-

Please adjust the volume.

2023 Business Results

Greetings.

Greetings. I am Peter Kwon, the Head of IR at KBFG. We will now begin the 2023 Full Year Business Results Presentation. I would like to express my deepest gratitude to everyone for participating today. We have here with us our Group CFO and SEVP Jae Kwan Kim, as well as other members from our group management.

We will first hear the 2023 major financial highlights from CFO and SEVP, Jae Kwan Kim and then engage in a joint Q&A session.

I would like to invite our CFO and SEVP to deliver our 2023 earnings results.

Good afternoon. I am Jae Kwan Kim, the CFO of KB Financial Group. Thank you for taking part in our 2023 earnings presentation.

Before going into the details of the business results, let me briefly walk you through the key financial highlight for the year of 2023 of KB Financial Group.

KB Financial Group's net profit attributable to controlling interest for 2023 posted KRW 4,631.9 billion. It is up 11.5% YoY, driven by non-interest income led solid earnings improvements and stable cost control despite macro uncertainty, thus demonstrating the healthy fundamentals and ability for profit growth.

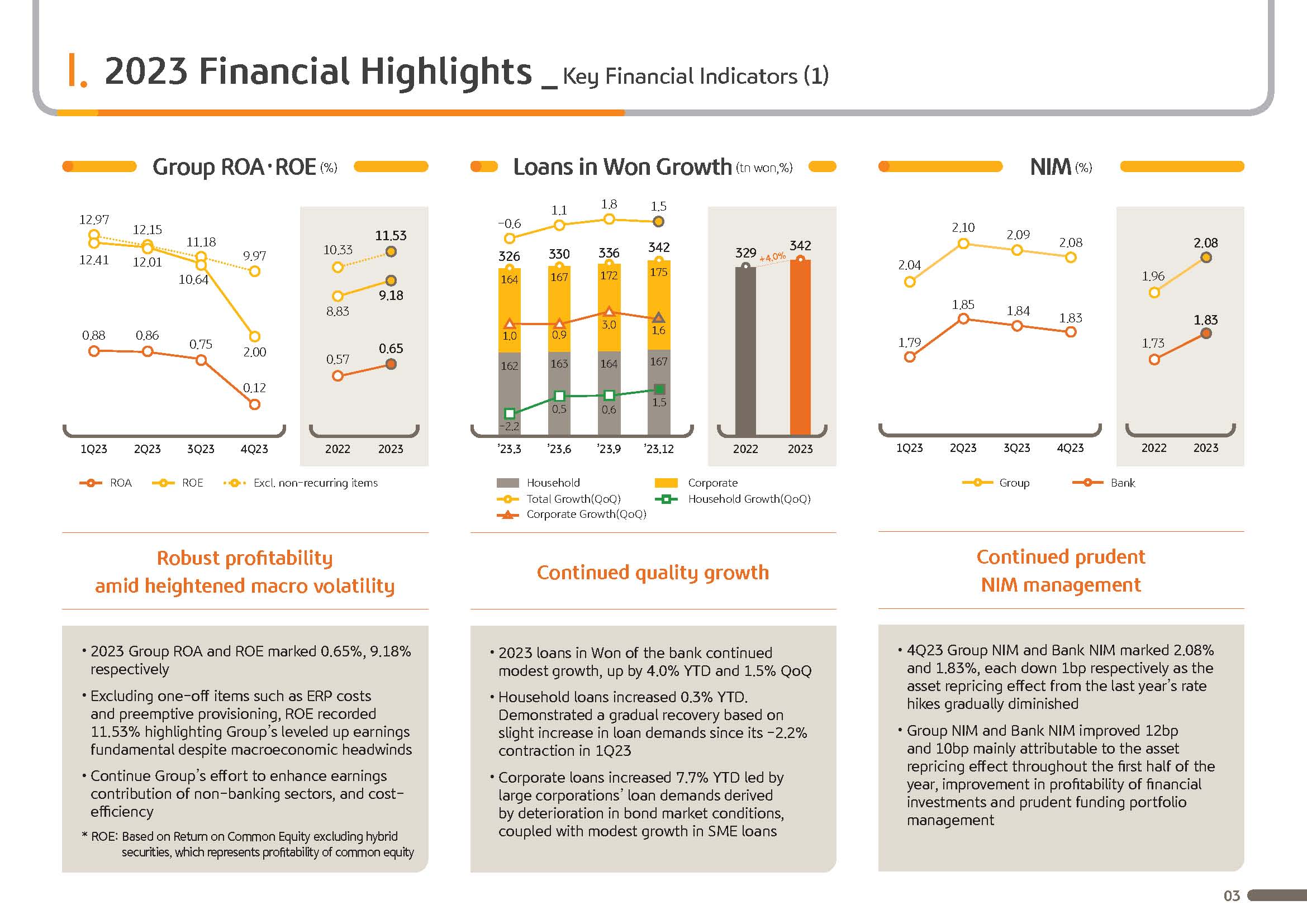

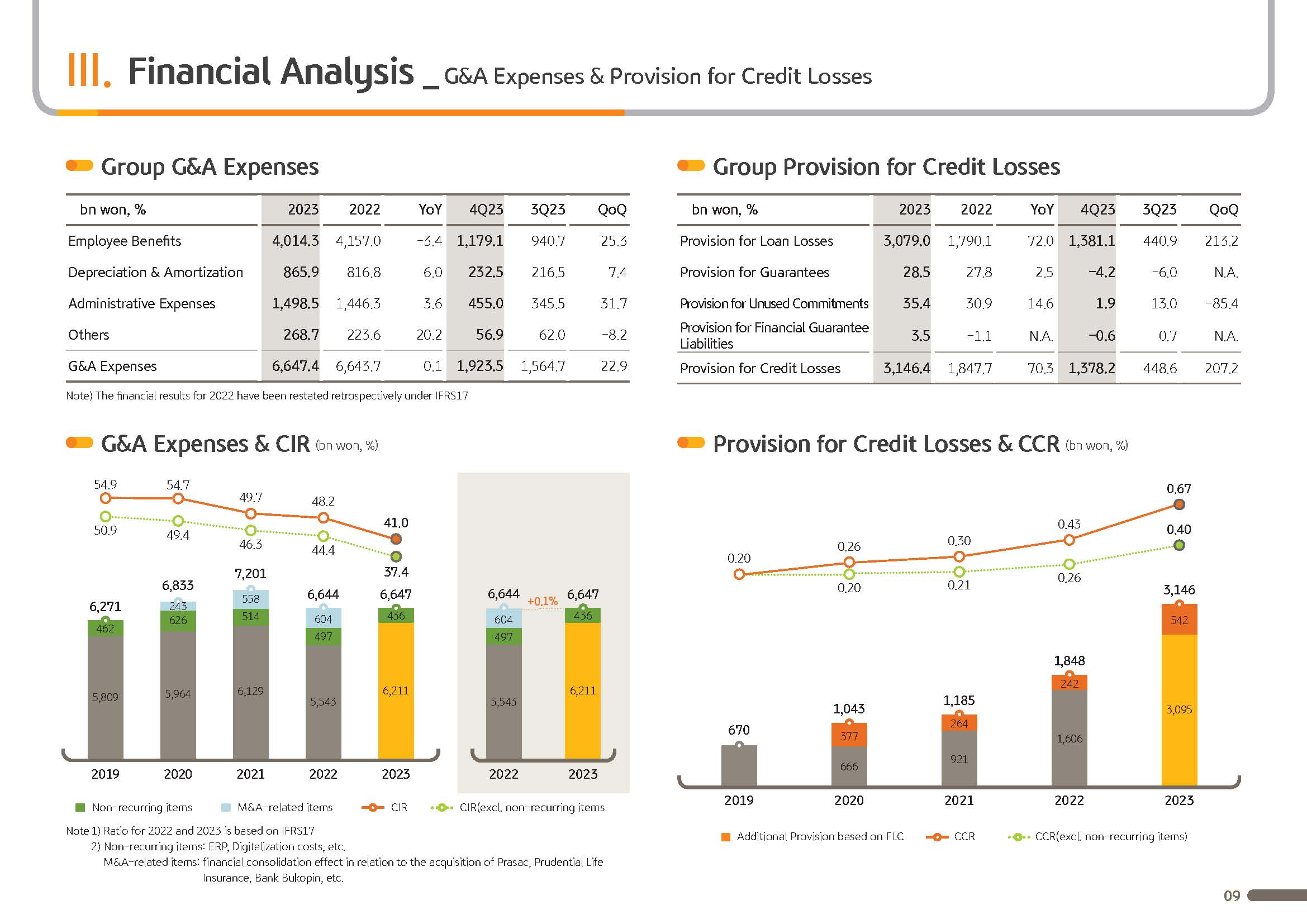

Balanced and strong earnings fundamentals was achieved across all of the top line segments of the group, which resulted in record high gross operating profit for 2023, posting KRW 16 trillion, up 17.8% YoY. As a result of efforts to enhance cost efficiency within the group, G&A expenses increased only 0.1% YoY and the group CIR in 2023 was at record low levels, coming in at 41% approximately.

However, provisions for credit losses posted KRW 3,146.4 billion last year, up significantly YoY due to continuing high interest rates, both at home and abroad.

Credit risk, especially in the real estate market, has expanded substantially. After Taeyoung E&C filed for a debt restructuring program in December, concerns are running high of deteriorating asset quality in the real estate PF market.

To be preemptively prepared during the first half of last year through changes in our expected loss modeling, we have set aside KRW 490 billion in provisions.

In addition, in the fourth quarter, reflecting a conservative outlook for the future, we have set aside an additional KRW 51 billion approximately and preemptively set aside approximately KRW 754 billion one of additional provisions for priority watch list sectors, including real estate PF and overseas commercial real estate to prepare for any future risk. We expect this to underpin our sustained and strong growth going forward.

In terms of returning profit to society, we have recognized KRW 333 billion out of the total of KRW 372 billion for the social contribution program in Q4, although last year’s net income did not quiet meet the market expectations because of this. Excluding such factors, the group's ordinary net income is approximately more than KRW 5.5 trillion, which is the highest level of fundamentals found in the industry.

