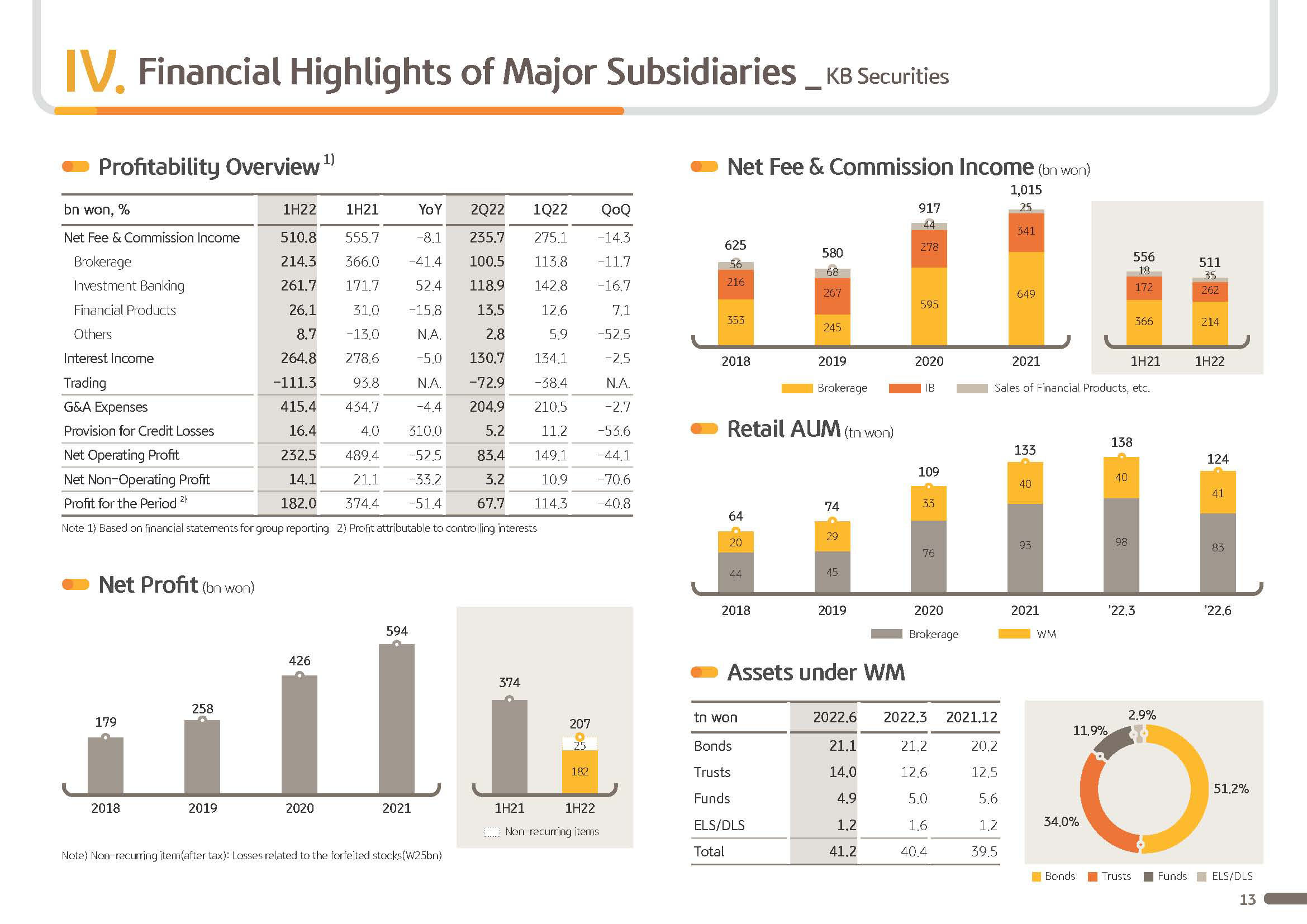

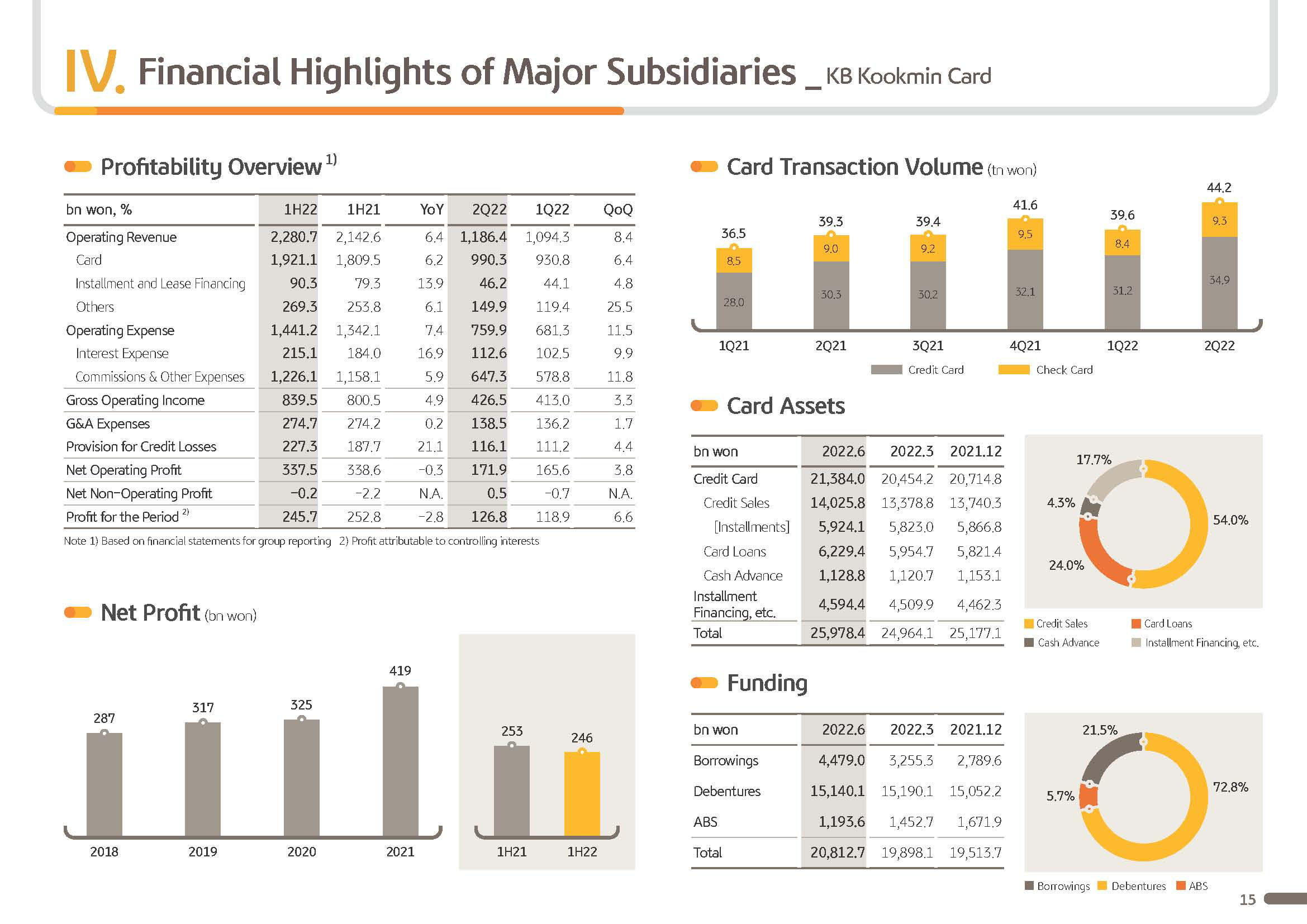

Q2 group net fee and commission income was KRW 874.9 billion, down 4.4% QoQ. And on a first half basis, it reported KRW 1,789.9 billion, down slightly YoY. This year, against sluggish financial markets at both home and abroad, brokerage fee income was constrained. And on slower sales of financial products, sale of trust and funds also slowed, dampening the group's fee and commission income.

