-

Please adjust the volume.

1H23 Business Results

Greetings.

I am Peter Kweon, the Head of IR at KBFG.

We will now begin the 1H23 business results presentation. I would like to express my deepest gratitude to everyone for participating today.

We have here with us our group CFO and SEVP, Scott YH Seo, as well as other members from our group management. We will first hear the 1H23 major financial highlights from CFO and SEVP, Scott YH Seo, and then engage in a Q&A session. I would like to invite our CFO and SEVP to deliver 1H23 earnings results.

Good afternoon.

I am Scott YH Seo, CFO of KB Financial Group. Thank you very much for joining our 1H23 earnings release conference call. I will begin with key performance metrics followed by earnings performance in greater detail.

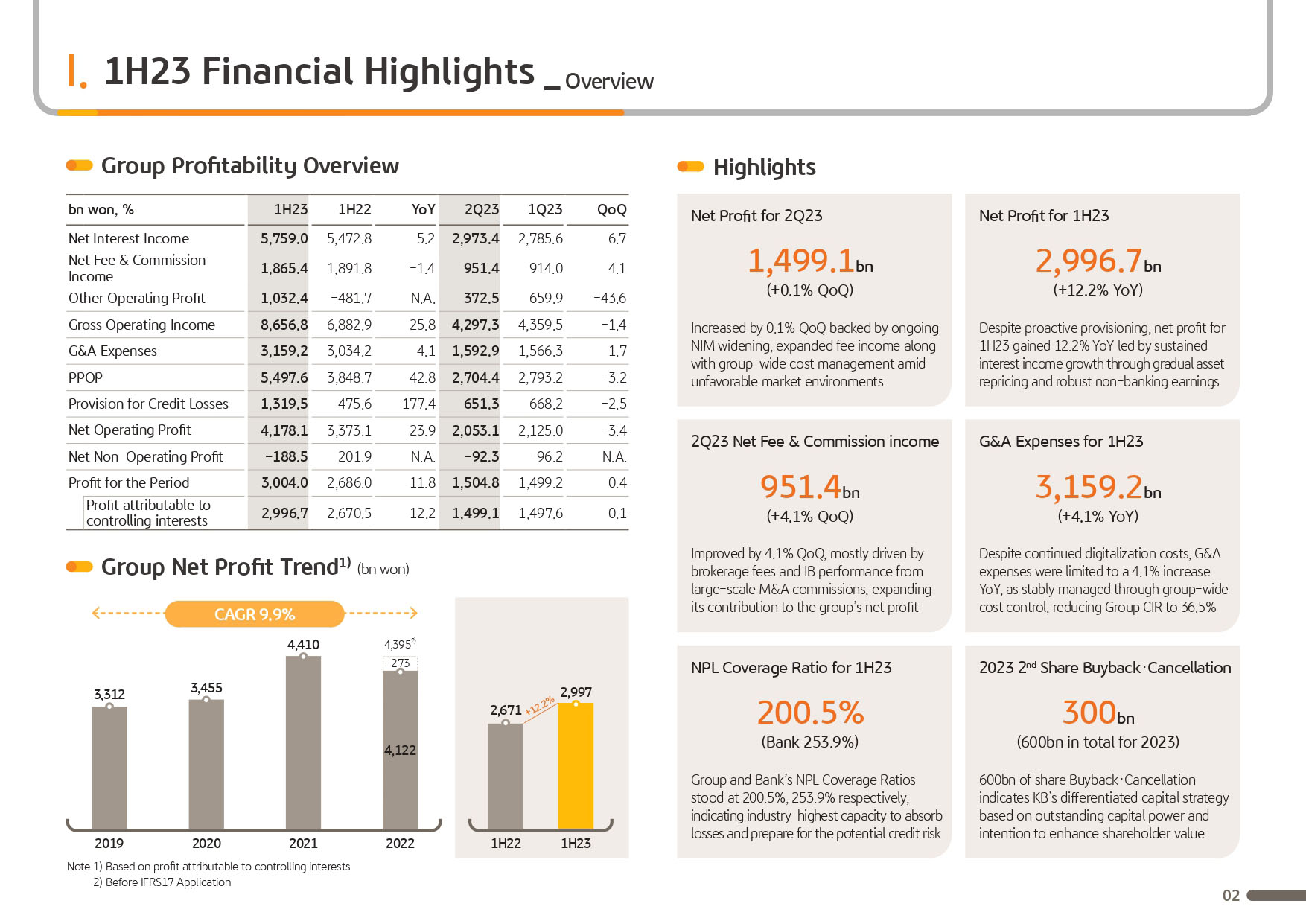

2Q23 group's net profit was KRW 1,499.1 billion, up 12.2% on year to KRW 2,996.7 billion as of the firsthalf of the year. Despite difficult operational backdrop with slowing real economy and rising sentiment for instability surrounding the financial market, Q2 net profit was driven by evenly spread growth of interest and commissions income and supported by cost control efforts, we outperformed market consensus by around 12%.

The group's first half ROE also reported 12.2% and annualized EPS was around 15,200 with around 9% YoY increase displaying a sustained growth trend. But considering the recent interest rate trend and macro backdrop, we expect NIM to face downward pressure during the second half.

And as we continue to stick to conservative lending stance in light of internal and external uncertainties, loan growth will inevitably be constrained with 2Q23 interest income growth suppressed.

KBFG will pursue growth around high-quality assets to secure sustainable interest income basis and by continuing our efforts around business diversification, we will drive growth of nonbank and noninterest business, while corporate-wide cost control will help fuel steady and solid bottom line growth during the year.

Also, in order to bring sustainable growth, KBFG has been steadfast towards inclusive financing, leading the efforts and making social contribution, pursuing co-prosperity with the local communities, and we'll continue to find ways to solve society's issues and expand our role in practicing social responsibility that define sustainable transformation.

In the meanwhile, with prolonged global economic recession, domestic economy is also experiencing a slump and higher interest rate which has heightened concern over deepening credit risk. As such, KBFG is focused on preemptive risk management from a more conservative perspective.

