-

Please adjust the volume.

2022 Business Results

Greetings.

I am Peter Kweon, the Head of IR at KBFG.

We will now begin the 2022 Annual Business Results Presentation. I would like to express my deepest gratitude to everyone for participating today. We have here with us our group CFO and Senior Executive Vice President, Scott YH Seo, as well as other members from our group management.

We will first hear the 2022 annual major financial highlights from our CFO and SEVP, and then have a Q&A session. I would like to invite our SEVP and CFO, to deliver 2022 annual earnings results.

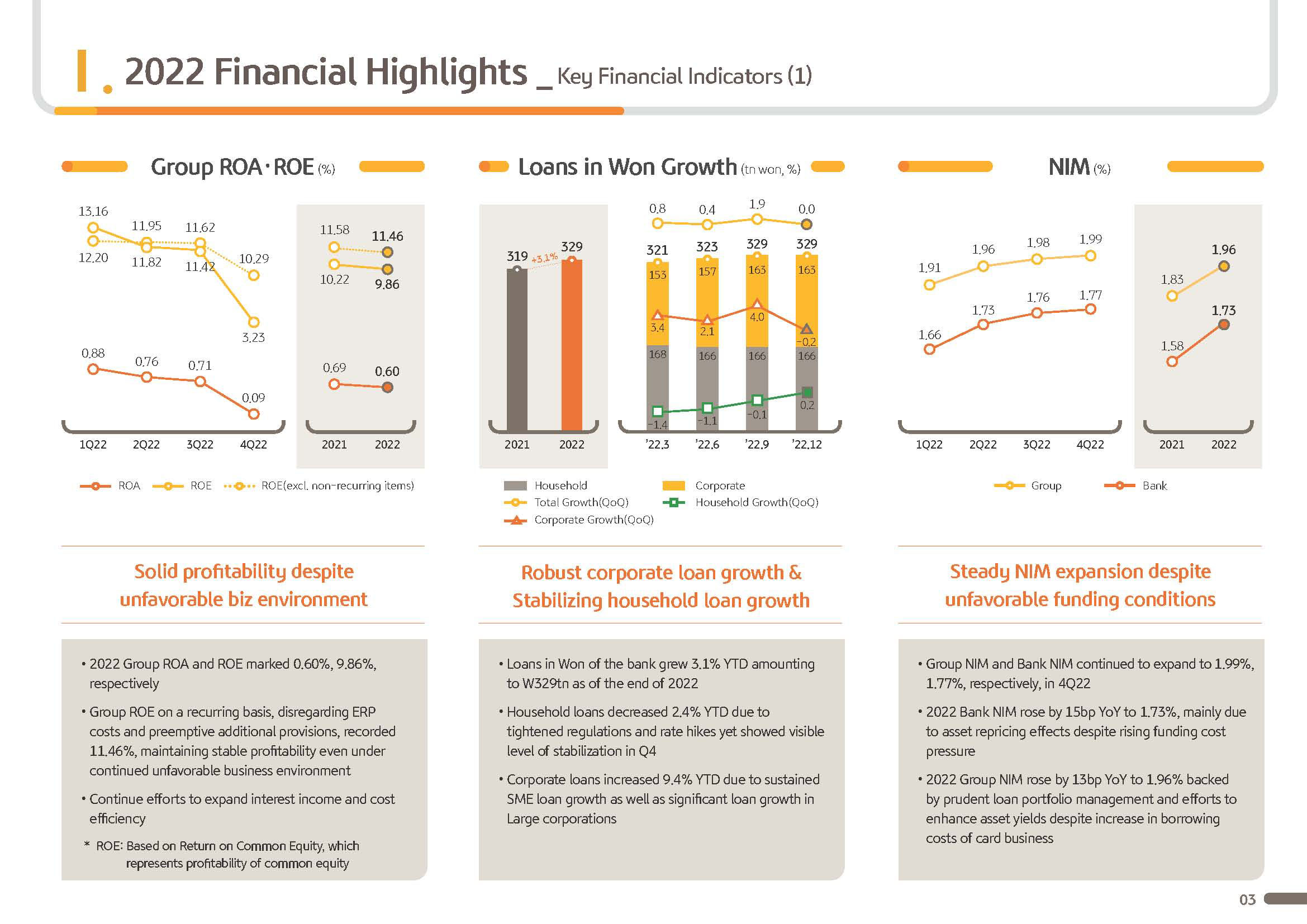

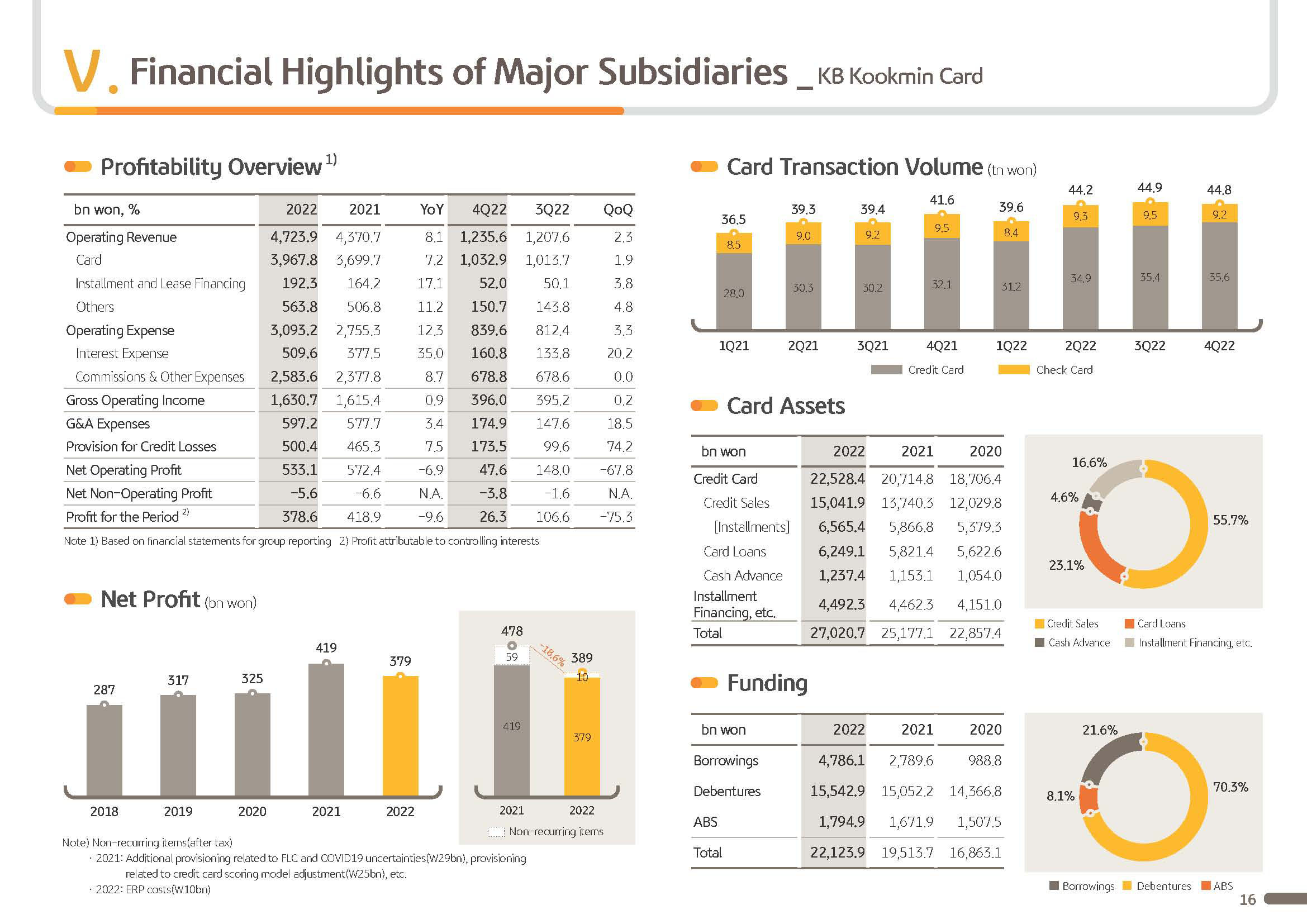

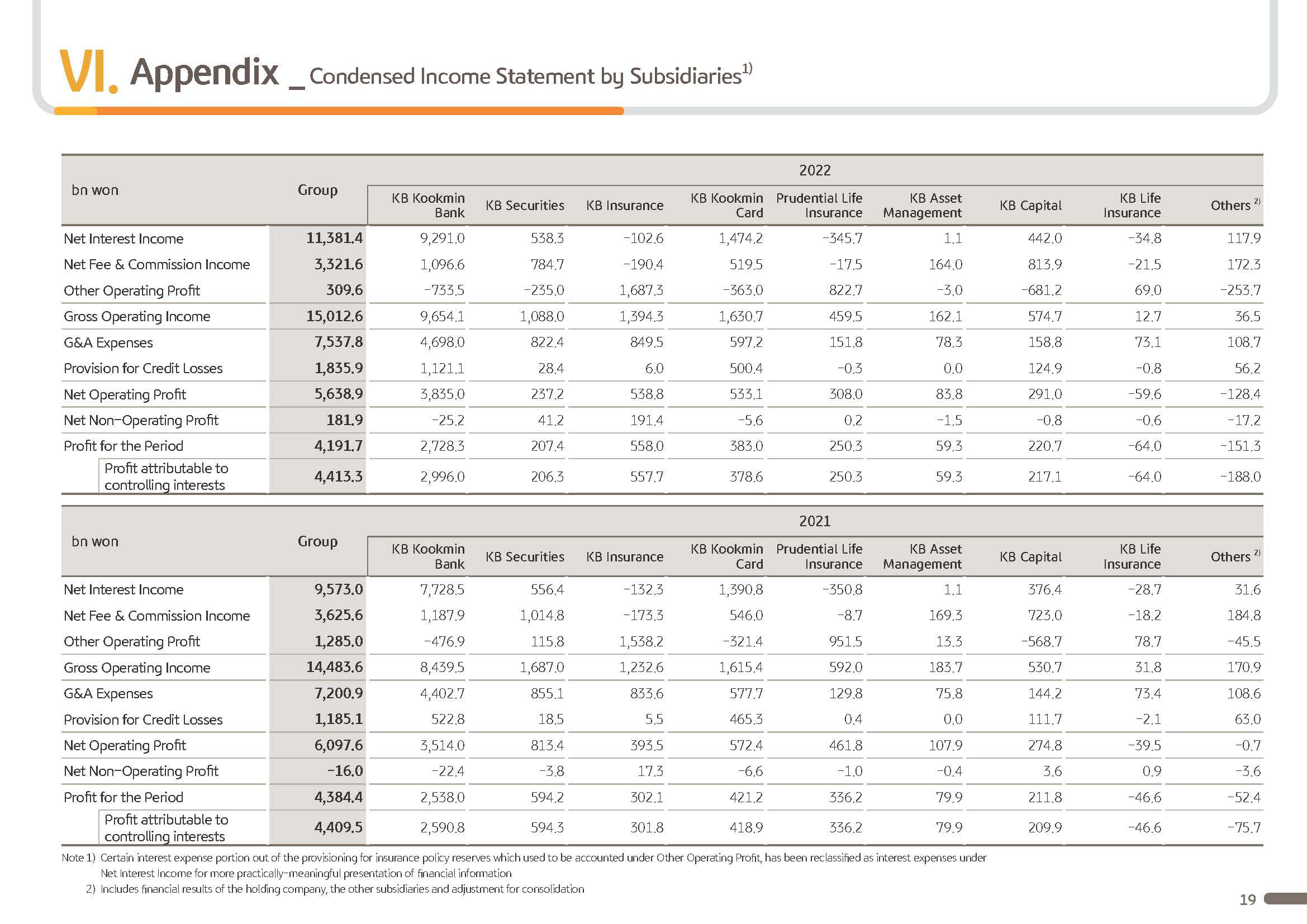

Good afternoon. I am Scott YH Seo, CFO of KBFG. Thank you for joining the company's annual 2022 earnings presentation. Before looking at the details of the income statement, I will briefly run through the highlights of business performance and key indicators of the group. KBFG's FY '22 net profit was KRW 4,413.3 billion, flat YoY but has underperformed market expectations or the consensus estimates of the analysts. EPS for '22 was KRW 11,200, 1.2% YoY, and ROE on common stock basis was 9.9%.

As CFO, it is regretful to have to announce results that fall short of expectations of shareholders and investors.

The biggest reason why we fell short of market expectations in '22 net profit is due to preemptive provisioning based on conservative FLC, forward-looking criteria. For 3 years up to '22 with the outbreak and spread of COVID-19 and living with COVID, experiences which no one expected drove sense of instability and brought uncertainties to global economy and the financial markets, which heightened concerns.

We expect macro uncertainties to grow this year globally and the signals for recession in the domestic economy across consumption, investment and exports are becoming more visible, building on the concern over rise in delinquency ratio and NPL ratio.

