-

Please adjust the volume.

1H24 Business Results

Greetings. I am Peter Kweon, the Head of IR at KBFG.

We will now begin the 2024 first half business results presentation.

I would like to express my deepest gratitude to everyone for participating today.

We have here with us our Group CFO and SEVP, Jae Kwan Kim, as well as other members from our group management. We will first hear the 1H24 major financial highlights from CFO and SEVP, Jae Kwan Kim, and then engage in a Q&A session. I would like to invite our CFO and SEVP to deliver 1H24 earnings results.

Good afternoon.

I am Jae Kwan Kim, CFO of KB Financial Group. Thank you for joining KBFG's 1H24 earnings presentation.

Before going into the 2Q24 earnings result, I will first go over the company's 1H24 shareholder return plan, which was resolved by today's BoD meeting.

Please turn to page 4 of the presentation deck.

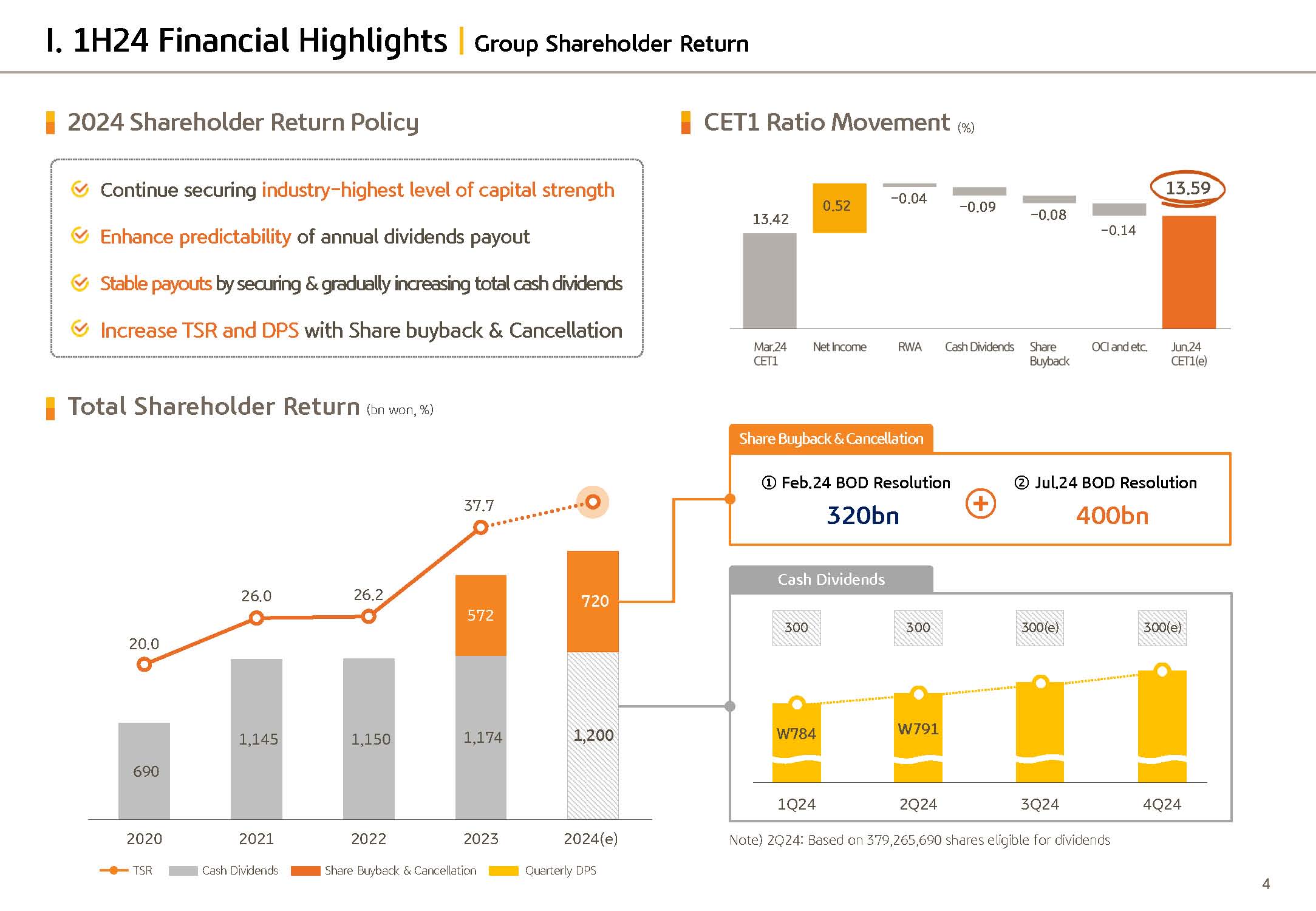

Despite difficult operational backdrop, KBFG has been pushing forward with industry leading shareholder return policy with a sustained effort on capital management to maintain industry's top notch capital strength.