However, thanks to our business diversification and efforts to strengthen competitiveness, earnings fundamental behind generating fee and commission income has improved a notch, driving the IB business performance by twofold YoY, landing the group on a solid market position. And the Securities business has gained a leading position on the league table for its DCM as well as ECM, M&A and acquisition financing business.

Next is other operating profit.

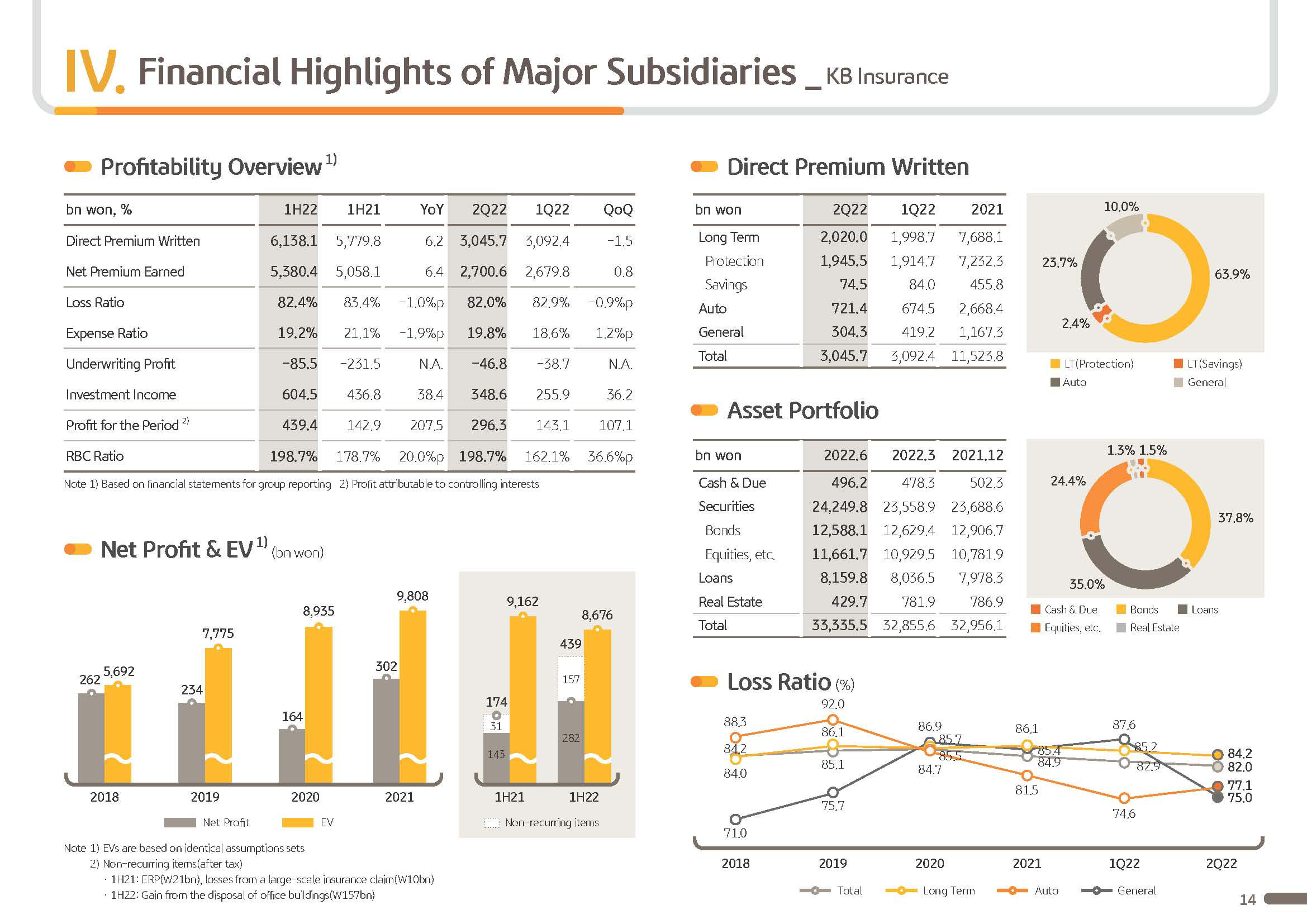

Other operating profit this year underperformed on the back of valuation loss from bonds following market rate hikes, while rise in FX rates and foreign equity index drove losses from ELS and CVA valuation, dampening performance from securities and derivatives and FX, leading to sluggish performance both YoY and QoQ. But for insurance underwriting profit, we saw overall improvement in loss ratio from the non-life business, while life insurance profitability was sustained, continuing on a positive performance trend.