At KBFG, to thoroughly prepare against such event, we adopted a more conservative FLC, forward-looking criteria versus previous years. Preemptive provisions for domestic operations in '22, reflecting conservative FLC was KRW 242 billion, up more than 30% YoY. This is to secure ample room if and when credit risks heighten.

Next, provisions for overseas banks who we acquired that we set aside in Q4 on a consolidated basis was 570 billion and was 382 billion on an equity holding basis. Although local supervisors continue to operate COVID-19-related forbearance program to prepare for possible deterioration once the program ends, KBFG decided to provision preemptively based on our own credit assessment principles.

This additional provisioning done for domestic and overseas was under a conservative approach to enhance forward-looking projections, and as such, there will not be such a large-scale provisioning for overseas operations in the future.

In such preemptive provisioning was absent, 2022 group net profit would have been KRW 4,971 billion, which is on par or above market expectations. Common equity-based ROE would have been 11.1%, highest ever in the past decade. This level of earnings for the group has yet again proven our solid fundamentals even under difficult and uncertain financial market and the overall economy.

Drag from securities and trading has been offset by stronger performances from traditional lending and deposit taking of the bank and the P&C insurance business. Q4 consolidated net profit was KRW 385.4 billion. Net profit saw a big decline QoQ due to seasonal one-off factors, including ERP and preemptive and additional provisioning. But excluding such impact, on a running basis, net profit reported around KRW 1.2 trillion keeping to our solid earnings capacity.

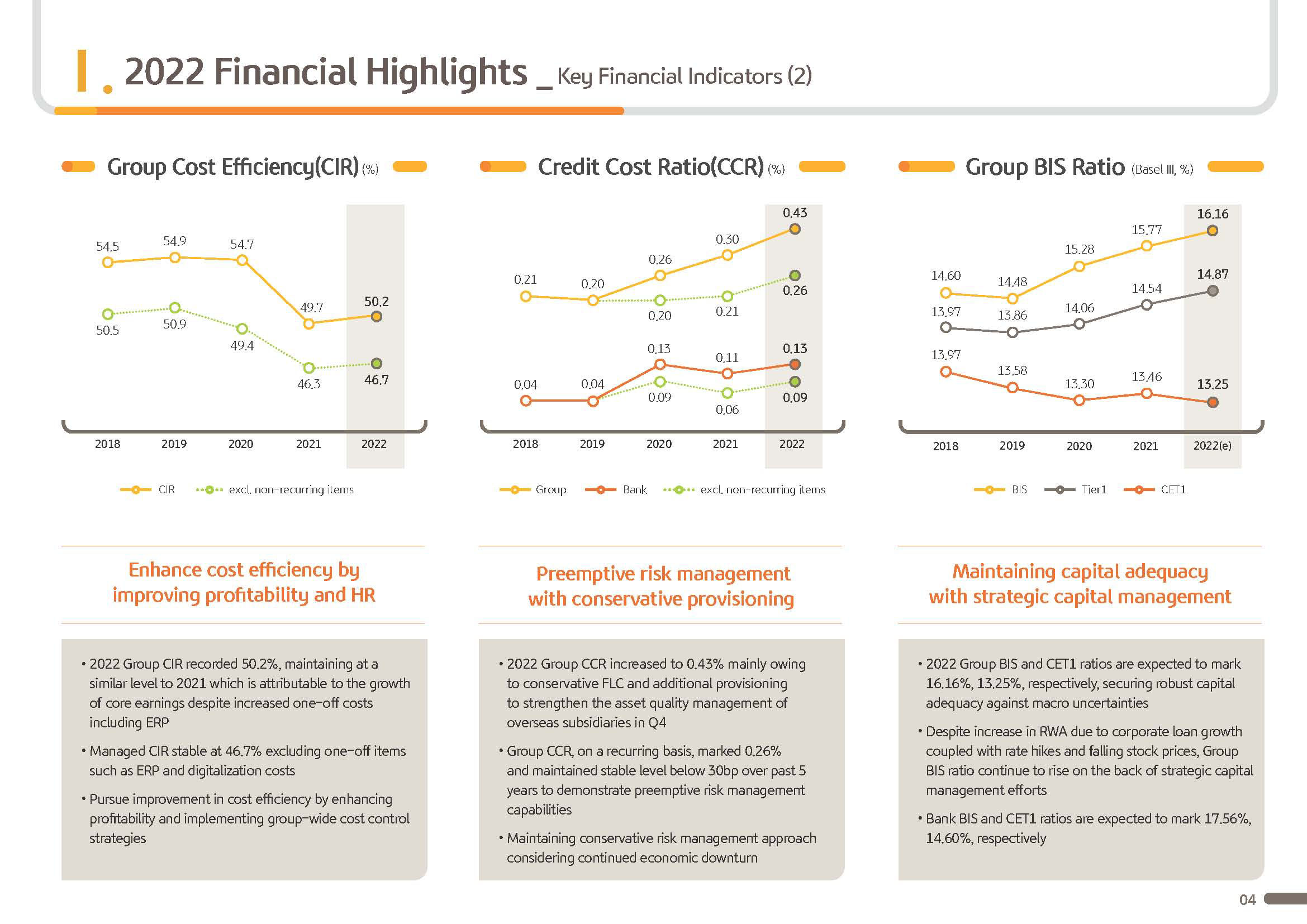

Next, group's 2022 credit cost on a consolidated basis was 43 basis points against total loans. On preemptive provisioning for domestic and overseas, group credit cost showed steep rise in '22. But excluding this impact, credit cost on a recurring basis reported 26 basis points, staying within a steady level.

Also, NPL coverage ratio as of the end of '22 on a domestic operations basis was up 7 percentage points YTD to 216%. Considering industry top NPL coverage, I believe KBFG has sufficient buffer to fend off possible domestic and global uncertainties that may emerge in the future.

Lastly, KBFG's BOD today approved a resolution to increase shareholder return rate up by 7 percentage points versus last year to 33%. In more detail, '22 cash dividend payout ratio was decided at 26%. On top of which, there will be KRW 300 billion of share buyback and cancellation.

Also, including KRW 1,500 of quarterly dividend already paid out, EPS for FY '22 was KRW 2,950 marginally up from KRW 2,940 last year. We will start buying treasury shares starting tomorrow, and it will last for 3 months. And immediately following the end of that period, those treasury shares will be canceled. I will go into more details on the capital management plan, including dividend policy on the very last page of the presentation.

Next, I will go into more detail on each of the line items.

