-

Please adjust the volume.

3Q24 Business Results

Greetings.

I am Peter Kwon, the Head of IR at KBFG.

We will now begin the 2024 Q3 business results presentation and

thank you very much for participating in today's earnings release.

We have here with us, our Group CFO and SEVP, Jae Kwan Kim, as well as executives from our group.

Regarding today's agenda, first there will be a video of our Group CEO and Chairman, Jong Hee Yang,

explaining our company's value-up plan, which was disclosed today; and then our group CFO will cover 2024 Q3 major earnings results. After that, we will have a Q&A session.

We will now watch a video covering KB Financial Group Sustainable Value-up Plan.

Greetings,

I am Jong Hee Yang, Chairman and CEO of KB Financial Group.

Dear valued shareholders and investors,

Thank you for your ongoing support and commitment to KB. Today, we would like to share a brief overview of ‘KBFG's Sustainable Value-up Plan’

KB is entrusted with the important responsibility of maximizing profitability with the capital that shareholders have invested, consistently generating high returns.

At the same time, as a financial leading company contributing to the national economy, we are committed to maintaining strong capital soundness.

Over the past decade, KB has made painstaking efforts to strengthen its fundamentals and diversify its portfolio.

Furthermore, we have firmly established our position as a leading financial group in Korea, delivering excellence in profitability, shareholder returns, and ESG initiatives.

As a result, our capital profitability and capital soundness have grown to a level comparable with leading global companies, and our per-share value has also improved considerably.

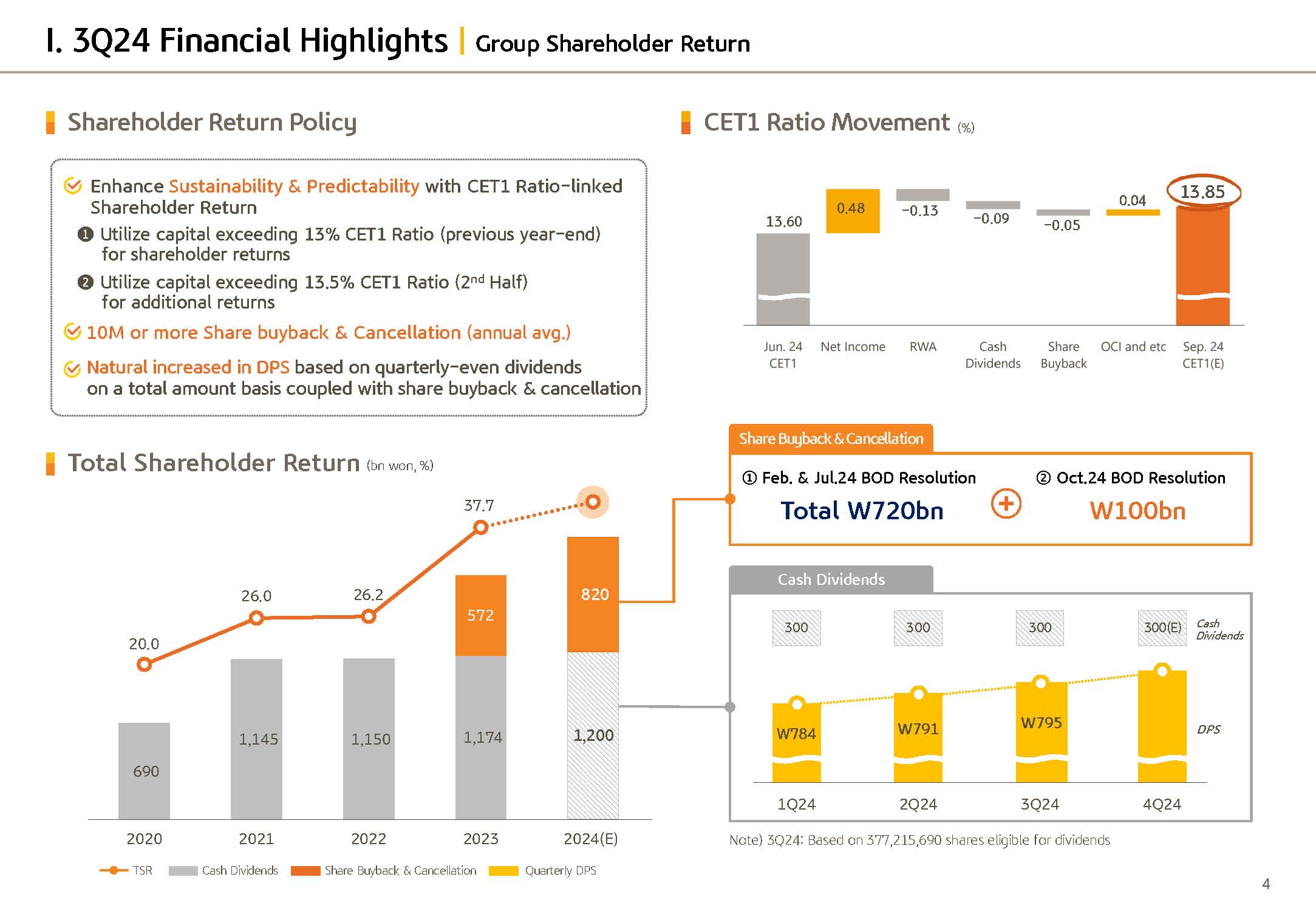

In addition, through ongoing efforts in shareholder returns, the total shareholder return ratio reached 37.7% in 2023

However, shareholder returns are still cited as the primary reason KB’s corporate value is undervalued.

To achieve a fair valuation of our company, we face the task of further enhancing the level of shareholder returns

While preparing for this value-up disclosure, the core philosophy of shareholder returns that we prioritized is ‘sustainability’ and ‘predictability’.

The key challenge we focused on was finding a way to achieve the “threefold goal” of continuously improving the company’s profitability while enhancing shareholder value and maintaining the company’s capital soundness.

Moving forward, KB will return excess capital to shareholders, excluding a portion of the management buffer, in alignment with the CET1 ratio.

For example, if the CET1 ratio at the end of 2024 is 13.5%, the capital exceeding 13% by 50 basis points will be used as a resource for dividends, share buybacks and cancellations in the following year.

At the same time, we will maintain the CET1 ratio in the mid-13% range throughout the year with accumulated profits,

while utilizing the amount exceeding 13.5% in the second half of the year for additional share buybacks and cancellations

The higher KB’s CET1 ratio, the more shareholder returns you can expect in the following year.

Additionally, you can anticipate the scale of shareholder returns based on the CET1 ratio.

Similar to global leading companies like JP Morgan, shareholder returns linked to the CET1 ratio will increase without limit as the CET1 ratio rises, allowing us to return more capital to our shareholders

To achieve this, KB Financial Group will improve its structure in line with a new ‘Value-up Paradigm’ that focuses on pursuing ‘qualitative growth’ beyond ‘quantitative growth’

We are refining our management system to strengthen our core profit-generating capabilities by continuously focusing on growth centered around Return on Risk-Weighted Assets.

Starting with the 2025 management plan, we will set asset growth targets aligned with the ‘Value-up Paradigm’ and redesign key performance indicators,

ensuring that all of us at KB move in accordance with this new paradigm.

Based on these changes, KB will continue to lead the industry in shareholder returns,

and the total shareholder return ratio will maintain its position as the best in the industry as well.

KB has been committed to enhancing shareholder value by being the first in the industry to implement share buybacks and cancellations, as well as adopting a ‘Quarterly–even dividends on a total amount basis’ even before the introduction of the value-up program.

The disclosure we presented today is the result of extensive considerations on how to satisfy our shareholders and stakeholders.

Due to time constraints, I cannot cover all the details, but I assure you that we are committed to continuous improvement in corporate governance, internal controls, ESG, and communication with our shareholders.

To achieve the ‘Threefold goal’ of enhancing profitability, capital soundness, and shareholder returns, all of us at KB, including myself, will wholeheartedly commit to this sustainable journey.

Thank you for listening.

Good afternoon.

I am Jae Kwan Kim, CFO of KB Financial Group. Thank you very much for joining our third quarter 2024 earnings presentation. Before going to Q3 earnings, I will first run through the resolution made by the BOD today regarding the third quarter shareholder return.

We're on page 4.

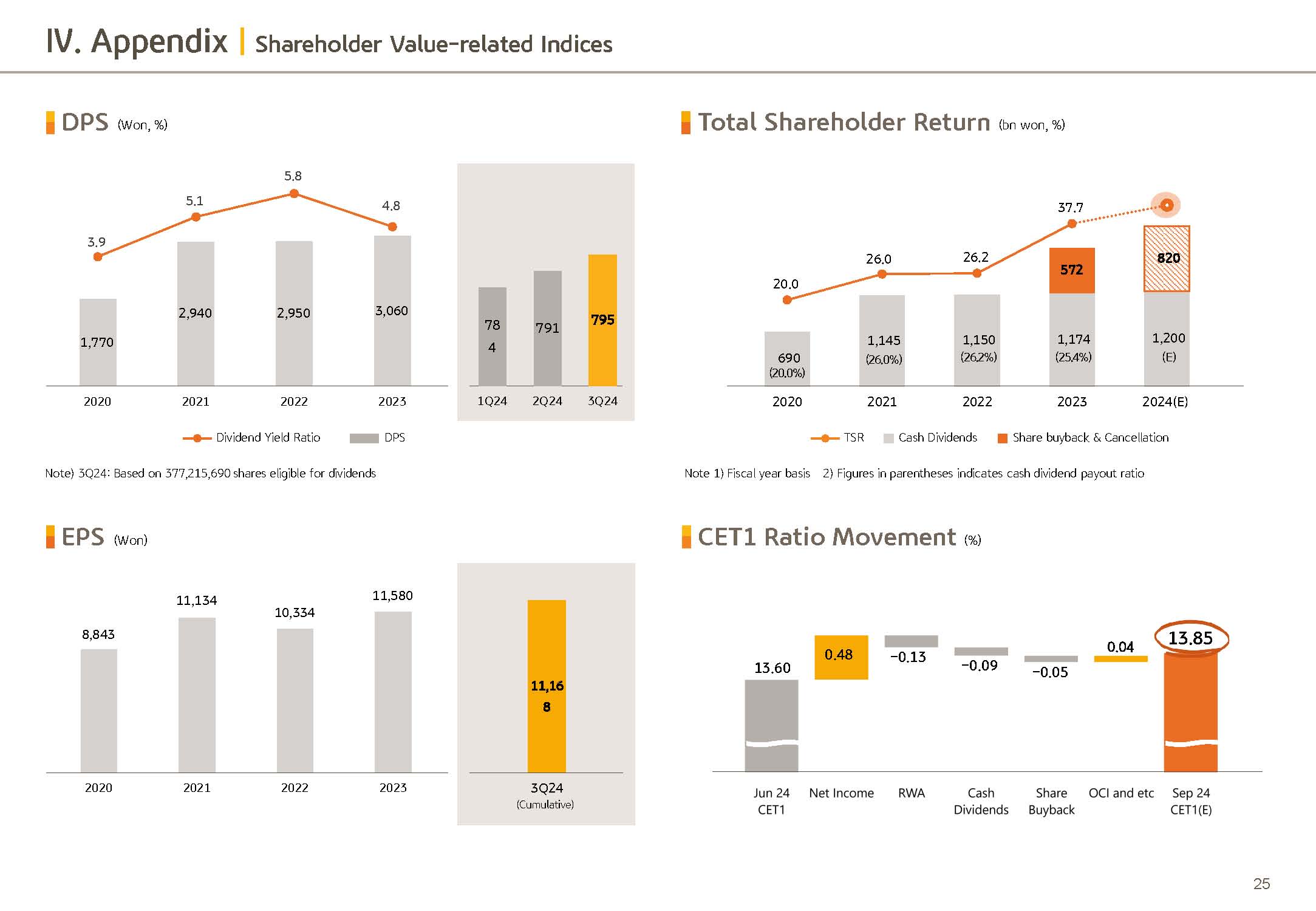

Based on industry's top capital strength and earnings capacity, KBFG is committed to a shareholder return policy with a view towards driving shareholder and corporate value enhancement. To pay out equal amount of dividend every quarter, we've done share buyback and cancellation driving quarterly DPS uptrend.

