-

Please adjust the volume.

1Q23 Business Results

Greetings.

I am Peter Kweon, the Head of IR at KBFG.

We will now begin the Q123 business results presentation. I would like to express my deepest gratitude to everyone for participating today.

We have here with us our group CFO and SEVP, Scott YH Seo, as well as other members from our group management. We will first hear the Q123 major financial highlights from CFO and SEVP, Scott YH Seo, and then engage in a Q&A session. I would like to invite our CFO and SEVP to deliver Q123 earnings results.

Good afternoon.

I'm Scott YH Seo, CFO of KB Financial Group. Thank you for joining the company's first quarter 2023 earnings presentation. Before going into the details of Q123 earnings performance, I will first run through key performance metrics for Q1. As you're all aware, starting Q1 of '23 results, our accounts are based on IFRS 17 standards, and we have retroactively restated '22 earnings of the group and its insurance subsidiary.

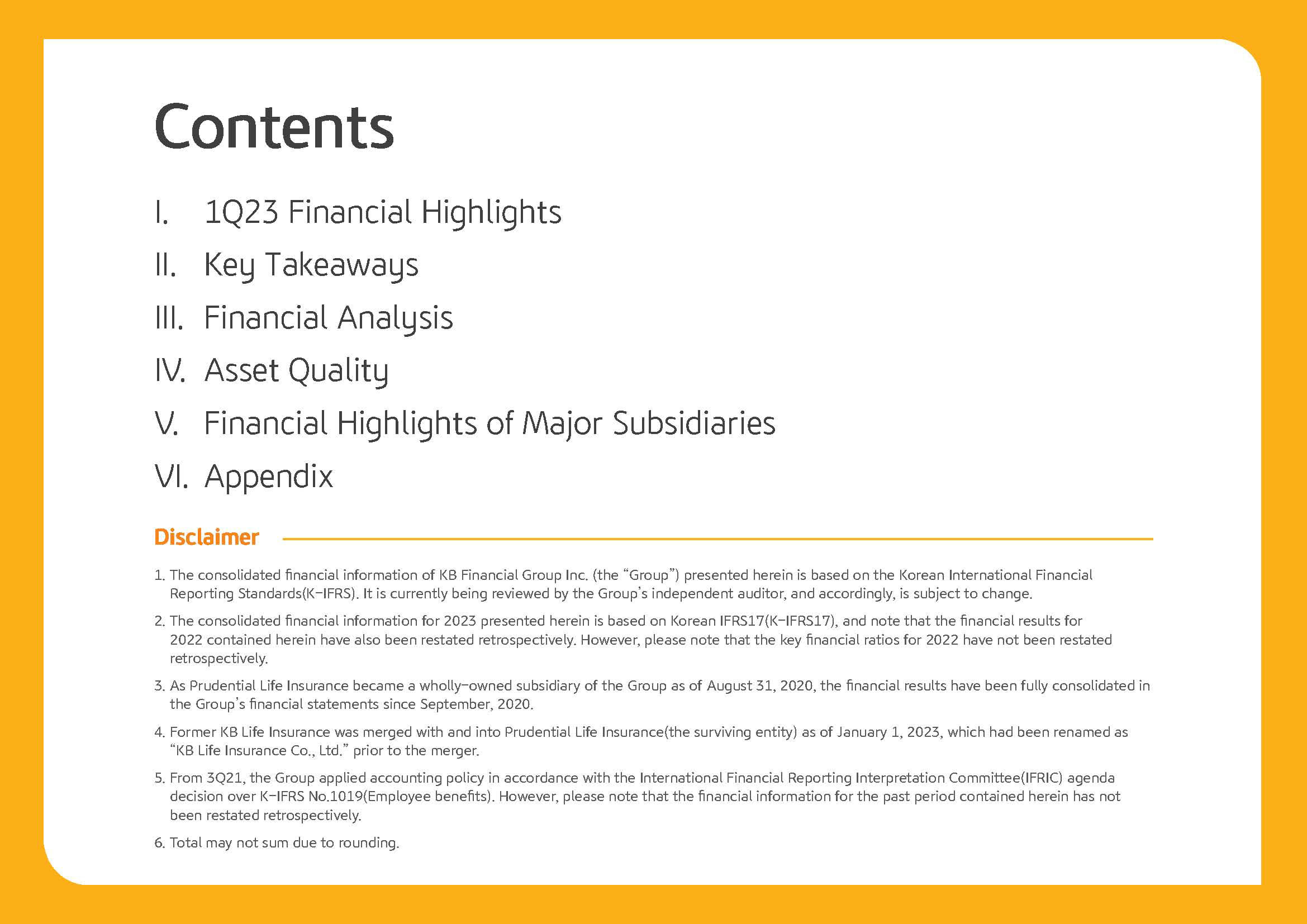

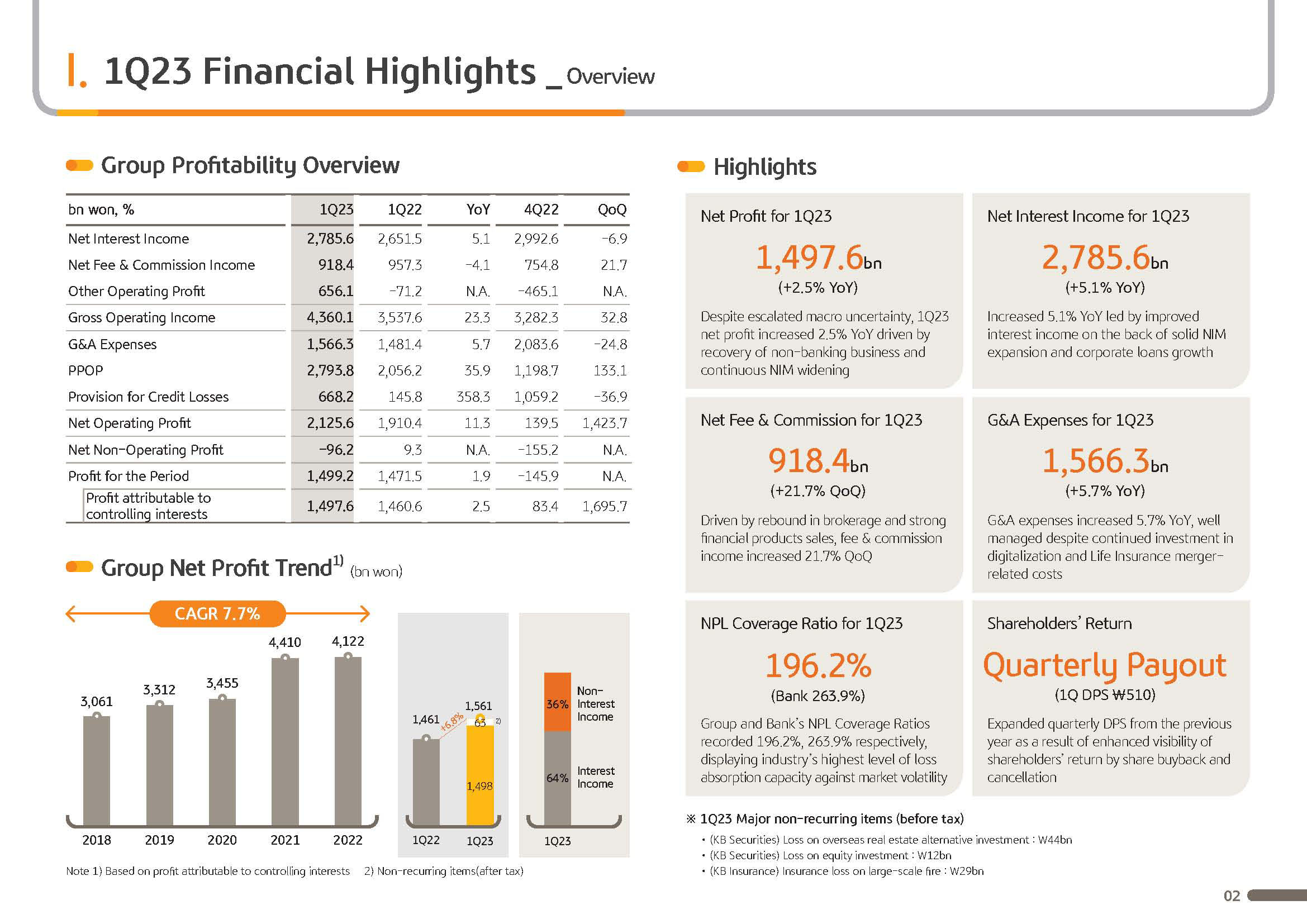

First, KBFG's Q1 net profit was KRW1,497.6 billion, which is up 2.5% YoY. Driven by balanced growth from bank and nonbank business, we were able to report earnings which was 6.5% higher than market consensus. Group's Q1 ROE was 12.4% and annualized EPS, earnings per share, was approximately KRW 15,224, increasing by 2% year-over-year and sustaining an uptrend. PPOP, pre-provisioning operating profit in Q1 was KRW2,793.8 trillion, growing 36% YoY.