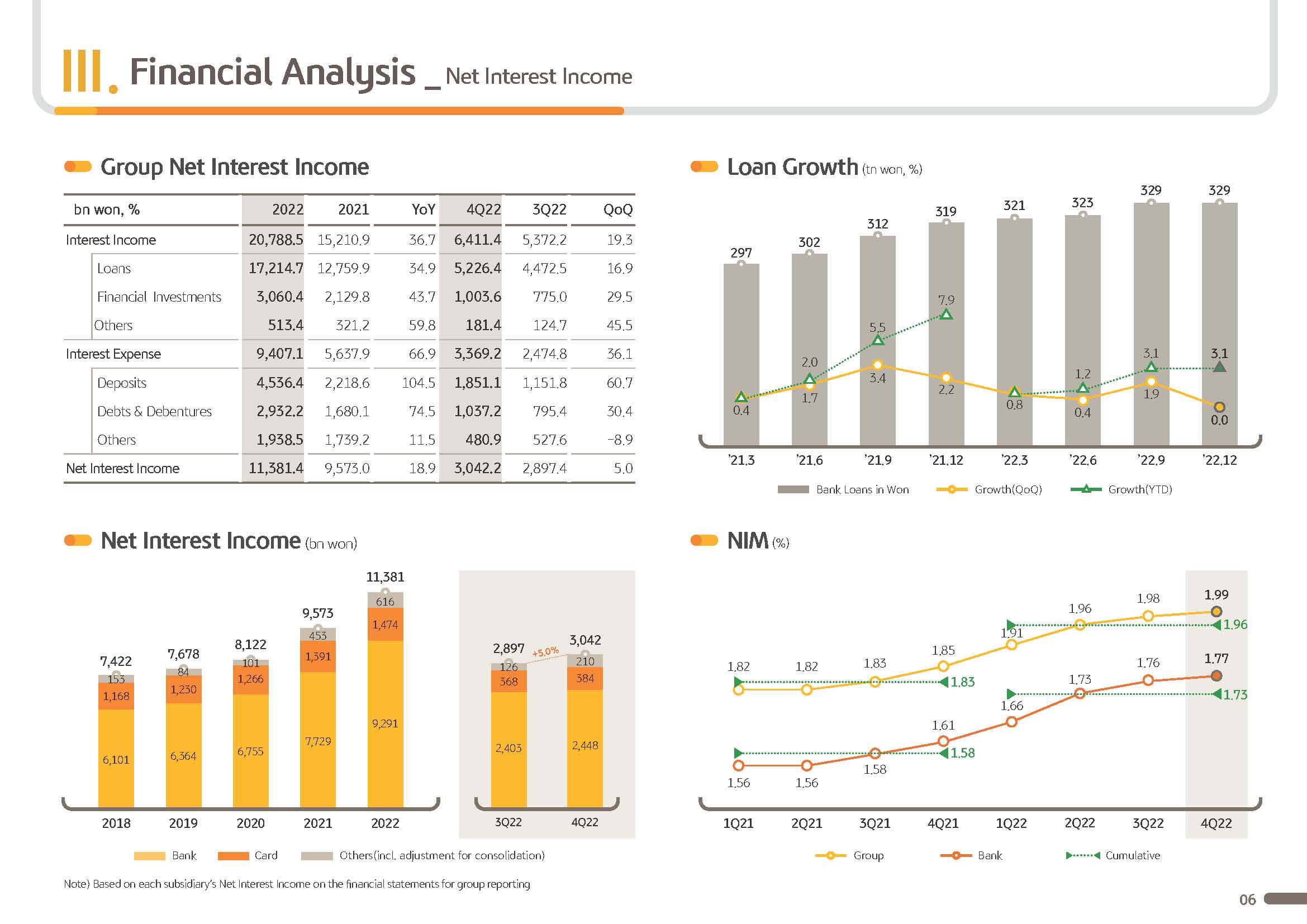

FY '22 Group's net interest income was KRW 11,381.4 billion up 18.9% YoY, while Q4 was KRW 3,042.2 billion, up 5% QoQ, driving performance improvement backed by solid loan growth and repricing of the loan book on the rise in interest rates, which continue to drive up NIM.