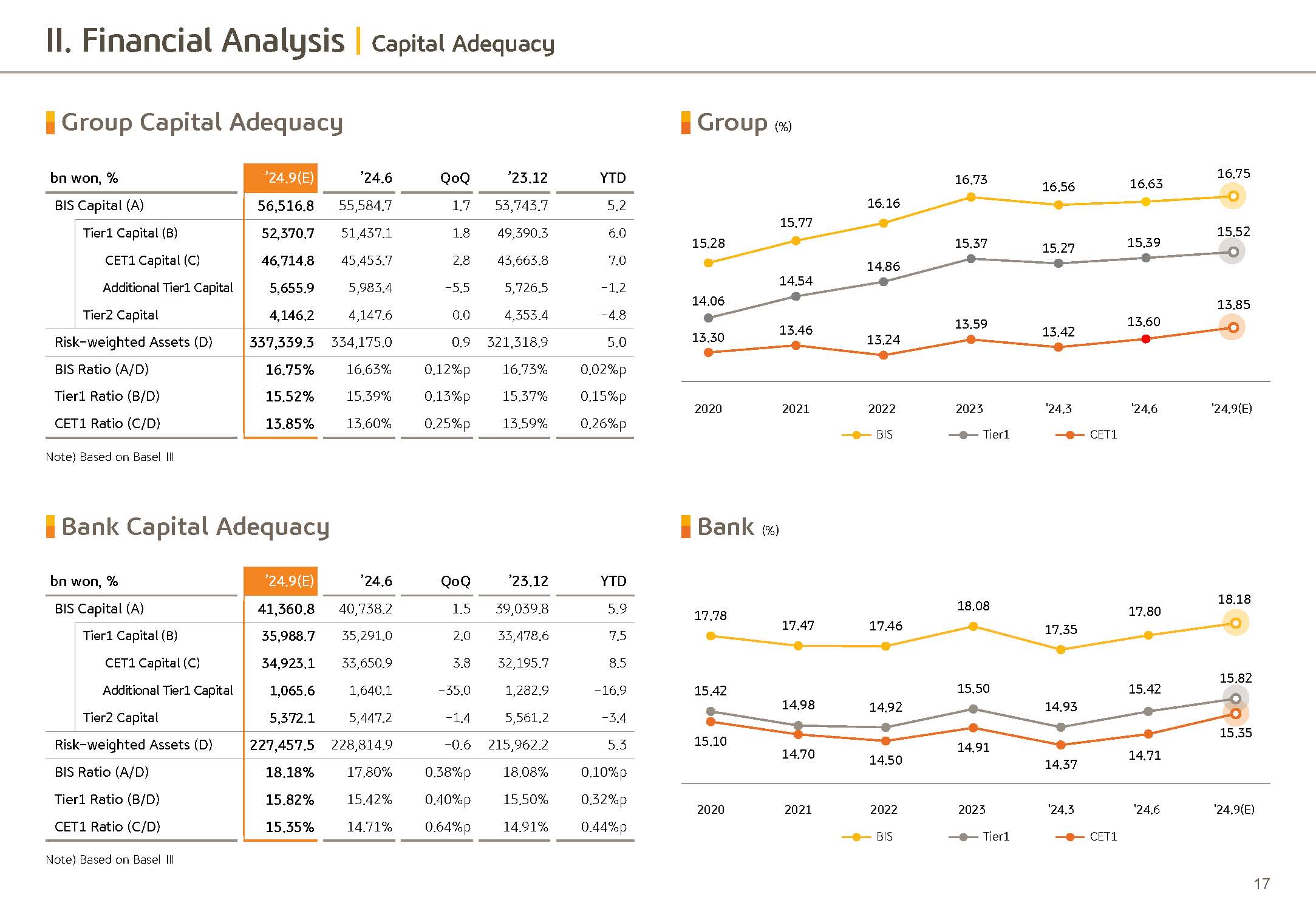

As you can see from the value-up plan disclosed today, we will continue to enhance shareholder value underpinned by RoRWA-centric business management and through CET1-linked shareholder return policy. CET1 ratio, which is common equity tier 1, is used for determining shareholder return and is expected to be 25 basis points increased Q-over-Q to 13.85% as of end of September.

In Q4, possibly due to FX rate movement, share buyback and seasonality weighing down on profit, CET1 ratio may slightly dip, but we plan to keep it robust at above 13.5% during the year. And today, the BOD approved quarterly cash dividend of KRW795 per share and additional share buyback and cancellation of KRW100 billion.

DPS, therefore, is KRW795, marginally up Q over Q following the impact from KRW400 billion of share buyback, which was announced during the first half of the year. And with KRW100 billion of additional buyback and cancellation, our plan is to buy back and retire a total of KRW820 billion this year, which represents industry's biggest buyback and cancellation yet again, a testament to the strong will of the BOD and the management placing foremost priority upon shareholder and corporate value enhancement.

Two keywords that characterize KB Financial Group's value-up plan are sustainability and predictability of shareholder return. Guided by such sustainability and predictability, we will endeavor to sustain shareholder return at industry's top-notch level in alignment with the new value-up program.

Now moving on to KBFG's earnings results for Q3 2024.