In the second half, we expect additional fee interest rate hike. And since there is the added possibility that financial market volatility can increase including for FX, we wish to maintain a defensive management stance for the time being and improve earnings stability through portfolio diversification and a flexible position strategy.

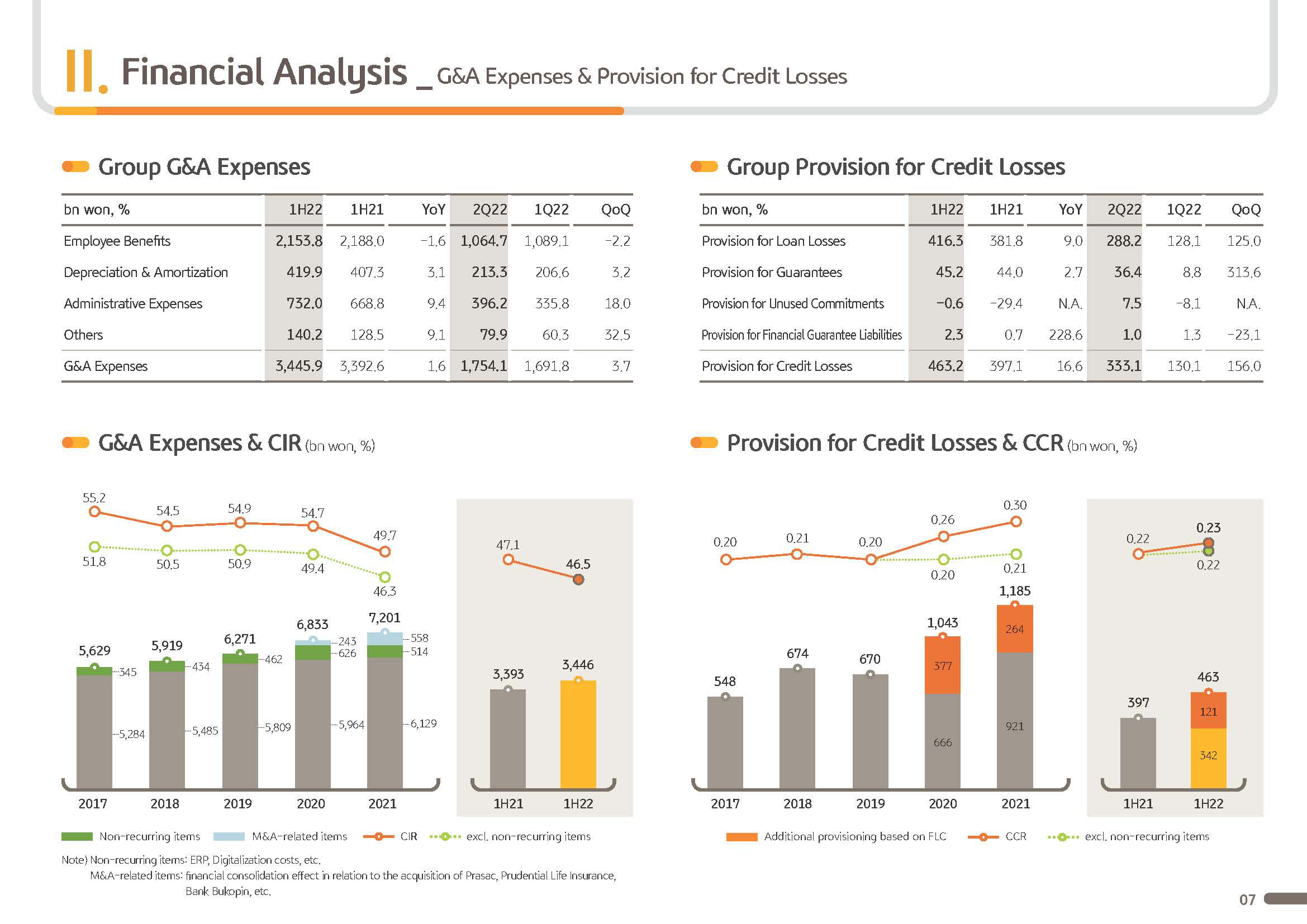

2022 first half group G&A posted KRW 3,445.9 billion. Despite the increasing group level investment in digitalization, as a result of cost-control efforts including labor costs, it only increased 1.6% YoY and is being well controlled. In addition, for Q2, G&A expenses, due to seasonal factors, including increase in advertising and promotion costs and taxes and dues, increased 3.7% QoQ.

Q2 group provision for credit losses posted KRW 333.1 billion and increased by KRW 203 billion, a slightly high range QoQ. As was aforementioned, reflecting the conservative FLC scenario in this quarter will be around KRW 121 billion of additional provisioning. And with the removal of the Q1 sizeable provisioning write-back in this quarter, the recurring level of provisioning, excluding these nonrecurring items, posted around KRW 210 billion level. First half provision for credit losses posted KRW 463.2 billion, an increase slightly YoY due to preemptive provisioning and asset growth but is maintaining a stable level on a recurring level.

I will be covering the major financial indicators from the next page.

