-

Please adjust the volume.

1Q25 Business Results

Greetings.

I am Peter Kwon, Head of the KBFG IR Division. We will now begin the 2025 Q1 business results presentation. Thank you very much for participating in today's earnings release. We have here with us Executives from the group, including CFO, Sang Rock Na.

First,

our Group CFO will cover 2025 Q1 major performance highlights. After that, we will have a Q&A session. Please note that like in the previous quarter, after our real-time Q&A session, we have set aside additional time for the management team to answer shareholders' questions.

I will now invite our group CFO to walk us through 2025 Q1 business Greetings.

Greetings. I am KBFG CFO, Sang-Rok Na.

Thank you for participating in our 2025 Q1 business results presentation. I will first touch upon Q1 key performance and major management indicators and give you more details for each category.

In addition by applying the financial supervisory services response to our inquiry regarding insurance contract accounting treatment, we retrospectively restated financial results from 2024 Q1 to Q3. Please take this into consideration.

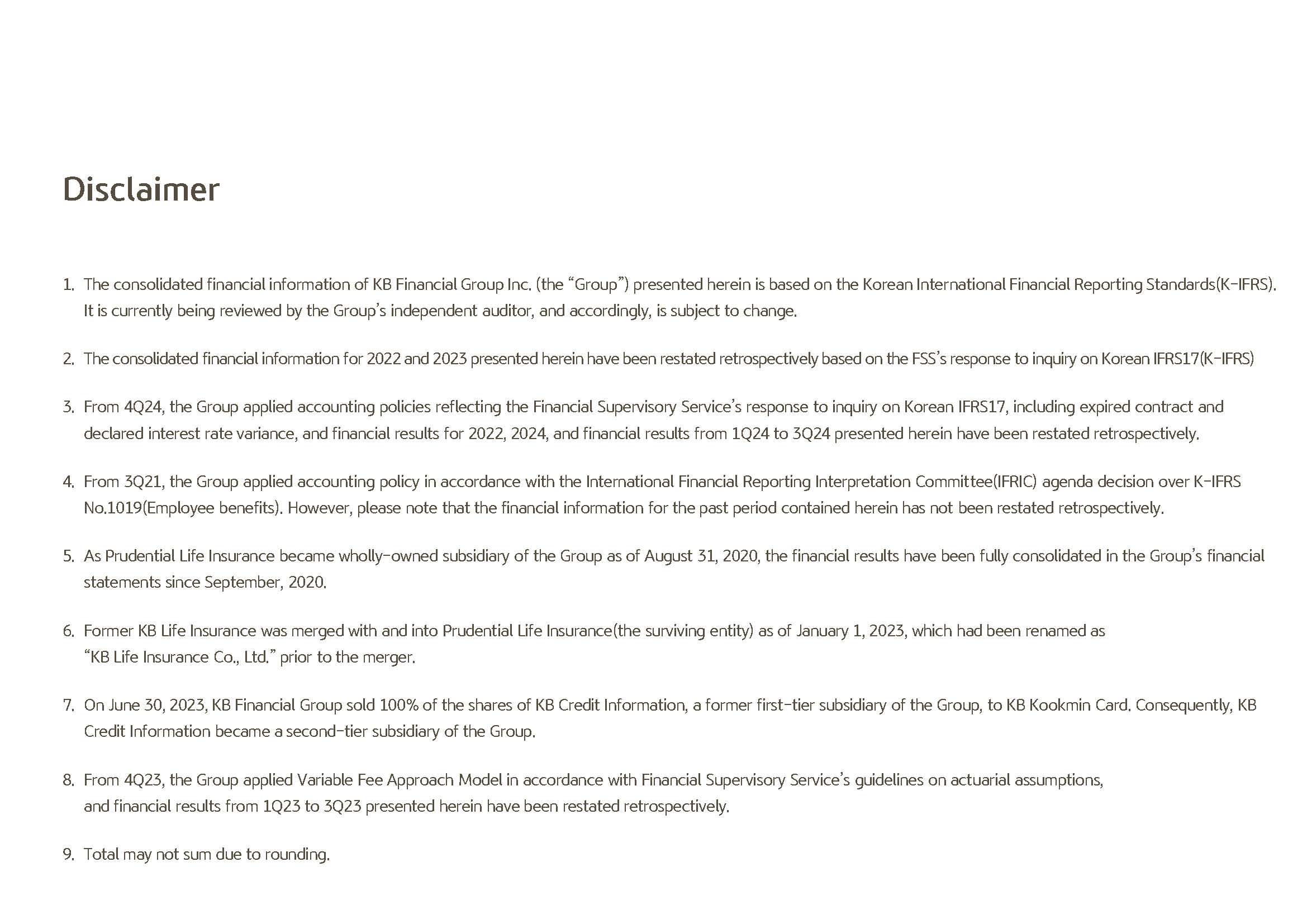

Let's go to Page 1.

In October of last year, we announced our clear road map regarding shareholder return. And this year, we are convinced that this will be a year when we will clearly demonstrate our group shareholder return policy.

Even though concerns over global economic downturn are spreading, once again, KBFG focused on stable capital ratio management and continued robust profit-generating capacity.

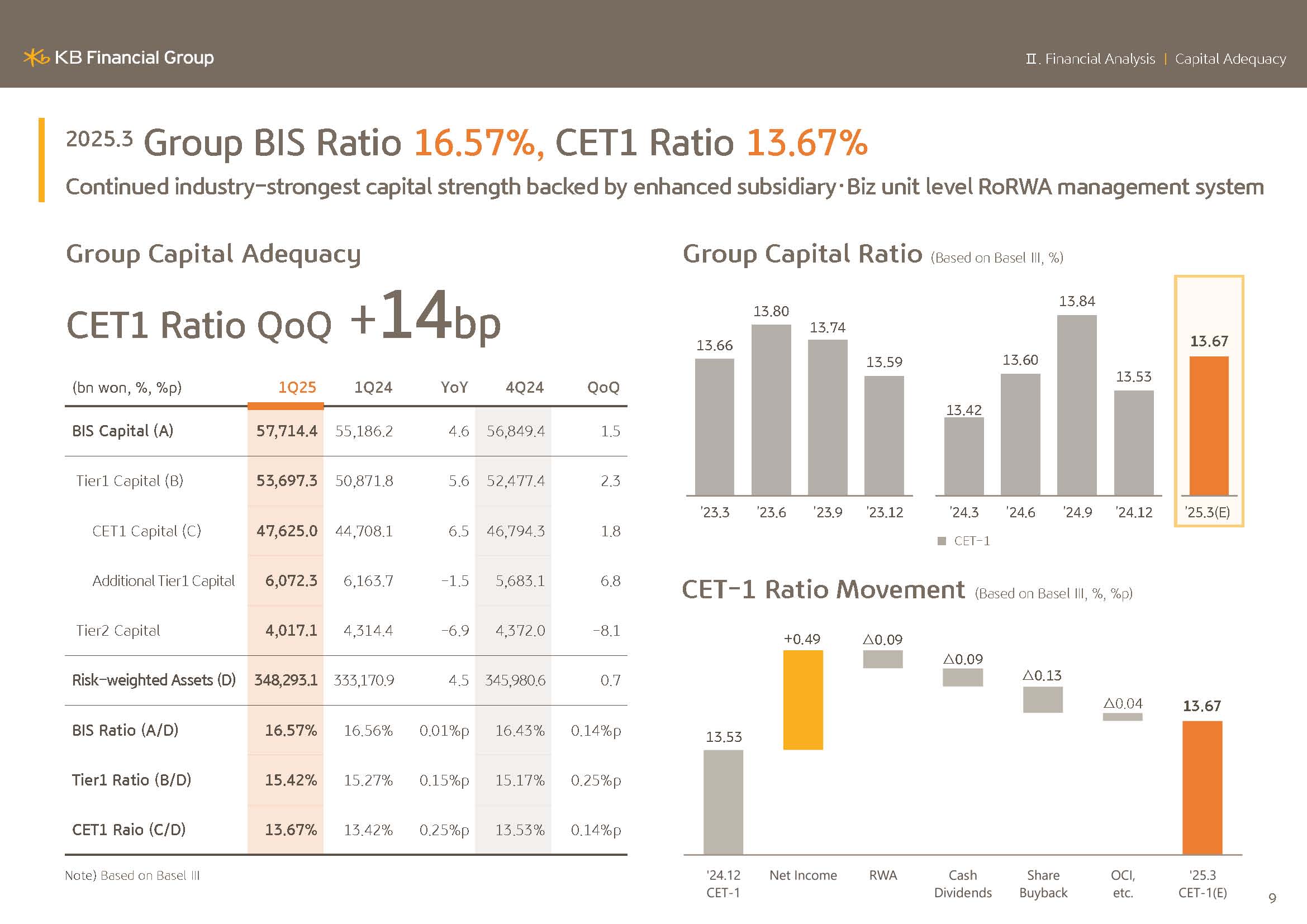

Most of all, March end CET1 ratio posted 13.67%, a 14 bps increase Q-o-Q, and we expect to maintain the industry's highest level of capital ratio.

And we can say that this was a result of stable management of risk-weighted asset growth as well as efficient capital allocation.