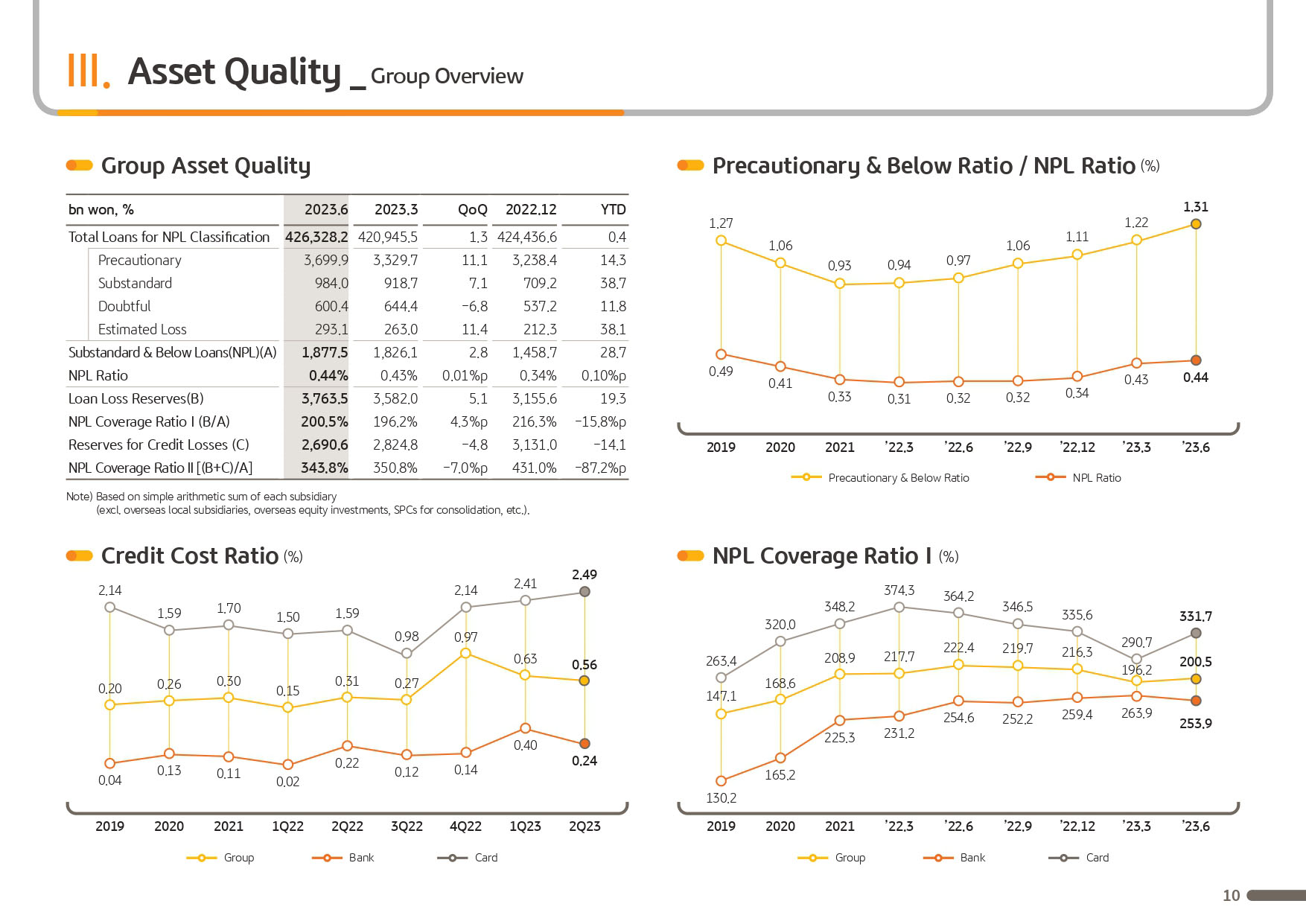

As a result, first half group's PCL, including Q1 general provisioning increased significantly versus last year, but we expect this will alleviate the impact from economic shocks going forward and will be a positive factor in removing business uncertainties and reducing profit volatilities driven by credit loss.

For your information, group and bank's NPL coverage ratio as of end of June were 201% and 254%, respectively, attesting to industry's highest loss absorption capacity against potential losses.

Lastly, KBFG BOD today decided on DPS of KRW 510 this quarter and will buy back and cancel KRW 300 billion worth of treasury shares. Following KRW 300 billion of share buyback and cancellation last February, we've decided on yet another buyback and cancellation, which goes to show our commitment in being faithful to our long-term capital plan announced early this year and our will to enhance shareholder value.

KBFG will continue to increase shareholder return through various means while maintaining capital adequacy so that we may live up to meet market expectations.