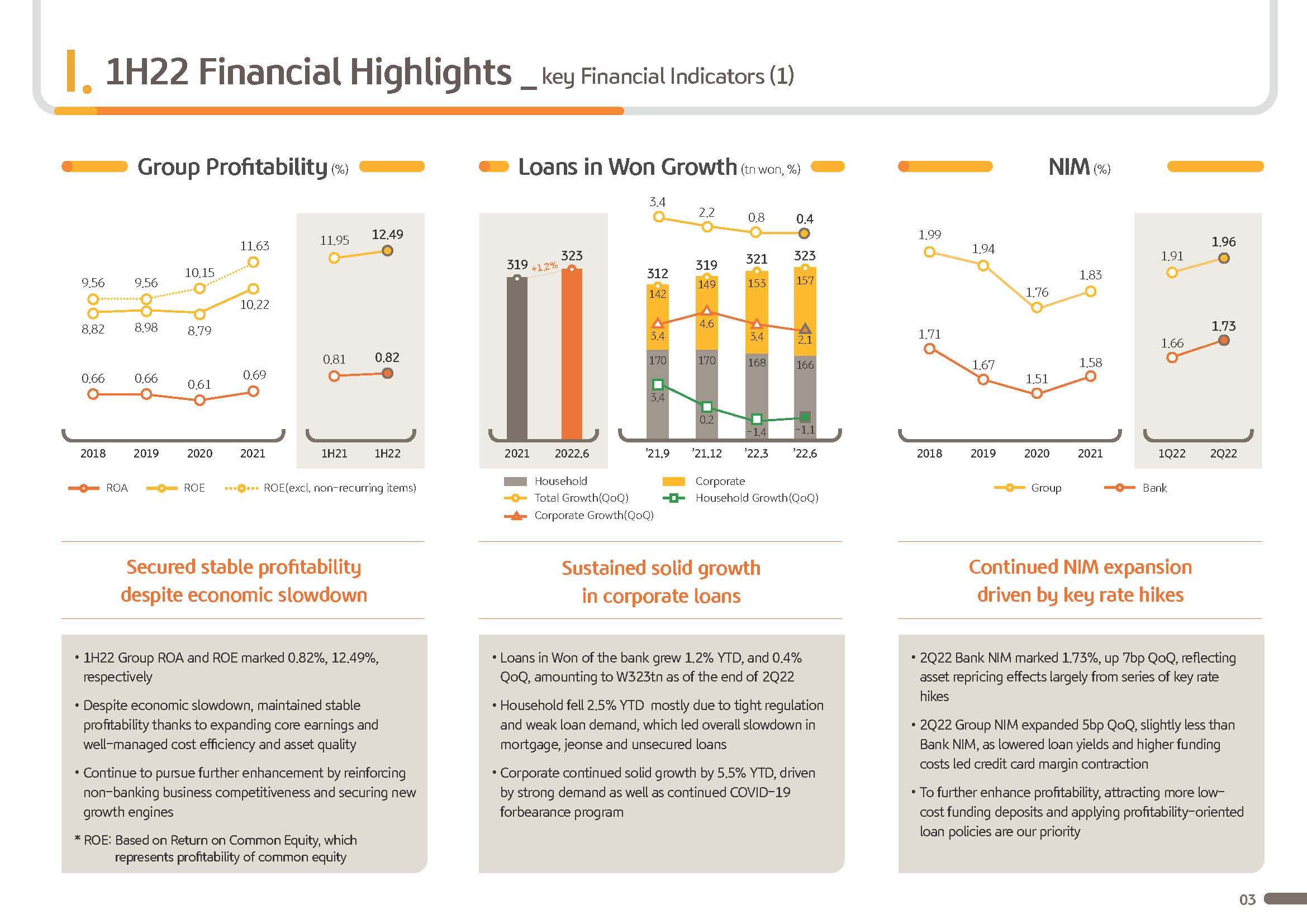

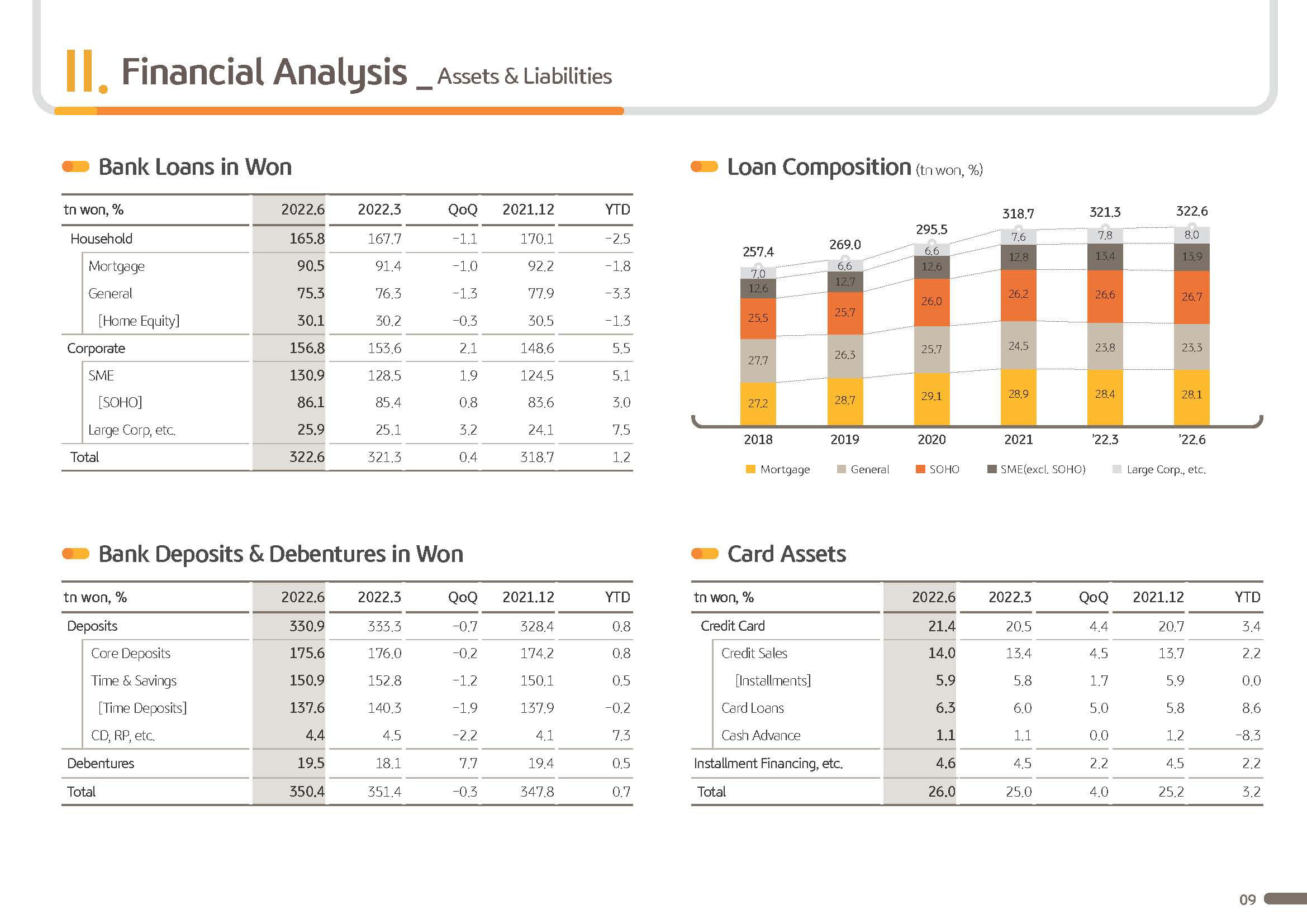

First, 2022 first half group ROCE posted 12.49%. And as a result of solid core earnings growth and cost control efforts, a level of higher than 10% is being well maintained. 2022 June end bank loan in won posted KRW 323 trillion. And compared to end of March, it grew 0.4% and 1.2% YTD. And on the whole, loan growth is at a low level.

In the case of corporate loans, it posted KRW 157 trillion as of end of June. It increased 2.1% compared to end of March and increased 5.5% YTD and is continuing solid growth rate for each quarter. In particular,general SME loans increased around KRW 4 trillion YTD and drove SME loans growth. For large corporate loans, with the loan demand growth following worsening conditions for corporate bond issuing and as a result of efforts to strengthen the IB business, it increased 7.5% YTD.

On the other hand, June end household loans posted KRW 166 trillion and decreased 2.5% YTD and is posting a minus growth rate. This was due to weaker overall loan demand due to strengthened household loan regulations and burden due to loan interest rate hikes and, in particular, since there was an increase of pressure to repay unsecured loans.

In the second half of this year, it is forecast that there will be a partial recovery of household loan growth. But since this is a period where conservative risk management is required due to internal and external conditions, we wish to focus on asset quality and profitability management and concentrate on qualitative growth centering on high-quality assets.

Next is net interest margin, NIM. Q222 bank NIM posted 1.73% and rose 7 bp QoQ and from this year on a cumulative basis expanded to 12bp. This was mainly attributable to the rapid loan asset repricing, reflecting steep key rate hikes from August of the previous year and the valued asset profitability improvement. On the other hand, Q2 group NIM posted 1.96% and rose 5 bp QoQ. With the card financial asset yield decline, including card loan and cash advance, and effects from card NIM contraction following funding cost increase, the increase was more limited compared to the bank's NIM.

Let's go to the next page.