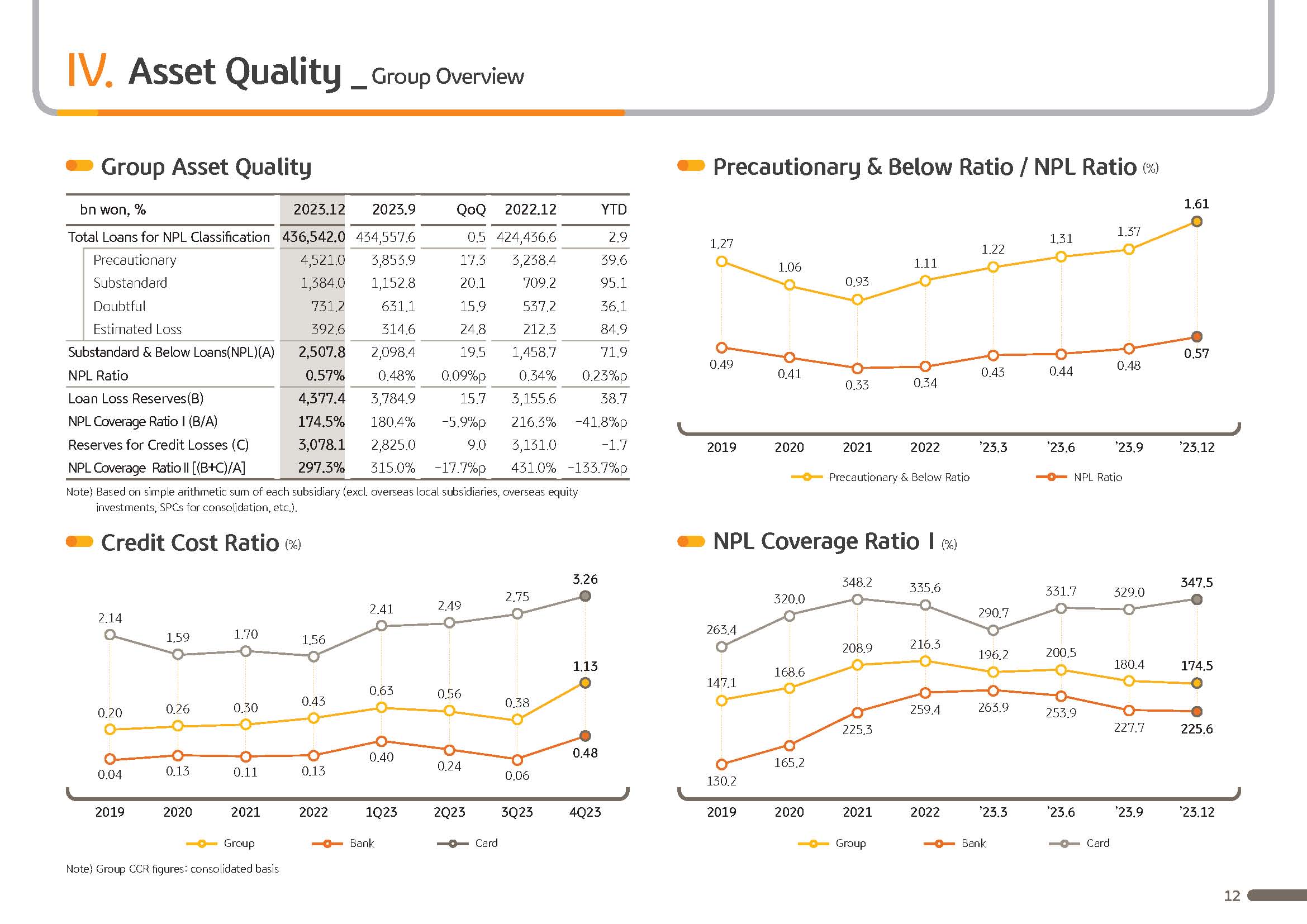

Meanwhile, the credit cost ratio of the group in 2023 posted 67 bps. But excluding one of factors on a recurring basis, it stands at approximately 40 bps, thus being maintained at a stable level. Also, as of the end of 2023, the group's NPL coverage ratio posted 174.5%. In this quarter, the asset quality of priority watch list sectors such as the real estate PF and overseas commercial real estate has been more conservatively rated, resulting in a slight fall in the NPL coverage ratio QoQ. Despite this, however, the group still demonstrates the industry's highest level of loss-absorbing capacity.

Meanwhile, KB Financial group's BOD today has decided that the per share dividend for 2023 will be KRW 3,060 up 4% from KRW 2,950 of the previous year and also resolved on the share buyback and cancellation of KRW 320 billion. The share buyback and cancellation is in addition to the KRW 300 billion in share buyback and cancellation that we undertook in July of last year, once again, showing the firm commitment of the BOD and the senior management toward enhancing shareholder return and value.

Lastly, let me briefly touch upon the progress made in 2023 regarding the group's mid- to long-term capital management plan that was announced in February of last year.

First, the total assets based on the 2023 year-end consolidated financial statement posted KRW 716 trillion, up 3.9% roughly YTD and led by the healthy loan growth of the bank, assets have expanded appropriately within the nominal GDP level. Secondly, as was mentioned already, following the previous year in 2023 as well, dividends has been gradually increasing, while share buyback and stock cancellation has been proactively undertaken.

So, despite a number of uncertainties, we are endlessly striving to achieve shareholder returns in keeping with the expectations of the market.

Going forward, the company will uphold its firm commitment to faithfully carry out the group's long-term capital management plan, and will do our utmost to implement a proactive shareholder return policy.

Let me now explain our business results in greater detail.