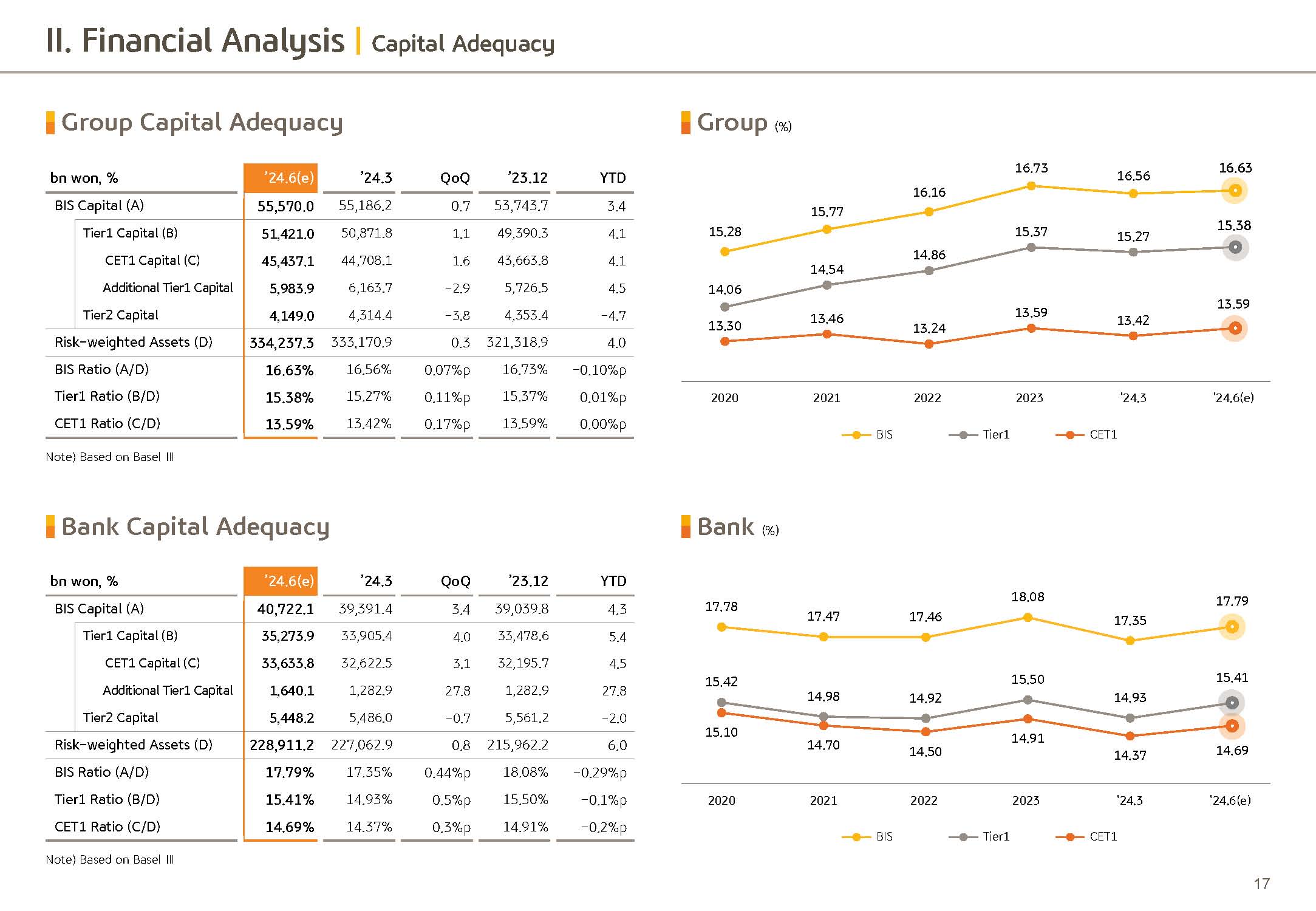

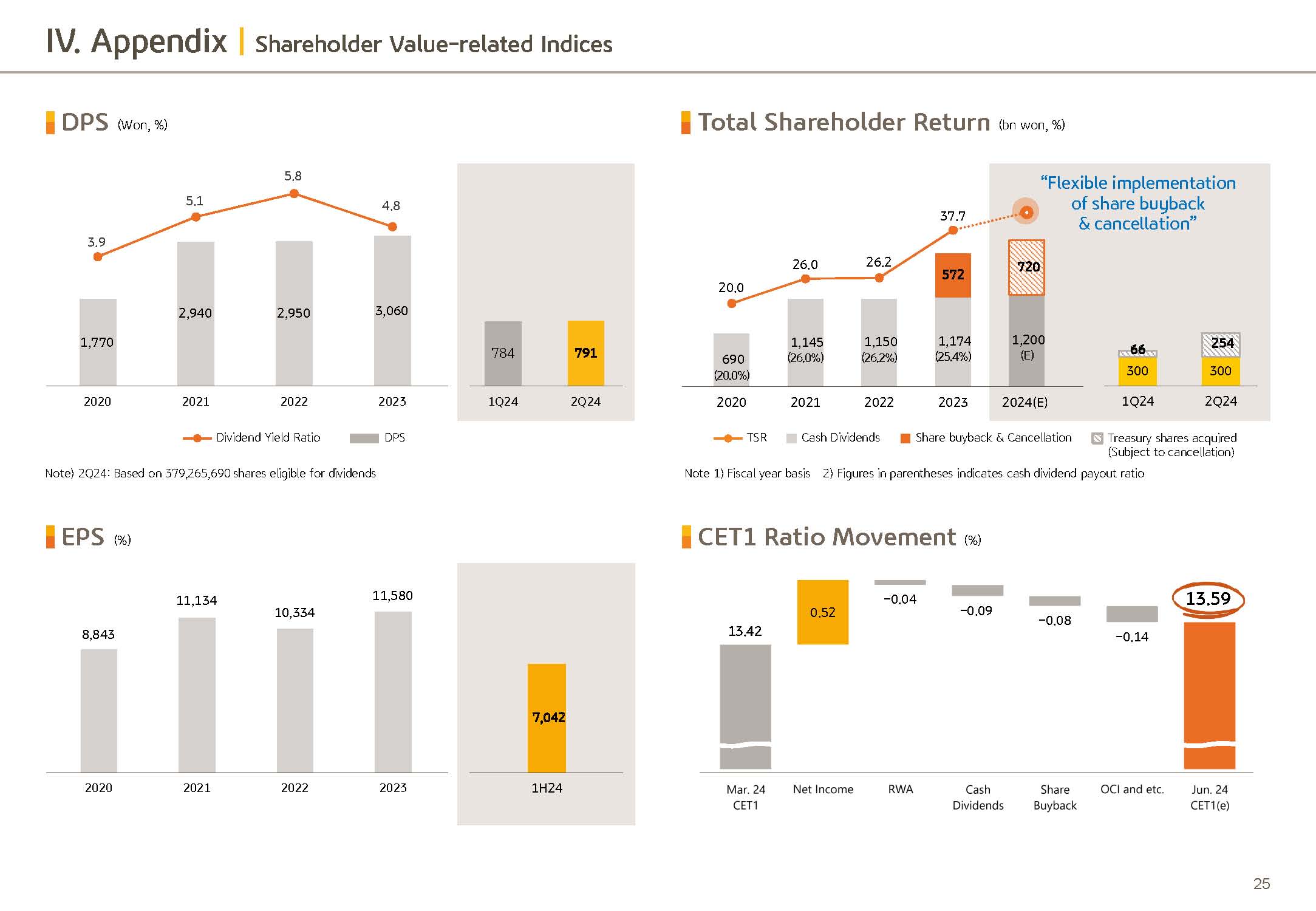

As a result, CET1 ratio as of end of June was up 17 basis points QoQ expected to reach 13.59%, which is a highest capital ratio in the domestic market.

As you are aware, last quarter, we were the first in the industry to start paying out “Quarterly-even dividends on a total annual amount basis”, enhancing visibility on annual payout and DPS while retaining flexibility in implementing share buyback and cancellation with a view towards improving shareholder return.

As for part of such efforts, today, the BoD decided on quarterly cash payout of KRW 791 per share and buyback and cancellation amounting to KRW 400 billion. KRW791 DPS is a marginal increase following the impact from KRW 320 billion share buyback announced during the 1Q24, while additional share buyback and cancellation of KRW 400 billion is yet again a testament of the commitment of the BoD and the management towards enhancing TSR, total shareholder return that is, and shareholder value.

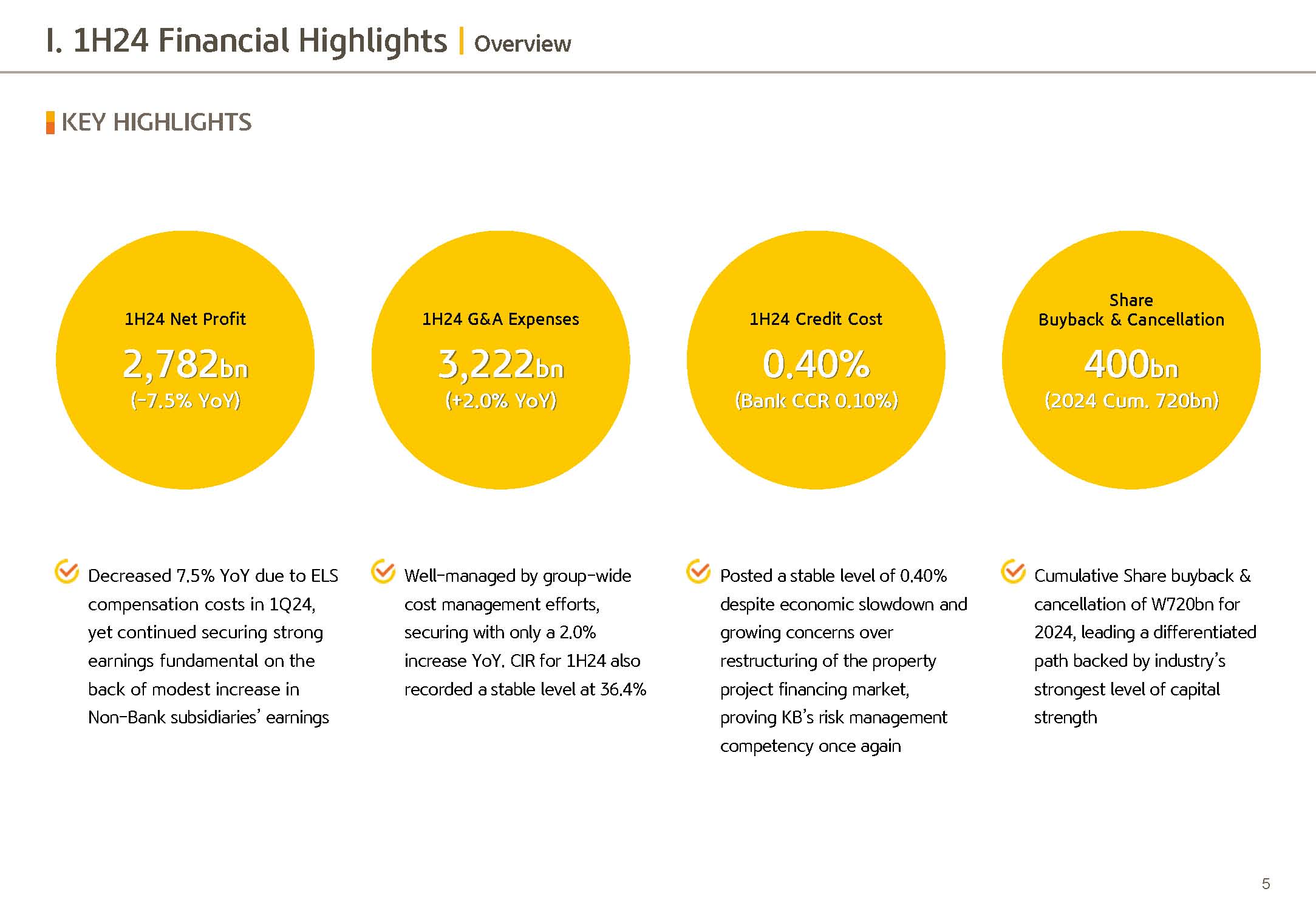

All in all, we will in total, buyback and cancel KRW720 billion, which distinguishes our shareholder return policy, underpinned by industry's top-notch capital strength and stable earnings capacity in spite of challenging operational headwind with growing macro uncertainties.

KBFG will endeavor to continue on with a progressive dividend policy, employing various means within the boundaries of sustaining robust capital adequacy so that we may meet the expectations of the market.