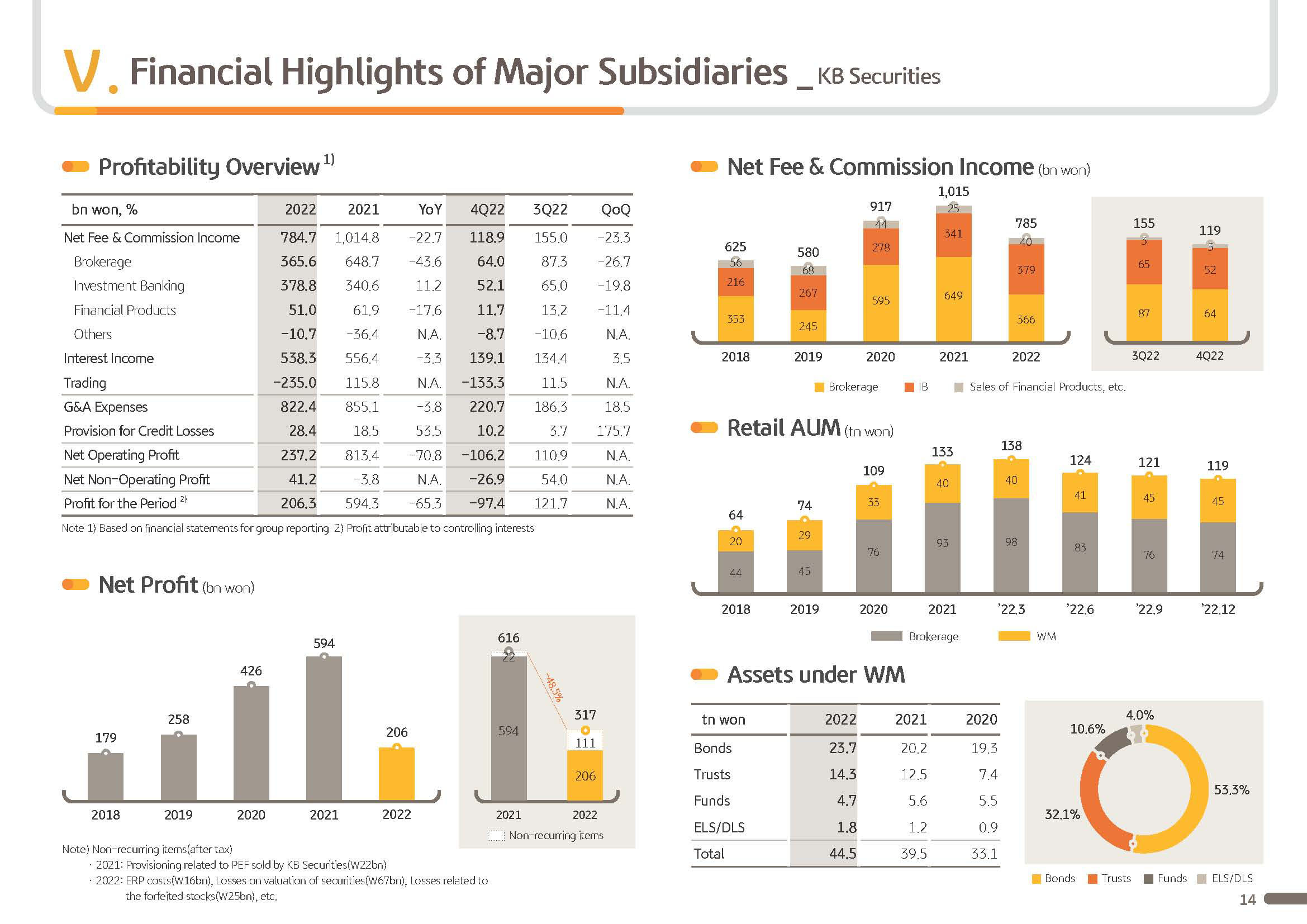

Next, group's net fees and commission income for FY '22 was around KRW 3.3 trillion. On depressed stockmarket, the fallen trading volume drove down brokerage fee income from the securities business by 45% YoY. And a sluggish financial product sales, the bank's trust and fund sales also posted a decline, bringing a 8.4% YoY decline.

However, despite difficult operational backdrop, both internal and external, thanks to the Group's continuing efforts behind business diversification and stronger competitiveness, fee and commission income has been above KRW 3 trillion for 2 consecutive years, attesting to robust earnings capacity. Group's IB fee income was up around 18% YoY, further broadening its market dominance.

Net fee commission income for the fourth quarter was 717.9 billion. On the back of deepening down trend in trading volume, brokerage fee income fell and due to seasonal volatilities, IB fee income also contracted, lowering Q4 number down by approximately 12% QoQ.

Next is other operating profit. Group's other operating profit for FY '22 was KRW 309.6 billion, showing a significant year-over-year decline, overall displaying underperformance. This is because of steep rate hikes. There were greater losses from bond investment. While due to USD/KRW exchange rate rise and stock market declines, there was underperformance from securities and derivatives and USD/KRW exchange rate

However, other operating profit for Q4 was at KRW 196.3 billion, which is an improvement by a large margin versus last year. This is despite around 93 billion of valuation losses from securities investment.

And on falling USD/KRW exchange rate and bond yield, the bank saw a large improvement in securities and derivative FX-related earnings of around 425.5 billion QoQ and base effect from insurance subsidiaries subpar performance due to previous quarter's seasonality has been removed, while loss ratio of non-life business improved, driving up insurance income by around 34% QoQ.

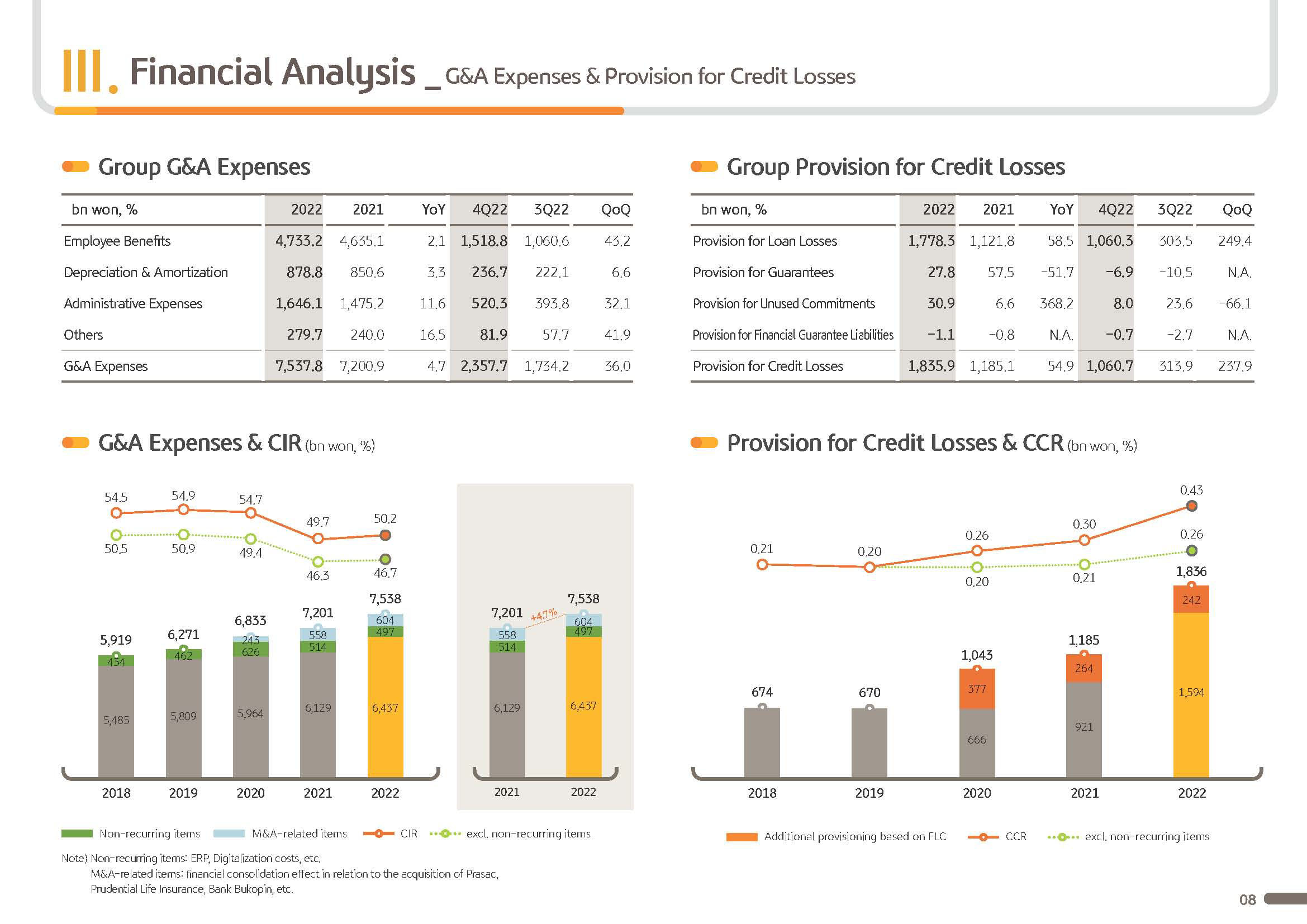

Next, I will cover group G&A expenses. 2022 G&A expenses posted around KRW 7,537.8 billion. This was an increase of about 4.7% compared to the previous year. And despite the increase in the size and cost of ERP in a situation, where the group's digitalization-related investment is expanding thanks to company-wide cost management efforts and efforts to improve the efficiency of the workforce structure, training is being well managed.