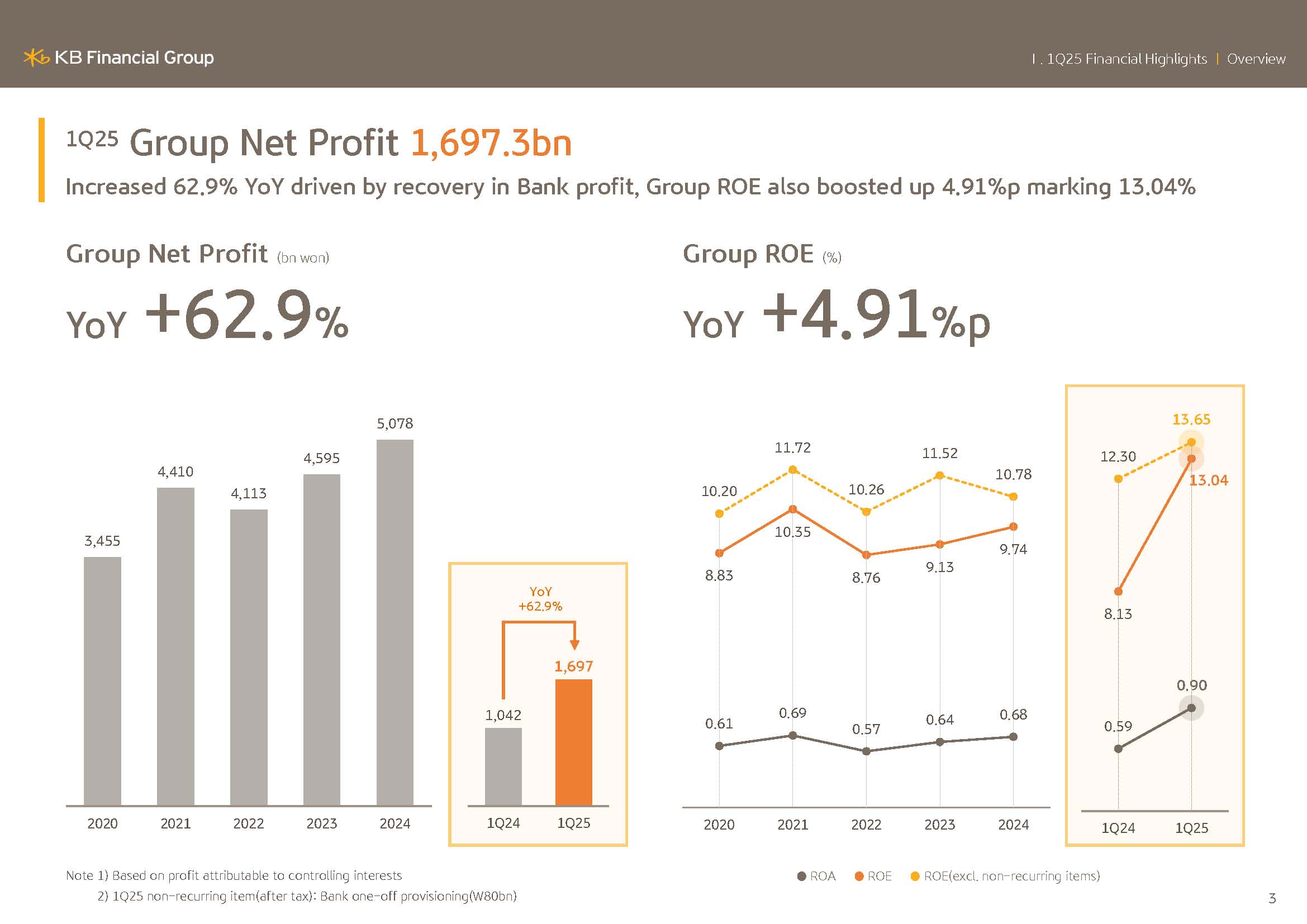

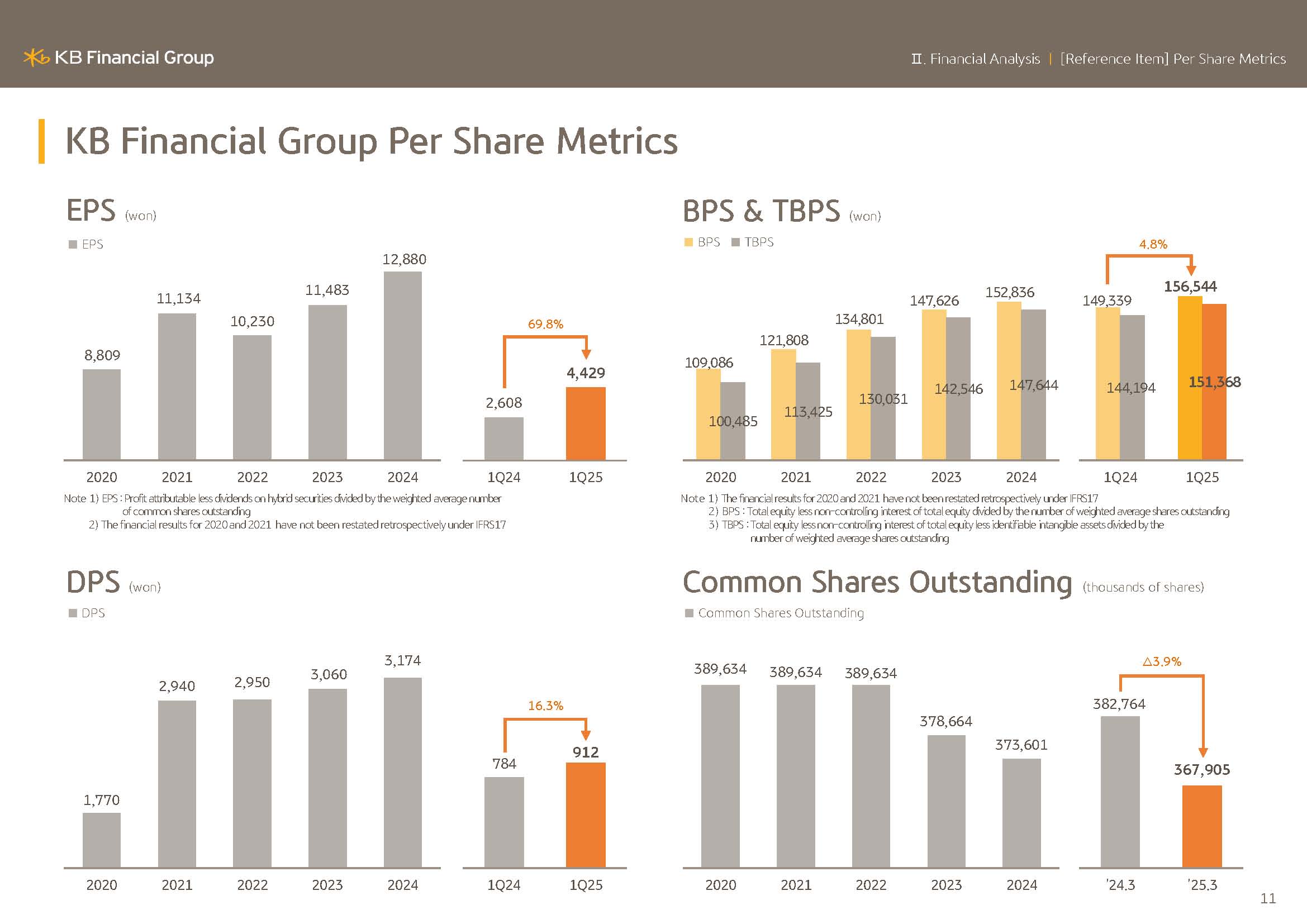

In addition, Q1 net profit posted KRW1.6973 trillion, and group ROE recorded 13.04% and is showing solid performance in all aspects of profitability and capital efficiency.

Going forward,

based on our capital management policy, focusing on CET1 ratio and strong earnings capacity, we'll keep the promise that we made with the market.