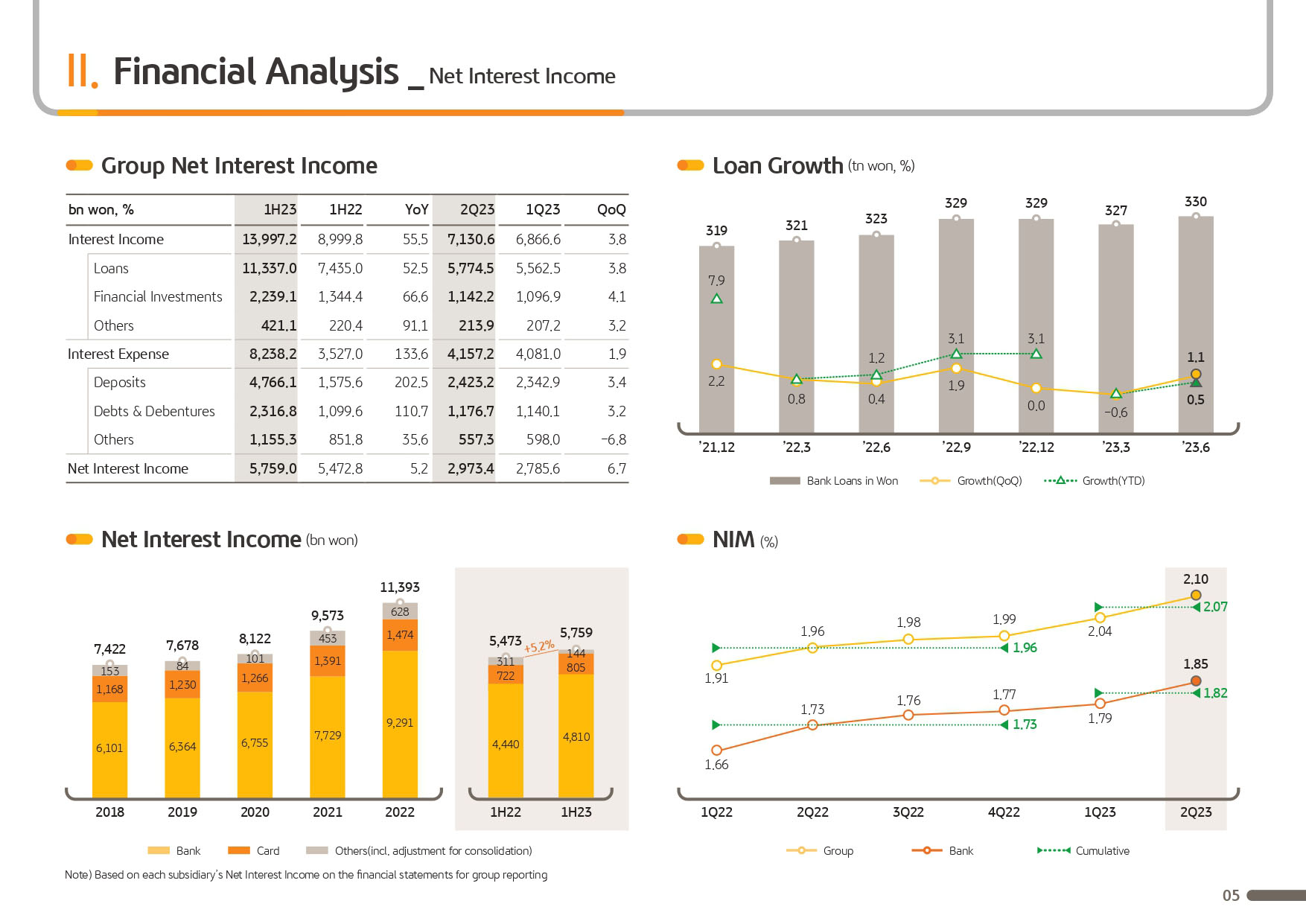

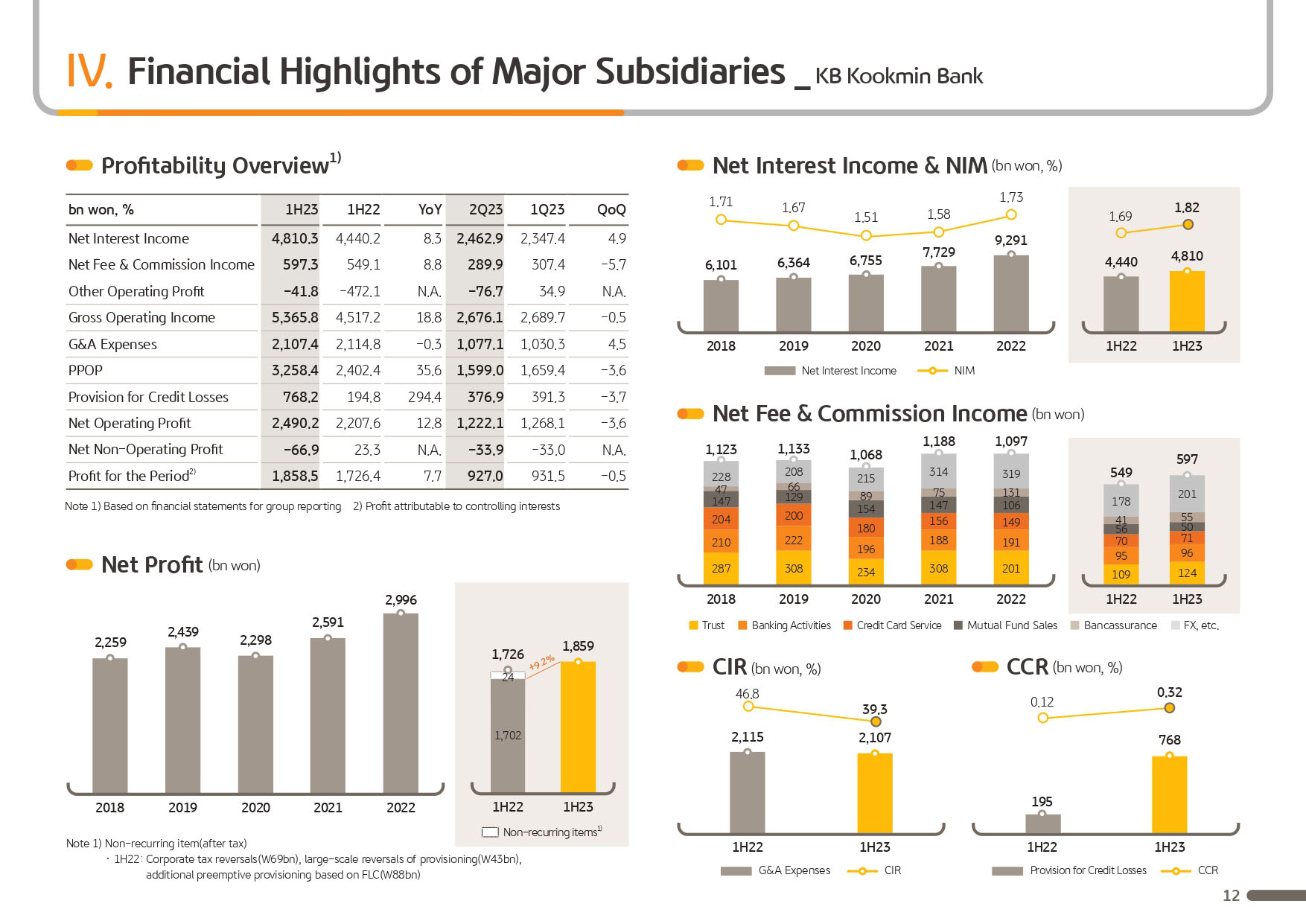

From now on, I will walk through business results in more detail. 1H23 Group's net interest income was KRW 5,759 billion, while Q2 net interest income reported KRW 2,973.4 billion, gaining 5.2% on-year and 6.7% on quarter.

The NIM for the group and the bank in the 2Q23 were 2.1 percentage points and 1.85 percentage points, respectively, sustaining an uptrend since last quarter. This is primarily due to market rate hike in the 2Q and against the backdrop of stabilization in core deposit declines, which started since Q3 of last year, followed by a slight uptick and continuing impact from repricing of loans, which drove QoQ NIM expansion of 6 basis points.

Also, amid continuing corporate loan growth, mostly around higher-quality assets, we saw recovery in household loan growth during the second quarter, supported by real demand, which, though limited, brought rebound in loan growth contributing to rise in the interest income.