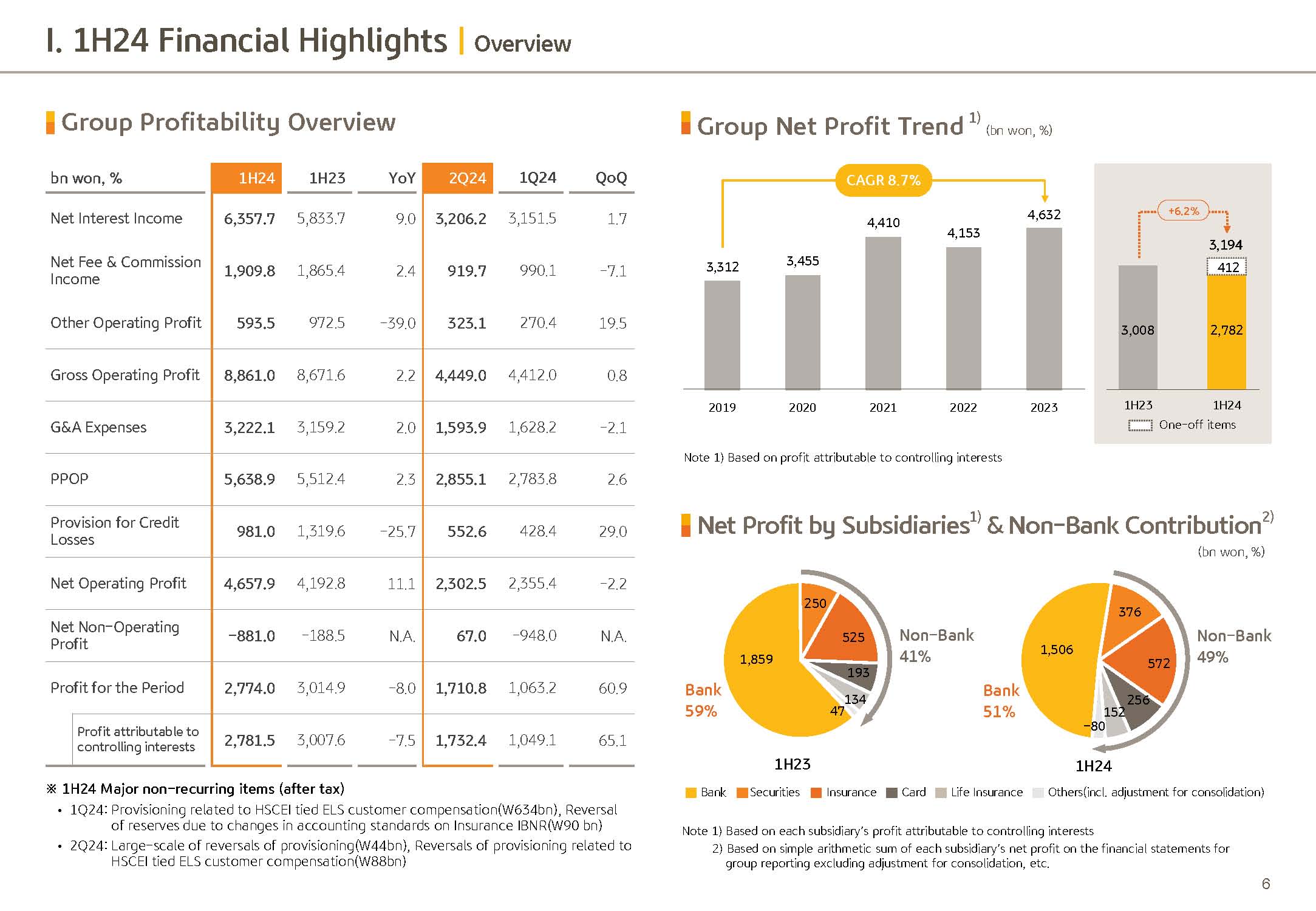

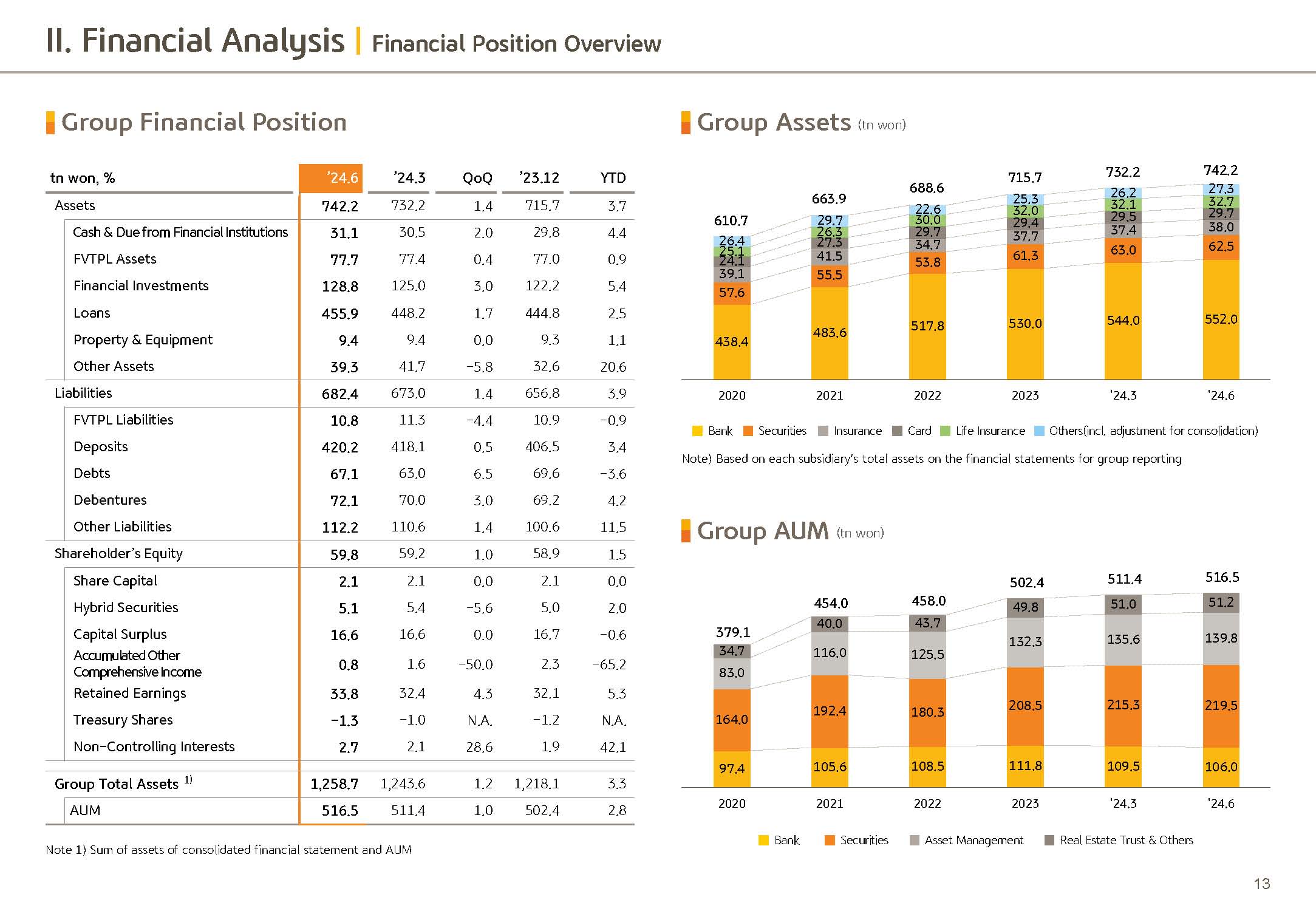

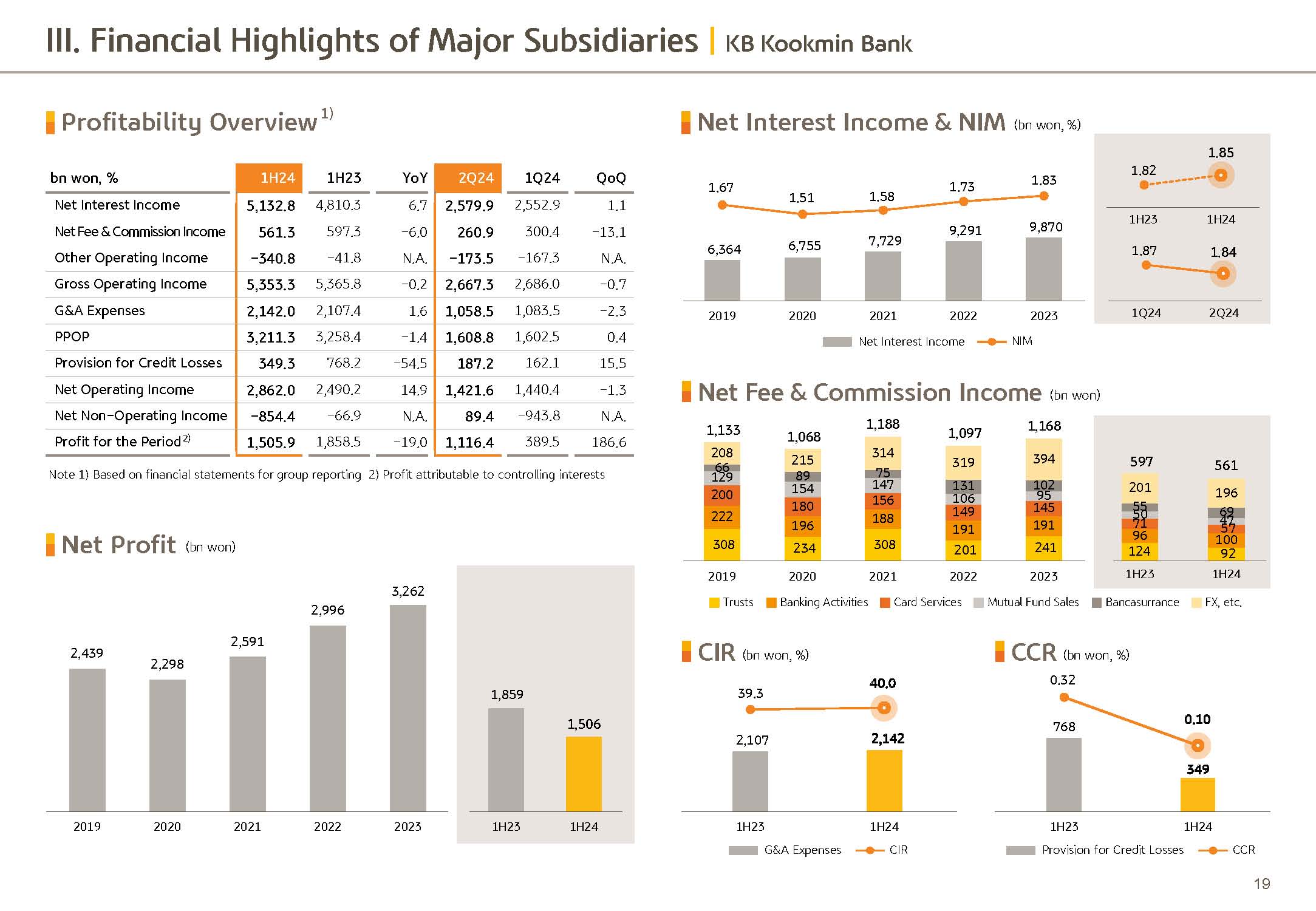

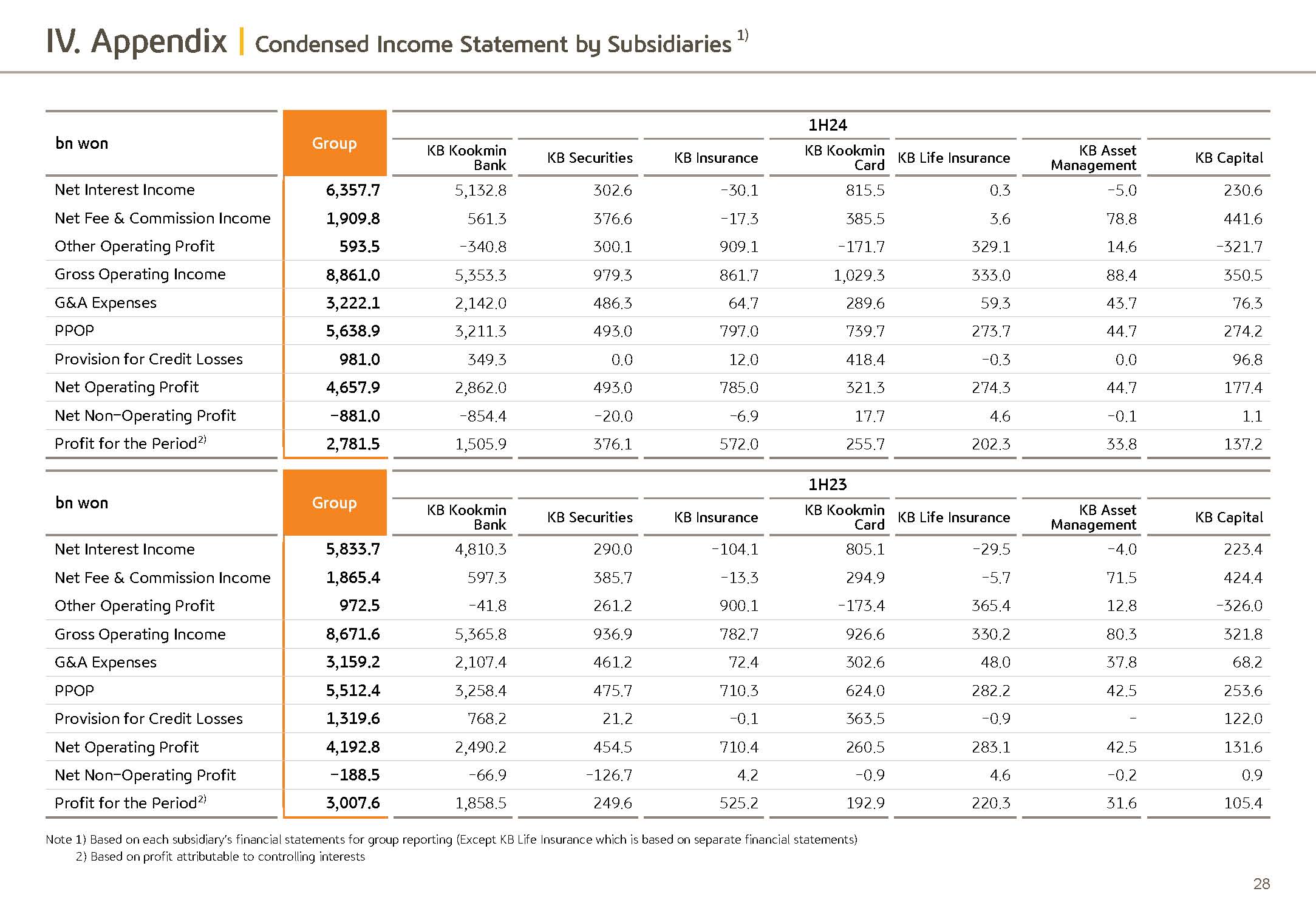

Now I will move on to KBFG's earnings for the first half of 2024. First and key business performance highlight and metrics of the group. KBFG's 1H24 Group net profit reported KRW2,781.5 billion. Because of sizable ELS compensation cost in Q1, this was a 7.5% decline year over year.