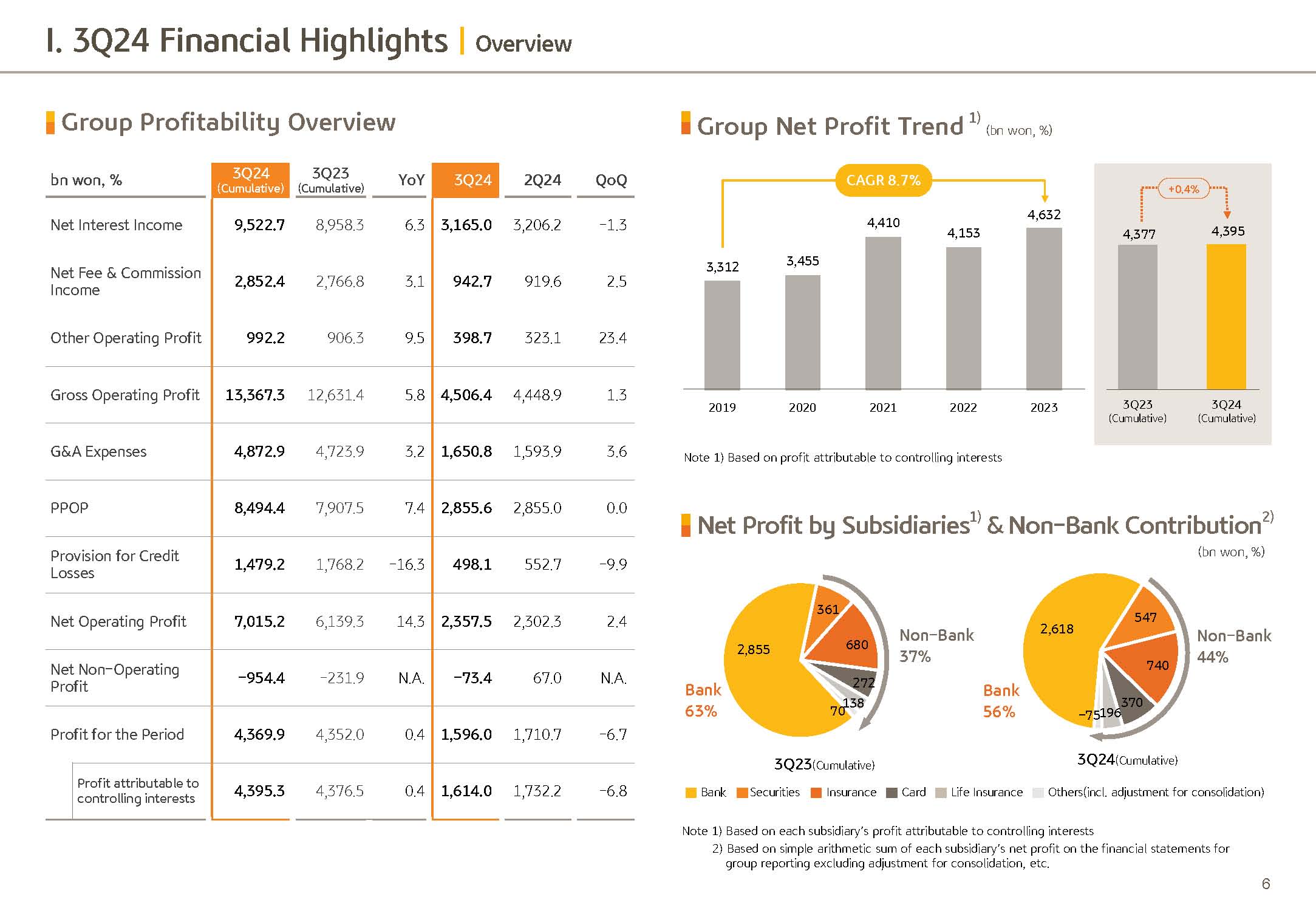

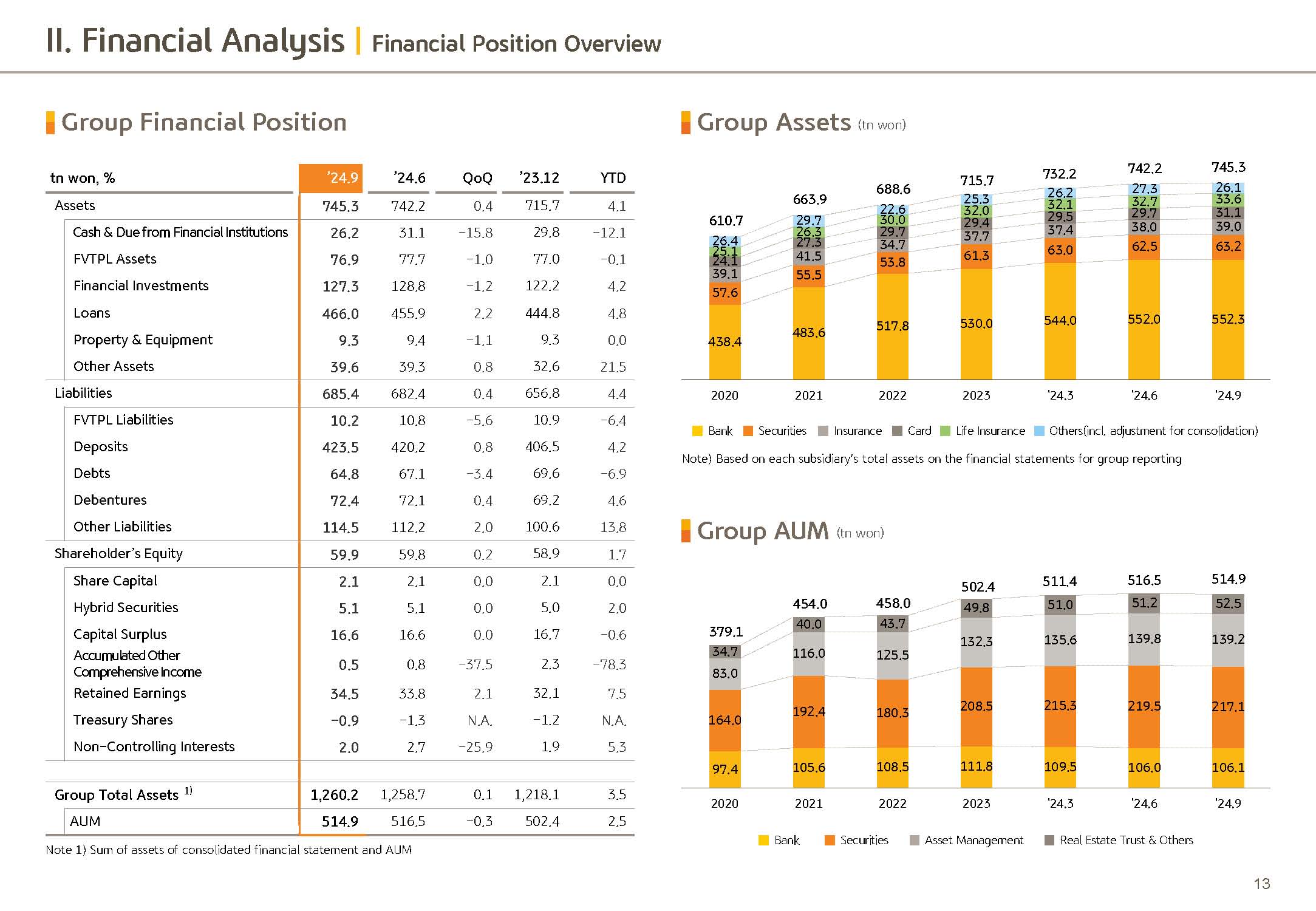

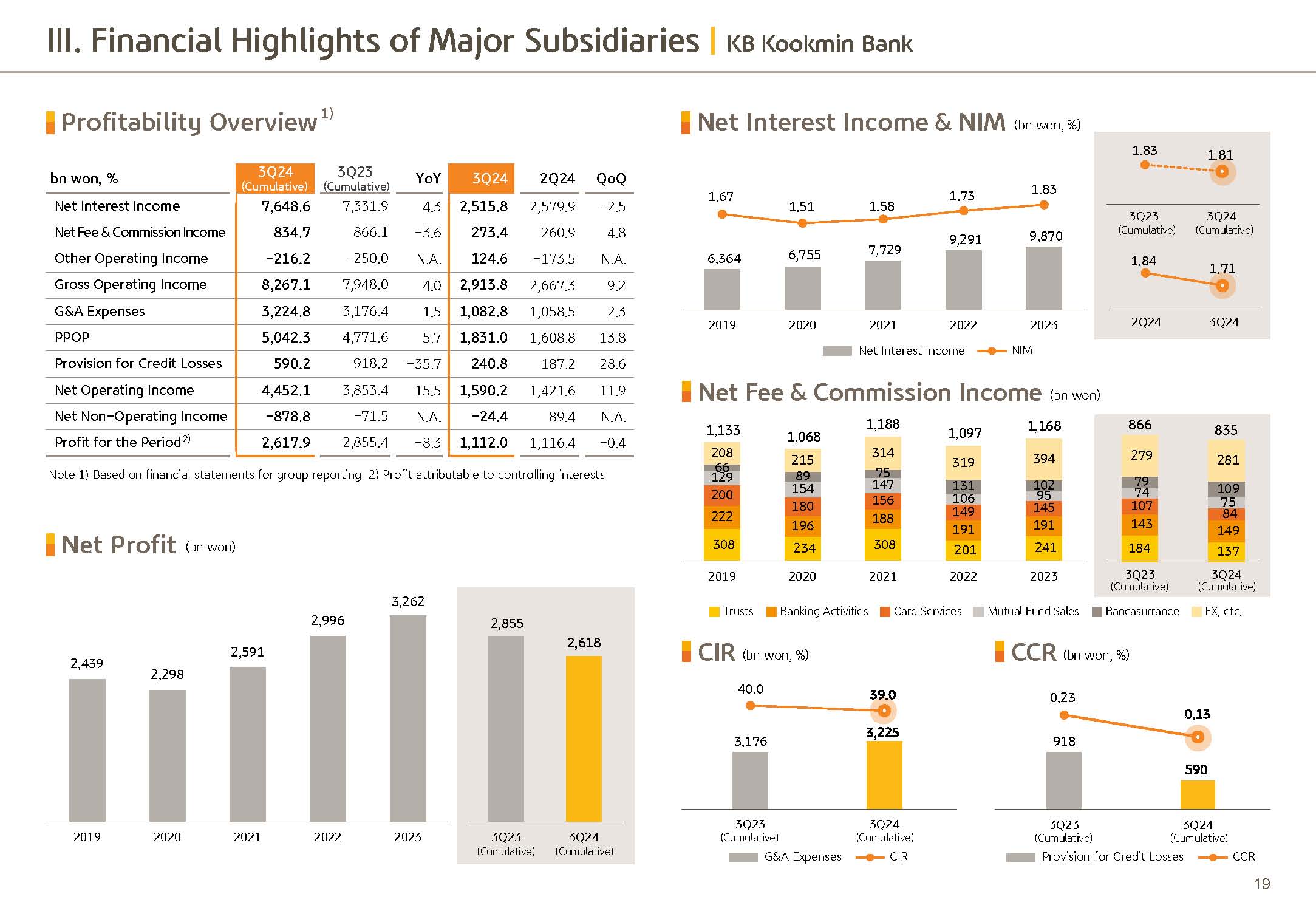

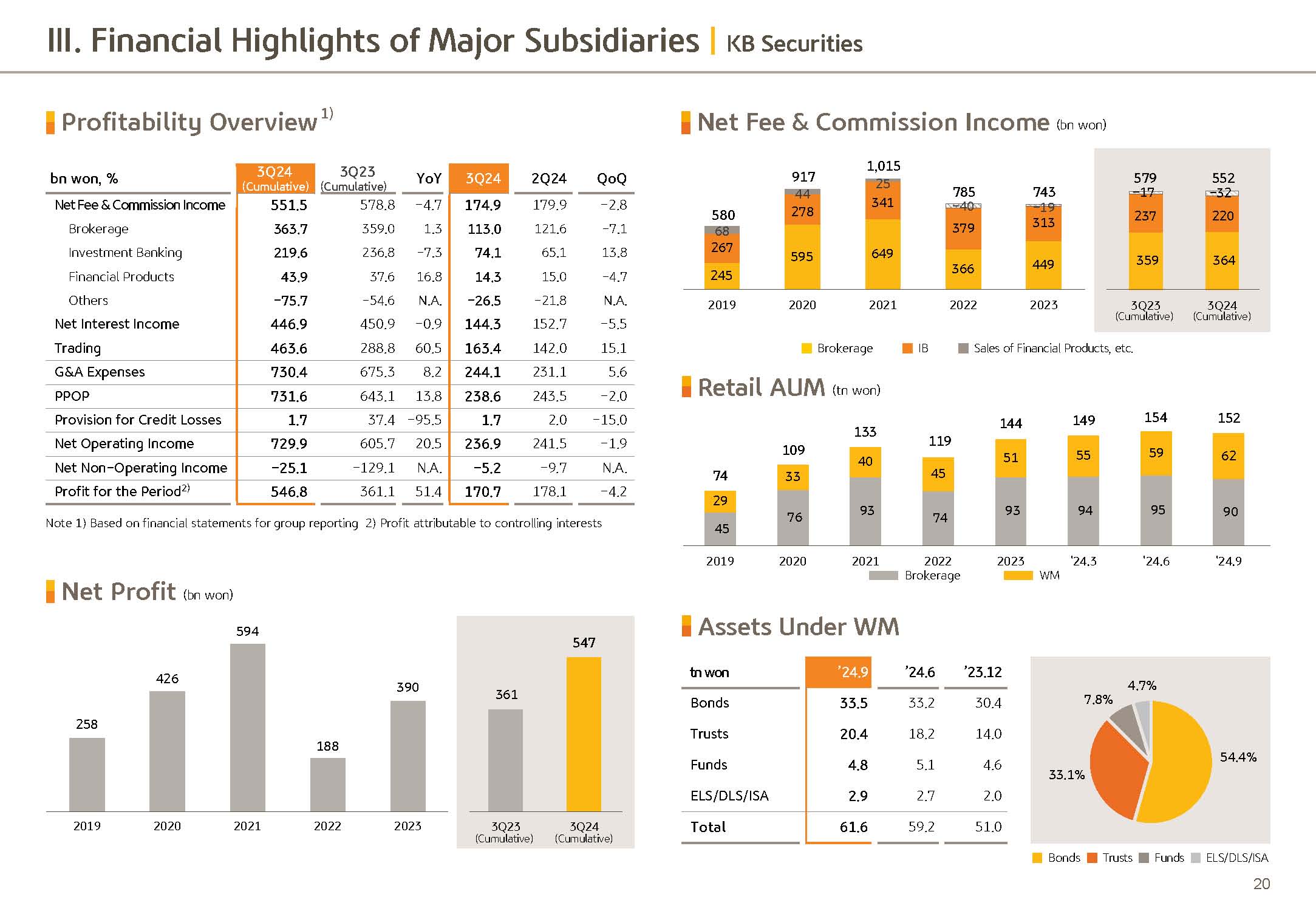

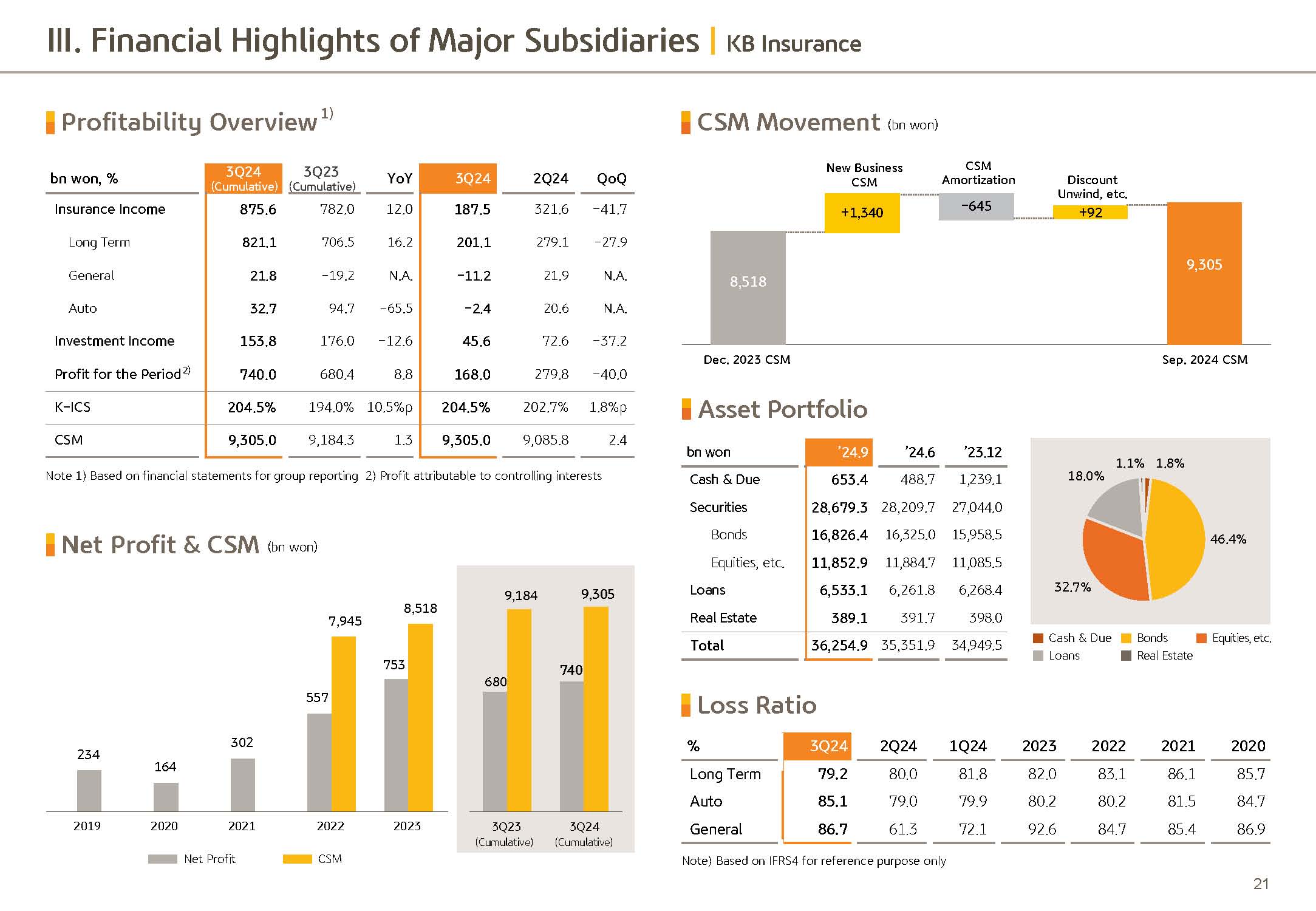

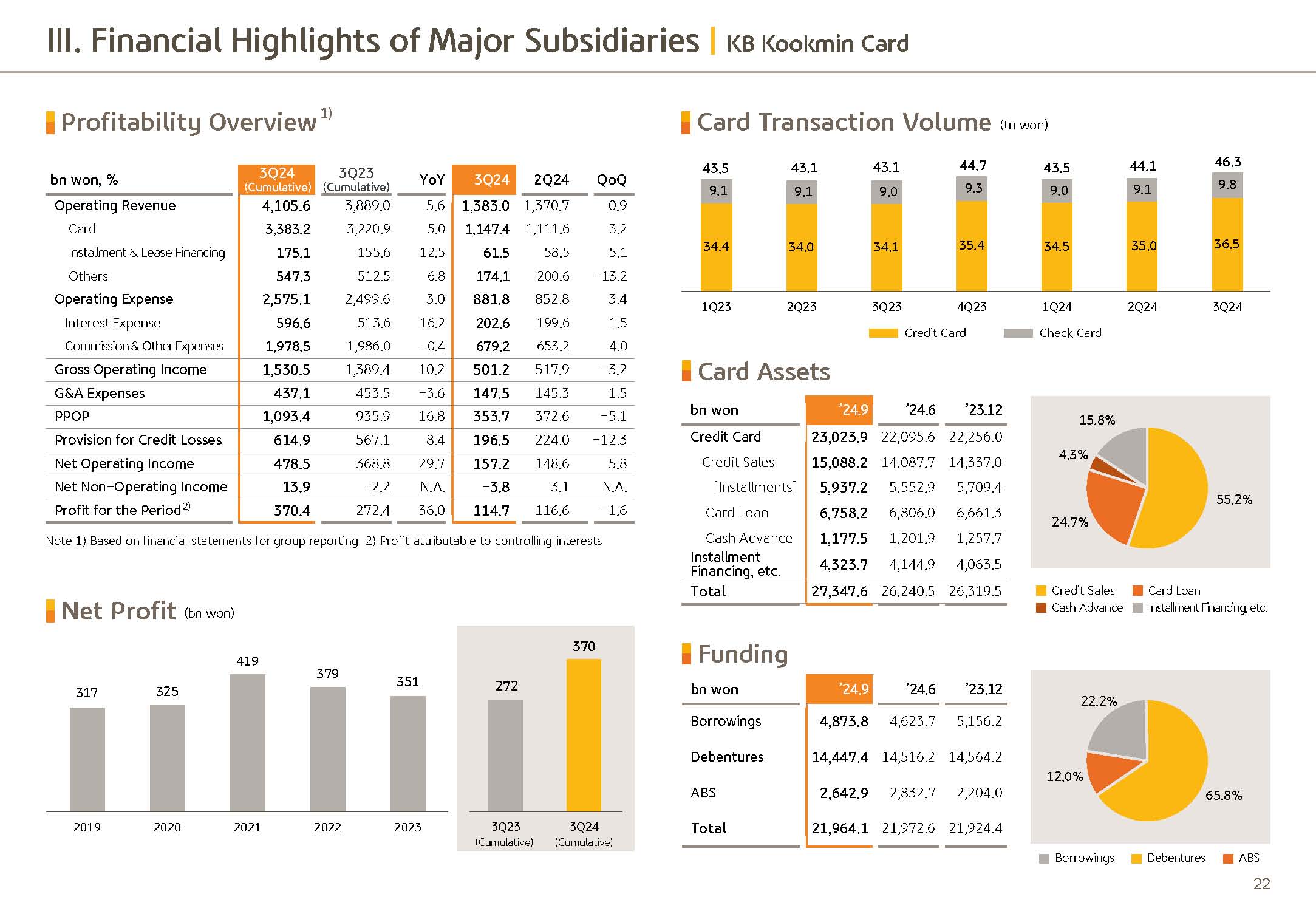

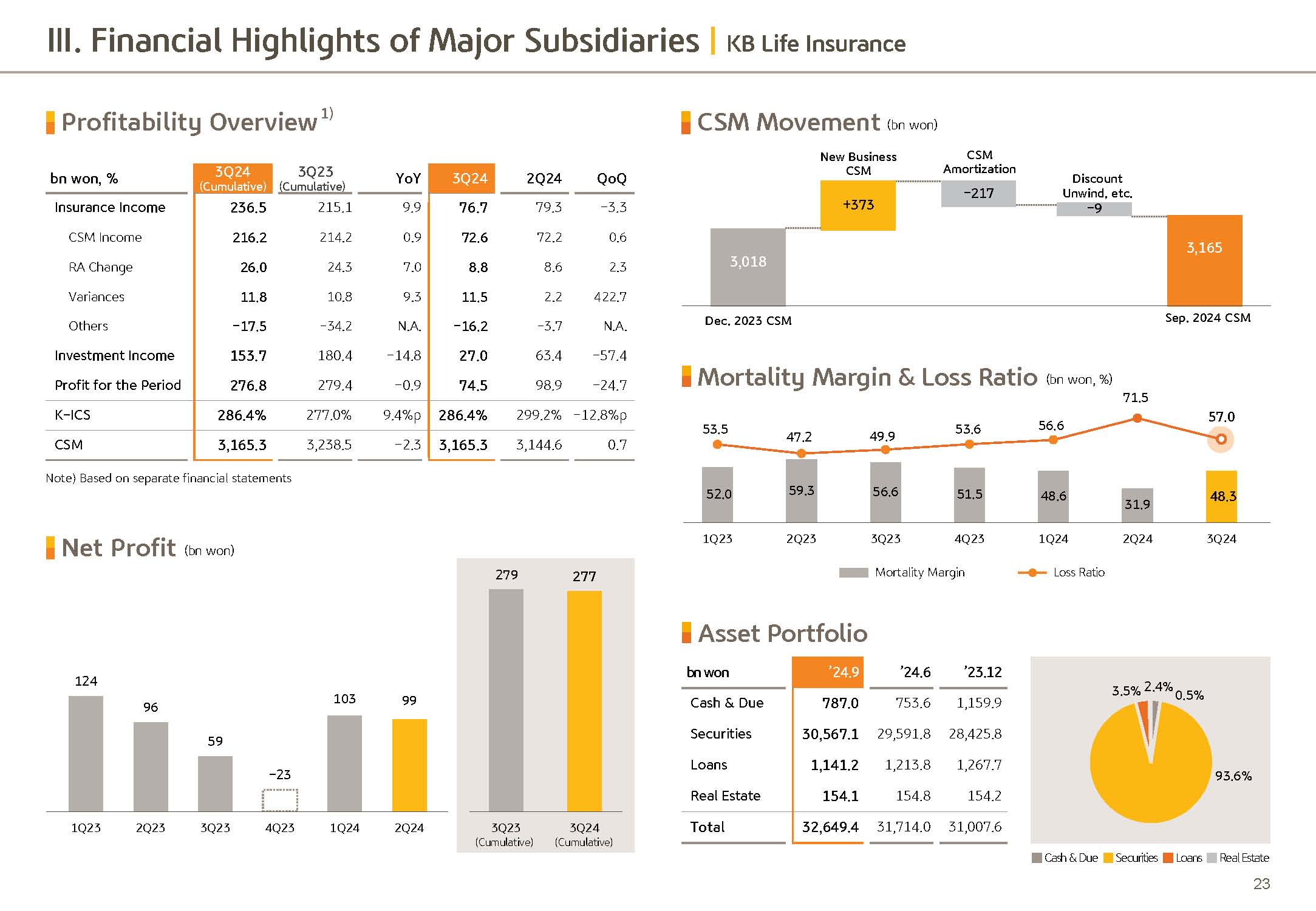

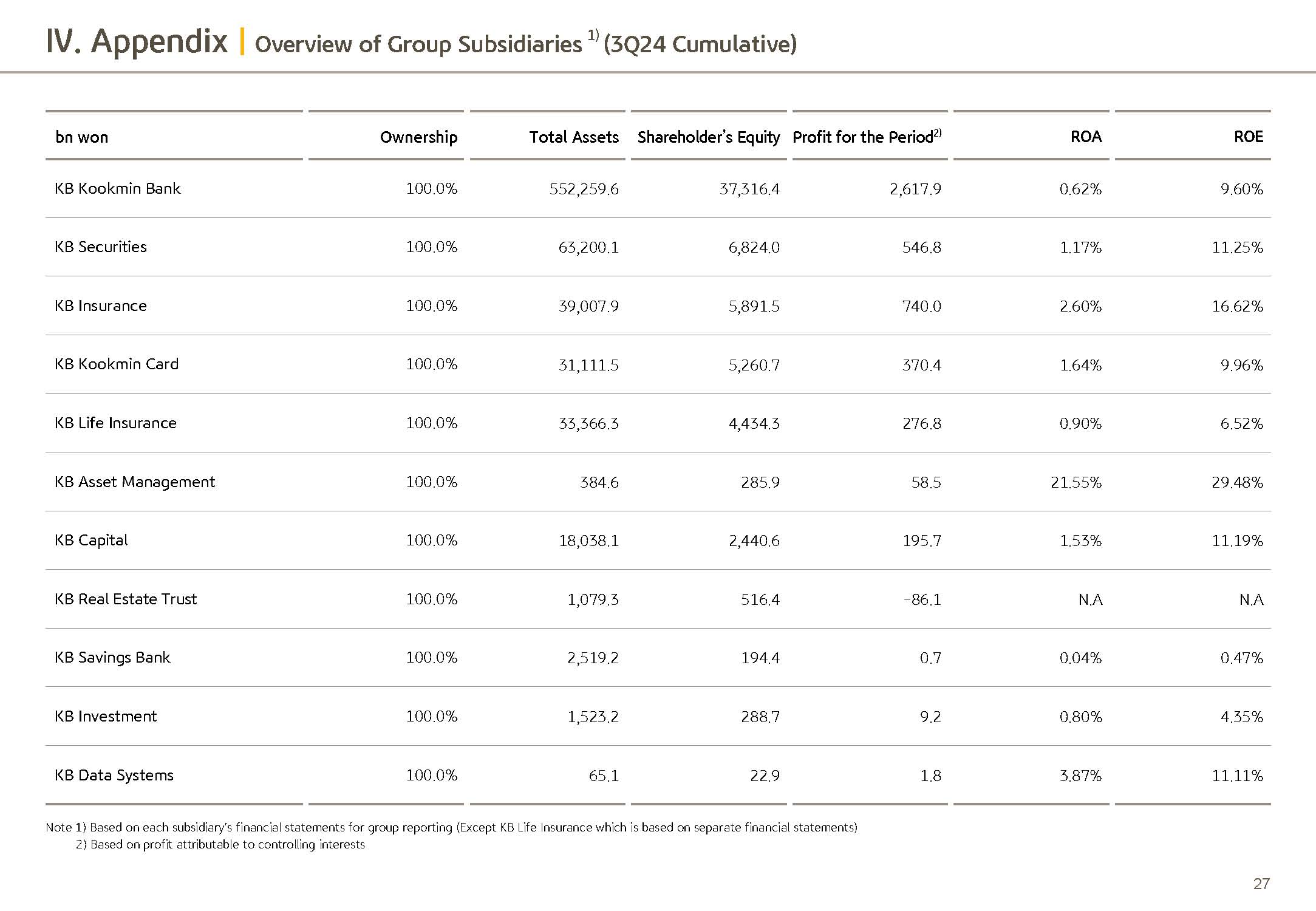