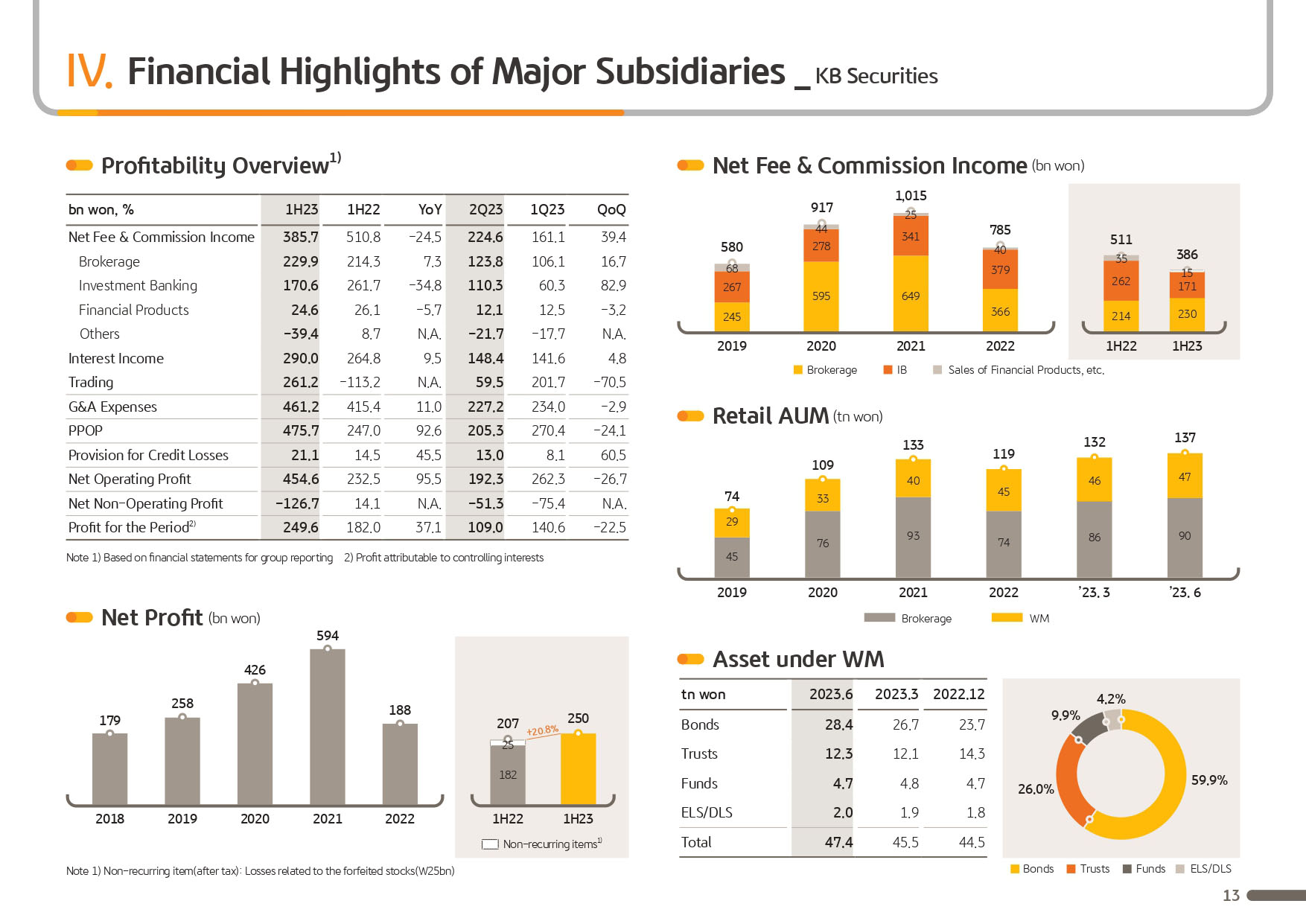

Next is fee and commission income. 2Q group's fee and commission income was KRW 951.4 billion and sustained recovery of domestic stock market as seen from an increase in trading volume, we saw an increase in brokerage fees as well as expansion of IB fees on the back of arranging for large-scale acquisitions, which drove QoQ increase of 4.1%.

On a cumulative first half basis, the income was YoY flat at KRW 1,865.4 billion, unhindered in maintaining industry's top fee income from the CIB businesses despite higher market volatilities and deepening competition and other difficult operational backdrop, both internal and external.

Next, I will go over other operating income, which includes prop trading income and insurance income. Q2 other operating income recorded KRW 372.5 billion and due to decrease of securities and derivative-related income as a result of a rebound in market interest rates, such as a rise in government bond yields, it decreased approximately 44% QoQ.

However, on a cumulative basis for the first half of the year, it recorded KRW 1,032.4 billion, an increase of KRW 1,514.1 billion compared to the same period the previous year when large-scale losses occurred. This is mainly attributable to the significant improvement in prop trading income through timely response to market conditions and prompt portfolio adjustment and expansion of insurance income.