But if you look at the second quarter on the back of evenly spread growth coming from the bank and non-bank businesses and solid earnings expansion, particularly from non-bank subsidiaries, i.e., securities and insurance, net profit came in at KRW1,732.4 billion.

Putting aside one-offs such as reversals from ELS compensation cost and loan loss provision, normalized net profit is at around KRW1.6 trillion. KBFG will continue its effort around keeping stable earnings fundamentals, supported by conservative provisioning stance and diversified group portfolio, so as to solidify its basis for sustainable growth.

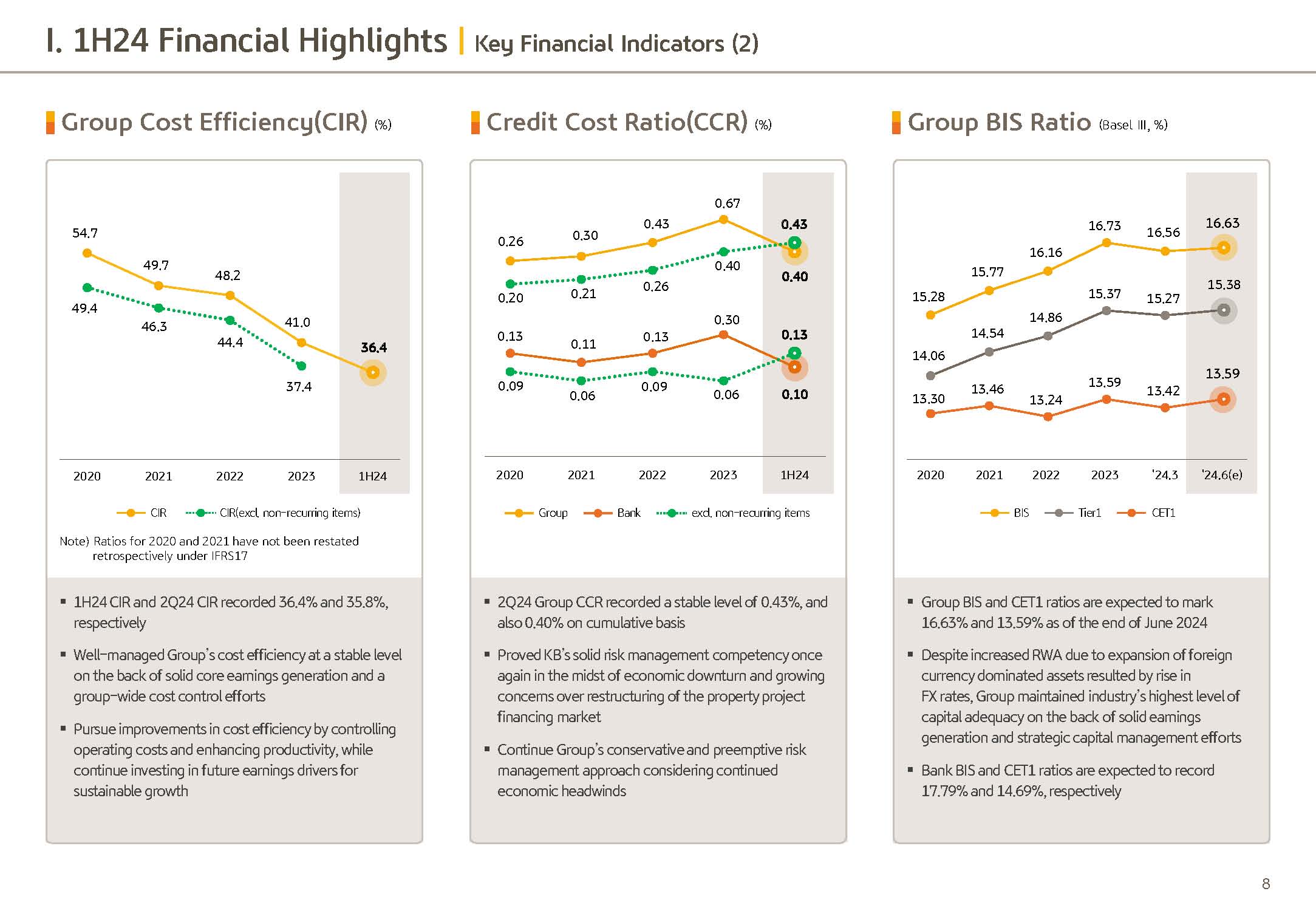

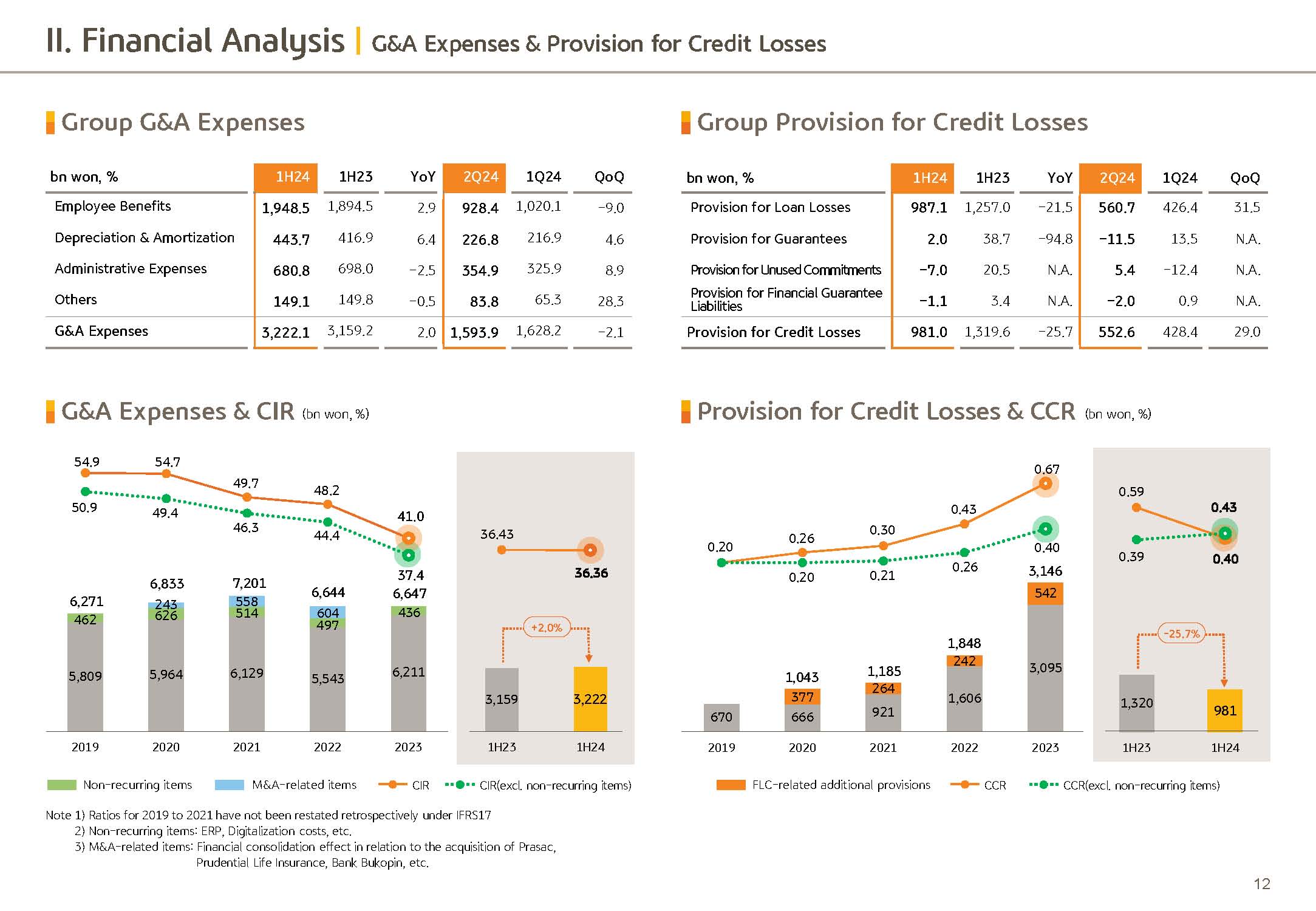

G&A expense in the 1H24 was KRW3,222.1 billion, up 2% year over year. Cost income ratio, which represents cost efficiency of the Group, was supported by solid earnings growth trend and corporate wide cost efficiency efforts, KB keeping in line with the controlled level of 36.4%.

Group's labor costs shifted to a downward trajectory last year, and we decline in number of headcount from early retirement program and cost efficiency efforts continuing, we expect to see Group's CIR trend to continue and stabilize downward.