SVB bankruptcy in the U.S. and Credit Suisse merger led to greater financial market uncertainties, despite which we were able to drive solid quarterly results driven by strong customer trust, underpinned by KBFG's robust capital base, and large improvements in contributions from sales and trading or market business, which was previously under pressure due to greater financial market volatility in ’22 as well as greater profit contribution from our insurance subsidiaries.

As a result, nonbank business share against group's net profit increased to around 41%, while group's earnings profile also improved with contributions from interest income decreasing significantly to 64%. Cost-to-income ratio, which is a measure of cost efficiency, decreased to 35.9% driven by solid profit growth trend and cost efficiency efforts that cut across the entire group.

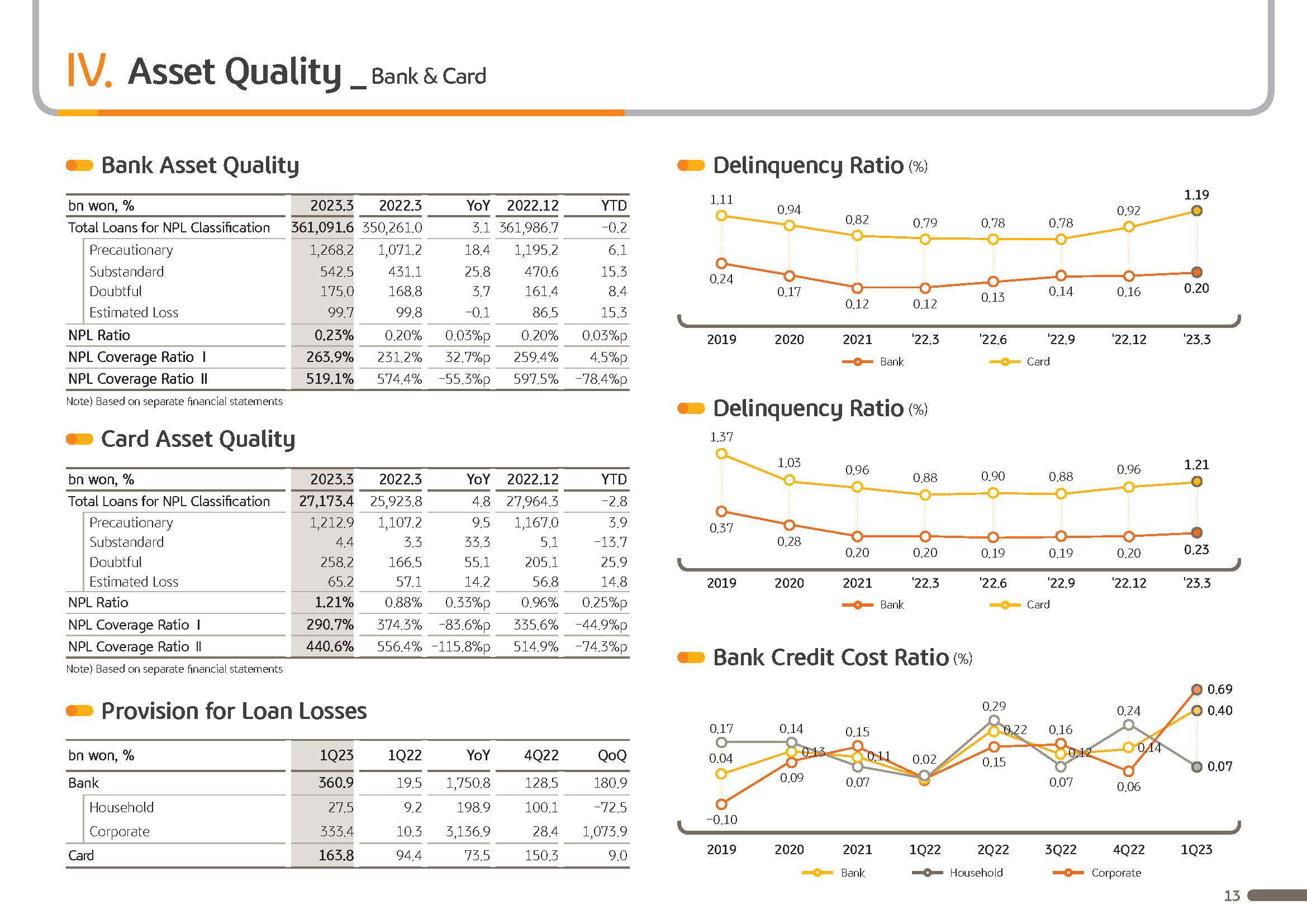

Now during this quarter, there was a significant increase in the group's PCL. This is largely due to conservative provisioning initiated at the group level for relatively weaker positions at card, capital and savings bank business in light of concerns over economic recession. In addition, 48% of group PCL was reserved as part of the bank's general provisioning irrespective of delinquencies in loan assets or NPL formation.