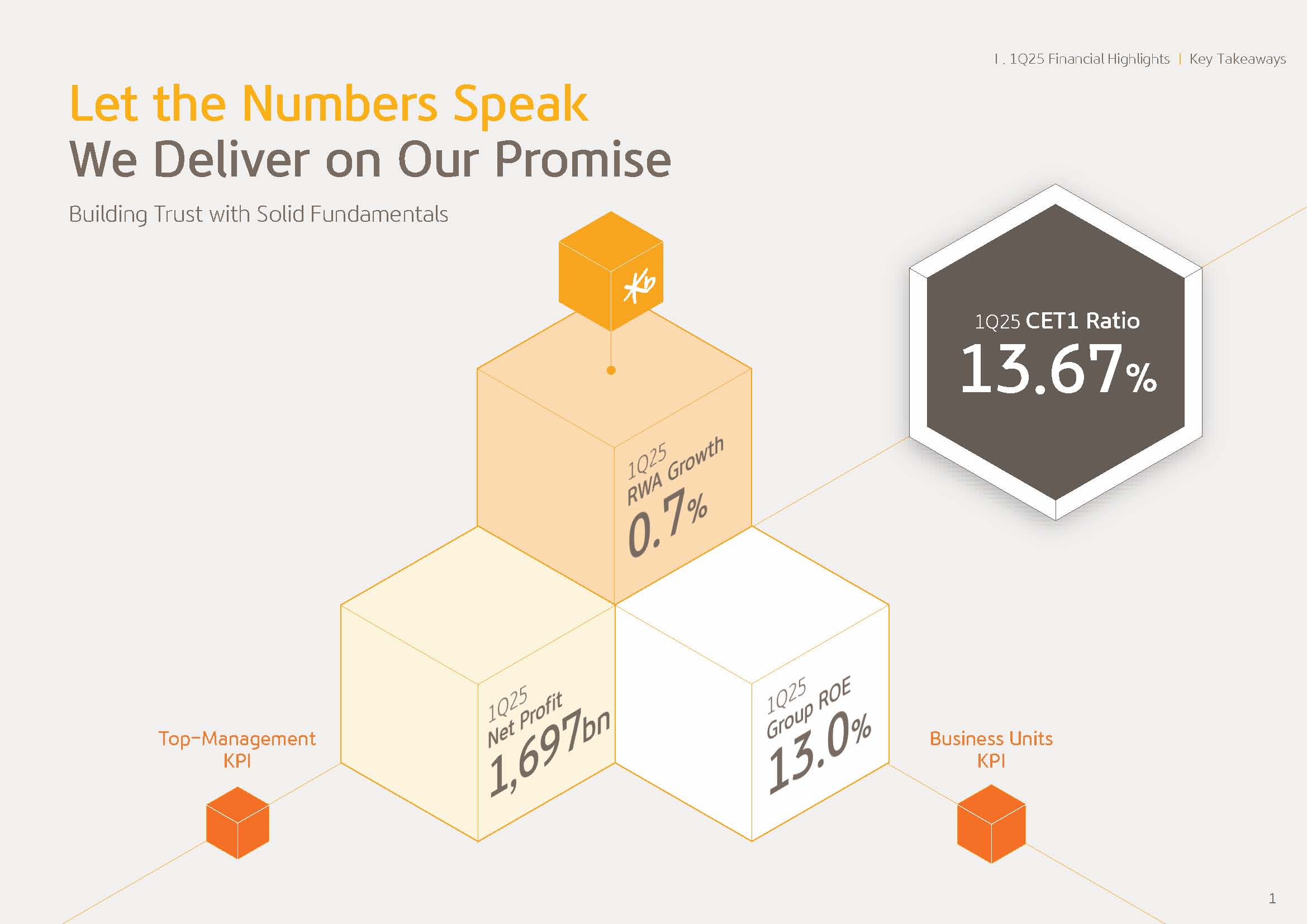

Next is Page 2.

On this page, I will once again explain about our shareholder value enhancement policy that the market is recently mostly interested in. As you are well aware, KBFG in October of last year, focusing on sustainability and predictability announced our shareholder return policy linked to CET1 ratio.

Shareholder return policy linked to CET1 ratio is designed to return more to the shareholders, the higher the CET1 ratio is without any upper limitation to the total shareholder return ratio.

Related to this,

I reiterate once again that our basic principle is to implement shareholder returns first in the first half of the year and then again in the second half of the year In case of this year, capital in excess of last year and 13% CET1 ratio has already been reflected in shareholder returns through methods such as annual cash dividends and Q1 share buyback and cancellation.

In addition, the amount, which corresponds to the capital in excess of the first half and base 13.5% CET1 ratio will be utilized as the shareholder return resources in the second half of the year. Likewise, KBFG has transparently established shareholder return principles and standards and based on strong capital strength is aiming for the industry's highest level shareholder return ratio.

However, due to the domestic and international, political and economic uncertainties, which have been continuing from late last year, the market volatility has expanded more than ever. We believe that in this unprecedented environment, this is the time when fostering market stability and flexible operation of our value of program is needed.

As a part of this, we preemptively utilized KRW400 billion in the first half of the year and decided to enhance shareholder return predictability.

Related to this,

to give a more detailed explanation, today, our BOD made resolutions for KRW912 cash dividend per share and KRW300 billion of share buyback and cancellation. KRW912 per share quarterly cash dividend is a sizable KRW108 increase compared to the previous quarter.

This was a result of our efforts to improve the somewhat low dividend payout ratio relative to our earnings, increasing our total annual dividend amount to KRW335 billion level each quarter and around KRW1.34 trillion level on an annual basis. This is a KRW100 billion increase compared to the KRW1.24 trillion that we planned and announced in February.

In addition to the KRW300 billion share buyback and cancellation, which was resolved today and considering the shareholder return plan regarding the amount in excess of the 13.5% CET1 ratio plan for the second half of the year, we believe that through ongoing continued share buyback throughout the year, we will more flexibly respond to the market volatilities.

With this decision, we expect that the second half shareholder return predictability and annual total shareholder return ratio will proactively expand compared to the past.

Going forward,

we will uphold the previously announced shareholder return policy as a principle. And based on this, we will flexibly adapt to the internal and external market changes in order to enhance our shareholder value.