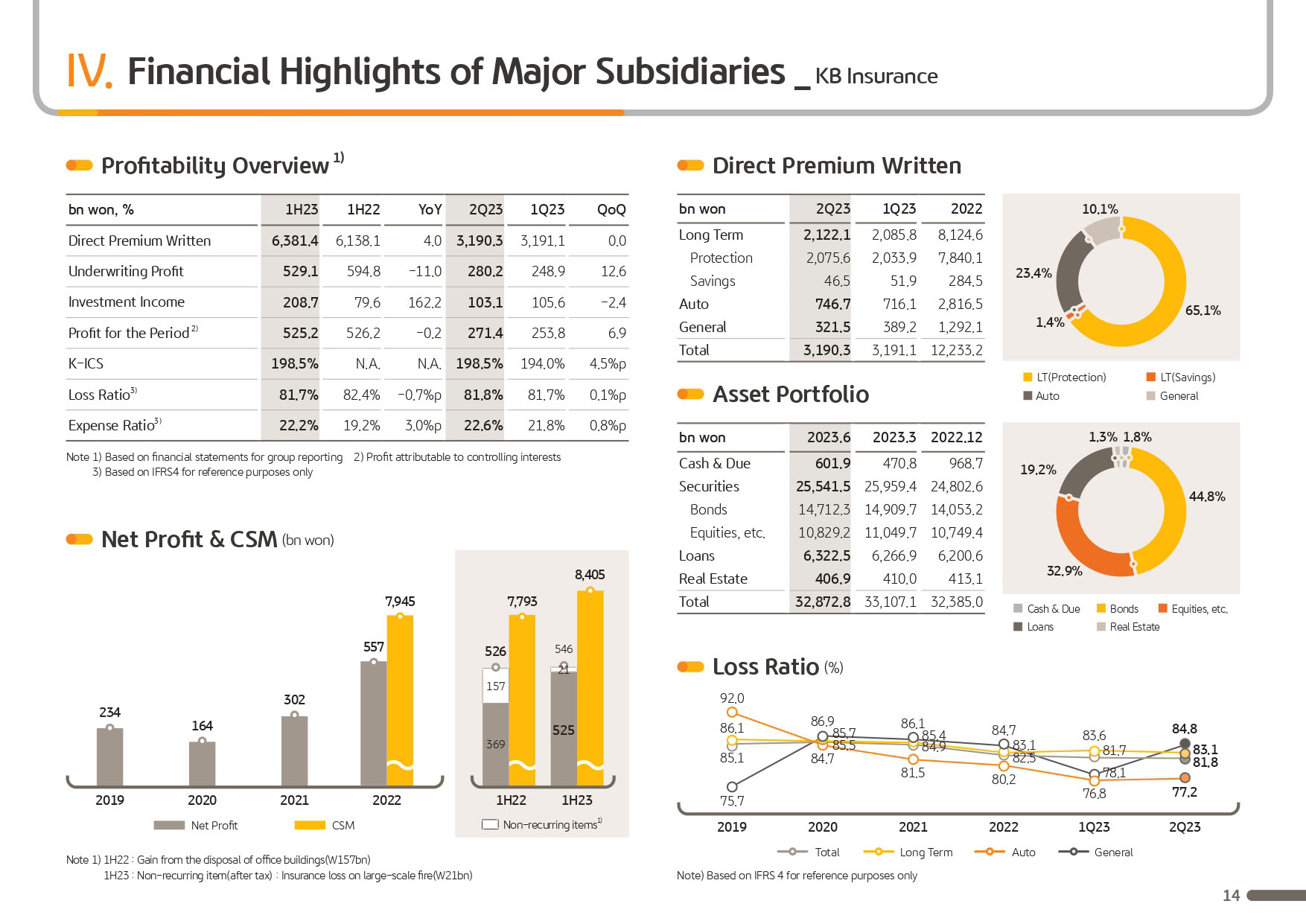

S&T division significantly reduced performance volatility compared to the past and achieved stable performance in Q2 following Q1. Insurance income also increased by 13.4% QoQ contributing to the group's profit growth on the back of expansion of long-term insurance sales and the maintenance of a sale loss ratio.

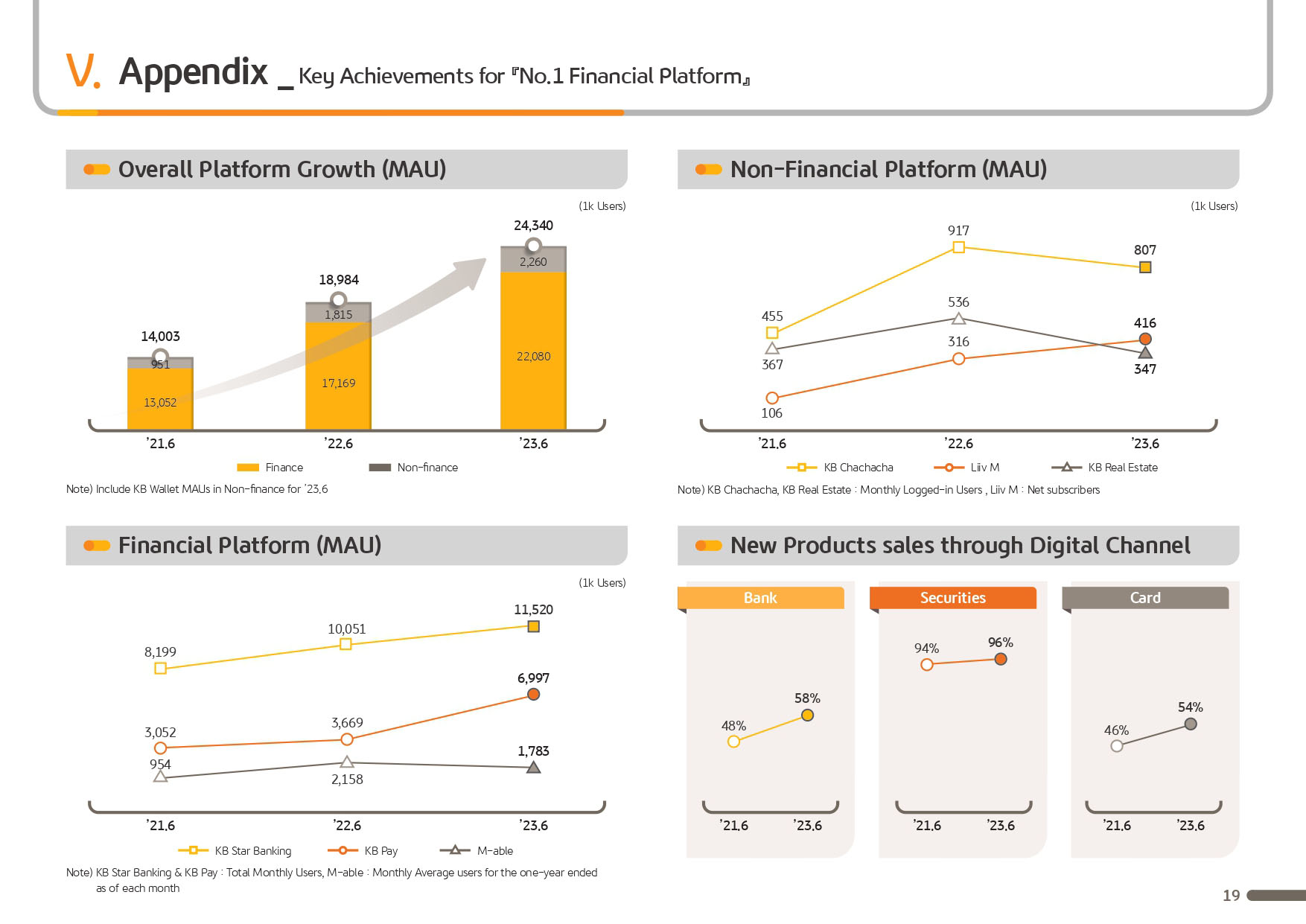

Through our business diversification efforts, we have been reducing our dependence on interest income and increasing the contribution of noninterest income and as a result of the end of June 2023, the noninterest income contribution has expanded to 34% level and the nonbanking profit contribution has also expanded to the 41% level.