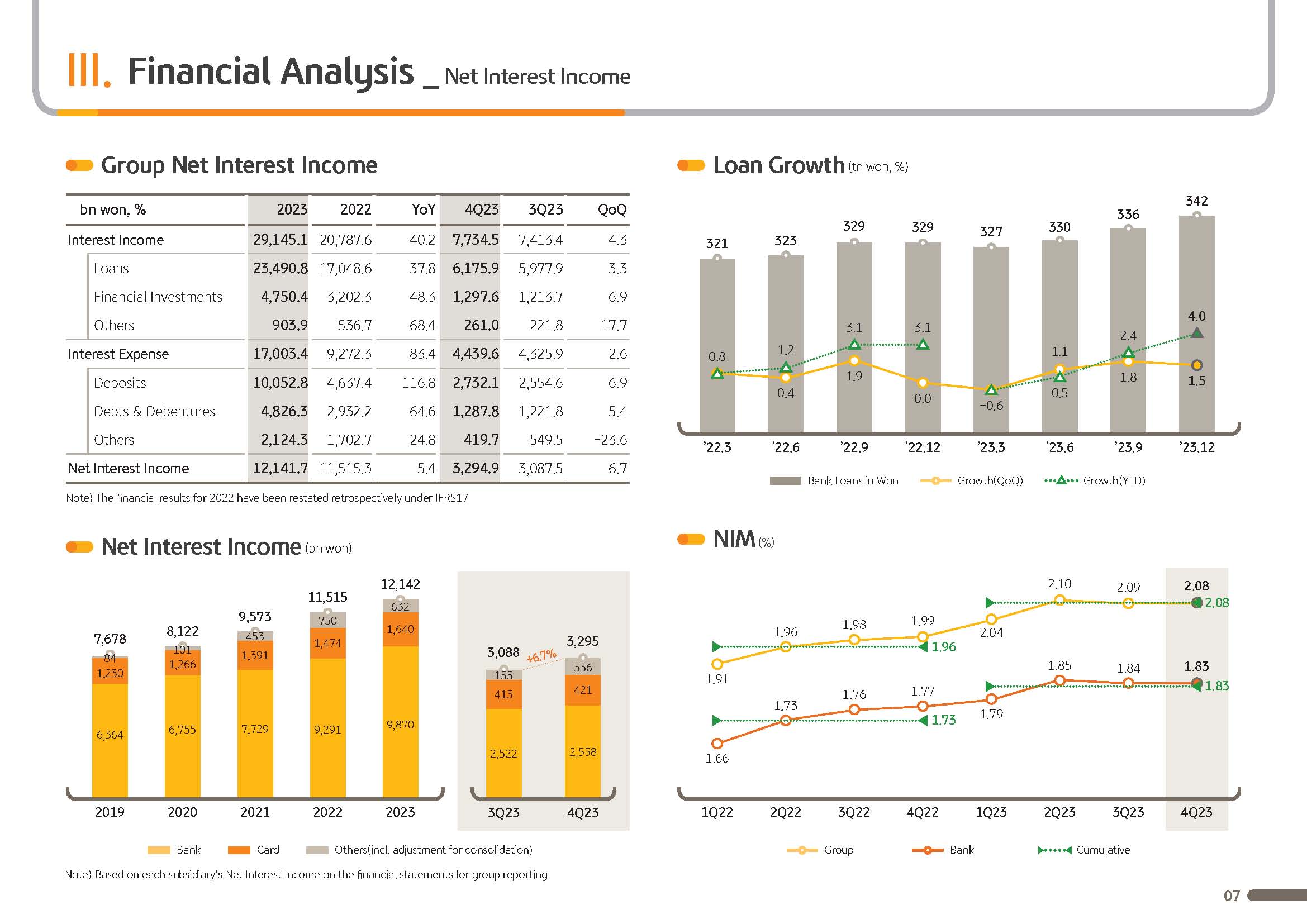

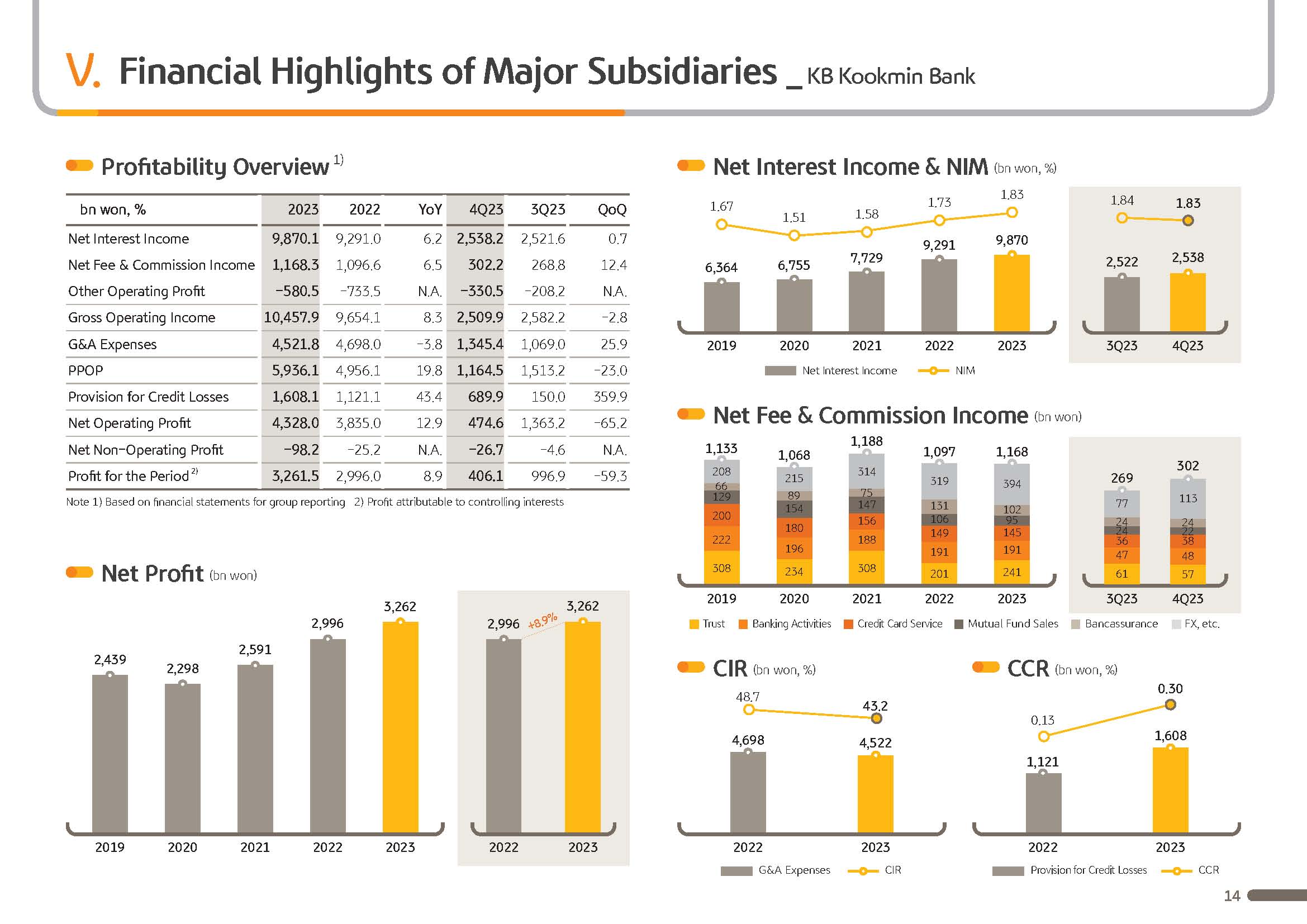

In 2023, the group's net interest profit posted KRW 12,141.7 billion, up 5.4% over last year. This is the result of improving net interest margins of 12 bps, reflecting the effects of loan asset repricing on the back of rising interest rates last year while Korean won loans of the bank increased 4% YTD, securing a stable profit base.