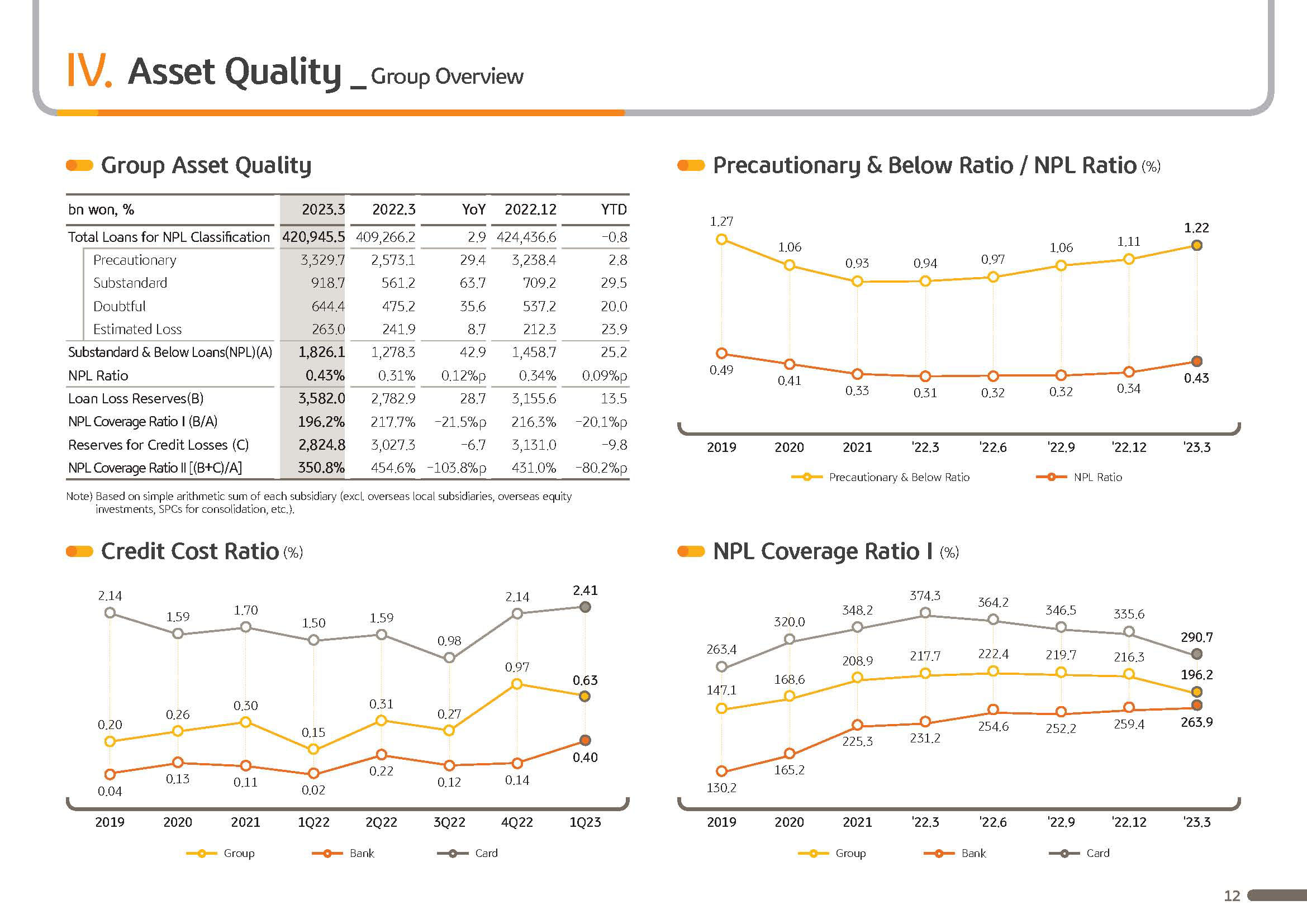

As a result, NPL coverage ratio for the group and the bank end of March were 196% and 264%, respectively, maintaining highest loss absorption capacity in the industry against potential losses. I am aware of grave market concern over the operational headwind faced by the financial industry.

Looking at group's CET1 ratio for the Q123, it reported 13.67%, which shows despite higher shareholder return, there was 40 basis point improvement versus end of '22. This is a clear demonstration of the fact that KBFG is a strong and stable business partner to our customers.

Under a challenging market, KBFG outperformed market expectations in Q123, underpinned by solid fundamentals and diversified business portfolio. We will continue to endeavor to meet expectations of customers and market players going forward.

Lastly, KBFG's BOD today decided on quarterly dividend payout of KRW510 per share. As you know, we've put in place quarterly dividend scheme since last year, and due to treasury share buyback and cancellation which took place early this year, DPS inched up slightly year-over-year. We will continue to think of ways to further enhance shareholder value of KBFG and implement such measures in a consistent manner.