Next,

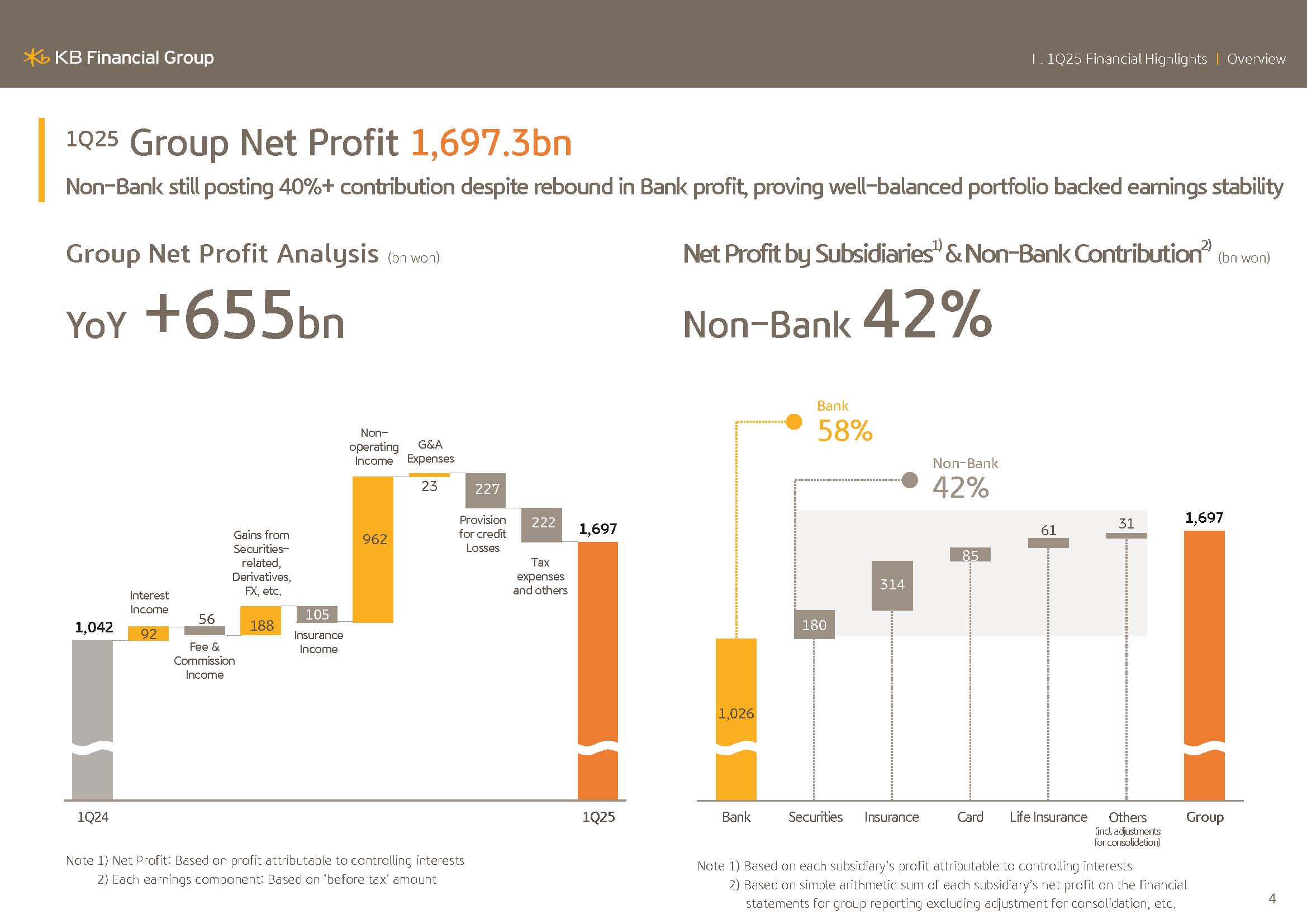

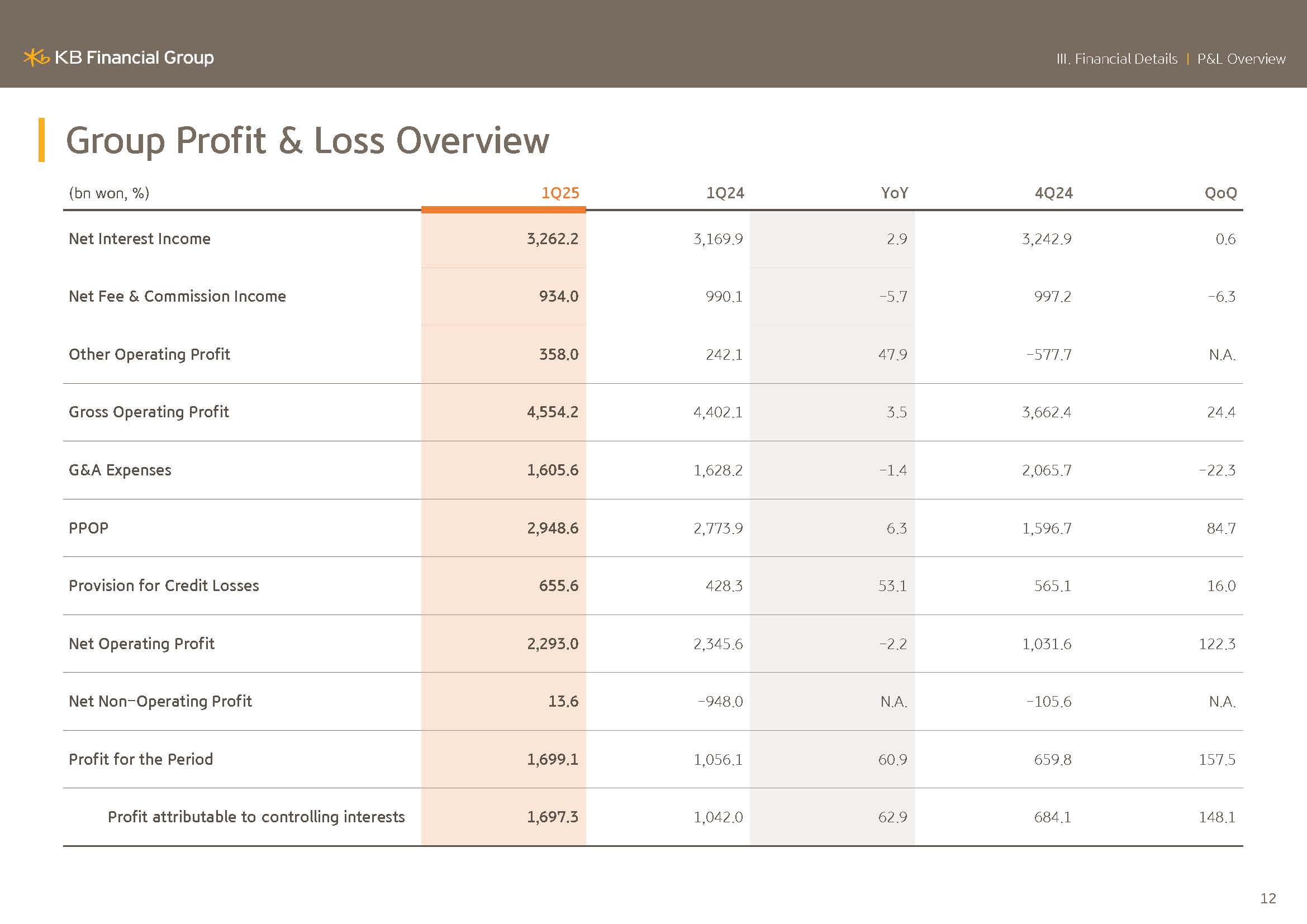

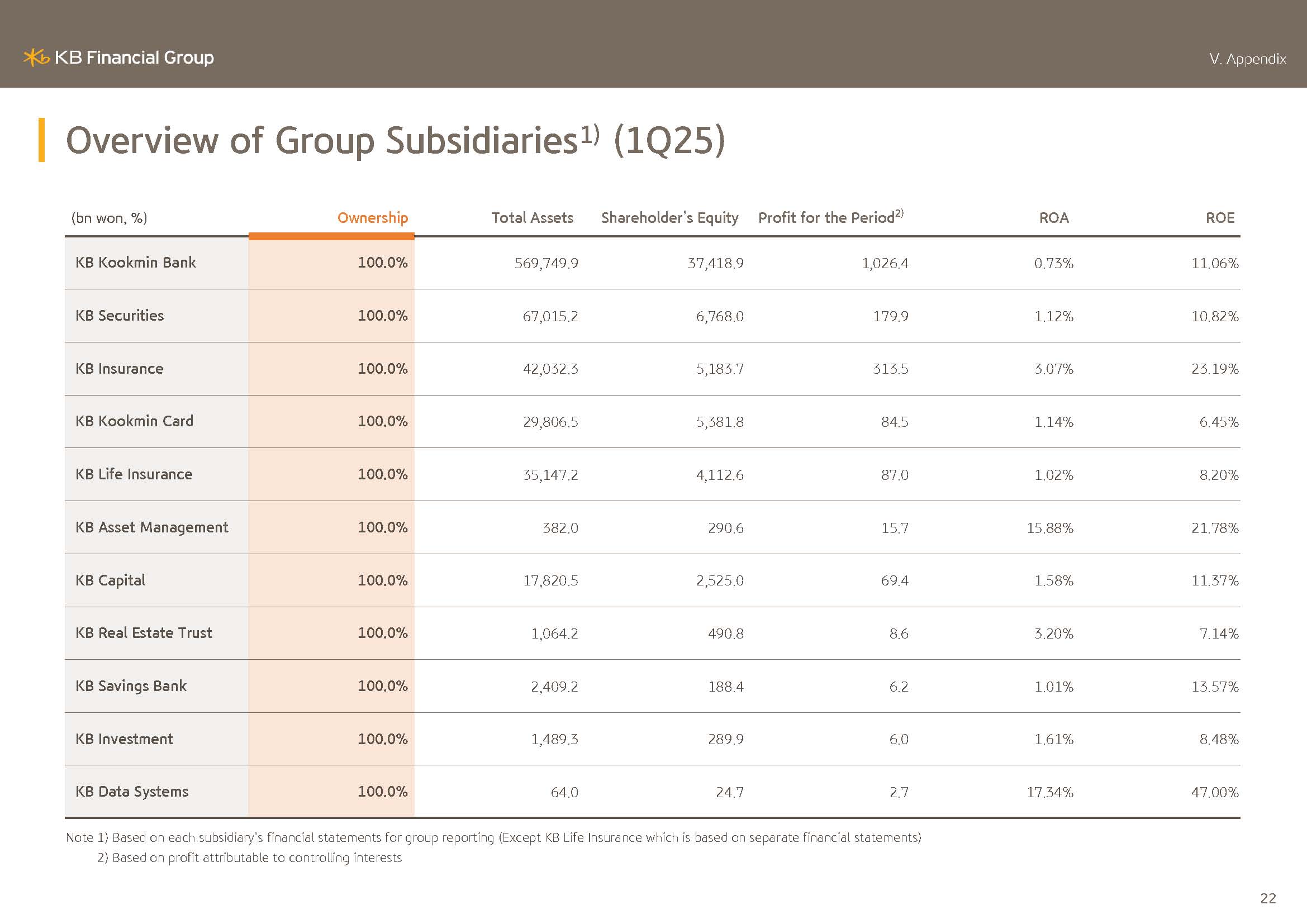

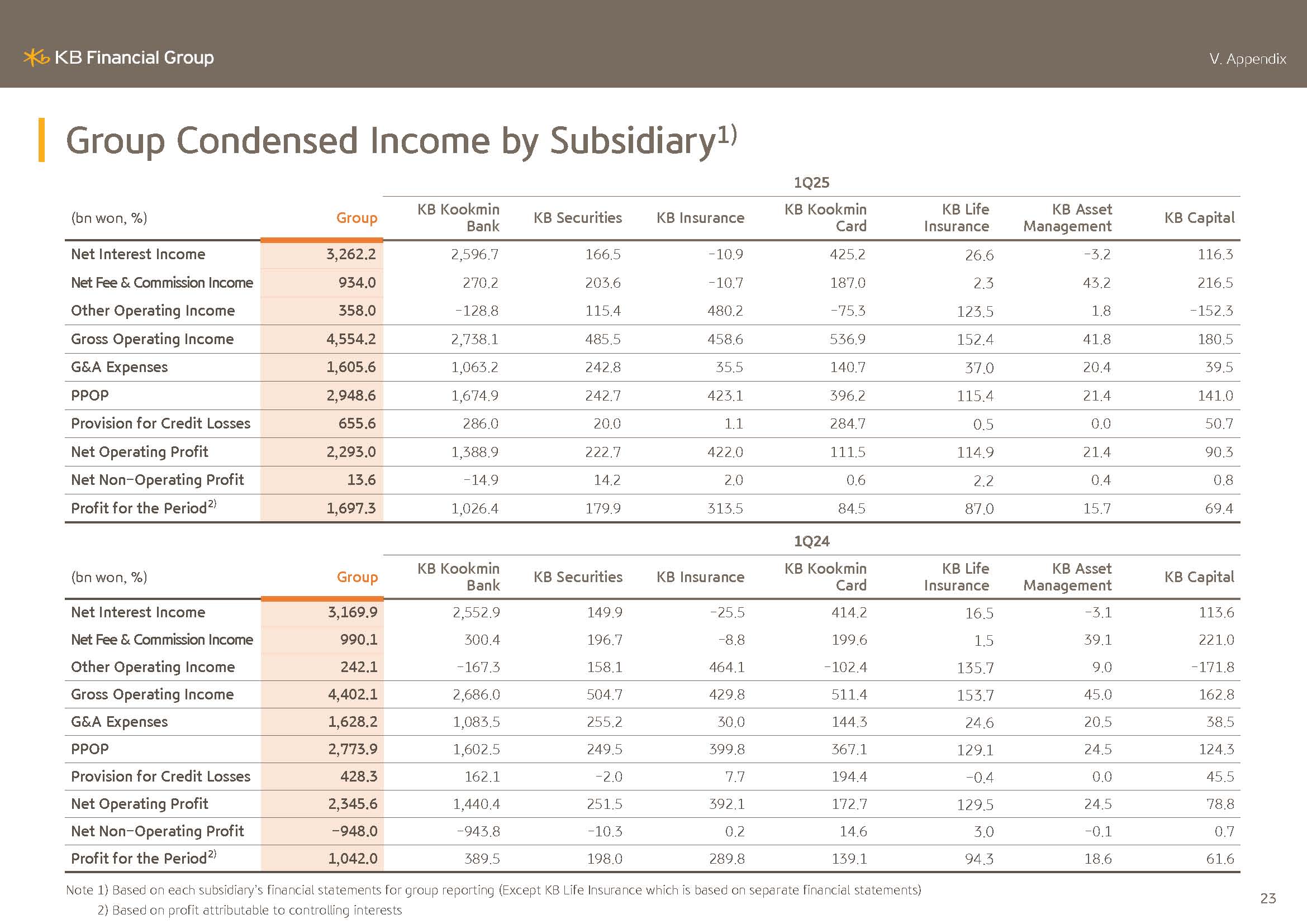

I will elaborate on KBFG financial performance. KBFG 2025 Q1 net profit posted KRW1.6973 trillion. With the fading away of the underlying effect stemming from last year's Q1 provisioning for ELS liabilities, the bank earnings fundamentals recovered in nonbanking subsidiaries' earnings expanded.