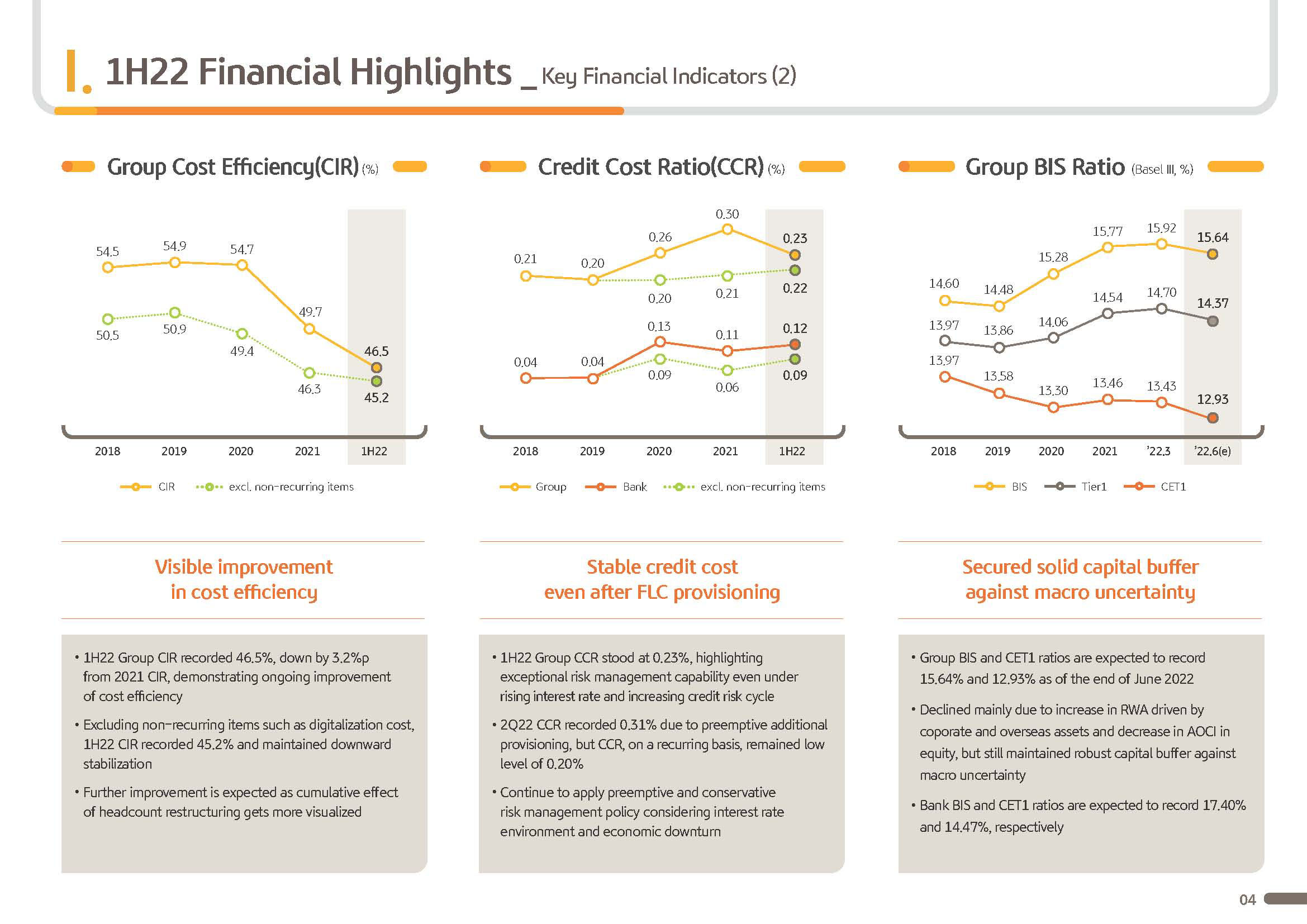

I would like to touch upon the group's cost-income ratio, CIR. As you can see on the top left-hand graph, 2022 first half group CIR posted 46.5%, and the group's cost efficiency is being continuously improved. In addition, even excluding the nonrecurring items including digitalization costs, CIR is showing a market lower stabilization trend. With the visualization of strengthening efforts for workforce efficiency, we believe that the cost efficiency will be additionally improved. And we aim to maintain the group's recurring CIR so that it can improve to mid-40%.

Next, I would like to cover the credit cost.

2022 first half credit cost posted 0.23%. And even in the situation where credit risk is increasing due to rapid interest rate hikes and economic downturn, it is still being maintained at a stable level. And Q2 CCR, when excluding preemptive additional provisioning, is at a low level at a 0.20% level.

Next is the group's capital adequacy.

As of end of June 2022, group BIS ratio posted 15.64%, and CET1 ratio posted 12.93%. With expansion ofcorporate and overseas asset expansion, risk-weighted asset decrease and with the interest rate hike and some price declines and with the decrease in accumulated other comprehensive income, it decreased QoQ. But on the back of robust profit generation and strategic capital management, it is securing the highest level of solid capital buffer in the financial industry.

From the next page are the detailed materials related to the performance that I just aforementioned, so pleaserefer to it if needed. With this, I will conclude 2022 first half KB Financial Group business results presentation.

Thank you for listening.