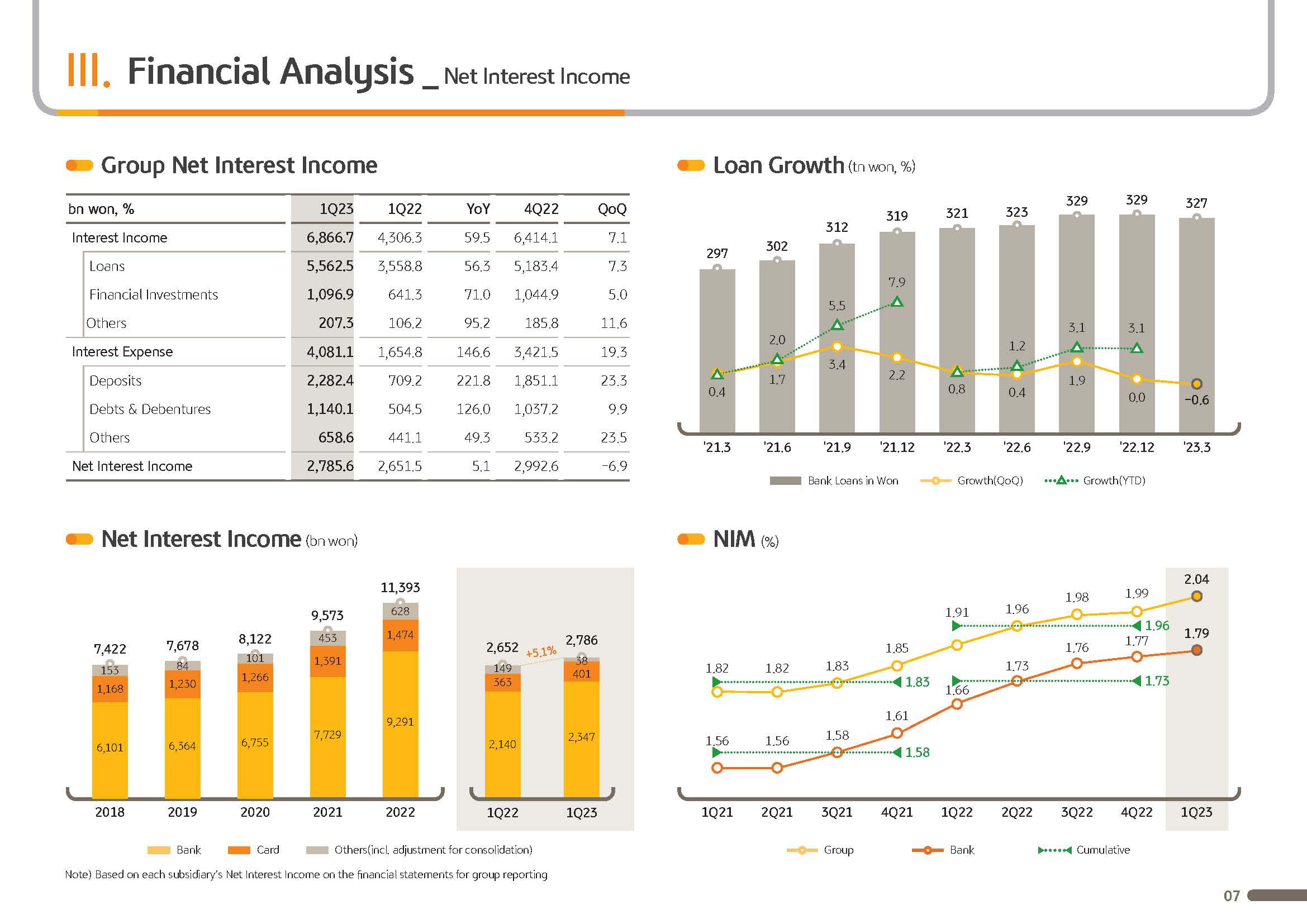

With that said, I will now walk through our business performance in more detail. Group's Q123 NII, net interest income, was KRW 2,785.6 billion, up 5% YoY, which was due to rise in average balance of interest-bearing assets and sustained improvement in NIM YoY. However, on a QoQ basis, NII fell 7%. Whilst NIM relatively fared okay, overall loan growth had been lackluster. The bank's NII decline was the first in 16 quarters.

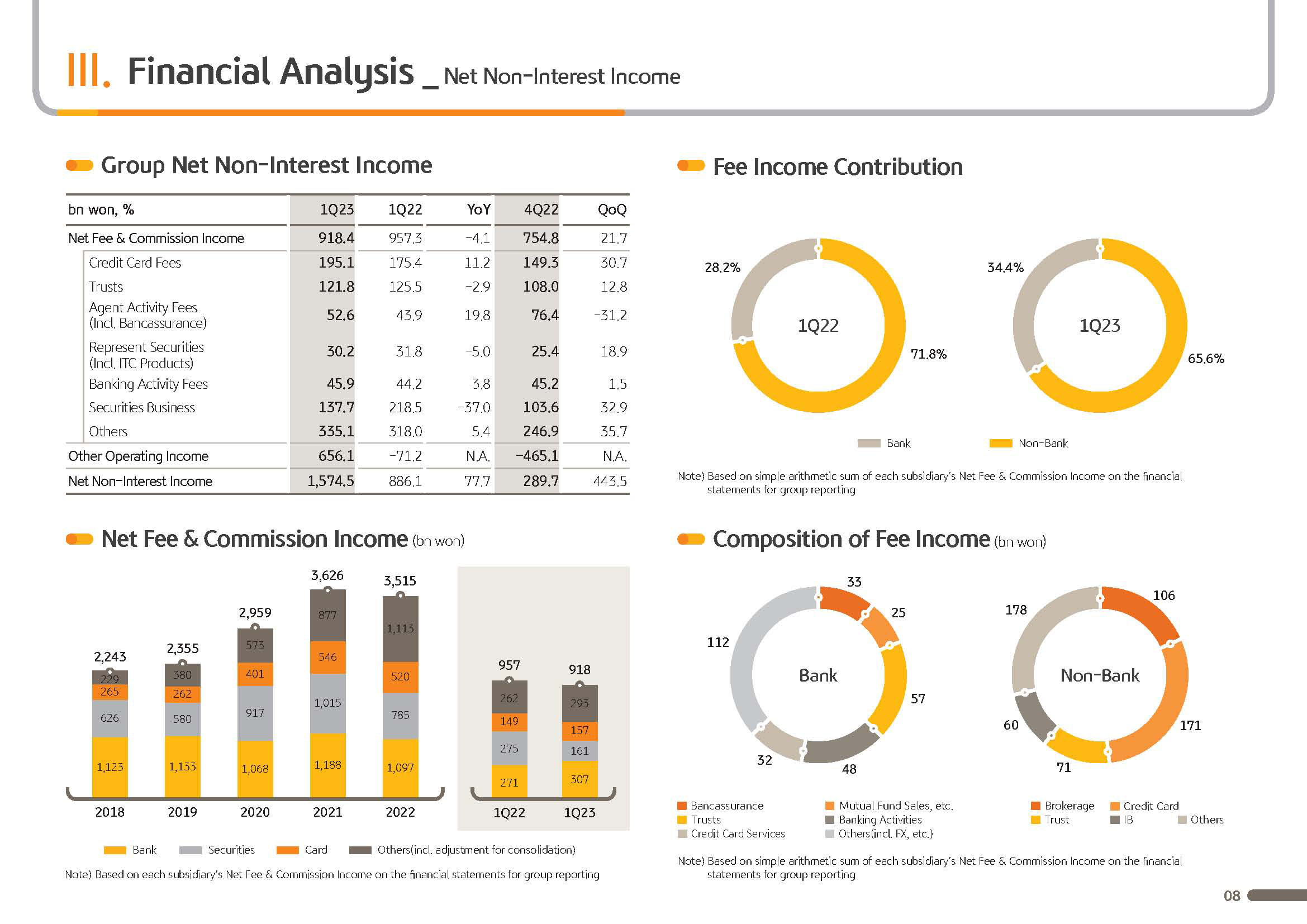

Next is net fee and commission income.