In addition with the demonstration of mutually complementary performance between the bank and the nonbank subsidiaries, the contribution from nonbank in the group's earnings increased to 42% and proved once again KB's unique well-balanced portfolio.

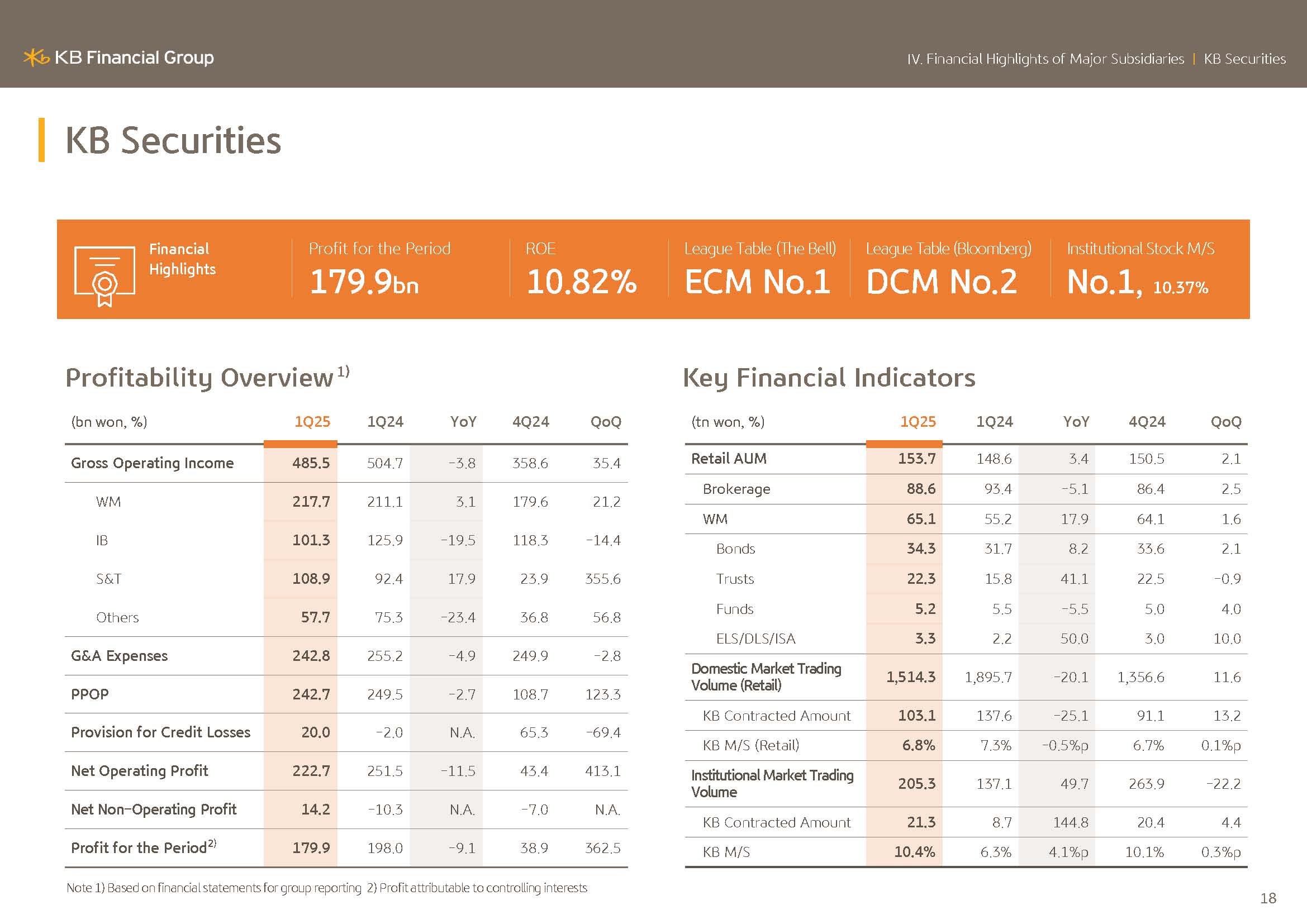

In the case of our major nonbanking subsidiaries, securities and insurance, WM and trading results improved and delivered a solid performance.

Real Estate Trust capital and savings bank that had preemptively provisioned due to concerns in the past over asset quality deterioration have alleviated burden from provisioning.

Meanwhile, the group's top line was further strengthened, thanks to balanced growth across interest and noninterest income, enhancing its overall profitability. As a result, gross operating profit reached a record high of approximately KRW4.6 trillion demonstrating a solid earning power.

Now I will provide a more detailed breakdown of our business performance by segment.

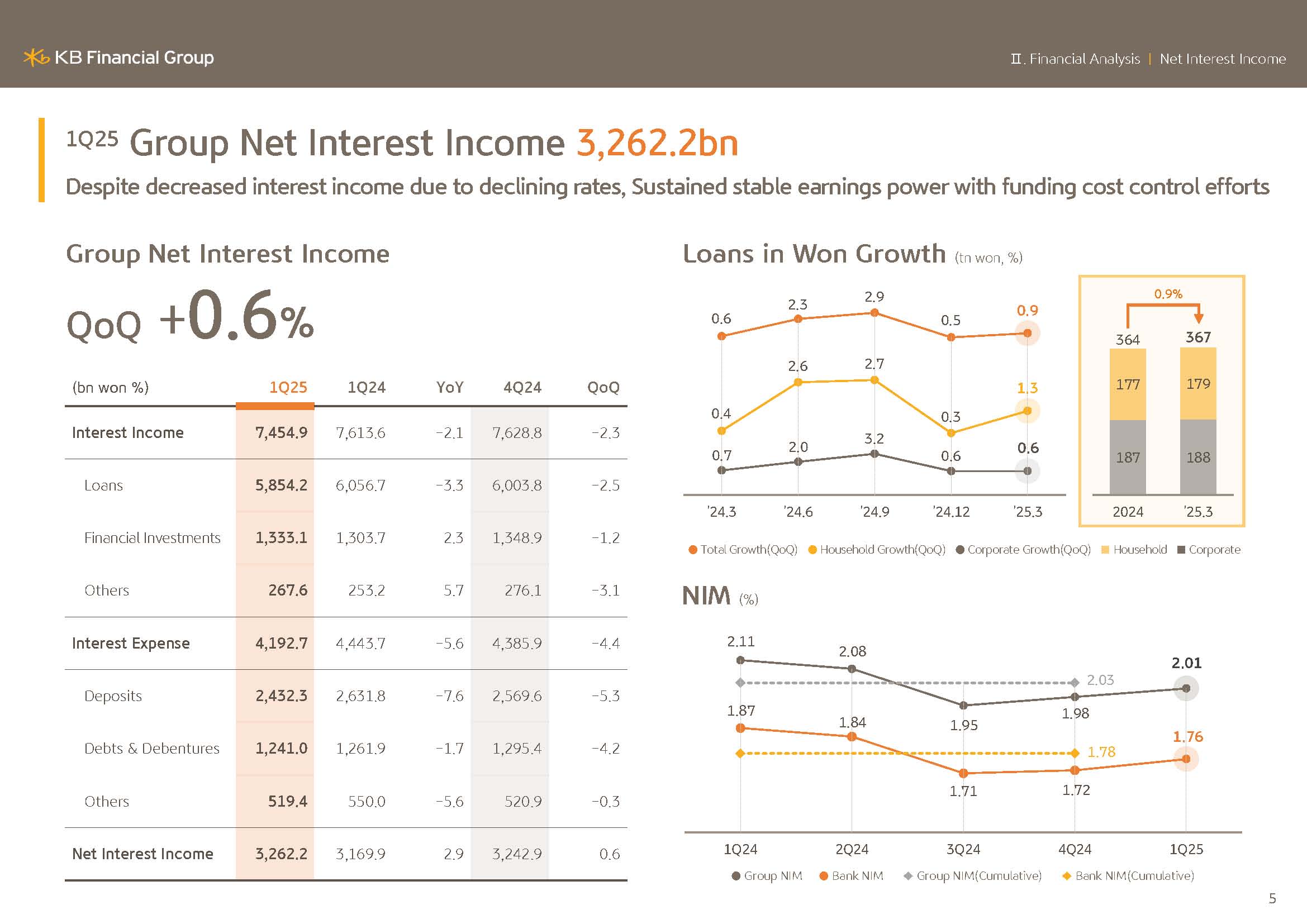

First, the gross net

interest income amounted to KRW3.2622 trillion. Due to the impact of falling market rates, bank interest income, mostly from loans, decreased; however, the inflow of core deposits from market liquidity funds increased. And as a result, net interest income remained at a level similar to the previous quarter.