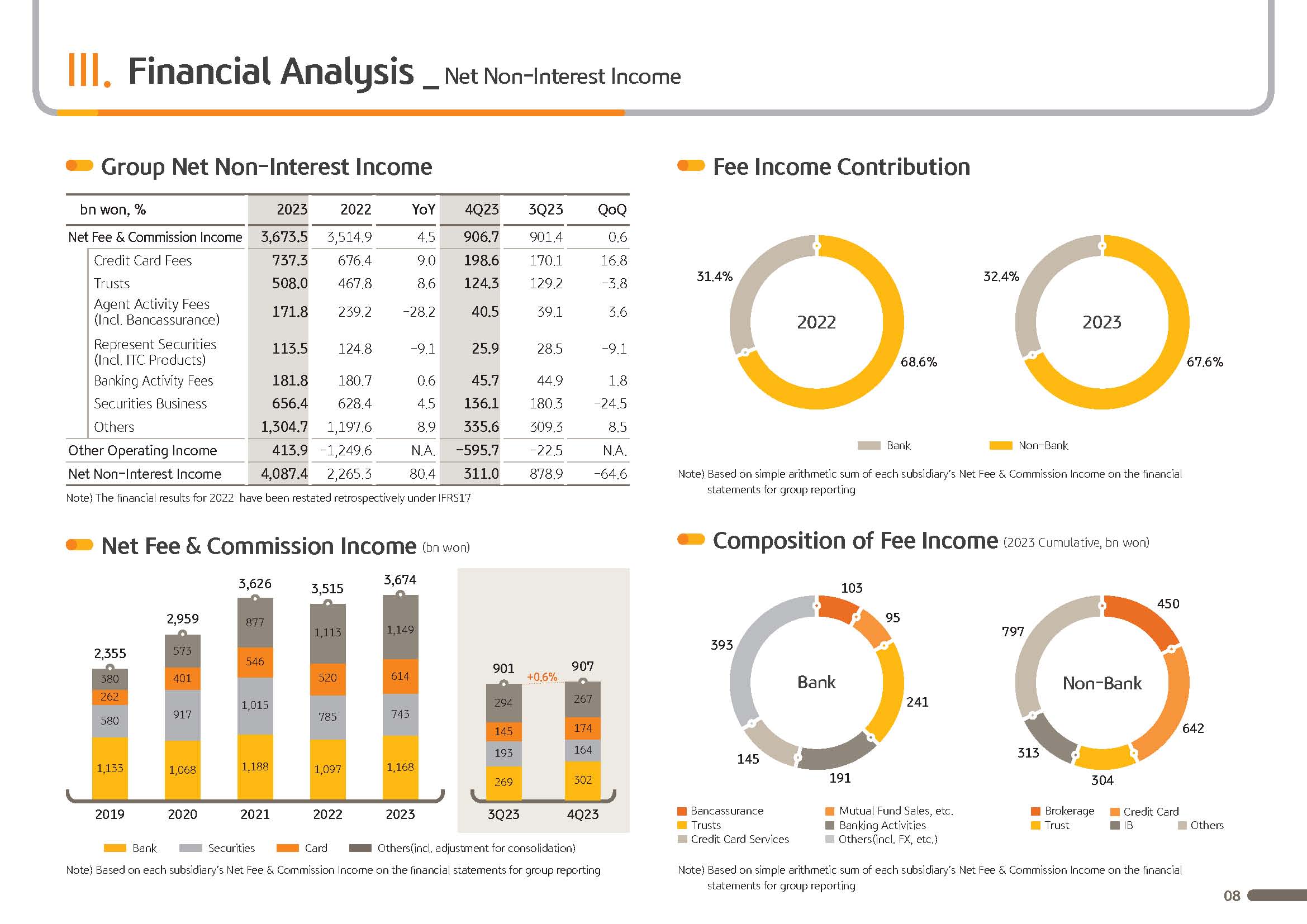

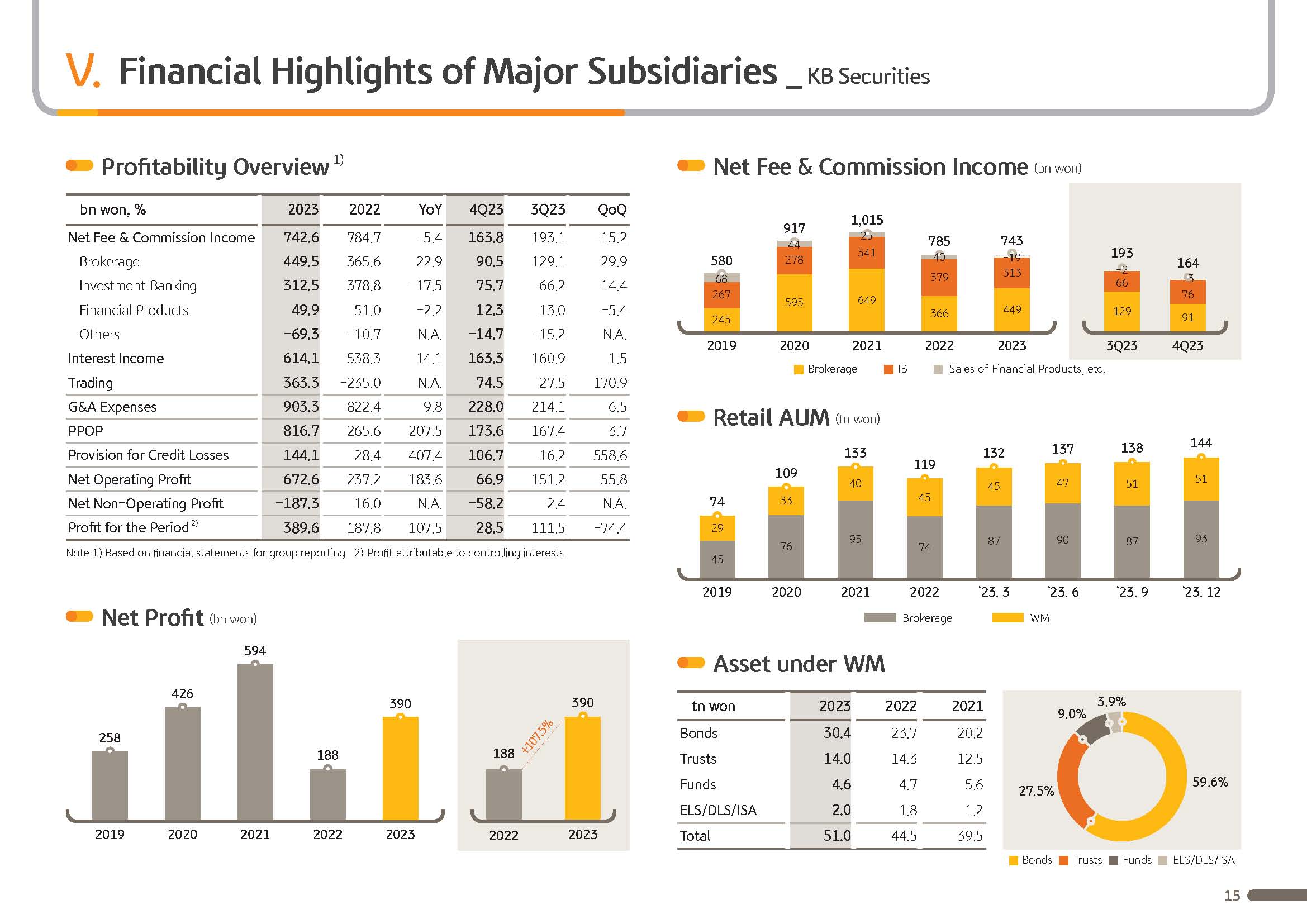

Next, the group's net fee income and commission posted KRW 3,673.5 billion, up 4.5% YoY in 2023, increasing by KRW 159 billion approximately. Such growth of the net fee income owes itself mainly to the solid growth of the business fees coming from the retail customer base of the credit card, securities and capital business despite the challenging market environment with the wealth management and real estate PF contracting.