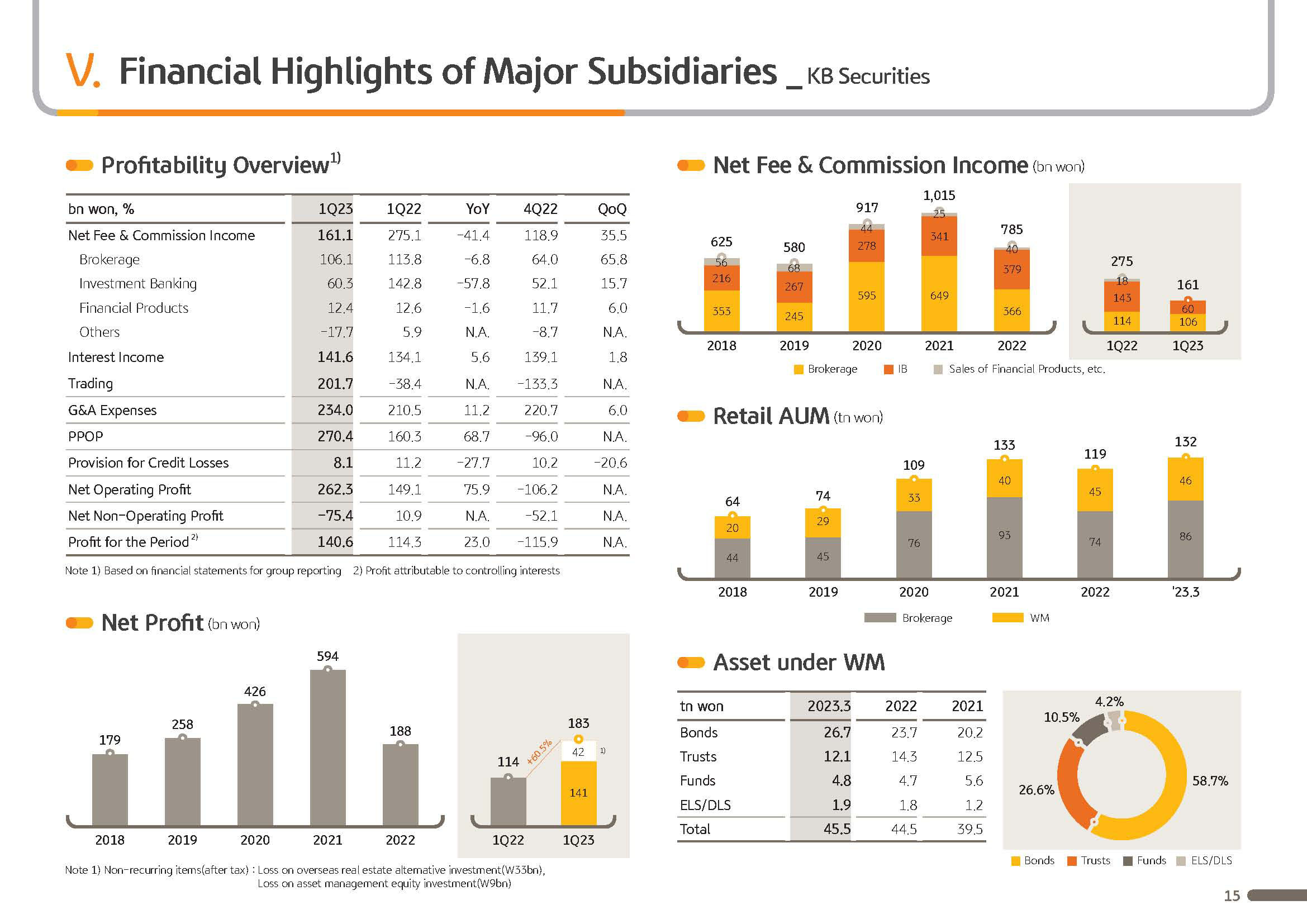

Group's Q1 net fee commission income was KRW918.4 billion, up 22% QoQ. This was driven by good performance from the bank's IB business winning and arranging for mega deals as well as increase in brokerage volume and efficient top line management of the credit card business.

On a YoY basis, however, net fee commission income dipped marginally, which is due to the high space effect from mega IPOs Q122 which drove IB income substantially, and due to softer fee income from the bank's trust business.

Next is other operating profit, which includes profit from prop trading and insurance business.

Q123 other operating profit was KRW656.1 billion, reporting sizable improvement both QoQ and YoY. It was thanks to our timely response to market rate declines and stock market rebound, and through a nimble rebalancing of portfolio, we were able to improve prop trading gains across all subsidiaries and expanded insurers' underwriting income by a large margin.

Sales and trading business underwent massive reorganization across the group in terms of organizational structure, performance evaluation and hiring of talent from outside. As such, we expect to generate steady earnings in '23 compared to the previous years.

For the nonlife business, insurance underwriting profit was up KRW243 billion QoQ. Despite one-offs such as massive fire incident in Q123, lower accident rates and improvement in claims from long-term lines continued, which drove KB Insurance's Q123 net profit of KRW263 billion on a separate basis, reporting 29% YoY increase.

The company has worked hard over the years to reduce its dependence on interest income and gradually grow noninterest income business, and such efforts behind diversifying profit sources paid off as noninterest income share which used to be around 20% increased to 36% as of March 2023.