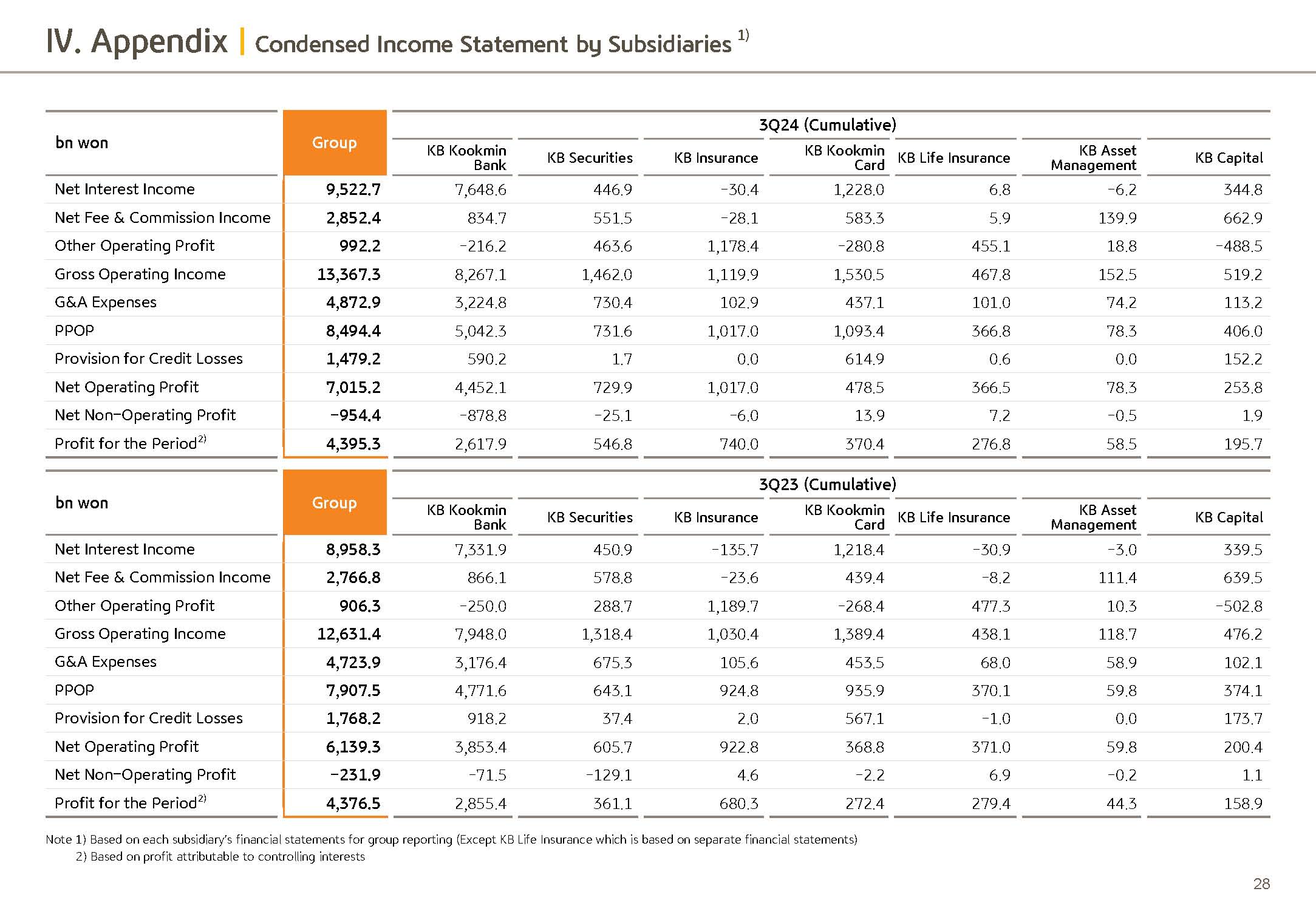

I will begin with group's performance highlights and key business metrics on cumulative basis ending Q3 '24. The group's Q3 2024 cumulative net profit was KRW4.3953 trillion, up 0.4% year over year. This is thanks to good performance across non-bank subsidiaries, including securities, insurance and credit card businesses despite continuing headwinds from rate cuts and sluggish economy.

On the other hand, net profit in Q3 reported KRW1.614 trillion, down on a Q-over-Q basis. This is mainly due to the base effect of sizable provisioning last quarter for ELS compensation and save for this impact. On a normalized basis, net profit was flat Q-over-Q.