Next,

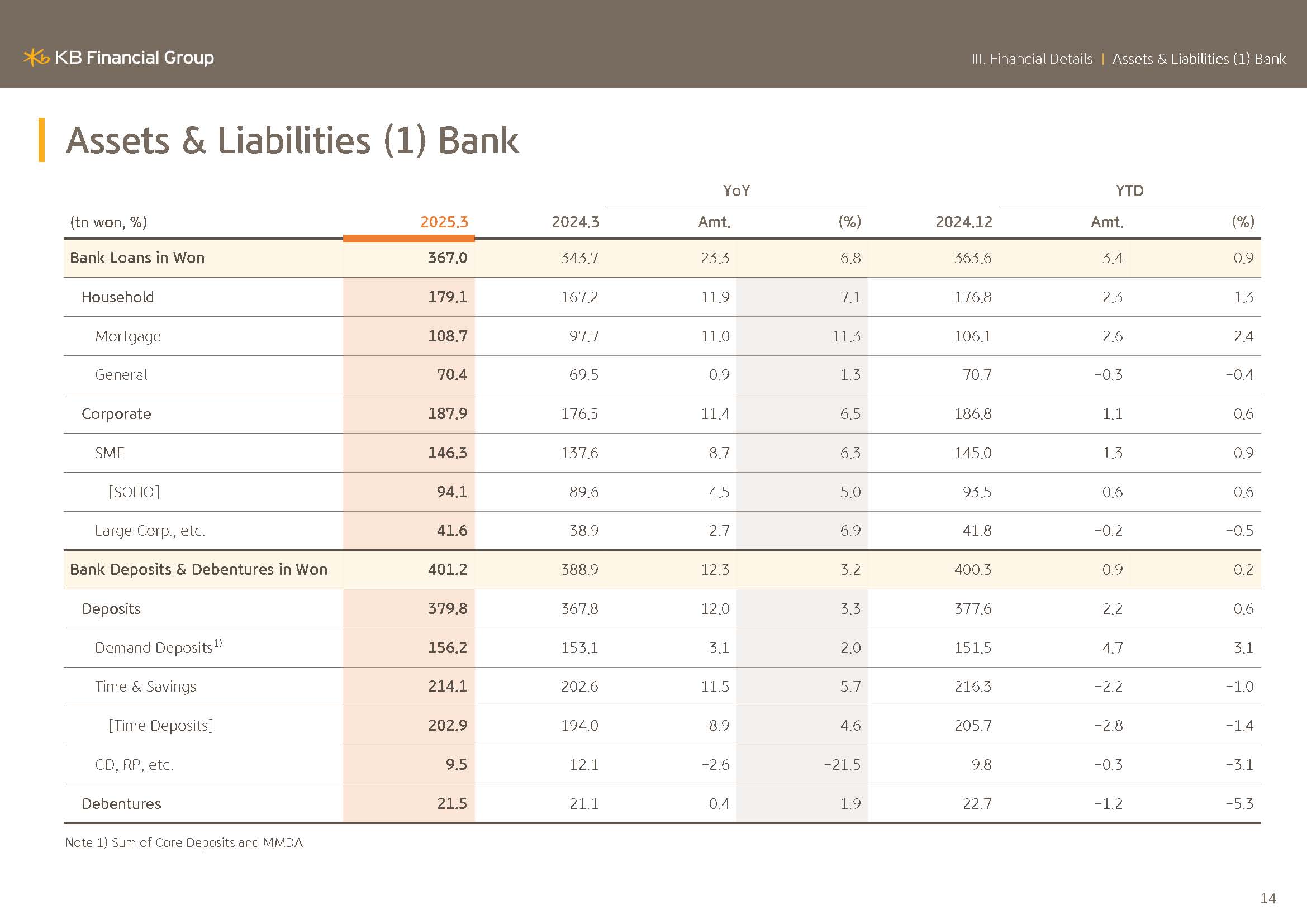

on the banks of Korean won loans. As of the end of March 2025, the bank's total Korean won-denominated loans amounted to KRW357 trillion, up slightly YTD.

Household loans stood

at KRW179 trillion, growing by 1.3% YTD, mainly driven by group loans. Corporate loans amounted to KRW188 trillion, with loans to high-quality SMEs and SOHO growing approximately KRW1 trillion YTD, driving the overall increase in corporate loans.

We plan to continue to maintain a growth strategy that is focused on comprehensive profitability while managing risk-weighted assets in consideration of the economic situation and the household debt levels.

Next,

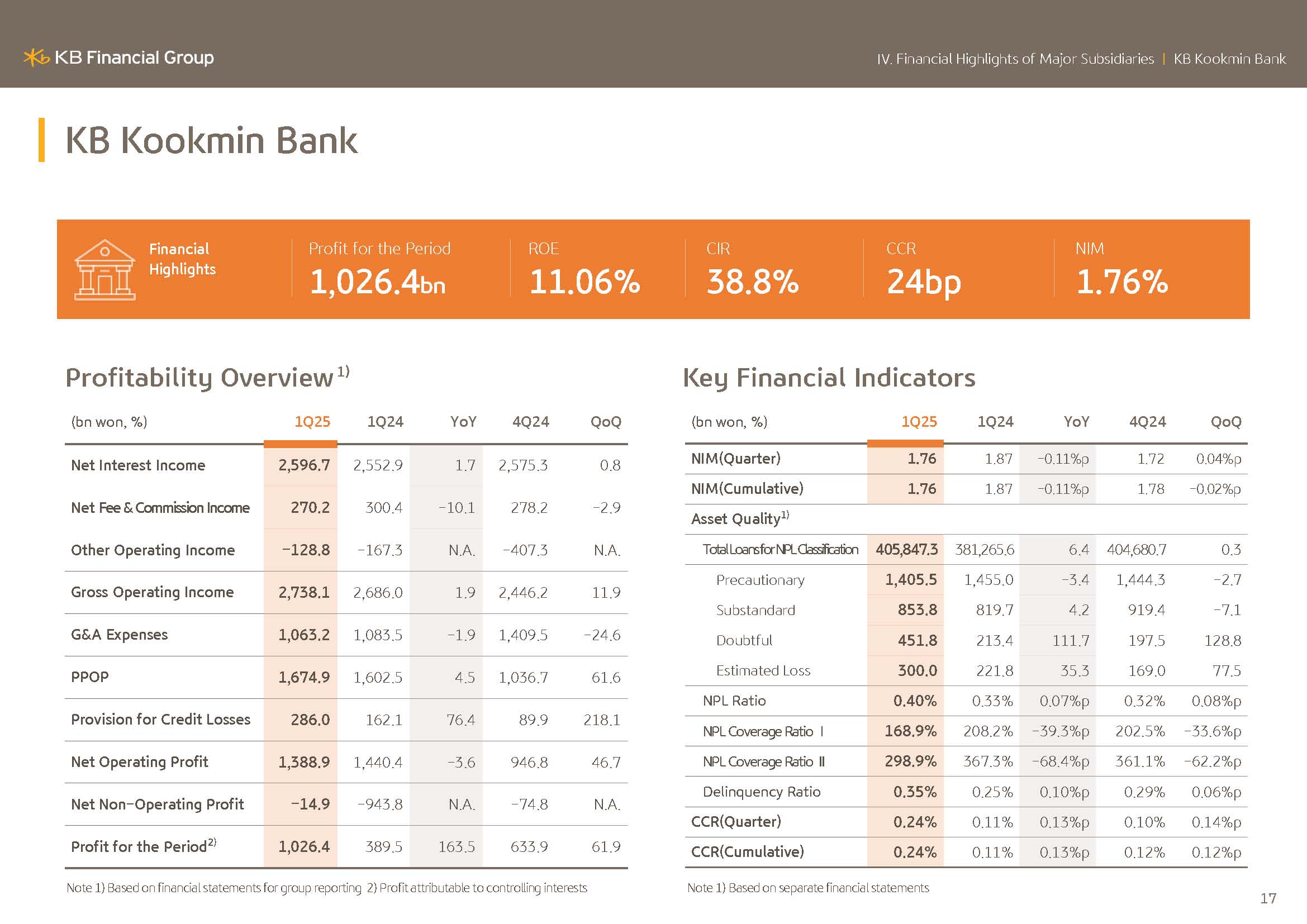

on the net interest margin in the bottom right section. In the first quarter, the group and the bank's NIM stood at 2.01% and 1.76%, respectively, showing an increase of 3 bps and 4 bps, respectively, Q-o-Q.

For the bank's NIM, while the decline in loan yields continued due to asset repricing from falling interest rates, the NIM increased by 4 bps Q-o-Q, thanks to efforts in cost reduction based on ALM management, such as increase in core deposits and repricing of high interest time deposits.