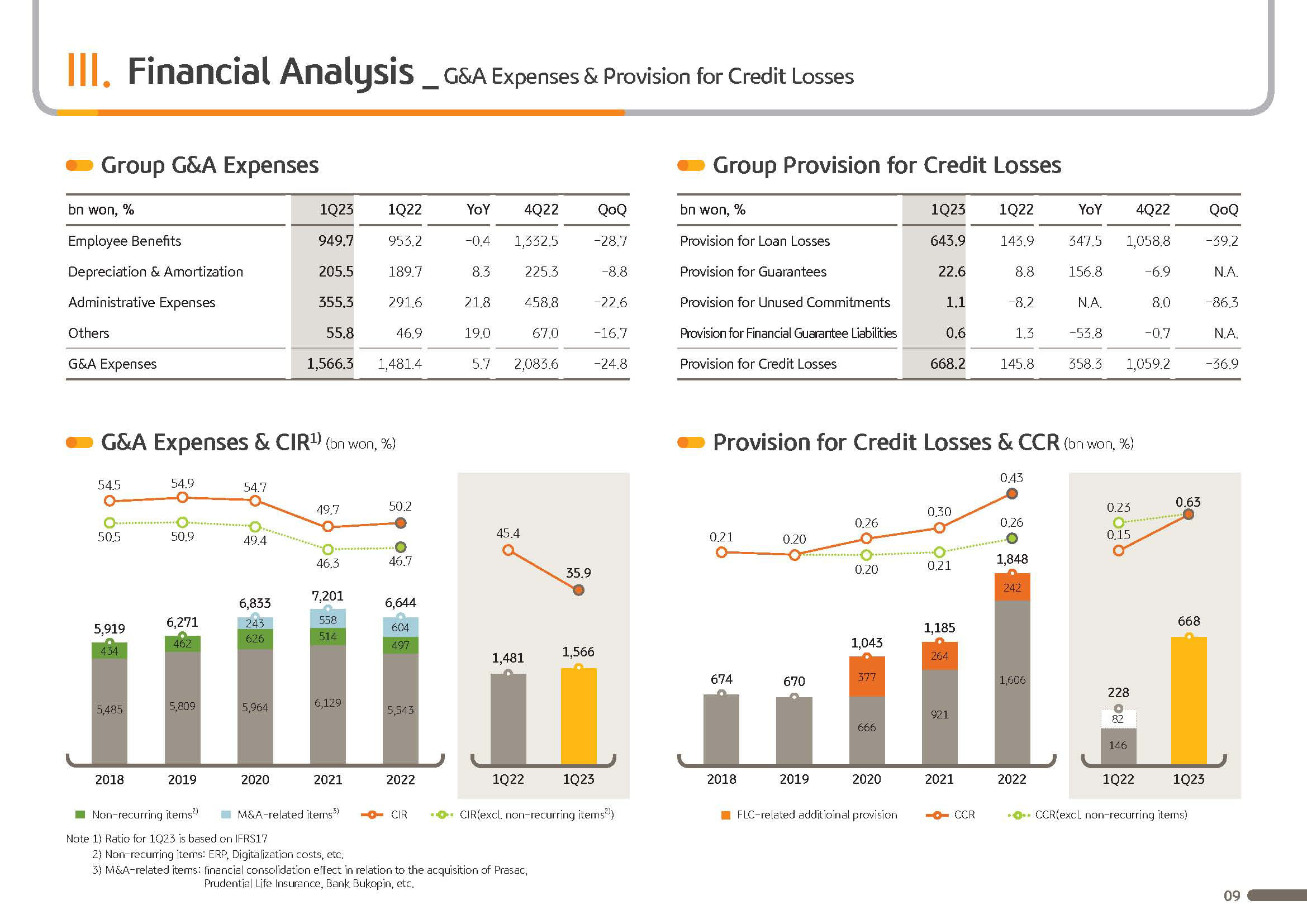

Next on G&A.

Q123 group G&A was KRW1,566.3 billion, up 5.7% YoY. Excluding expenditures related to KB Life integration and CapEx for digitalization, G&A was kept well below the past 12-month inflation.

In light of the concerns of the economic recession this year, rigorous cost management has to be part of the company's priority. As such, we will focus on corporate-wide cost management, revisiting cost items from the 0 base so as to ensure cost efficiency.

Last is our group's PCL. Q1 PCL reported KRW668.2 billion, a sizable increase year-over-year. As mentioned before, this is due to conservative provisioning stance taken across the entire group in light of recently elevated potential for credit risk.

Next page is on key financial metrics.

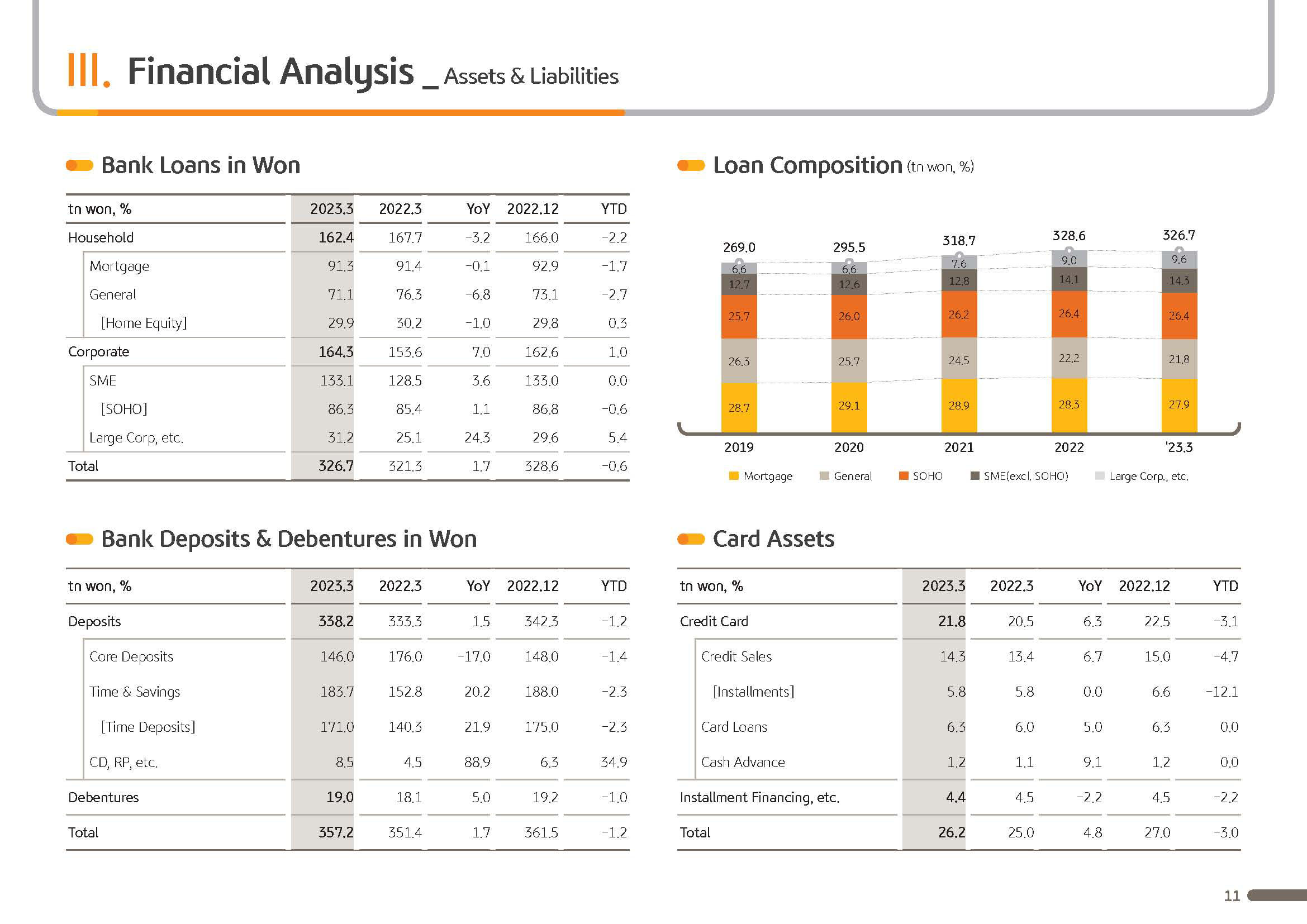

Bank's loan in won graph shows, as of March 2023, total loans in won was KRW327 trillion, down 0.6% YTD, and as such, overall loan growth has been quite lackluster. Household loan reported KRW163 trillion on the back of concerns over economic slowdown, which drove decline in loan demand, including unsecured loan and Jeonse loan with decline being 2.2% YTD, posting a negative growth rate.

On the other hand, corporate loan was KRW164 trillion, up 1% YTD, increasing around KRW1.6 trillion on the back of loan growth for large corporates. As both internal and external environment dictate conservative risk management, we plan to focus on managing soundness and profitability and drive quality growth centering on quality assets.