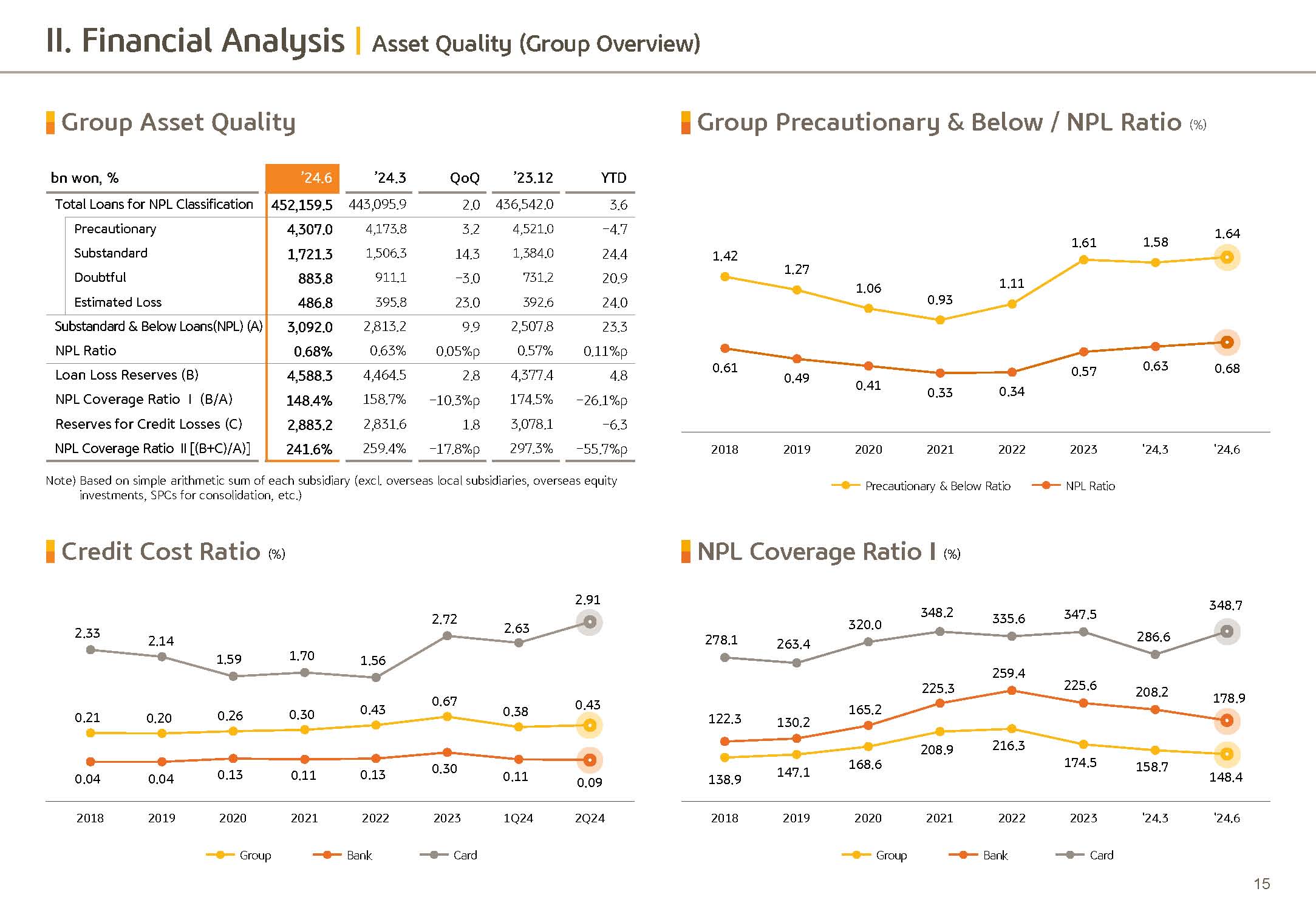

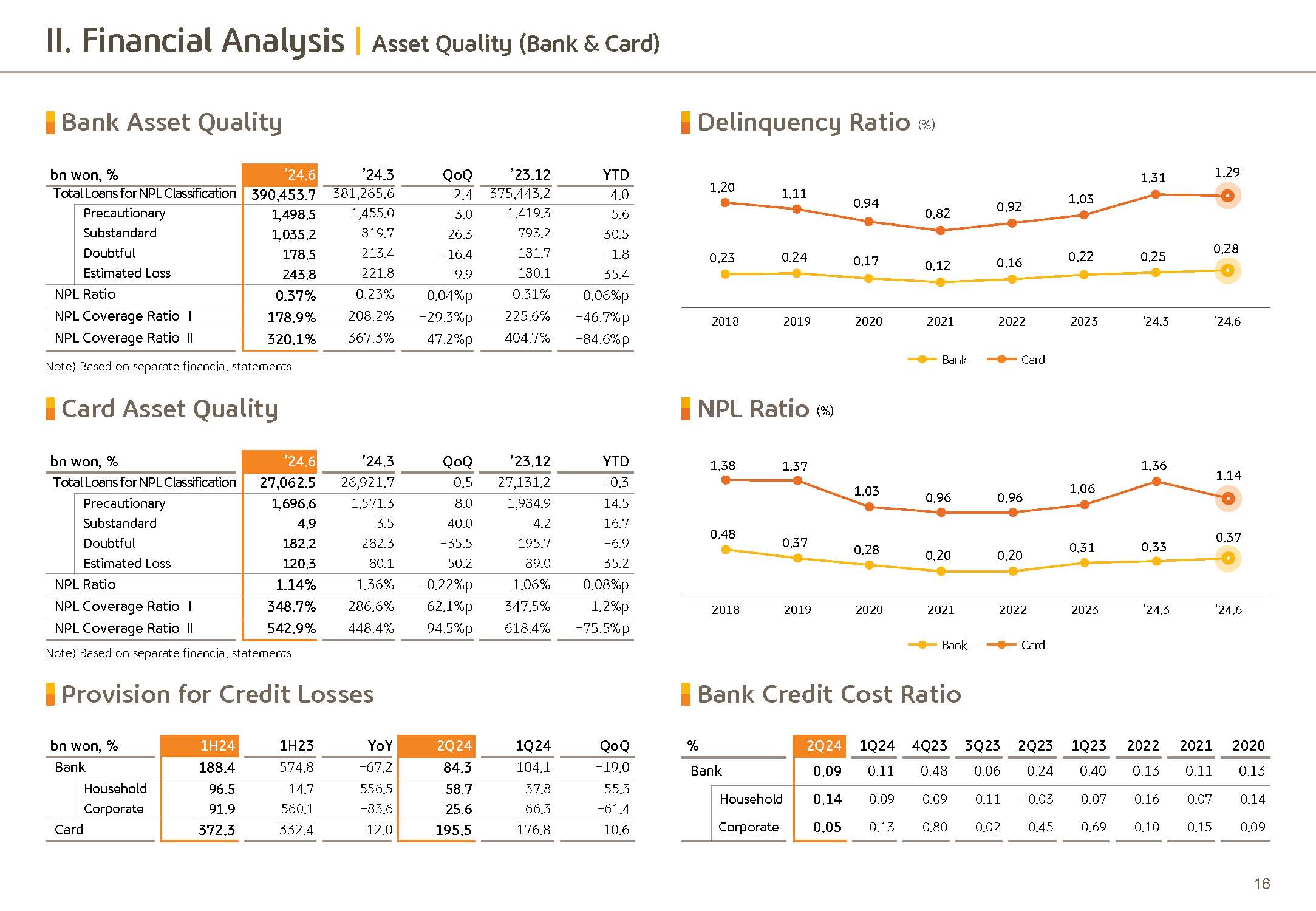

1H24 cumulative credit cost for the Group was 40 basis points, being kept at a steady level. Macro uncertainties are continuing this year, triggering concern on overall asset quality of the industry, but we have ample capacity to respond that by preemptive conservative provisioning and rigorous management against additional risks. As such, we believe Group's credit cost will be kept under a steady control.

Meanwhile, banking sector prices in the market have displayed strength on the back of high expectations placed on the value of programs since the beginning of the year. As I mentioned at the beginning on the shareholder return page, KBFG has been at the forefront of progressive shareholder return underpinned by stronger fundamentals, capital ratio strength, and stable governance structure writing its own version of value up history.

Also to maintain consistency of our value up approach, we have faithfully implemented mid to longer term capital plan, which was announced last year and was the first company in Korea to make preliminary value of disclosures back in May. In the second half, in addition to scheduled value of disclosures, we will continue to endeavor to drive corporate value and shareholder value enhancement.

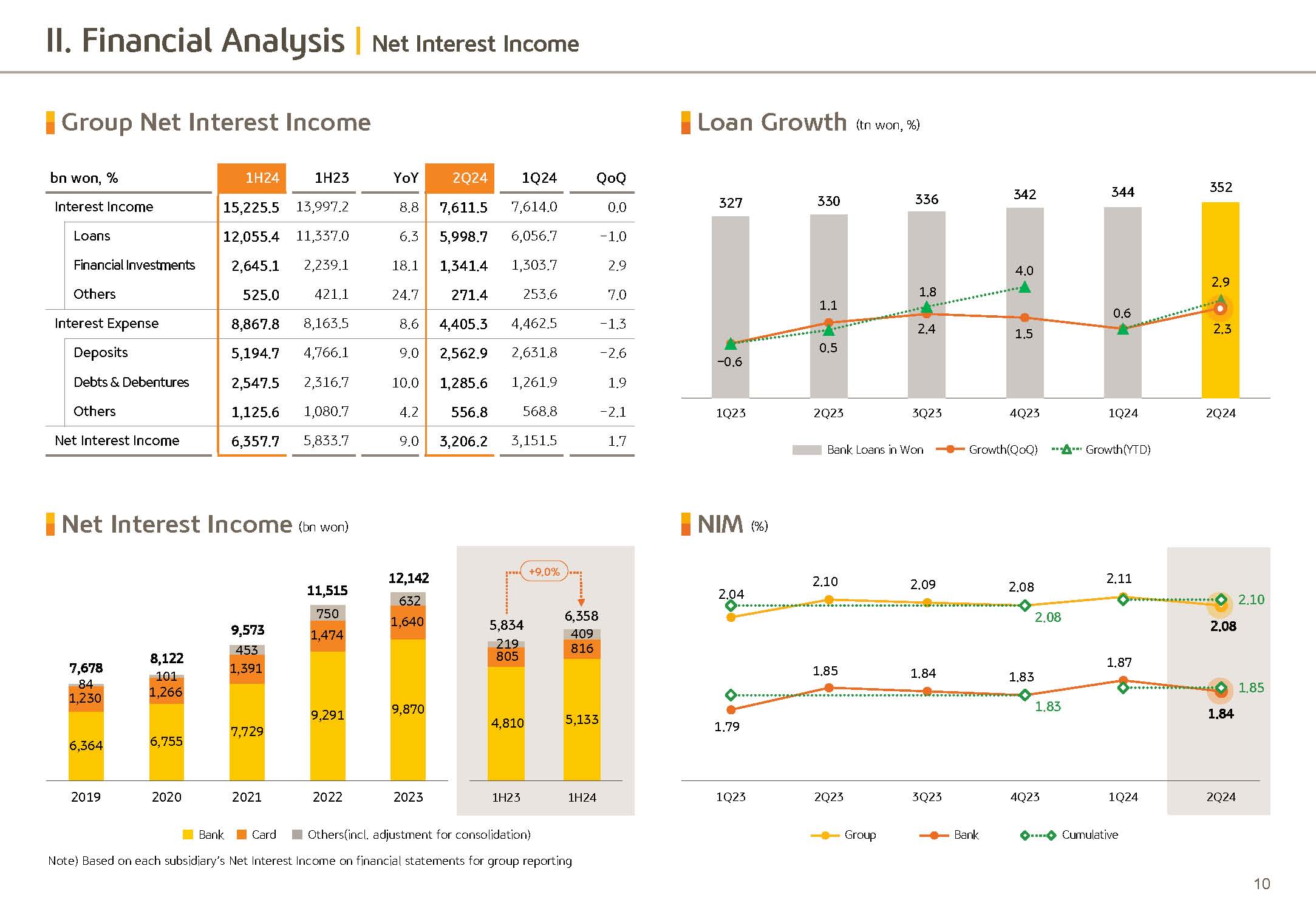

With that said, I will move on to detailed items. 1H24 Group net interest income posted KRW6,357.7 billion and Q2 net interest income recorded KRW3,206.2 billion and went up 9% YoY and 1.7% QoQ respectively.