Next,

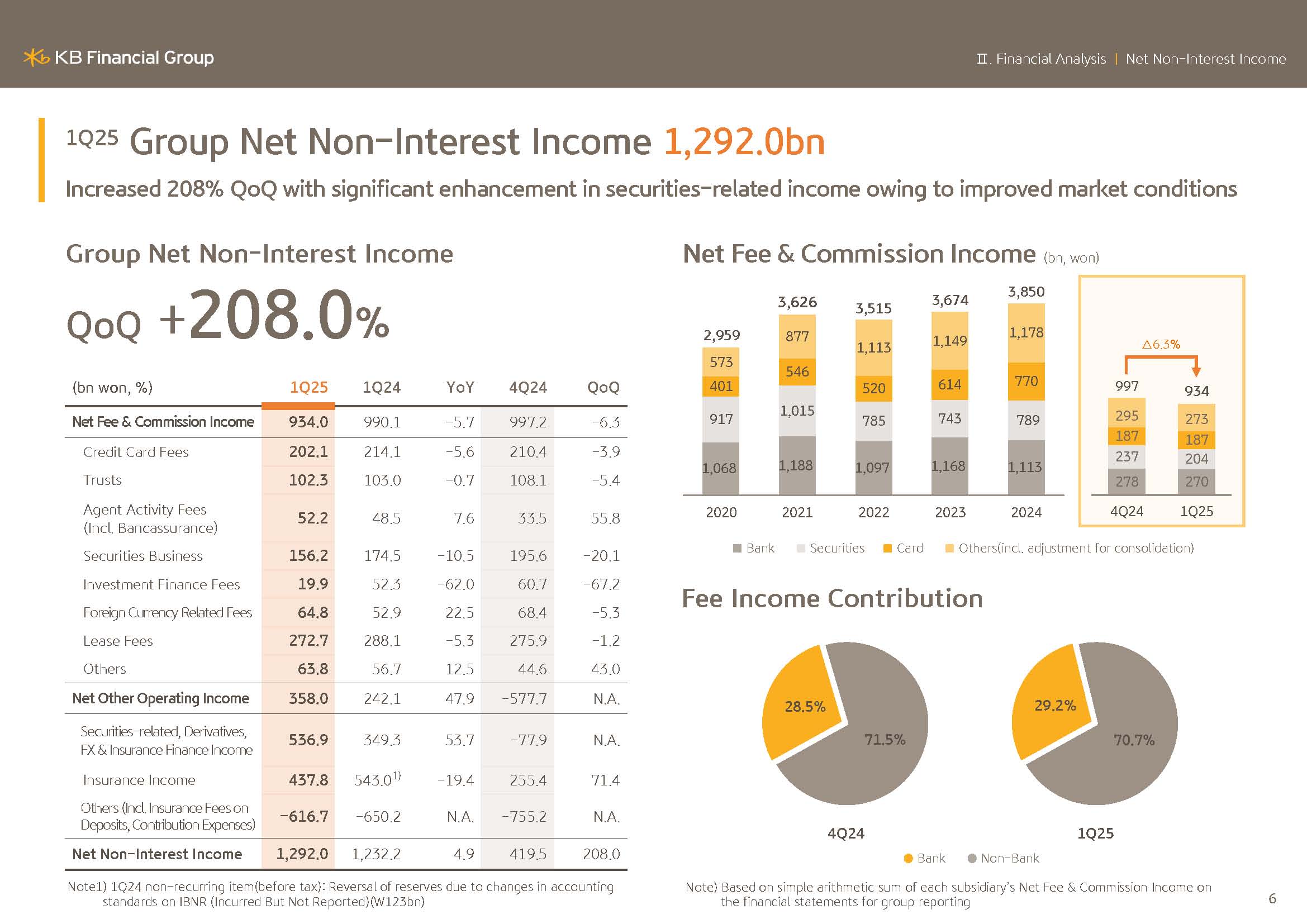

moving on to non-interest income.

In the first quarter, the group's noninterest income amounted to KRW1.292 trillion, improving both on a Q-o-Q and a Y-o-Y basis. This was largely due to significant improvements in securities related performance as a decline in market rates, including government bonds continued.

As a result, other operating income increased KRW115.9 billion Y-o-Y. Additionally, the first quarter's net fee income reached approximately KRW934 billion, although it was down slightly Y-o-Y due to adjustments in card merchant fees and delays in the recovery of real estate PF fees.

Since 2023, we have maintained an earnings fundamental of over KRW900 billion each quarter.

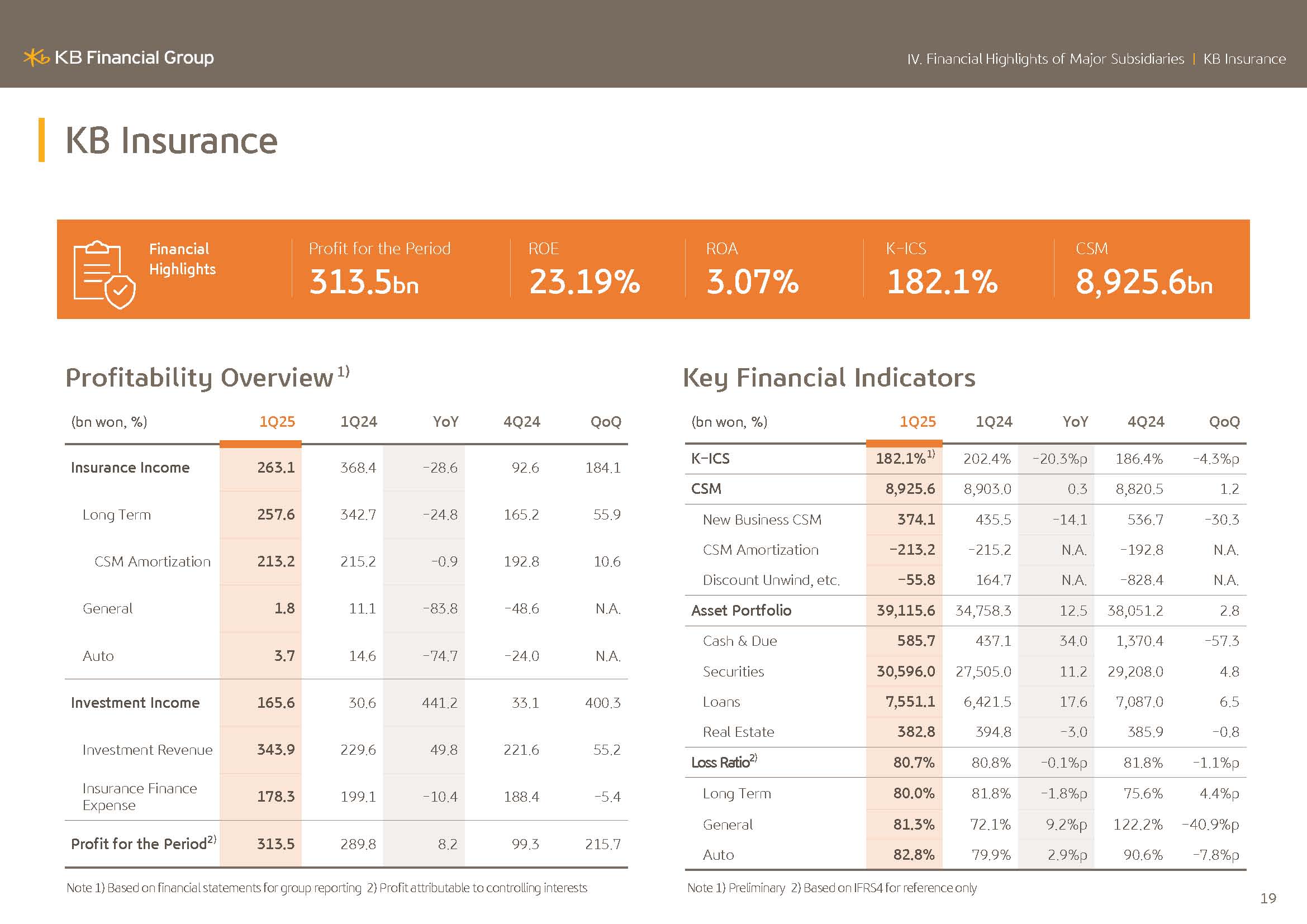

On the other hand, insurance operating profits amounted to KRW437.8 billion, down slightly Y-o-Y. However, excluding base effects such as the write-back of IBNR reserves and non-life insurance during the fourth quarter of last year, there was a modest increase on a recurring basis.

While some challenges are expected this year, including adjustments to the optimal assumptions and the realization of insurance liability discount rates, we plan to sustain stable earnings through improvements in insurance profitability based on CSM growth, and expansion of investment returns.

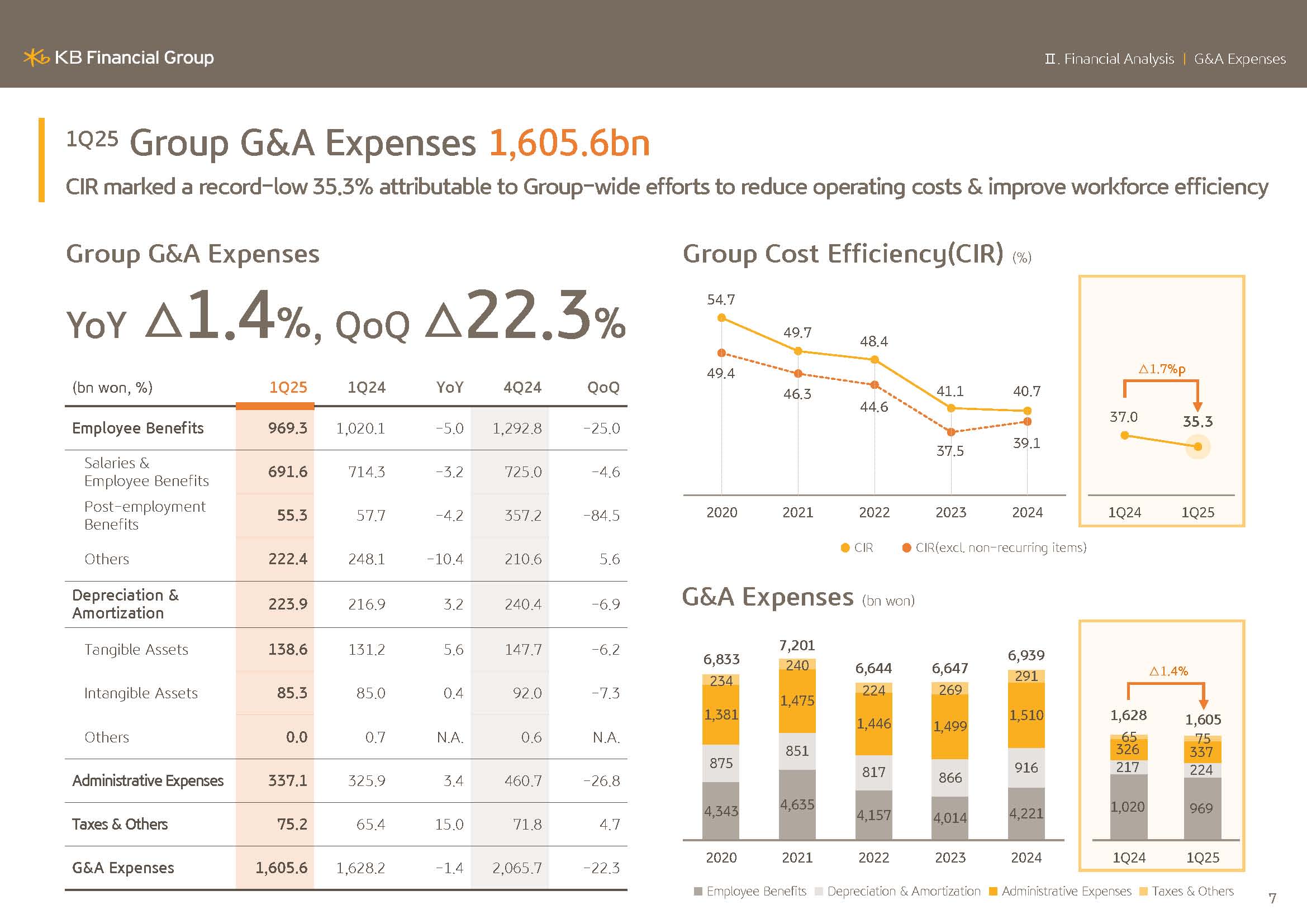

Next, I'll go on to general and administrative expenses.