On the other hand, Q4 G&A expenses posted KRW 2,357.7 billion and due to seasonal factors, including around KRW 316 billion of ERP costs, it decreased significantly QoQ.

The following is the group provision for credit losses. 2022 Q4 group's consolidated provision for credit losses amounted to KRW 1,060.7 billion, a significant increase compared to the previous quarter. As mentioned earlier, this was on the back of preemptive large-scale additional provisioning. And excluding this, provisioning amount on a recurring level posted around a KRW 370 billion level.

On the other hand, the amount of provision for credit losses on a consolidated basis in 2022 posted KRW 1,835.9 billion, excluding one-off items such as preemptive accumulation of additional loan loss provisions on a recurring basis has posted about KRW 1.1 trillion.

On the next page, I will cover key financial indicators.

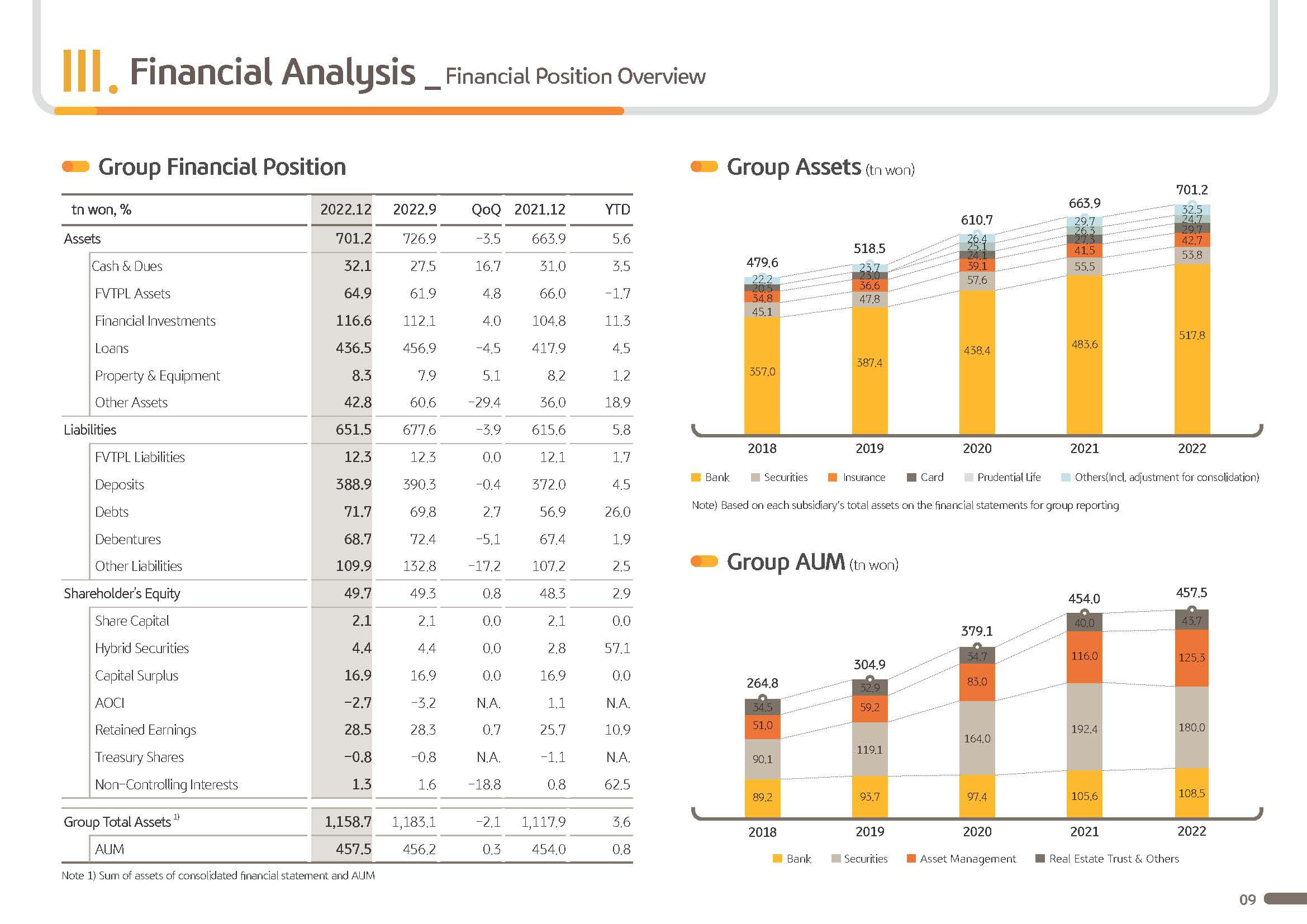

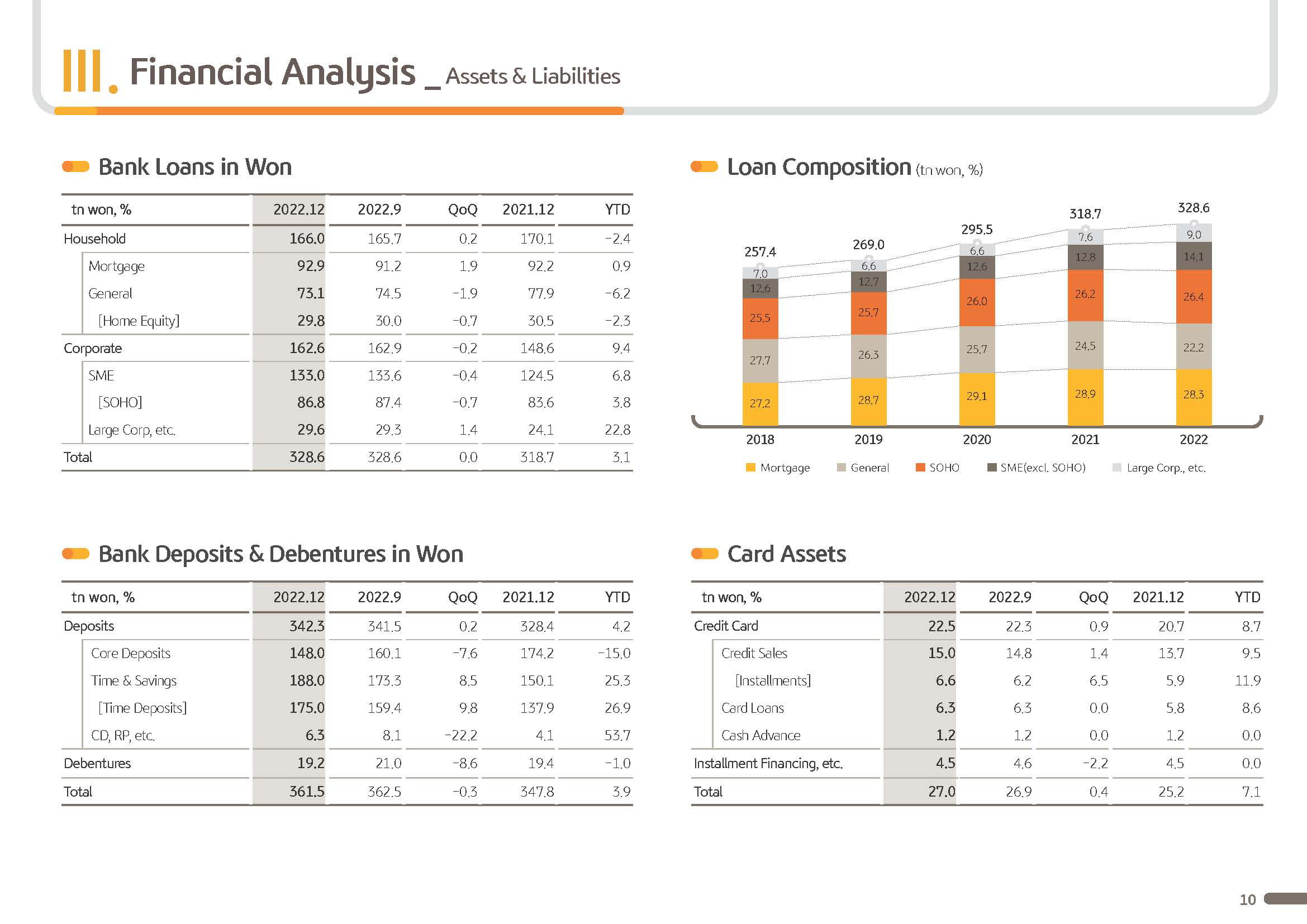

First, the group profitability in the upper left corner. As mentioned earlier, the group ROE in 2022 posted 9.9%. Next, looking at the bank loans in the growth graph in the middle, as of the end 2022, bank loans in won posted KRW 329 trillion, an increase by 3.1% YTD and maintained a similar level compared to late September. Among the loans, corporate loans posted KRW 163 trillion. And SME SOHO and large corporate loans all had balanced growth. And on the back of this, it grew 9.4% YTD and realized a sound growth trend.

On the other hand, corporate loans decreased slightly by 0.2% compared to the end of September, and this was due to decrease in SOHO loan demand due to rising loan interest rates and economic slowdown and also due to overall year-end debt payback increased, including large corporations.

On the other hand, household loans recorded KRW 166 trillion, and due to steep rise in loan interest rates and influence of loan regulations, it decreased by about 2.4% YTD centering on unsecured loans. However, with a 0.2% growth QoQ, there was a slight stabilization of household loans, which have been declining throughout the year, and in particular, housing loans due to increased real demand just in Q4 increased by about KRW 1.7 trillion.