This was possible on the back of loan average balance growth and continued interest income contribution expansion, including non-bank subsidiaries such as insurance, despite the net interest margin contraction following the interest rate decline.

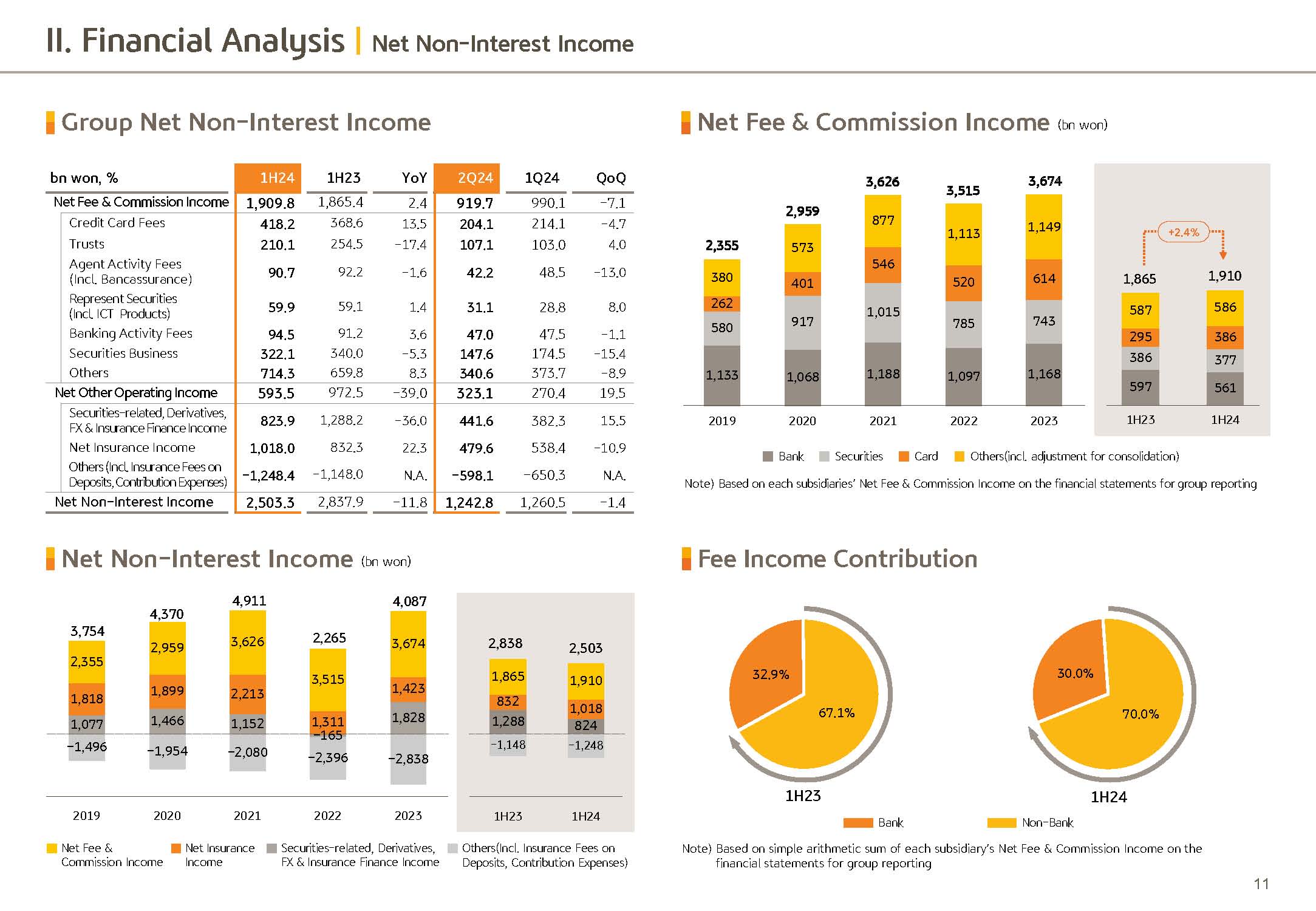

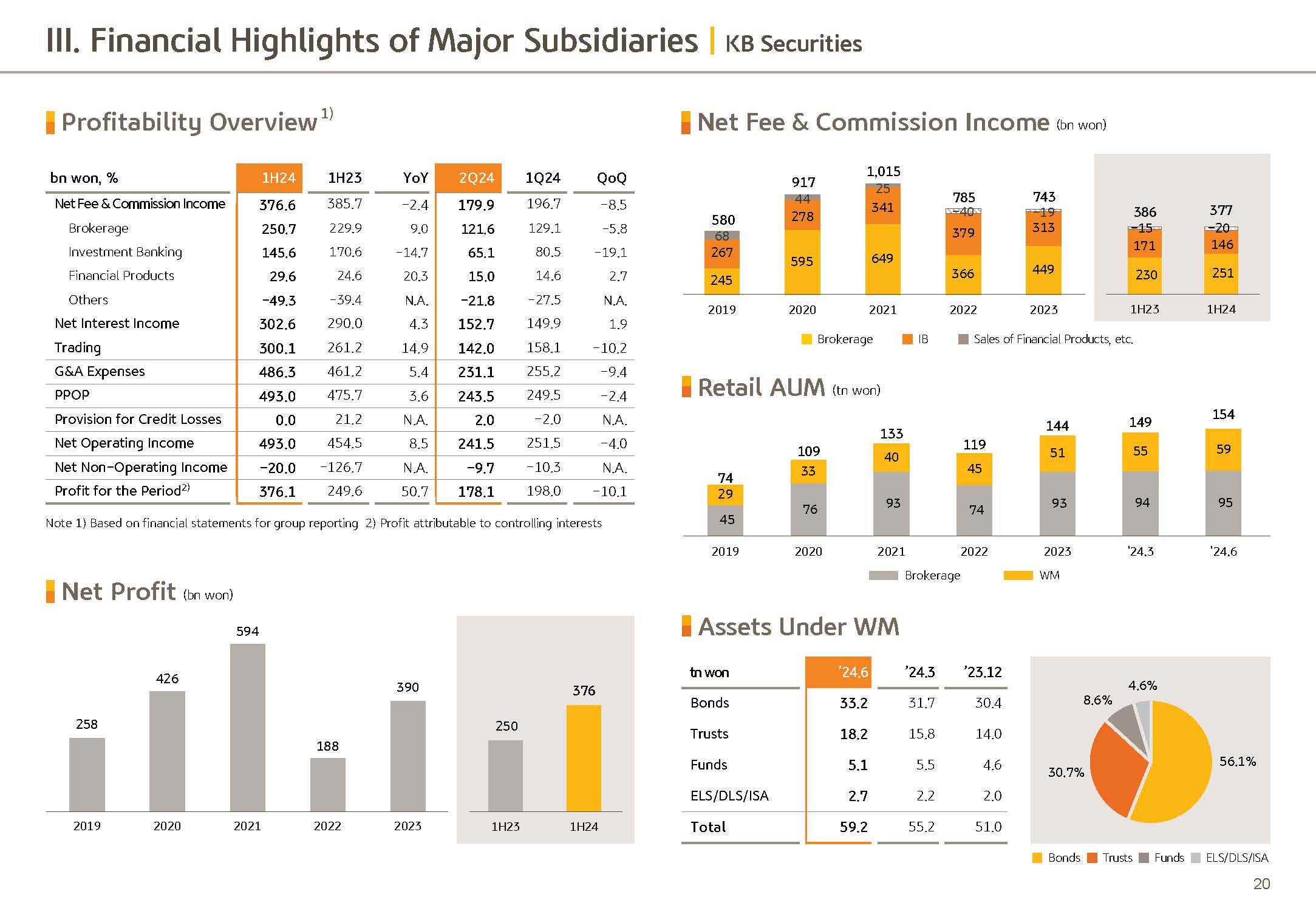

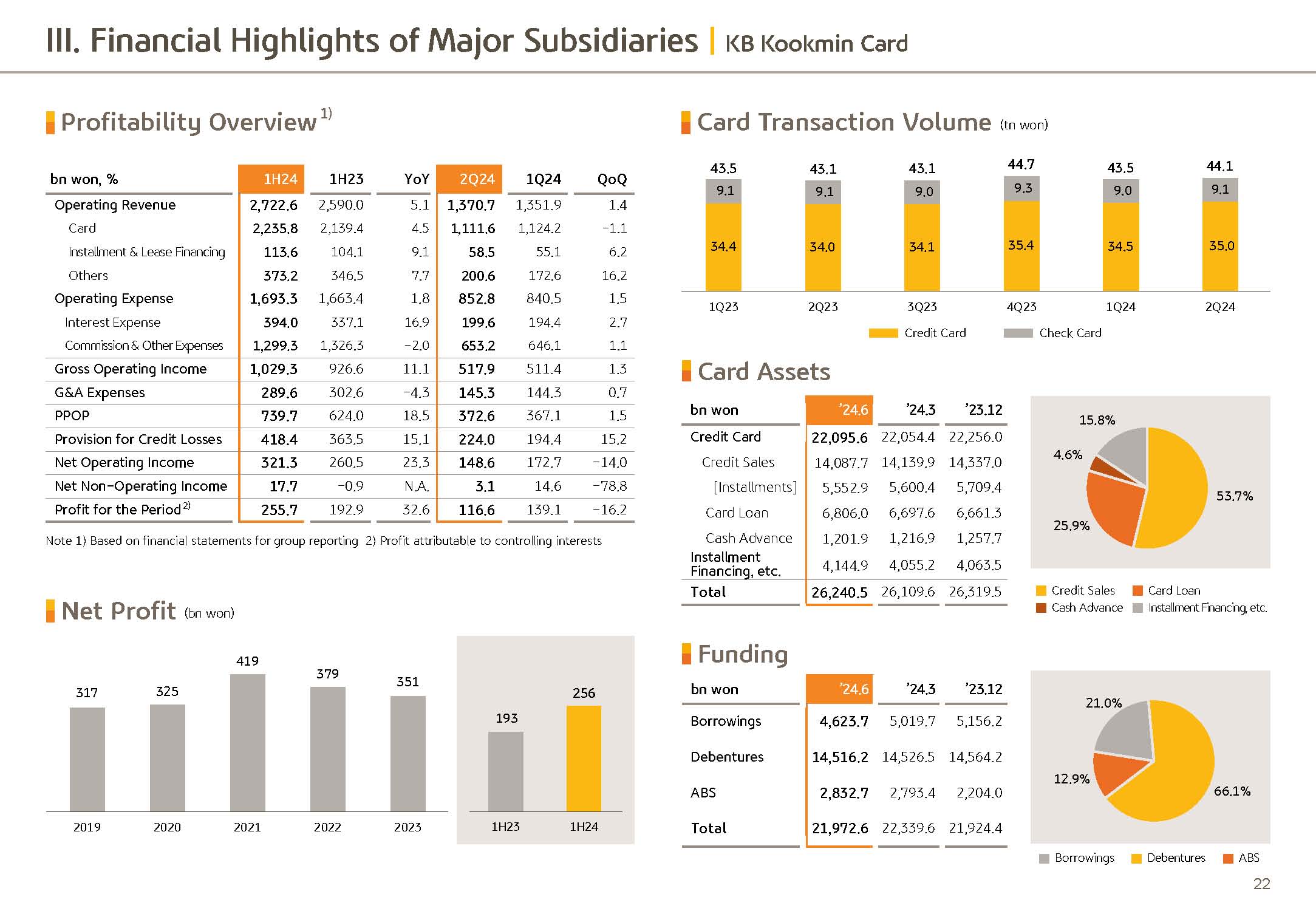

1H24 net fee and commissions income posted KRW1,909.8 billion and increased 2.4% YoY. This is mostly attributable to the increase in stocks transaction amount, following higher expectations regarding the value of program, expanding brokerage income, and increasing securities financial product, sales fees, card fees, and capital fees, and commissions.

However, Q2 Group net fee income posted KRW919.7 billion and with the IB fee, [decline] following the real estate PF market contraction, it went down slightly QoQ.

However, on the back of strengthening group wide sales activities and efforts to diversified business, for six consecutive quarters a KRW900 billion level of net fee income was recorded, attesting to the fact that Group fee income generation fundamentals has been robustly maintained.

Next, I will cover other operating profit. Q2 other operating profit posted KRW323.1 billion and with improvements in the financial market environment, including interest rate and stock index, on the back of expansion of securities, investments, performance, including bonds and beneficiary securities, it posted sound performance with a 19.5% QoQ increase.