However, as briefly mentioned previously, the expansion of interest income is expected to be limited in the second half, and we expect the contribution of insurance income to group profits to be lower than the first half due to first: the possibility of accounting change method regarding actuarial assumptions; and second, seasonality in the second half.

In response to this, we intend to defend against the decline in operating profit before provisioning and secure a foundation for stable profit growth by additionally expanding noninterest income such as by increasing commissions in the WM and IB business and improving trading performance.

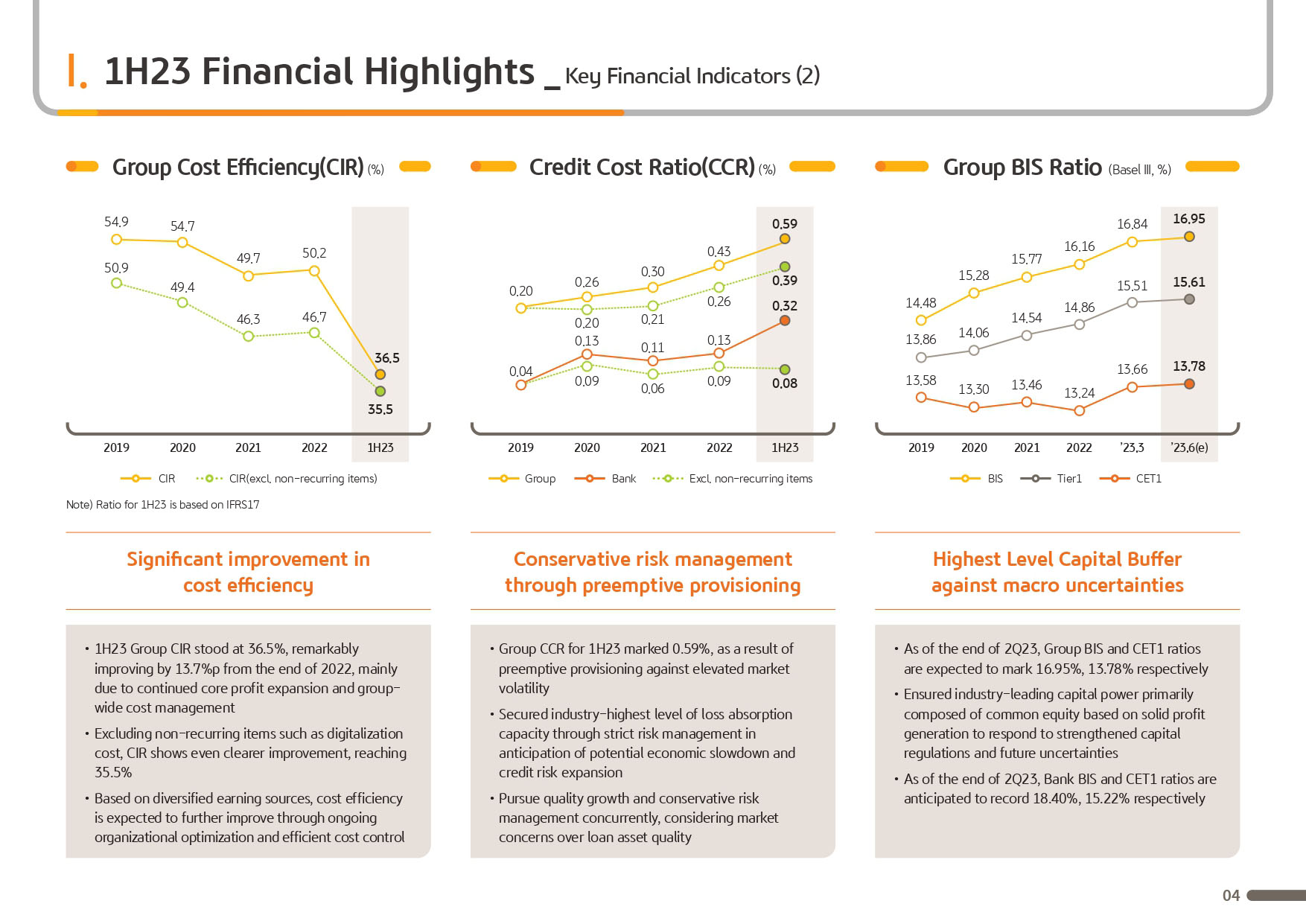

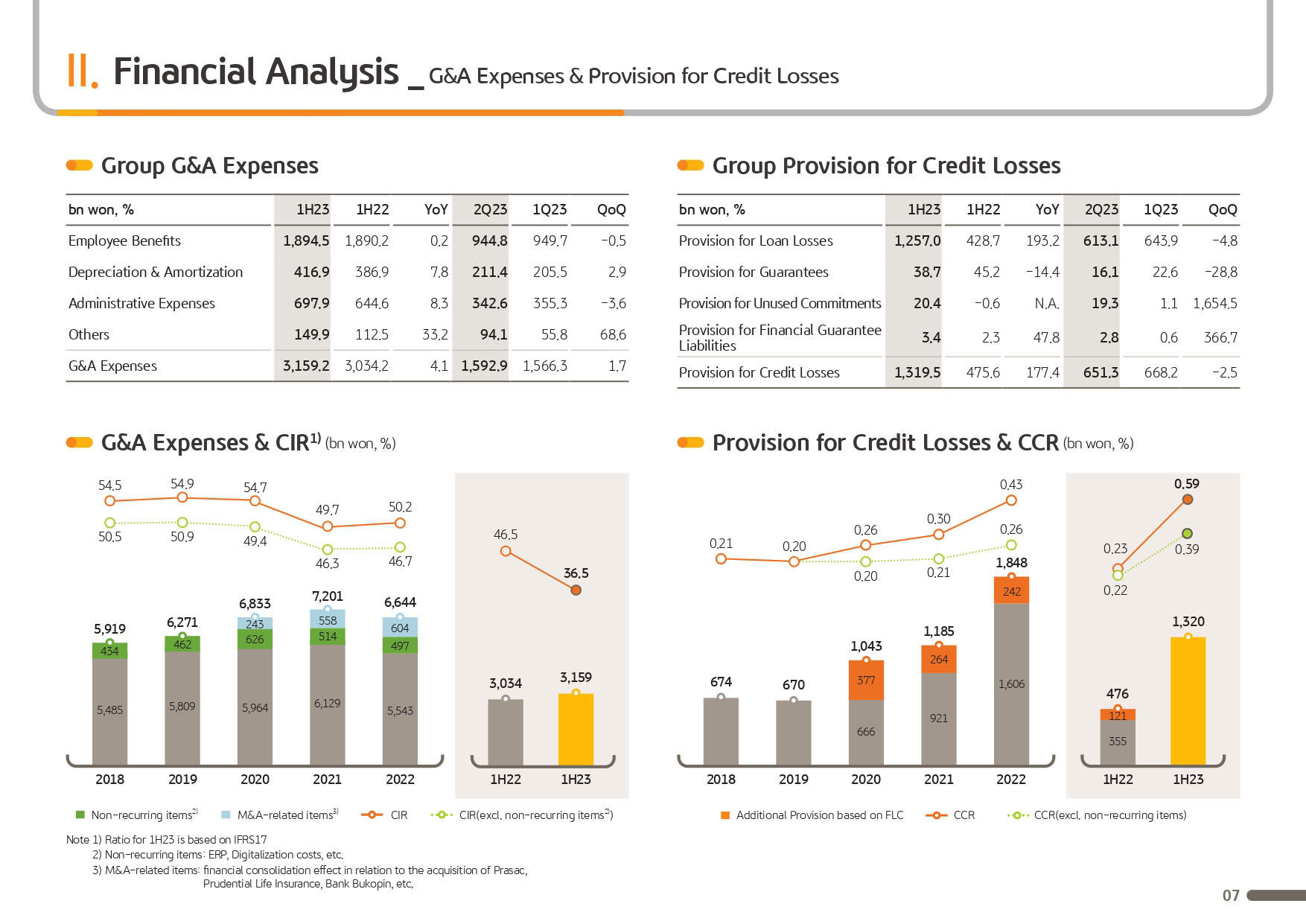

Next, I would like to go over SG&A. The group's cumulative G&A expenses in the 1H23 posted KRW 3,159.2 billion and despite continuing digitalization and IT-related investments, thanks to group-wide cost control efforts, it is being well managed overall with only a 4.1% increase YoY.