Next, net interest margin, NIM.

Q123 group and bank NIM each recorded 2.04% and 1.79%, respectively, and increased YoY. Looking at the details, Q123 bank NIM, despite the continued outflow of core deposits, as a result of asset repricing and flexible funding portfolio management efforts, deposit beta became stabilized and rose 2bp QoQ.

In the case of group NIM, with bank NIM improvement and improvement of card asset yield centering on installment finance, asset yield improved for card and thus rose 5bp QoQ.

Let's go to the next page.

This is the status of our group's asset quality. Q123 group NPL posted 0.43% and slightly deteriorated YoY and QoQ. Q123 quarterly group NPL net increase was at KRW360 billion level, and the increase in NPL from card, capital savings, bank accounted for 66% of the total group NPL increase in Q123. In addition, PF bridge loans took up 31% of this net increase.

Continuous asset price adjustments and the realization of economic downturn are analyzed as the biggest cause of NPL increase. The group NPL ratio is still lower than the 2019 level, and we expect that it will be controllable to a level that does not greatly exceed the current level through strict pre and post-NPL management.

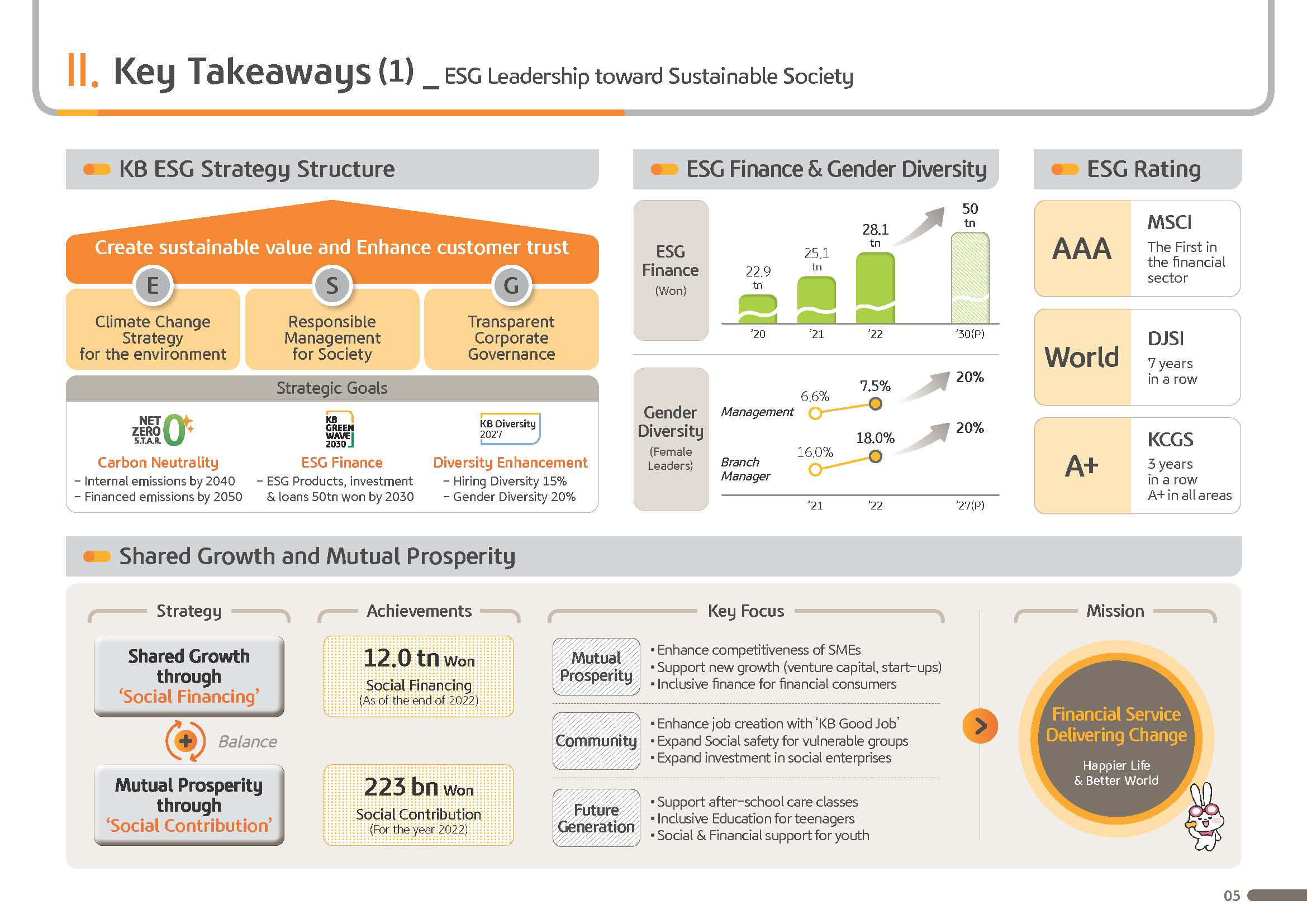

From this page, I would like to elaborate on ESG leadership towards a sustainable society among KB Financial Group's 2023 management strategy directions.

KB Financial Group, centering on our ESG Committee, has been establishing systematic ESG strategies and goals and have been implementing diverse implementation tasks step-by-step as major ESG strategic goals

First, KB Net Zero S.T.A.R. in order to achieve carbon neutrality of our internal emissions by year 2040 and finance emissions by year 2050. Second, KB Green Wave 2030 to expand ESG finance to KRW 50 trillion by year 2030. Third, KB Diversity 2027 to foster female talent in the good and to secure diversity among our members.

Of this, ESG Finance is at a KRW28.1 trillion level at the end of 2022. And taking into consideration group's plan to continuously expand support and gradually increasing trends, it is expected that the original goal will be achieved earlier.

In addition, the goal of fostering female leaders by removing the glass ceiling and glass walls and to expand gender equality based on providing clear opportunities have slightly improved compared to a year ago. As the pool of excellent female talent is gradually expanding, we also expect the increasing speed to naturally accelerate.

Our differentiated ESG management efforts is being assessed and recognized as of the highest level at home and abroad. In particular, in the MSCI ESG rating announced last month, we were the first and only domestic financial institution to be rated AAA, and we demonstrated ESG ratings results at a global top tier level.

Next, in order to create a sustainable future in society, which is our ultimate goal we want to achieve through ESG management, we are pursuing harmonious growth with society and diverse efforts for mutual prosperity.

As of the end 2022, the balance of social financing reached about KRW12 trillion, and we are implementing practical efforts such as carrying out KRW223 billion of social contribution projects during last year. Not resting on our laurels this year as well, we plan to continue promoting mutual growth efforts centering on 3 key focus areas which are mutual prosperity, community and future generation.