On a first half cumulative basis, it posted KRW593.5 billion. And with a contraction in performance related to securities, FX, and derivatives due to the interest rate and FX rate effect, the performance was lower than the same period compared to the previous year.

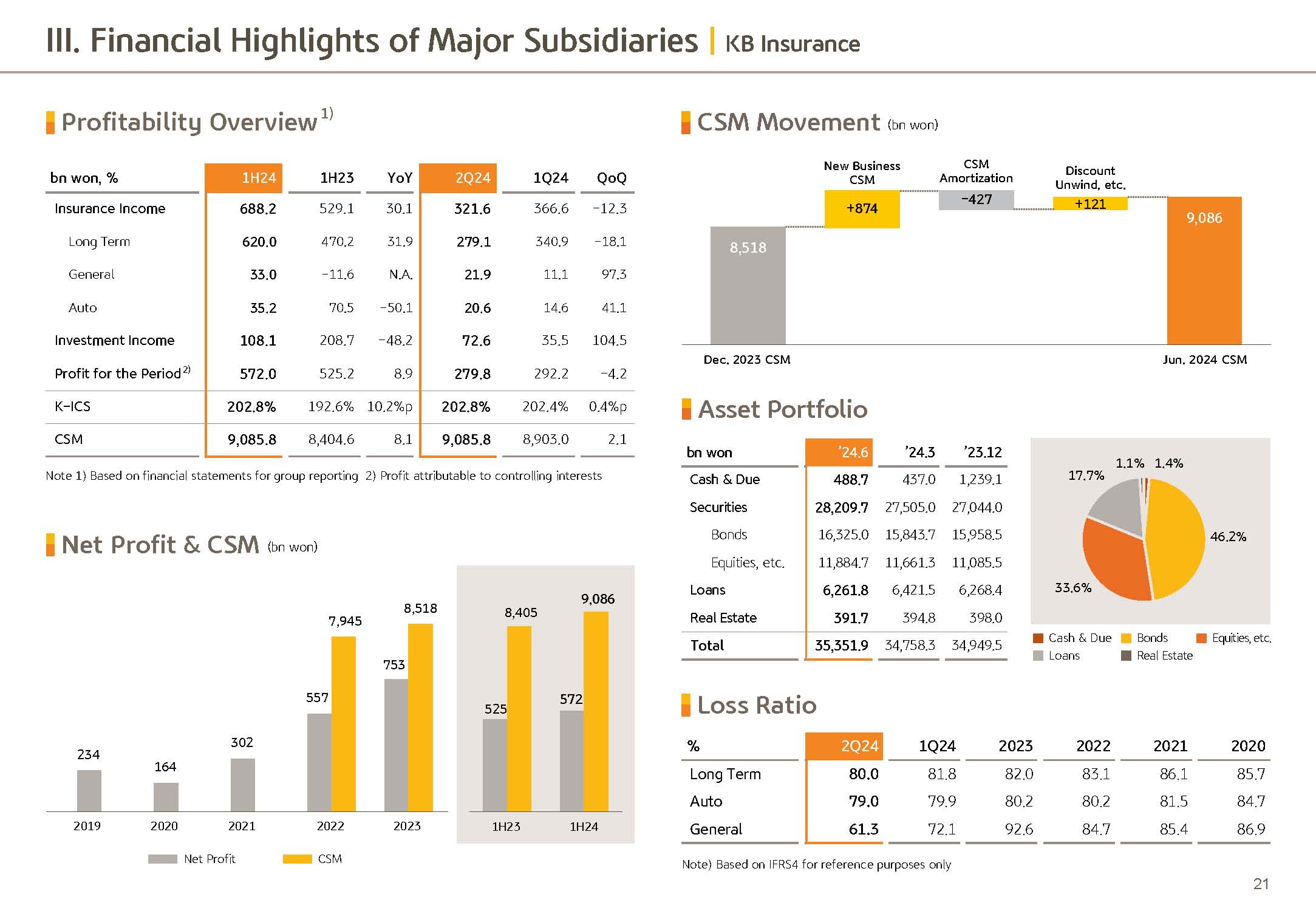

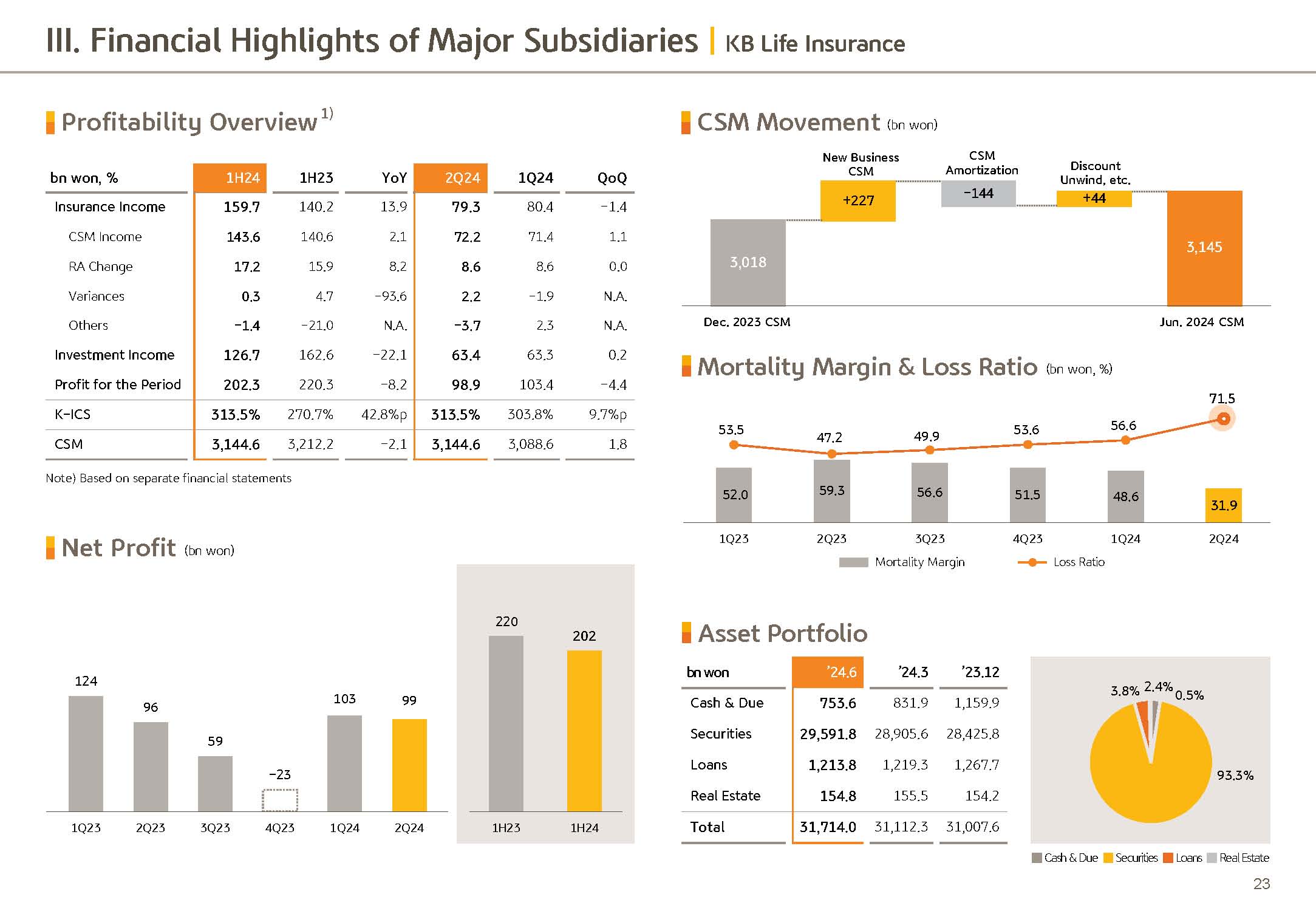

On the other hand, in the case of 1H24 insurance income, it went up KRW185.7 billion YoY. This is attributable to the previous quarter's non-bank insurance IBNR reverse -- reserve reversal and long-term and general insurance loss ratio improvement.

Next, I will cover G&A expenses. 1H24, G&A. posted KRW3,222.1 billion. And on the back of continuous cost rationalization efforts, it went up around 2% YoY and Q2 G&A decreased 2.1% QoQ and is being well managed.

Next, the Group provision for credit losses. Q2 provision for credit losses posted KRW552.6 billion, an increased QoQ. Despite the provisioning reversal due to one-offs in this quarter, this is mostly attributable to additional provisioning related to real estate trust and maintaining our conservative provisioning accumulation stance in case of future economic slowdown.