Next, I will cover the net interest margin. 2022 Q4 group and bank NIM recorded 1.99% and 1.77%, respectively, and improved by 1 bp QoQ. Bank NIM due to decrease in core deposits and increase in term deposits led to funding cost burden increase, and had a limited expansion until Q3 of the previous year, but with the still continued loan asset repricing effect the overall improvement trend is continuing.

On the other hand, regarding Group and bank 2022 annual NIM with steady loan asset repricing reflecting interest rate increase as a result of profitabilities centered loan portfolio management and efforts to enhance managed asset yields, there was a 13 bp and 15 bp sizable increase YoY, respectively, and led the group's interest income expansion.

Let's go to the next page.

First, I will cover group cost efficiency. 2022 group CIR recorded 50.2%. And despite the expansion of the group's ERP volume on the back of solid growth in core earnings there was only a slight increase YoY. Recurring CIR is being managed at a stable level at 46.7%, excluding one-off items, including ERP and digitalization costs. Going forward, we will continue to strengthen our top line profit generation capabilities. And through group-wide cost management efforts, we will further improve the group's cost efficiency.

Finally, I would like to cover the group's capital ratio. As the end of 2022, group's BIS ratio posted 16.16%. CET1 ratio recorded 13.25% and we are maintaining the industry's highest level robust capital adequacy against economic slowdown and macro uncertainty. In particular, for the BIS ratio, despite the corporate loan centered growth, rise in USD/KRW exchange rate and stock price decline leading to RWA increase, on the back of capital management efforts, including hybrid bond issuance and flexible positioning strategy, rose 39 bp YTD.