2Q23 G&A expenses increased 1.7% QoQ due to seasonal factors such as tax and dues. Meanwhile, the cumulative group CIR for the 1H23 was at a 36.5% level. It was a significant improvement of more than 10% points compared to the previous year as continued core profit growth and group-wide cost control efforts became visible.

We are targeting an annual CIR of early 40% range in the mid to long term and we plan to further improve the group's cost efficiency through organizational efficiency and group-wide cost control efforts based on a diversified profit base.

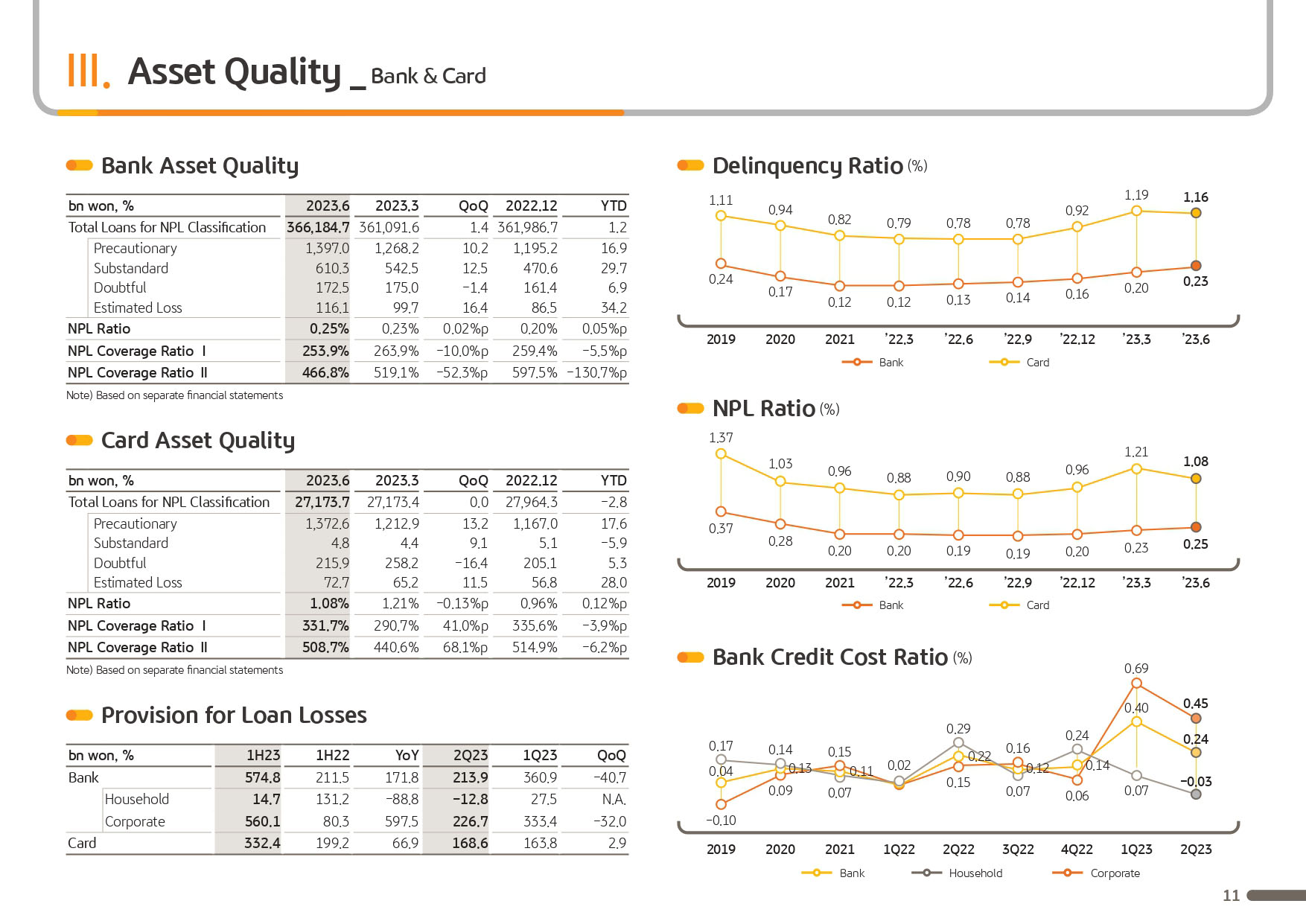

Lastly, it is the group's provision for credit losses. Q2 provision for credit losses posted KRW 651.3 billion and quarterly CCR reported 56 basis points. It was a 2.5% decrease QoQ compared to the large-scale general provisioning accumulated in the previous quarter.