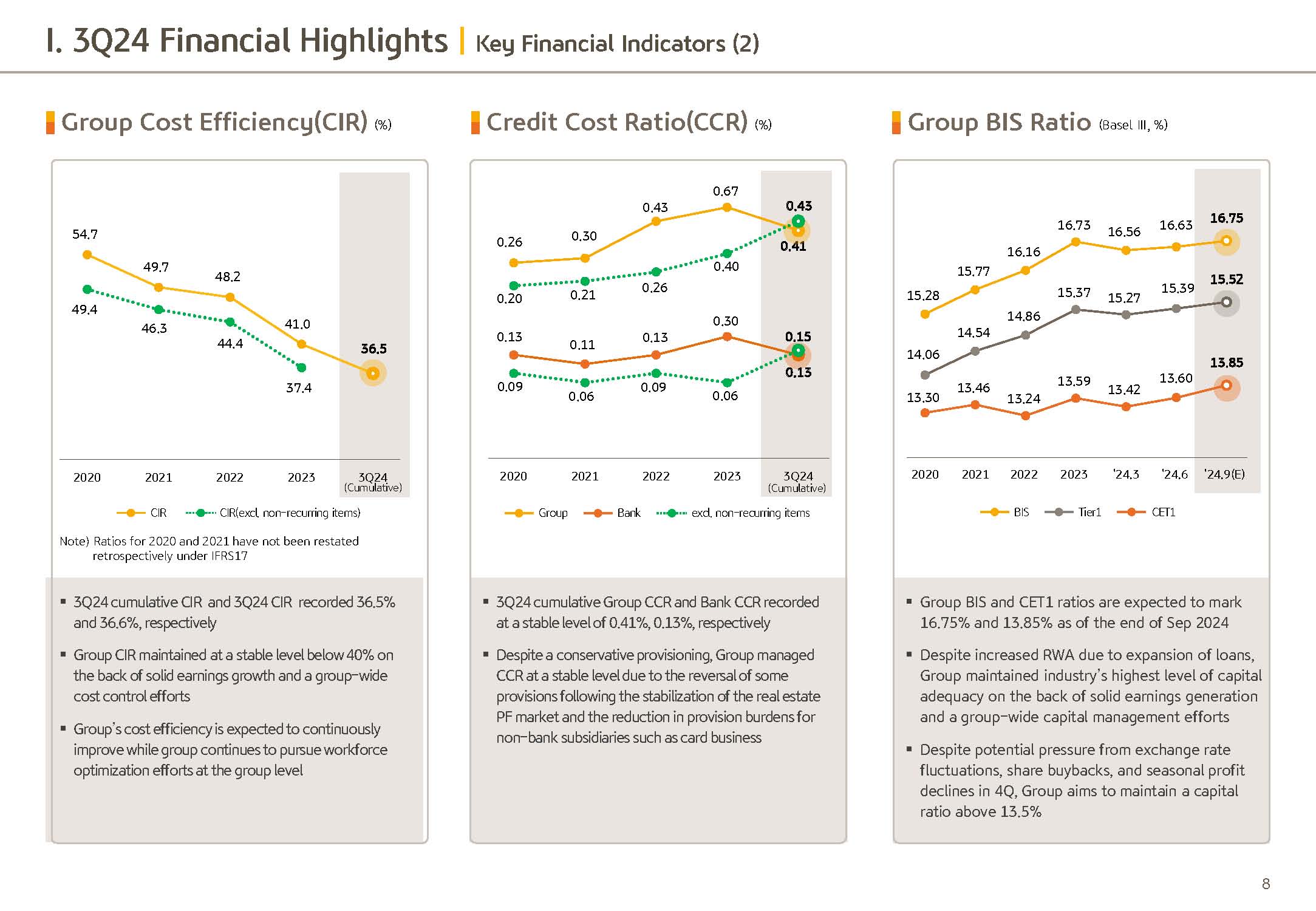

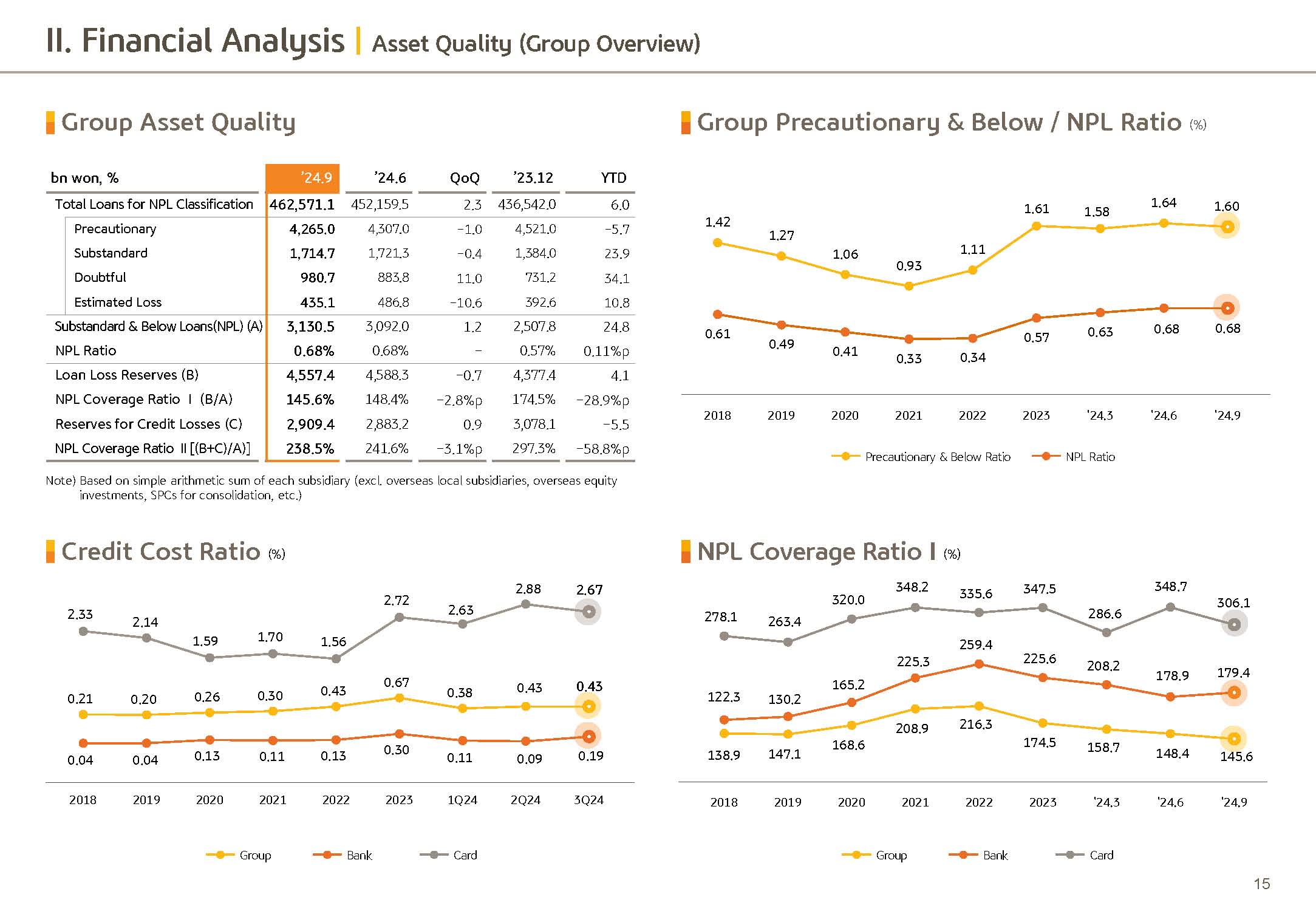

Next, group's cumulative credit cost in Q3 recorded an improvement of 11 basis points year over year, coming in at 0.41%. Despite ensuing macro uncertainties, we have ample amount of buffer following pre-emptive provisioning, and we expect to be able to maintain a robust control over credit cost going forward as well.

As mentioned, as of September end 2024, group CET1 ratio reported 13.85%, maintaining industry's top level of capital buffer on the back of solid profit generation and strategic capital management. This, in turn, has been the basis of KRW100 billion of additional share buyback and cancellation enabling KBFG to continue on with differentiated shareholder return policy supported by capital strength.

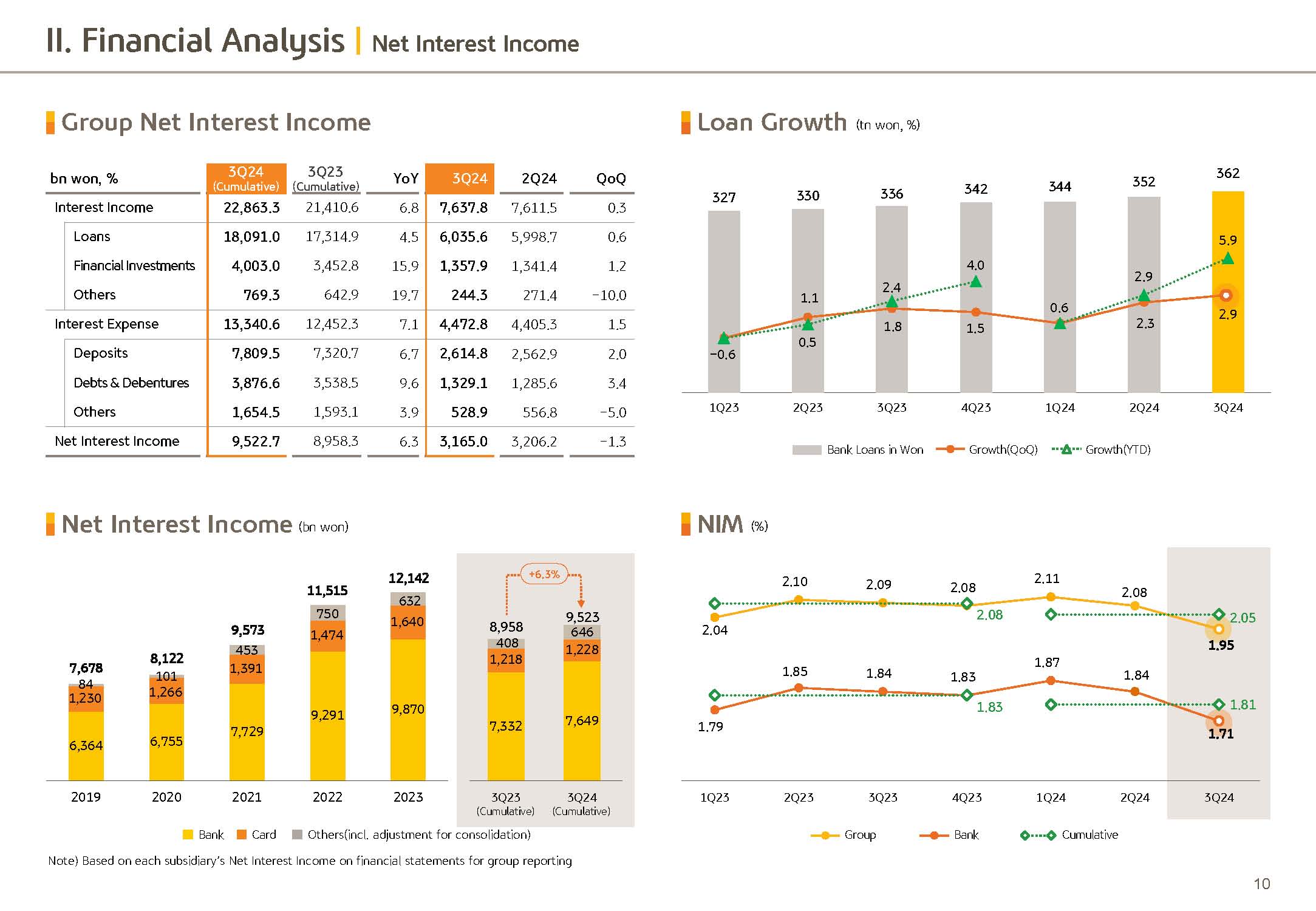

With that said, I will now move on to detailed breakdown of the company's third quarter results. Group's net interest income in Q3 was KRW3.165 trillion, down 1.3% Q-over-Q on the back of interest rate cuts and which drove down yield from loan assets.

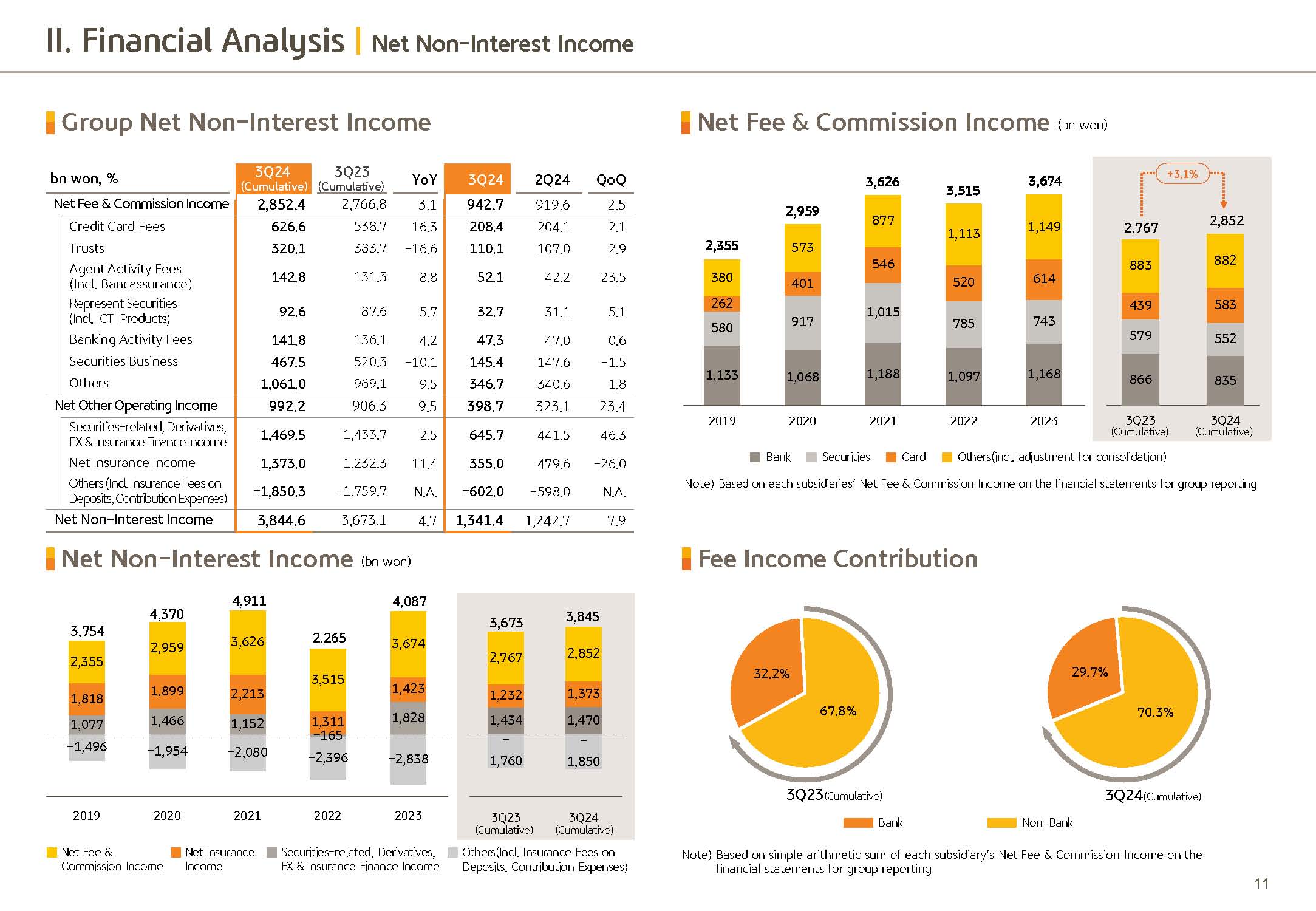

Q3 net fees and commission income was KRW942.7 billion on the back of increases in the bank's bancassurance and securities investment banking fee driving 2.5% Q-over-Q increase.