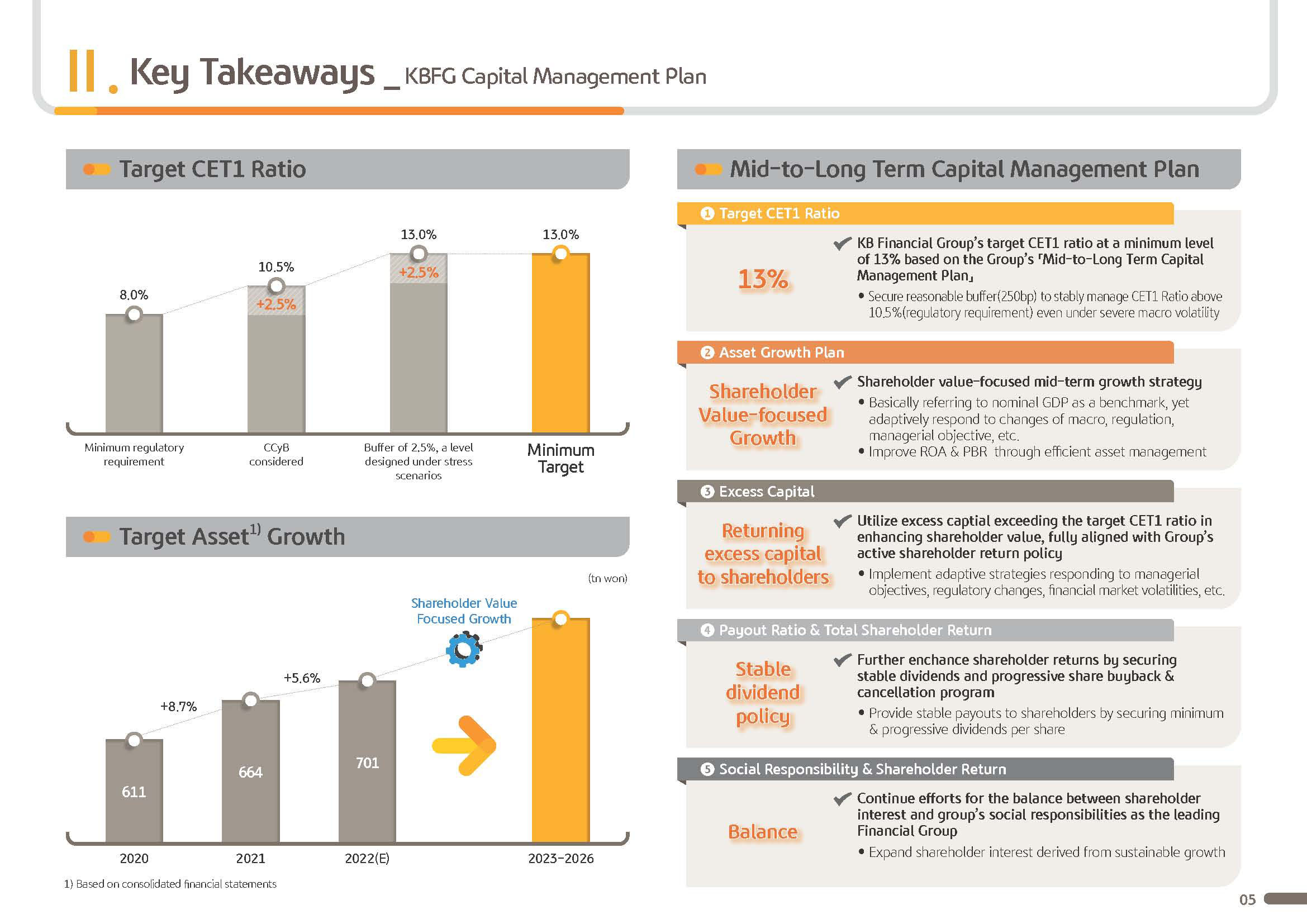

On this page, I would like to cover KB Financial Group's mid- to long-term capital management plan.

The domestic financial market in 2022 had a rapid change in the macro environment, including steep rise in the key interest rate, sharp rise in exchange rate and expansion of global inflation. In the industry overall, there was greater interest and concern about loss absorption capability against the economic shock, in other words, capital ratio and adequacy.

Accordingly, KB Financial Group while increasing the group's capital ratio and managing it at a stable level to respond to economic shocks that may occur in the future, we'll expand shareholder value and pursue a continuous shareholder return policy. And to this end, we have established a mid to long-term capital management plan for the group.

To this end, in early December 2022, after deriving KB Financial Group's optimal capital structure based on robust capital capability and abundant liquidity, our management plan was established. After this, through in-depth consideration and sufficient discussion between the management and the BOD, we came out with a capital management plan that takes into account complex factors, including appropriate capital ratio, asset growth rate and shareholder return policy.

Please look at the right side of the page, and I will explain in detail about our mid to long-term capital management plan.

First, our CET1 ratio maintenance target is 13%. This will not only meet the 10.5% regulatory capital ratio or RRP basis but also as a result of the stress test reflecting a conservative scenario at the level of the IMF financial crisis, we found that if the group maintained a CET ratio of 13%, the group will secure a total of 250 BP management buffer.

Secondly, KB Financial Group will pursue Group's growth strategy from the perspective of shareholder value. Therefore, system growth, such as the nominal GDP growth rate, will be used as the basic benchmark, and we will pursue flexible capital allocation and asset growth strategies considering macroeconomic, regulatory environment and business objectives. In addition, with efficient asset management, we will make efforts to improve ROA and PBR in parallel.

Thirdly, after achieving the aforementioned asset growth target, if exceeding target CET1 ratio of 13%, as long as there are no changes in the supervisory regulatory environment or financial market volatility or special reason for the business purpose of the company, our principle will be to actively return to our shareholders.

Fourth, KB Financial group based on solid fundamentals and industry highest level capital strength while maintaining the cash dividend payout ratio and amount at a stable level. We'll utilize various shareholder return tools such as share buyback and cancellations and gradually increase our total shareholder return ratio.

In order to continuously expand shareholder value, instability of dividends must be secured along with the expansion of shareholder return ratio. Each year, we plan to maintain at least the same level of DPS at the minimum at the same level as the previous year and gradually increase it so that we can provide stable payout to our shareholders. If KBFG's valuations, absolute and relative discounted transactions continue, we will actively implement share buyback and cancellations.

Finally, KB Financial Group will do our best to play our role as Korea's representative financial institution and do our best to harmonize this with shareholder interest. As previously mentioned, KB Financial Group subsidiaries, including our bank is the most important source of liquidity for economic entities, and we believe that proportion of the role of KB Financial Group occupies in maintaining the stability of the domestic financial system is by no means small.

Accordingly, KBFG as Korea's representative financial institution at a time when the unit functions and roles of financial institutions are needed, including stability of the domestic financial system and soft landing of economic entities in response to economic fluctuations, we will comprehensively review all interest, including shareholders and stakeholders and implement our capital policy.

For the stability of the social system, we plan to faithfully fulfill the role of the group at a time when it is needed. And to this end, we plan to have our sustainable growth in parallel with the expansion of shareholder profits. Through the group's mid- to long-term capital management plan I have covered so far going forward, we believe that we have come up with a framework, which has developed a level further to implement a more sophisticated capital management and advanced capital policies.

We promise you that we will more safely implement and develop this further to more solidify the group's sustainable growth, and at the same time, do our best to implement the industry's leading shareholder return policy. We will do our best.

From the next page, there is detailed data regarding the business performance I have covered so far, and please refer to it if needed. With this, I will conclude my report on 2022 business performance report of KBFG. Thank you for your attention.