But even taking this factor into consideration, it is at a level exceeding the recurring level provisioning after last year. This is mainly due to the accumulation of additional provisioning worth approximately KRW 170 billion due to the change of Korea Federation of bank's assumption guidance regarding the bank's estimated loss forecast model.

In the first half of the year, provision for credit losses was KRW 1,319.5 billion, and group credit cost on a cumulative basis for the first half was 59 basis points compared to total loans, a significant increase compared to the previous year.

However, considering the macro environment, such as the current level of provisioning and market interest rates, it is highly likely that the group's credit cost will record an early to mid 40 basis point level per annum in 2023. This is mainly due to a short-term time mismatch between nominal and real provisioning rather than an increase in the delinquency ratio.

With the recent financial company's asset quality indicator deterioration, we understand that there are many concerns about the spread of insolvency risk in the market. However, we have secured the industry's highest level of loss absorption capacity through preemptive risk management and as concerns over asset quality deterioration is continuing, we will further strive for substantial growth in conservative asset quality management.

On the other hand, regarding the issue of provisioning write-back related to a specific ship builder, which has recently become a concern of the market, it was not recognized in the group's earnings in the first half of the year, but we plan to make a careful decision in the near future by considering various aspects such as the group's future performance and financial soundness.

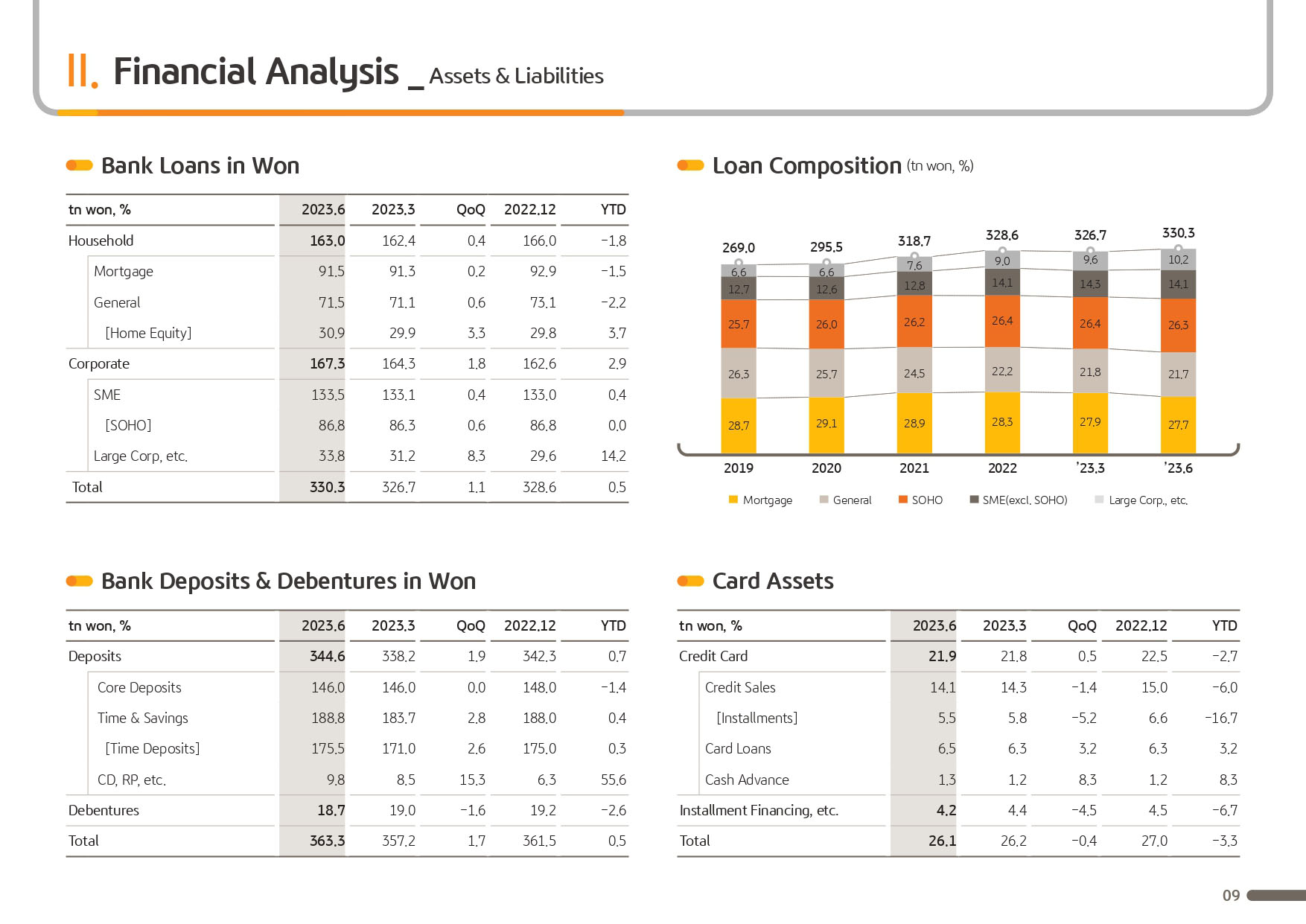

On the next page, I will go over the major financial indicators. First, if you look at the bank's loans in Won growth graph as of the end of June 2023, the bank's loans increased by 1.1% compared to the end march and increased by 0.5% YTD and posted KRW 330 trillion.

Corporate loans posted KRW 167 trillion as of end June and increased 1.8% from the end of March and 2.9% YTD and continuing stable quarterly growth, in particular loans to large corporations centering on prime assets increased by more than KRW 4 trillion YTD, driving corporate loan growth, while SOHO loans and general SME loans also showed a slight net increase YTD.

Meanwhile, as of the end of June, household loans posted KRW 163 trillion, down by 1.8% YTD due to high interest rates and slow demand recovery. However, in this quarter, negative growth pressures eased with an increase of 0.4% QoQ centering on real demand funds such as housing mortgage loans and jeonse loans

As this is a time and conservative risk management is required due to internal and external conditions, we plan to build this on qualitative growth centered high-quality assets in the second half of the year, focusing on asset quality and profitability management.

Let's go to the next page. I would like to go over group capital ratio on the top right of the page. As of the end of June 2023, the group's BIS ratio posted 16.95% and CET1 ratio recorded 13.78%. We are maintaining excellent capital adequacy centering on common equity capital based on stable profit generation while securing a sound capital buffer against macro uncertainties.

Please refer to the next page for details on the performance explained so far, and this concludes KB Financial Group's 1H23 business performance presentation. Thank you for your attention.