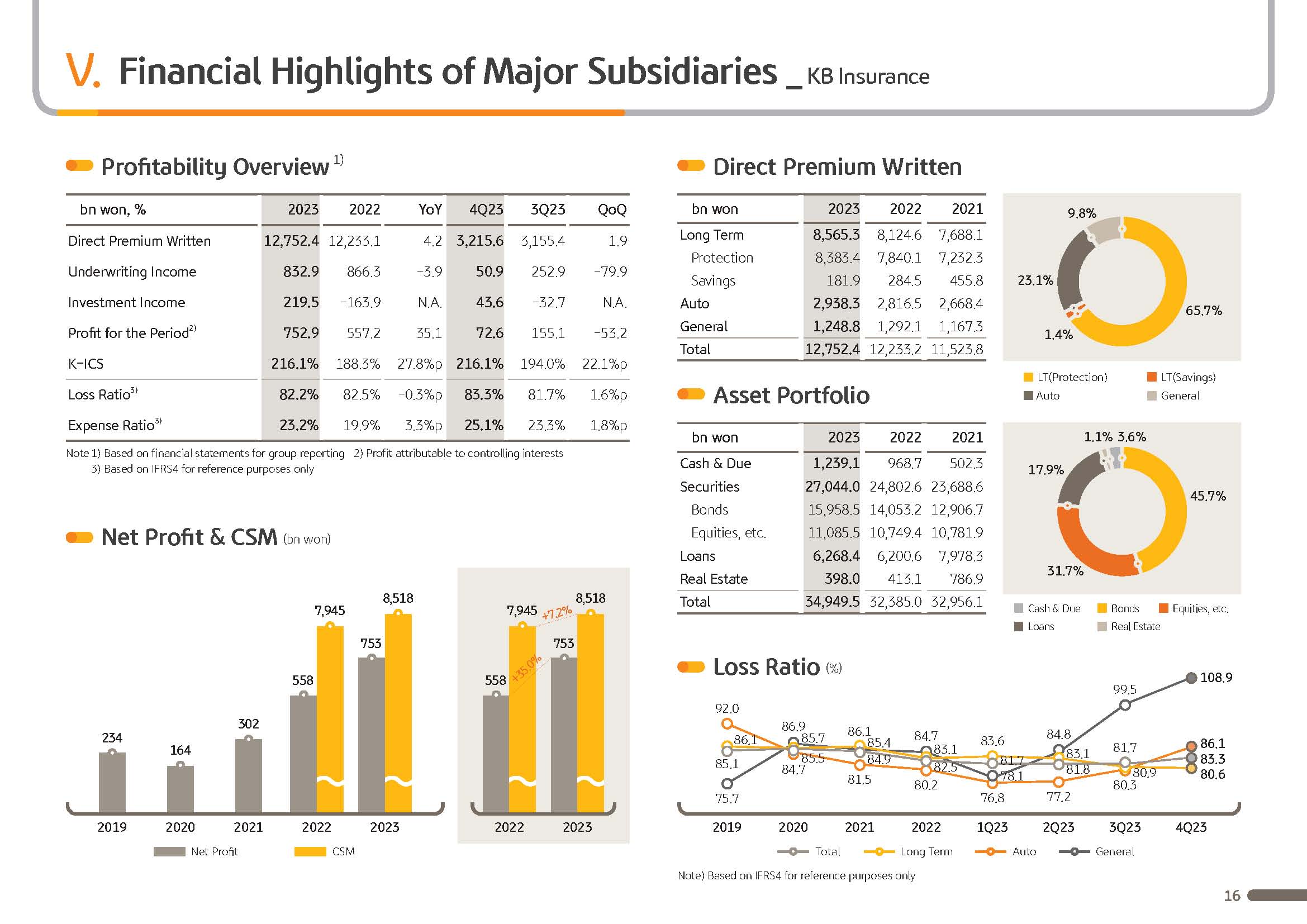

Next, let me move on to the other operating profit. In 2023, the other operating profit posted KRW 413.9 billion, showing significant improvements over the previous year's large losses, up by KRW 1,663.5 billion. Against the backdrop of improving market conditions, including interest rates and stock indexes, efforts have been made to engage in timely responses to the market in addition to diversifying the funding asset portfolio, leading to meaningful enhancements in the performance of marketable securities and derivatives. In the case of insurance related income, despite increasing costs owing to actuarial assumption changes of the financial authorities last year related to IFRS 17 in the second half of the year, growth of 8.5% was posted over the previous year, maintaining a solid earnings momentum.

However, the other operating profit in Q4 declined significantly QoQ posting losses of KRW 595.7 billion. This is due to seasonal factors driving an increasing loss ratio, which led to a fall in insurance income, added to which KRW 333 billion of social contribution program expense was reflected as other operating expense.

Next is on G&A expenses. In 2023, the G&A expense posted KRW 6,647.4 billion. As has been previously referred to, this is a mere 0.1% increase over the previous year and is the result of personnel restructuring, strict cost control and other measures taken across the group to enhance cost efficiencies.

Finally, the group's credit loss provisions. In Q4 the credit loss provisions posted KRW 1,378.2 billion, a significant increase QoQ. This is due mostly to the large-scale preemptive provisioning against the priority watch list sectors at the group level, reflecting a conservative SLC. And excluding such factors, the credit loss provisions at the recurring level is approximately KRW 573 billion.

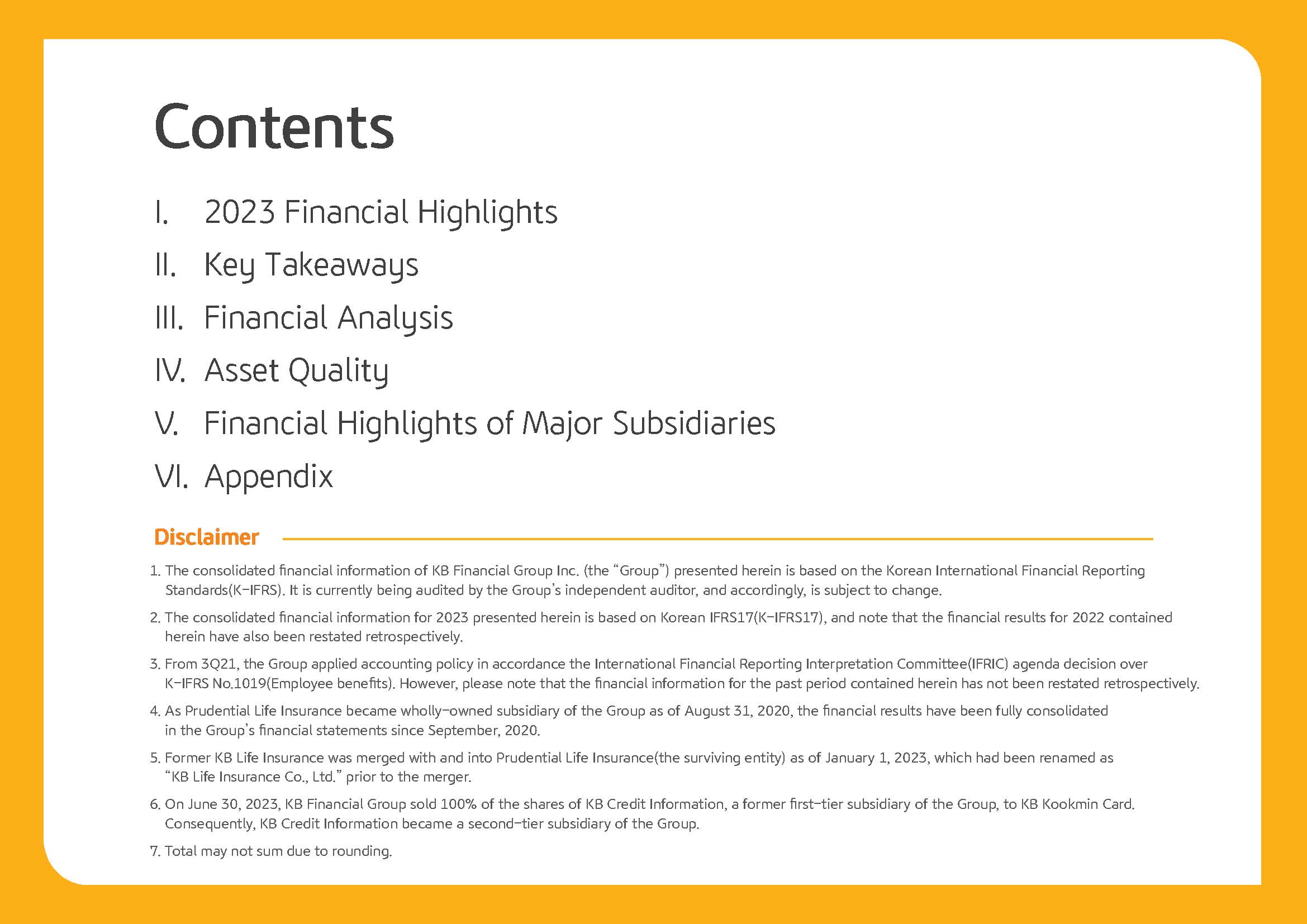

On the next page, I will explain the key financial indices. First, the group's profitability. KBFG's 2023 ROE posted 9.18%, and the recurring level of ROE, excluding one of items, stands at 11.53% level, highlighting continuous and solid earnings fundamentals. Next, I will cover bank's loans in won growth.