Next is other operating profit. In Q3, other operating profit reported KRW398.7 billion, up 23.4% Q-over-Q, driven by fall in market rate and FX rate, which drove significant expansion in returns from securities and derivatives.

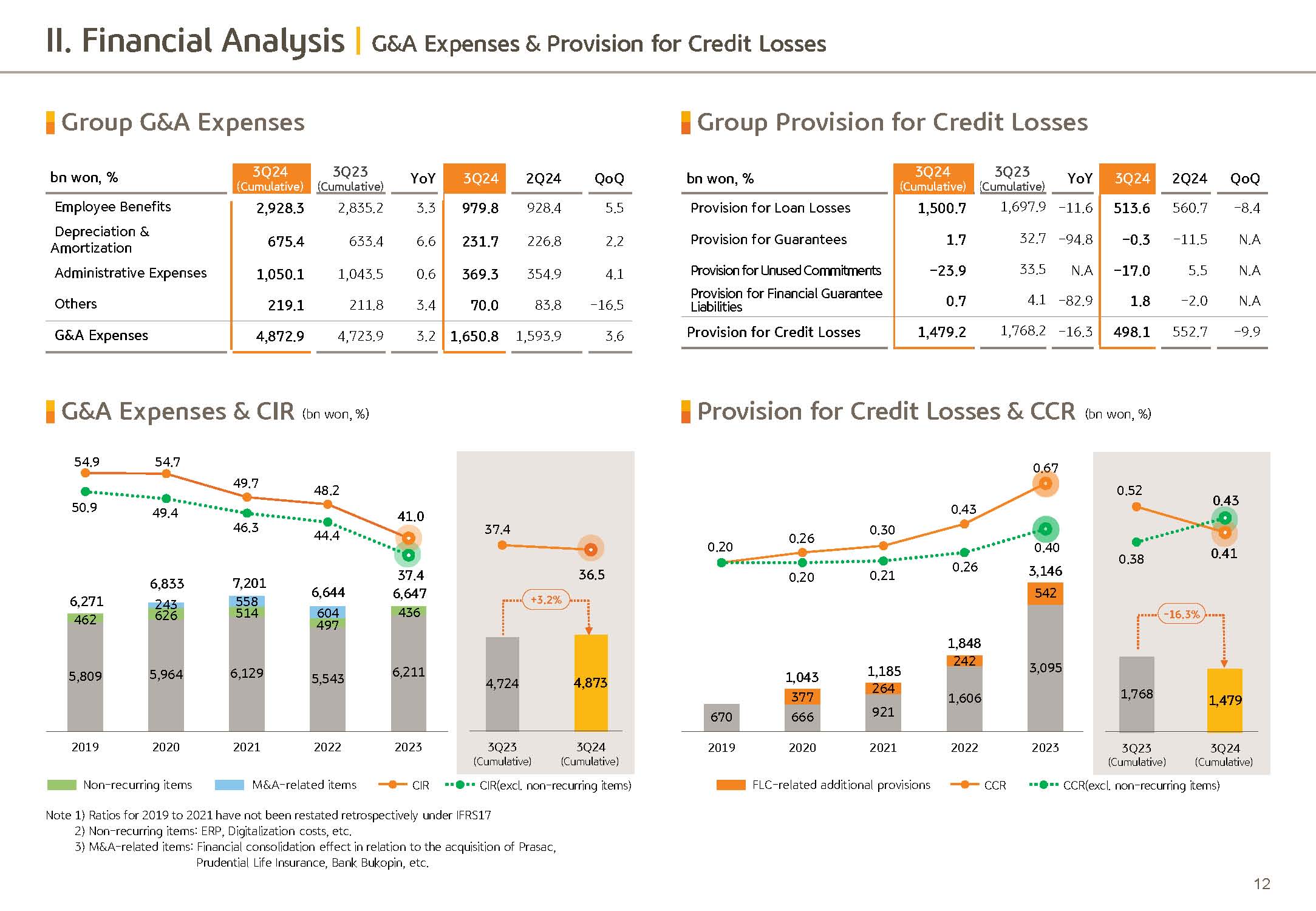

Next is on G&A expense. While Q3 G&A expense came in at KRW1.6508 trillion, which is an increase of 3.6% Q-over-Q, Group CIR in Q3 on a cumulative basis reported 36.5%, keeping to below 40% level, thanks to a solid top line growth and sustained effort behind cost efficiency gains.

Next is on group's PCL.

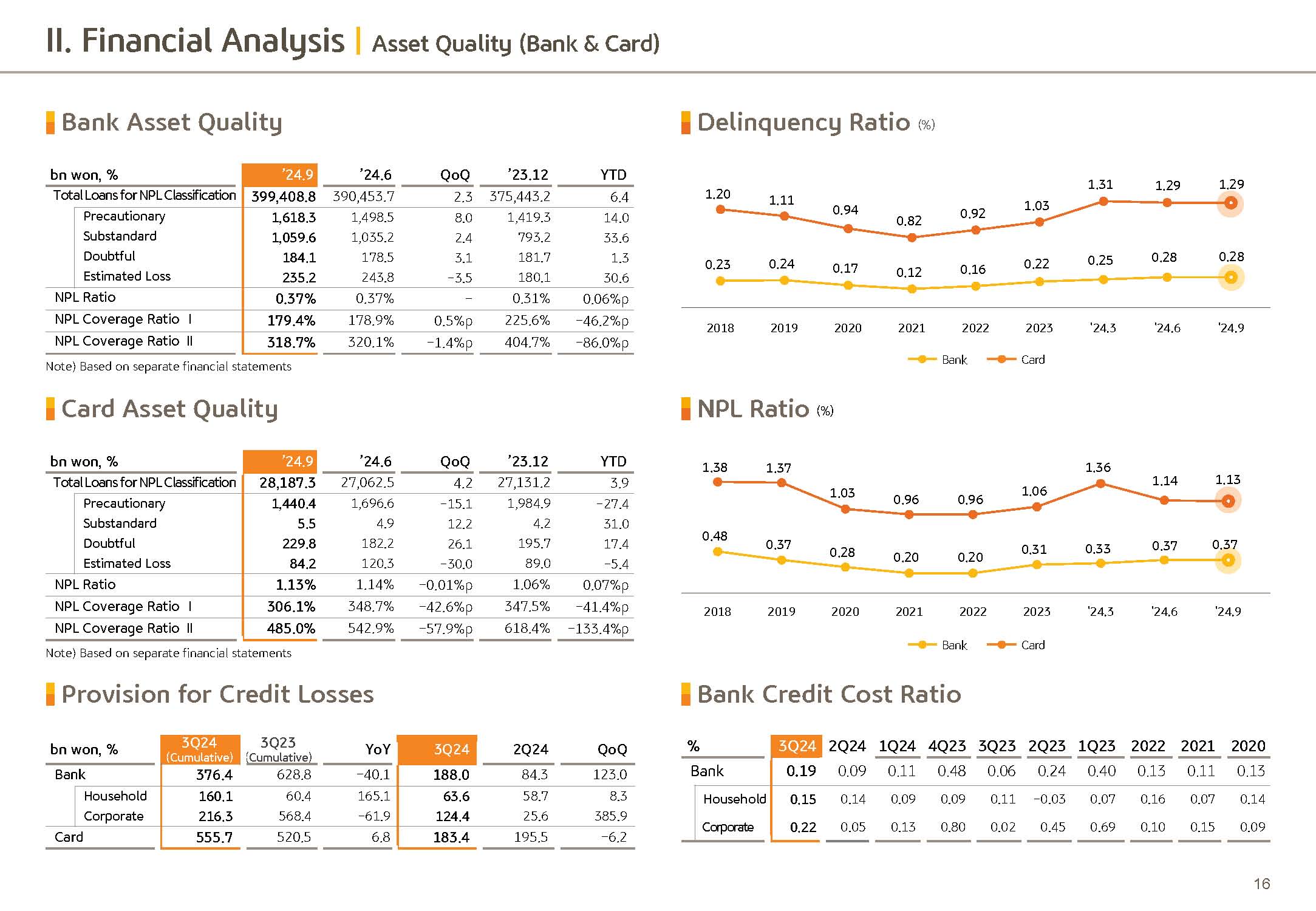

Third quarter PCL was KRW498.1 billion, down 9.9% Q over-Q, mainly due to lessened burden for provisioning at non-bank subsidiaries, including KB card, savings bank and real estate trust.

Lastly, non-operating profit in Q3 recorded a decline of KRW140 billion Q-over-Q on the back of base effect of last quarter's sizable provisioning for ELS compensation cost.

On the next page, I will explain key financial indicators.

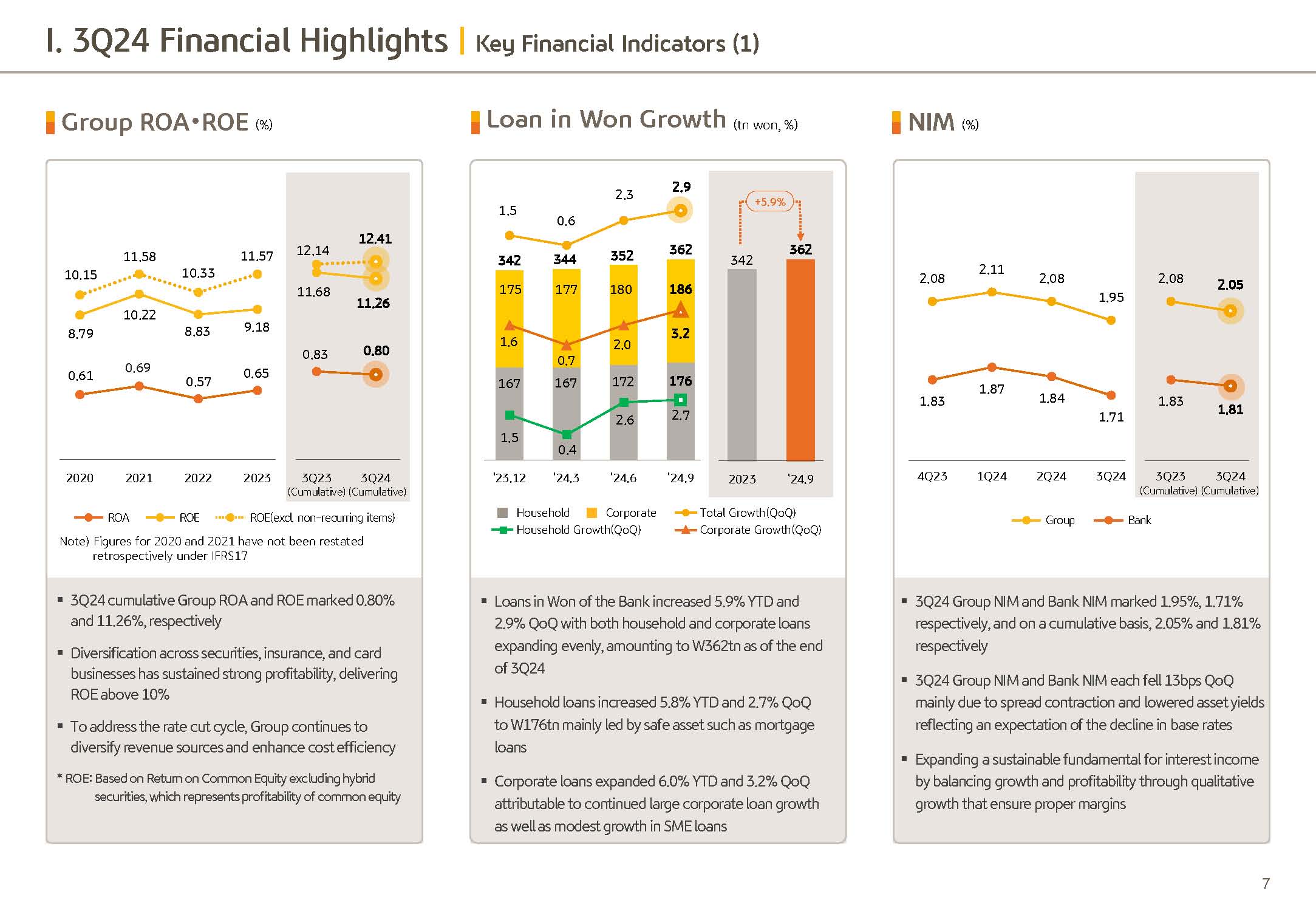

First, profitability indicators. Q3 '24 cumulative group ROE was 11.26% coming in and above the target ROE of 10%. In the face of upcoming rate cut cycle, we will also continue to place effort behind diversifying the revenue source and improving cost efficiency.