Through efforts such as strengthening the competitiveness of SMEs, small businesses and practicing inclusive finance, we will create a soil which will enable joint growth. We will pursue community growth through job creation, contribution to the expansion of social safety net and expansion of investment in social enterprises.

We will take the lead in nurturing the future generation of our society by supporting the establishment of elementary school after-school care programs, step-by-step growth of teenagers and socioeconomic independence of young people preparing for self-reliance.

Going forward, KB Financial Group will swiftly act to implement financial service, delivering change to create a better world. Based on a higher level of ESG management leadership, we promise to fulfill our responsibility and role, befitting our status as a leading financial institution.

Let's go to the next page.

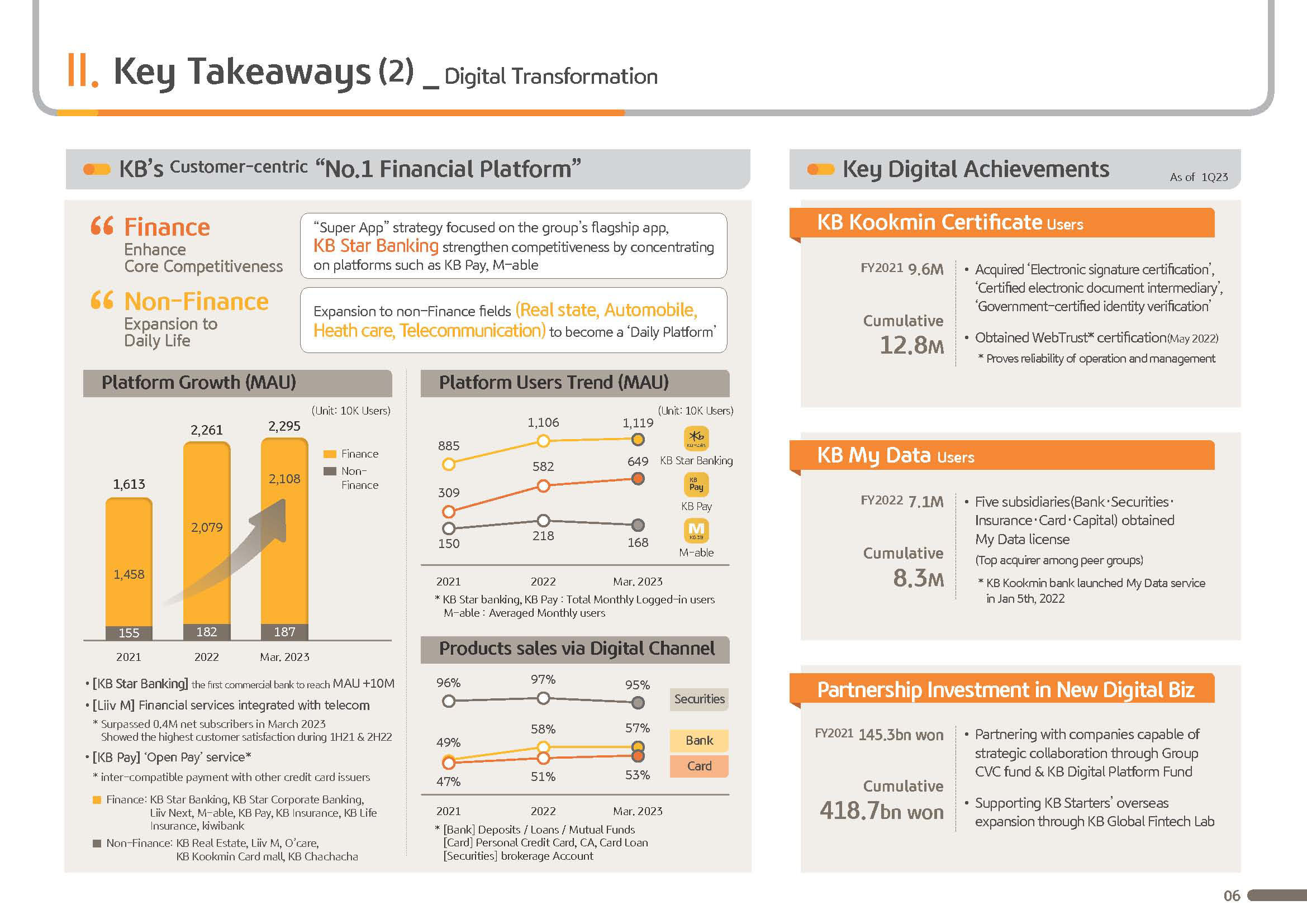

Finally, on this page, I would like to elaborate on KB Financial Group's digital competitiveness.

Along with non face-to-face financial transactions accelerated by COVID-19 pandemic, as competition is intensifying with Internet banks such as KakaoBank and Toss Bank, digitalization is being emphasized as an important competitive edge in the financial industry.

KB Financial Group, which has been one step ahead in responding to these changes, has been strengthening its major platform centering on customer needs and pain points.

And going forward, from an omnidirectional perspective that encompasses platform content and marketing, we will pursue digital transformation so that we will solidify our top-tier position in the digital financial market.

As a part of these efforts, we are pursuing the super app strategy centering on KB Star Banking and are concentrating our capabilities on group's core platforms such as KB Pay and M-able. Focusing on the 4 major nonfinancial areas, real estate, automobile, health care and telecommunications, we aim to expand the nonfinancial areas and are continuing our efforts to become a customer-oriented #1 financial platform which offers the best customer experiences.

As a result, as of the end of March 2023, digital platform MAU grew rapidly by 42% compared to the end of 2021, exceeded 22.95 million people.

KB Star Banking, the group's flagship app, was the first commercial bank to achieve 11 million MAU. Liiv mobile was the first in the financial sector to operate a service combined with telecom and achieve 400,000 subscriber retention, and we also recently obtained final approval for MVNO full service from the Financial Services Commission.

In addition, KB Kookmin certificate acquired 3 government certifications for the first time in the industry and grew 34% compared to 2021 and exceeded 12.84 million users and is growing as a representative private authentication service in the financial sector.

Apart from this, in order for strategic and preemptive investment in promising start-ups, we established the CVC fund, enabling partnerships with promising platform-related ventures, start-ups and new technology companies which can strategically cooperate with subsidiaries, and made around KRW418.7 billion of strategic investments.

Through the KB Starters program, we discovered around 202 excellent start_ups by March ’23 and established around 274 partnerships with KB subsidiaries and have been supporting overseas expansion through KB Global FinTech Lab.

Likewise, we are also operating innovative financial service programs at the highest level in the financial sector. Going forward, along with our group's flagship app, KB Star Banking, we'll also activate KB Pay and others, and through continuous expansion of service areas and content enhancement, work hard to become a part of the daily lives of our customers.

From the next page, there's detailed data regarding the business performance I've covered so far, so please refer to it if needed.

With this, I will conclude my report on Q123 business performance report of KBFG. Thank you for your attention.