Bank's loans in won as of end 2023 posted KRW 342 trillion, a 4% YTD and 1.5% increase QoQ. Corporate loans posted KRW 175 trillion, a 7.7%, increasing YTD around KRW 12.5 trillion increase and led last year's bank loan growth. This was a result of increase in loan demand derived by deterioration in corporate bond market conditions leading to a KRW 8.9 trillion YTD increase of large corporate loans and SME loans continuing to grow centering on high-quality SME and SOHO loans.

On the other hand, household loans after posting minus growth in Q1 has been continuing a gradual stable recovery trend based on real demand and posted KRW 167 trillion, a 0.3% growth YTD. In this year as well, we will take into consideration multifaceted factors such as the economic circumstances and household debt situation and focus on qualitative growth, centering on asset quality and profitability, and maintain loan growth within an appropriate level.

Next is NIM. Group and bank 2023 NIM posted 2.08% and 1.83%, respectively, a 12 bp and 10 bp increase YoY. This improvement in NIM was a result of our utmost focused efforts in NIM management, including reducing funding costs by securing the industry's highest level of low-cost core deposits through our superior sales capability and channel competitiveness and by significantly improving profitability of our financial investments compared to the previous year through profitability-centered portfolio management.

However, in the case of Q4 group and bank NIM with the gradual diminishing of the loan asset repricing effect reflecting the interest rate hike in the second half of the year, both went down 1bp QoQ, respectively.

Let's go to the next page. Regarding the group's CIR and CCR, I will skip this part since I covered this earlier, and I will elaborate on the group's capital ratio, which is found in the upper right-hand side. 2023 end estimated group BIS ratio posted 16.71% and CET1 ratio posted 13.58%, respectively. Despite the increased RWA due to growth centering on corporate loans as well as year-end dividend effect, group's BIS ratio increased 55 bps YoY still maintaining the highest level of robust capital buffer in the financial industry still fully prepared for macro uncertainties.

I will explain in more detail regarding the CET1 ratio from the next page.

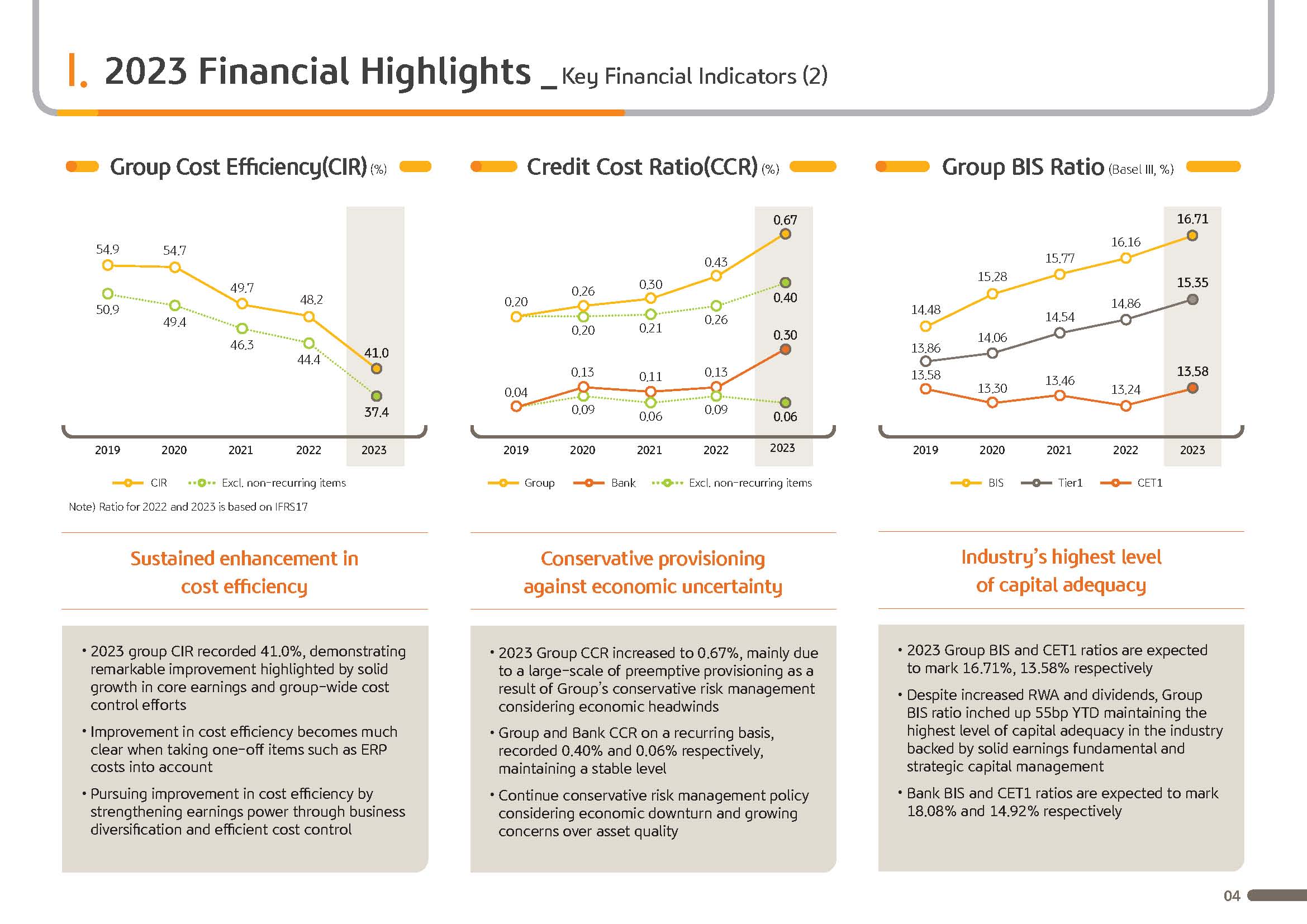

This page is for us to more clearly explain about the indicators that shareholders and investors are interested in, including share-related indicators and CET1 ratio. First, if you look at the graph on the left, you can see that the group's CET1 ratio as of 2023 year-end posted 13.58%, a 34 bp improvement YTD.