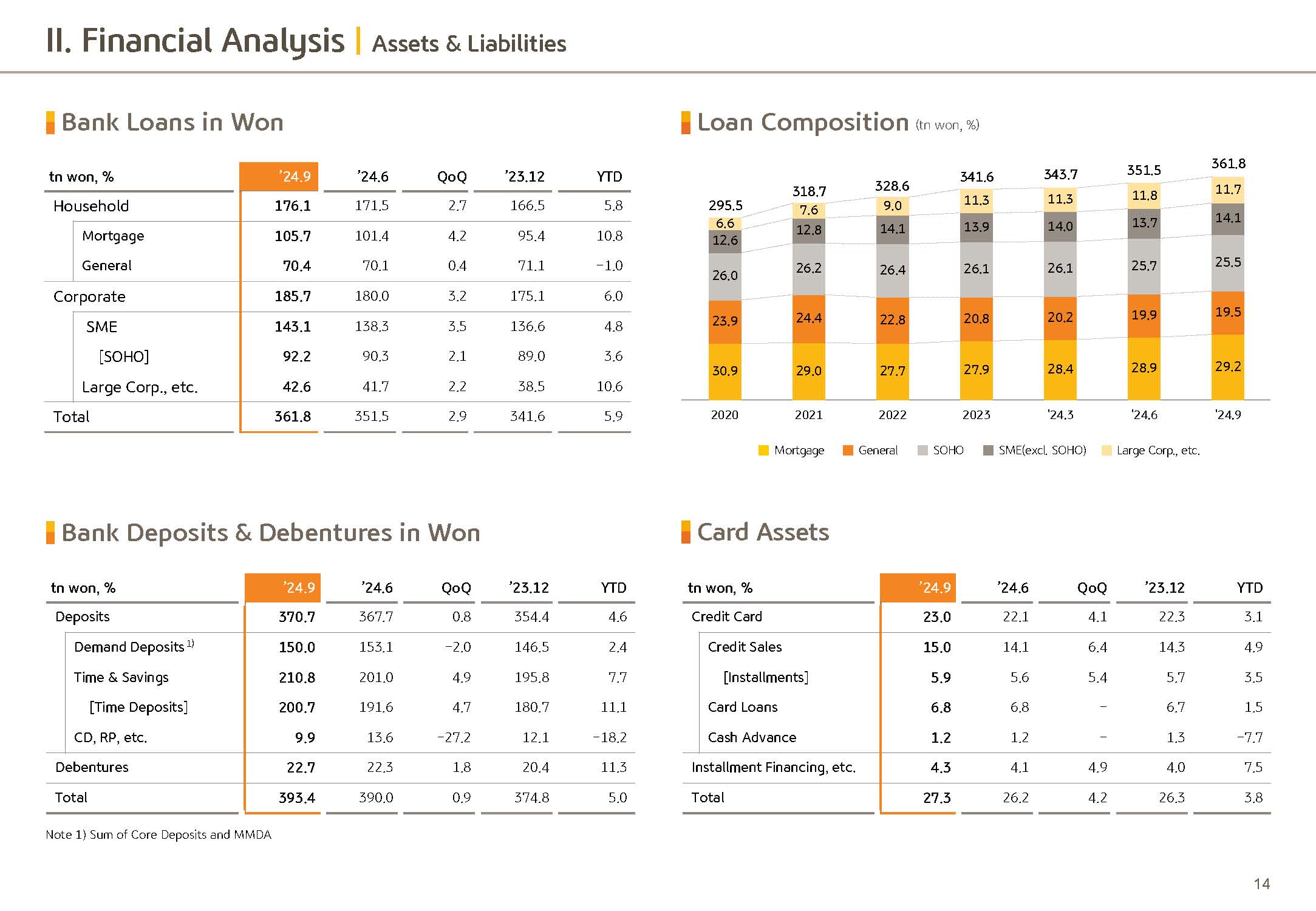

Looking at now the growth of loans in won, bank's total loan in won as of September end '24 was KRW362 trillion, up 2.9% versus June and 5.9% year to date.

Household loan was KRW176 trillion, on rise in demand following recent increases in the transaction volume, which drove 2.7% increase or KRW4.6 trillion versus end of June. Corporate loan reported KRW186 trillion, as loans to large corporates continued following the second quarter trend on top of which SME loans also up trended, driving 3.2% rise compared to end of June.

Next is on NIM. Group and bank's NIM in Q3 was 1.95% and 1.71%, down 13 basis points, respectively, Q-over-Q. Now this is because market rate has priced in expectations of base rate cut. And as repricing of deposit lags, loan repricing, we saw spread contraction and lower yield on loan assets.

However, downward pressures on NIM, including steep rise in mortgage lending and base rate cuts being priced in, have been mostly captured during Q3. And we, therefore, expect as repricing of deposit follows the lending rate, there will be offsetting of NIM erosion.

Also, loan growth has slowed since September as government had stringent control on household lending, and we expect to maintain Q4 bank NIM at a steady level on the back of recovery in margin.

Rather than focusing on growing the loan book, we plan to focus on quality-driven growth with adequate margin under a right balance between growth and profit, so as to broaden sustainable basis for interest income generation.

Let's go to the next page.

I will cover the group's cost income ratio, CIR. As you can see on the graph on the top left-hand side, 2024 Q3 cumulative group CIR posted 36.5% and through solid earnings growth and group-wide cost control efforts, it is maintaining a stable level.

Next is credit cost ratio. Credit cost, Q3 cumulative group credit cost posted a 41 bp level and with the real estate PF market stabilization, some reversal took place and thus, group's CCR is being stably managed.

Last is group's capital adequacy. Despite the risk-weighted asset growth effect with the loan growth in the quarter, on the back of group's proactive capital management efforts and sound net interest growth, we have secured the highest level of capital adequacy in the industry.

In September, base BIS ratio and CET1 ratio is expected to post 16.75% and 13.85%, respectively. As I covered in the shareholder return slide, we will continue to work to improve capital efficiency to improve shareholder return visibility by managing the CET ratio to more than 13.5% throughout the year.

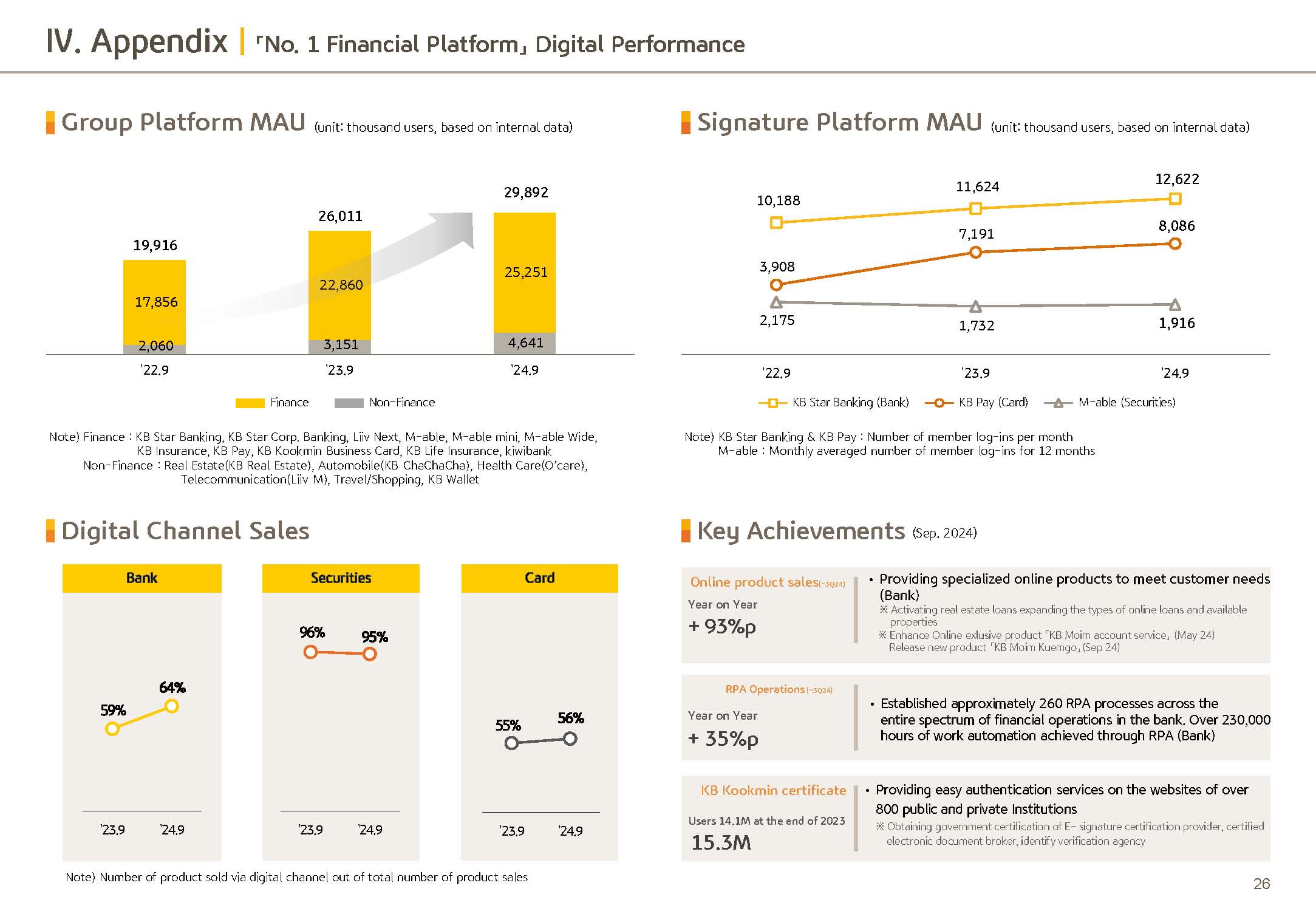

KB Financial Group is striving and making diverse efforts to strengthen communication with and provide investment information access to not only institutional investors but also to individual investors.

As a beginning, we will newly put up a value-up bulletin board on our website to provide diverse investment-related information, including for our value-up program.

From the next earnings release, we plan to provide time to receive questions beforehand from individual investors and to answer them.

Please refer to the next pages for details related to the business presentation that I have covered so far. With this, I will conclude KB Financial Group's 2024 Q3 business results presentation.

Thank you for listening.