On the other hand, first half cumulative provision for credit losses posted KRW981 billion and decreased by a great degree YoY. This was caused by the underlying effect stemming from the preemptive large scale provisioning, reflecting the conservative FLC scenario in the previous year?

Last, regarding the Q2 non-operating profit. On the back of the underlying effect following the previous Q1 large scale ELS provisioning reversal, it grew by a large degree QoQ. From the next page, I will go over key financial indicators.

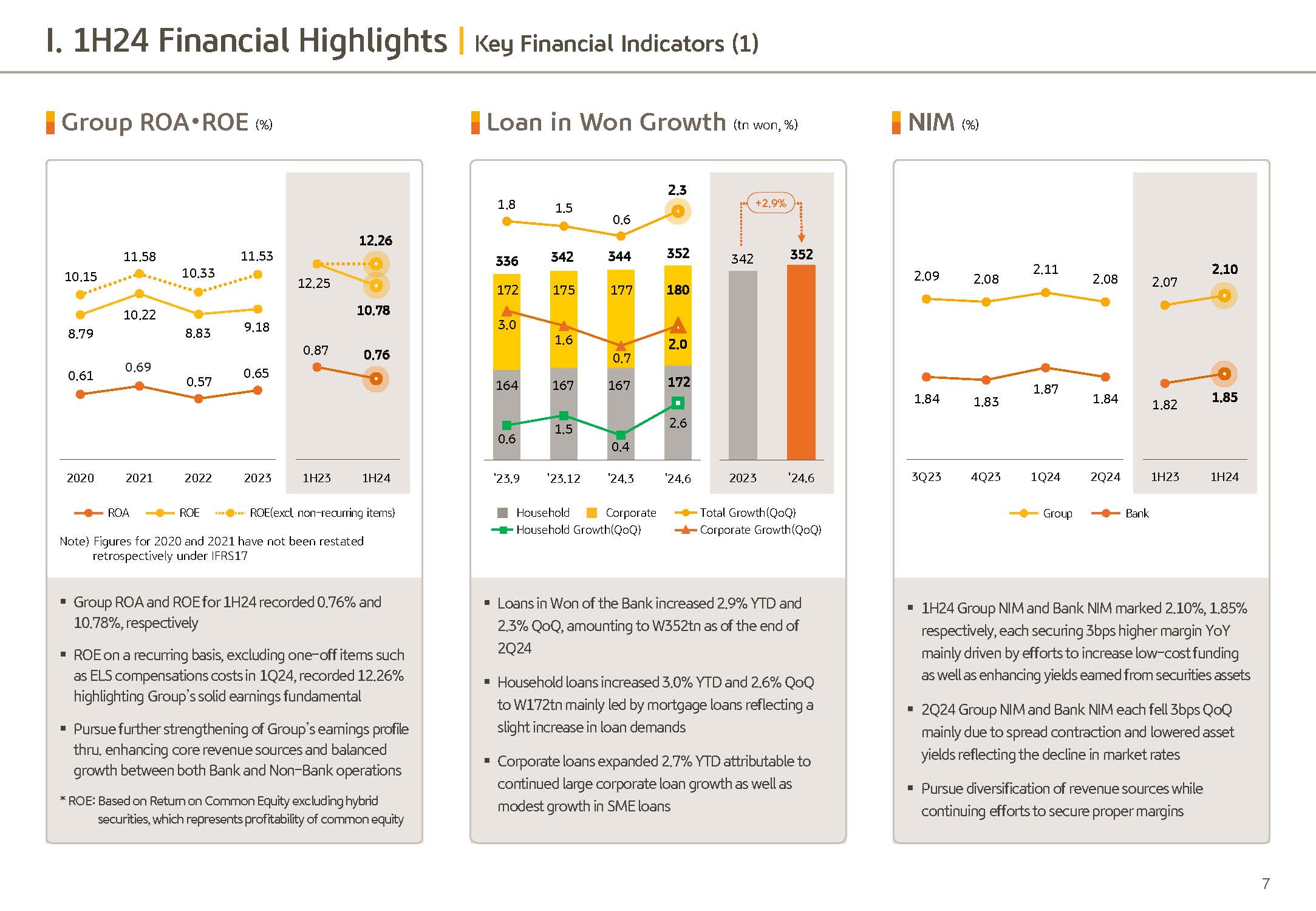

Next, the Group's profitability indicators. 1H24 Group ROE posted 10.78%. Non-operating profit, which declined steeply due to the previous quarter's ELS compensation cost recovered and based on a differentiated business portfolio, core profit growth continued and the recurring ROE excluding one-offs, posted 12.26% and solid profitability is being maintained.

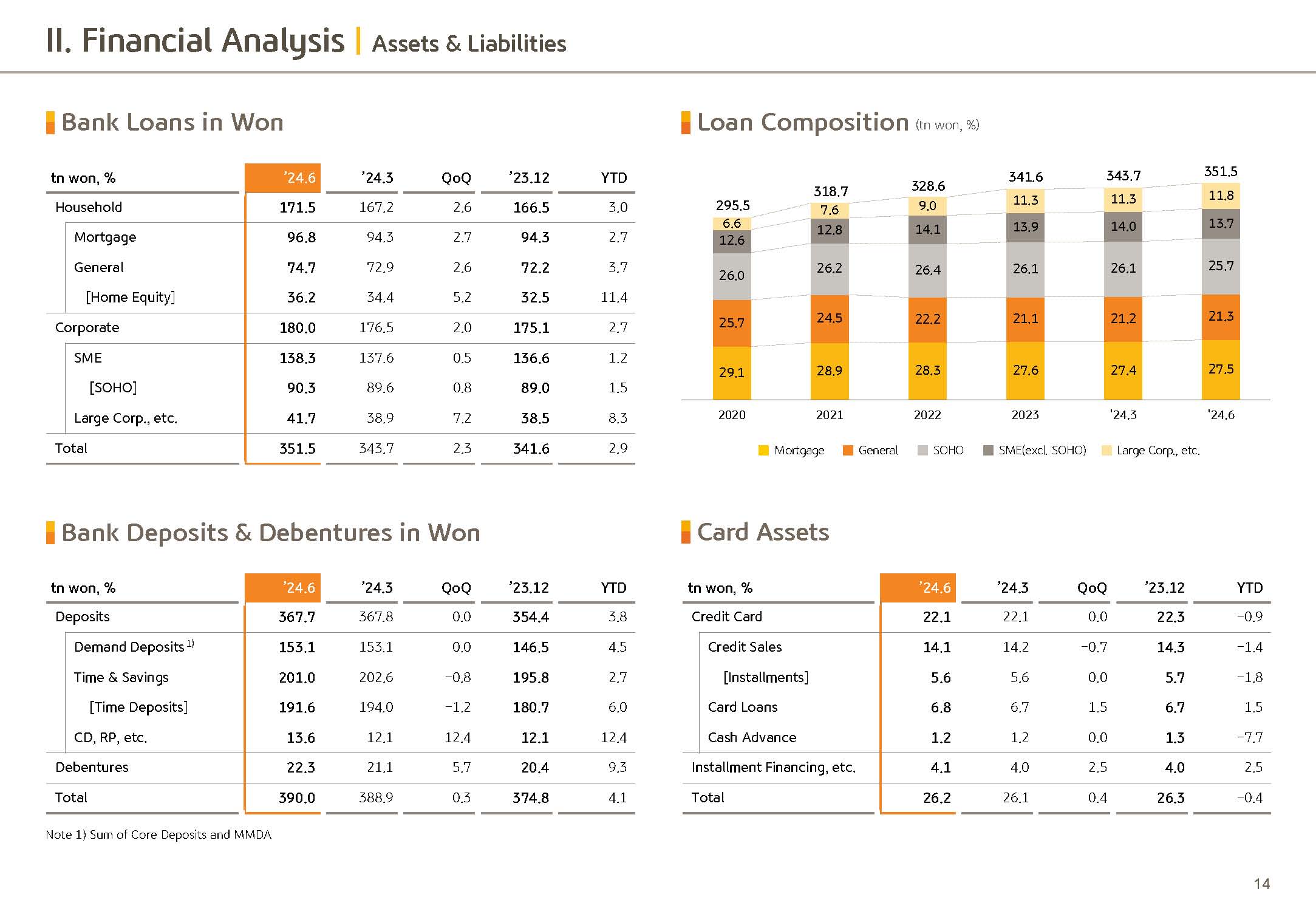

Next, I will cover bank's loans in won growth. 2024 June end, bank loans in won posted KRW352 trillion and increased 2.3% compared to end March and increased 2.9% YTD. Due to our asset quality and profitability based loan policy, an overheated competition in the corporate loan market, the bank's loans in won in the early part of the year showed slightly low growth. But from Q2, loan demand increase centering on real demand and loan growth is gradually recovering.

In detail, household loans posted KRW172 trillion. And with the expansion in loan demand and loan from national funds due to home transaction increase, it went up 3.0% YTD around a KRW5 trillion increase. In the case of corporate loans, in Q2 with the expansion in large corp. loans and the addition of moderate SME loan growth, it increased 2.7% YTD.

We will monitor the economic circumstances and household loan situation and focus on qualitative growth on asset quality and profitability in the second half as well and flexibly manage loan growth speed. Next is net interest margin, Q2 Group and bank NIM each posted 2.08 percentage points and 1.84 percentage points respectively, and each declined by 3bp QoQ, respectively.

This was mostly attributable to spread contraction in market interest rate decline and other factors leading to lower asset yields. However, on a YoY basis until now, Group and bank each increased by 3bp respectively.

Let's go to the next page. I will cover the Group's cost income ratio CIR. As you can see in the top left hand graph, 1H24 Group CIR posted 36.4%. And with continued core profit growth and group wide cost management efforts, cost efficiency improvement trend is continuing and is showing downward stabilization.

Next to the credit cost ratio. Q2 Group credit cost posted a 43bp level and slightly increased QoQ, but is still maintaining stable asset quality, still within a predictable scope.

Last, is Group's capital adequacy. Despite the won and dollar FX increase in the quarter, on the back of Group's levels, active risk weighted asset management efforts and solid net profit increase, June end BIS ratio and CET1 ratio is expected to post 16.63% and 13.59%, respectively, the highest level in the financial industry.

As we had mentioned in the capital policy that was presented in the early part of the year in the business earnings report, we will manage the CET1 ratio at a 13.5% level and continue group wide efforts to improve capital adequacy, so that shareholder return visibility can be enhanced.

The next pages are detailed material related to shareholder value related indicators and management performance. So please refer to it if needed.

With this, I will conclude KBFG first half business results presentation. Thank you for listening.