Looking at the factors behind major movements, additional factors, including group's solid net profit growth and OCI movements each contributed by around 144 bps and 24 bps, respectively to push up the CET1 ratio. RWA, which increased by KRW 19.1 trillion YTD and the dividend share buyback and cancellation, which was recognized in 2023, each contributed to 80 bps and 54 bp drop in CET1 ratio, respectively.

Next, 2023 EPS posted approximately KRW 11,580 and on the back of sound income growth and share buyback and cancellation effect went up approximately 12.1% YoY. In addition, the BPS posted approximately KRW 148,240. And like the EPS, thanks to our consistent efforts to enhance shareholder value, including active share buyback and cancellation, improved by around 9.3 %YoY.

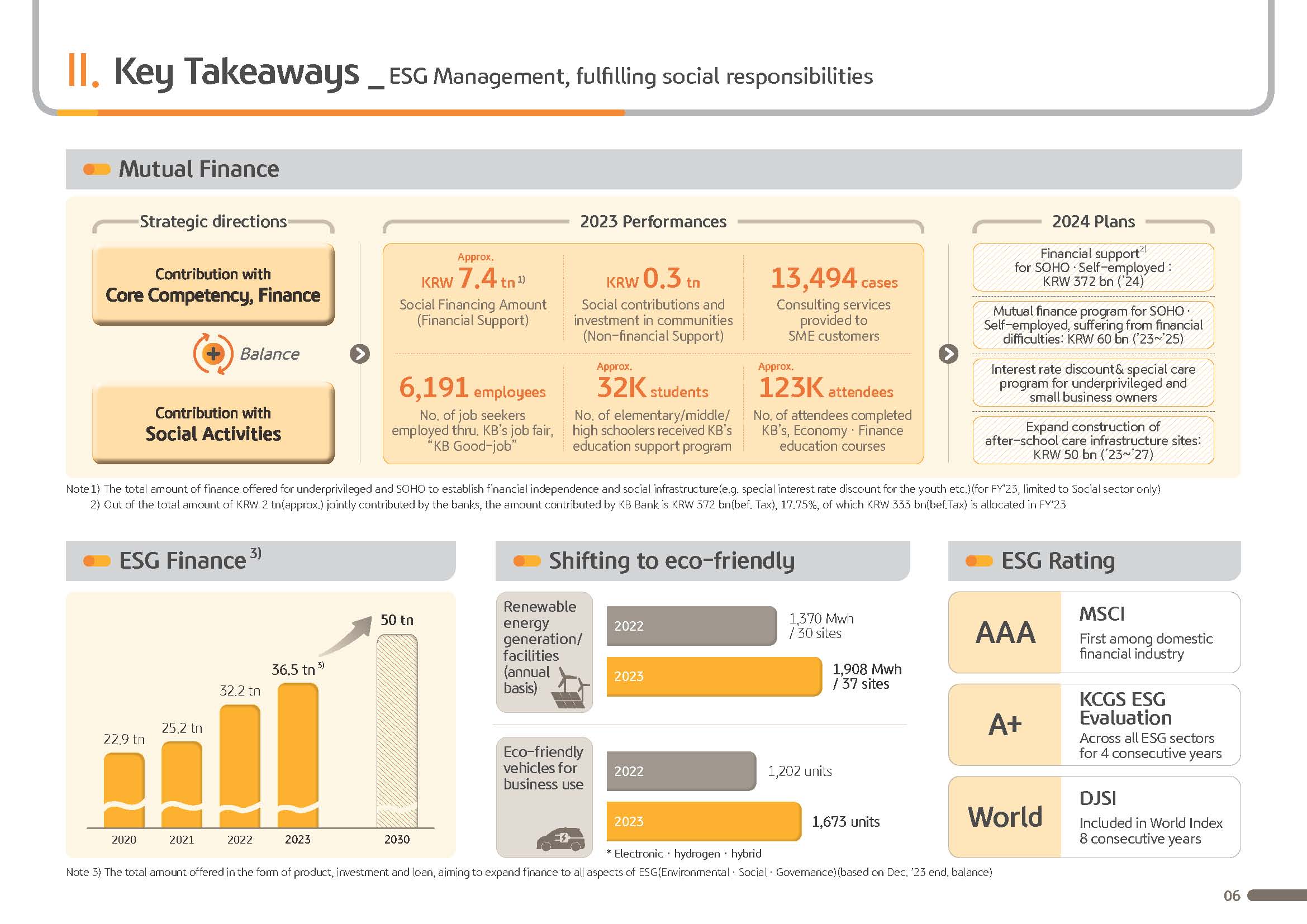

From this page, I would like to cover KBFG's ESG management for shared growth fulfilling social responsibilities among our group's core management strategies. In order for us to create a sustainable future and society, which is the ultimate goal that we want to achieve through ESG management, have been working hard for social contribution, utilizing our core competency in finance and also engaging in social contribution activities in a balanced and accelerated manner.

2023's representative performance results include newly providing around KRW 7.4 trillion of social finance utilizing our core competency in finance, including financial products for the underprivileged, low interest for refinancing loans, and [hope] savings program for the youth.

In the nonfinancial side, we contributed around KRW 300 billion for social contribution and local community investment, including supporting the underprivileged and small businesses and activities to improve social infrastructure. In addition, we provided around 13,500 cases of free consulting to small businesses. And through the KB Good-job fair, we connected around 6,190 jobs to job seekers and actively engage in diverse social contribution activities and programs.

We will not be complacent with these results, but also focus our efforts for other social contribution activities as well. First, related to the bank-wide public social contribution program, which was announced late last year, we plan to support KRW 372.1 billion, the largest among all participating banks and we plan to expedite the completion of interest cash back implementation within Q1 of this year and plan to consecutively support small business owners and the underprivileged through our voluntary program.

Apart from this, we plan to increase different support programs so that the self-employed can overcome their economic difficulties, expand programs to reduce interest rates for the underprivileged and sole proprietors and expand guaranteed loans through guarantee institutional special contributions. And in particular, in order to resolve the low fertility program.

We contributed a total of KRW 75 billion to expanding elementary school after school care school childcare programs until 2022. And from 2023, we have been additionally supporting a total of KRW 50 billion related to increasing after school and other childcare-related institutions.

KBFG pledges that we will engage in a higher level of ESG management, which benefits its role as a leading financial group that will grow with the people through consistently implementing diverse social contribution finance programs that can provide realistic benefits that can be felt firsthand. Please refer to the next pages which cover details regarding the business results I have covered so far.

With this, I will conclude 2023 KBFG business results presentation. Thank you for listening.