In the first quarter, G&A were kept at stable KRW1.6056 trillion, down 1.4% Y-o-Y, thanks to efforts to rationalize costs mainly in recurring expenses. Additionally, the group CIR reached a record low of 35.3% reflecting a strong top line growth in efforts to optimize the workforce and cost structure as such. There is a clear improvement in cost efficiency. Looking ahead, we expect a downward stabilizing trend of the group CIR to continue, driven by ongoing cost efficiency efforts at the group level.

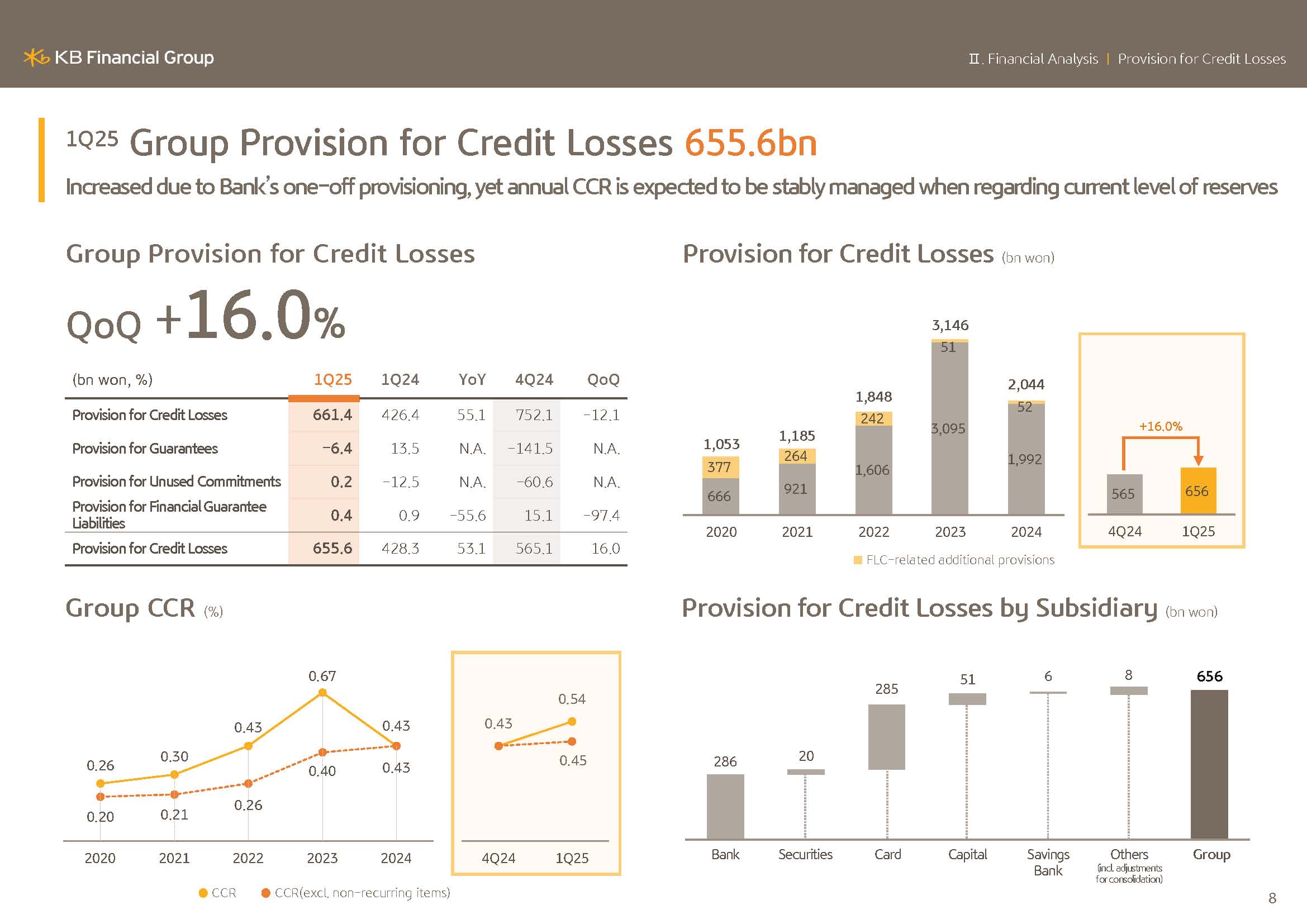

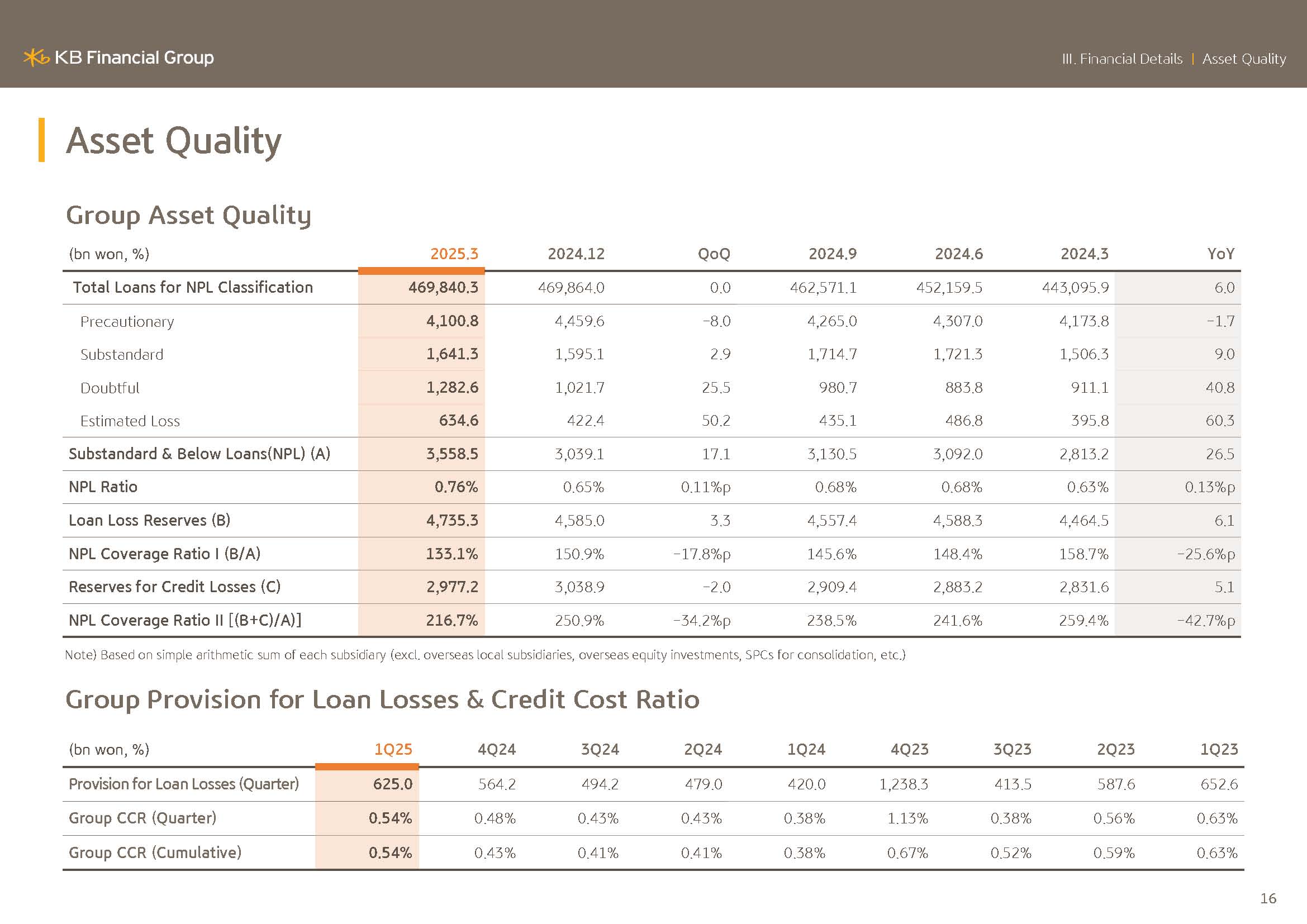

On Page 8, we have the group's provisions for credit losses.

On the first quarter, a provision for credit loss amounted to KRW655.6 billion, with the group's credit cost standing at 54 bps up slightly Q-o-Q. However, excluding one-off factors from the bank, the recurring level of the group's credit cost is 45 bps and is still being managed at a predictable level.

Going forward,

we will continue to strengthen our management to potential nonperforming exposures and maintain a conservative risk management stance to ensure asset quality. For your reference, considering the current level of provisions, market interest rates and the macroeconomic environment, we expect the group's annual credit costs for 2025 to be a manageable mid-40 bps level.

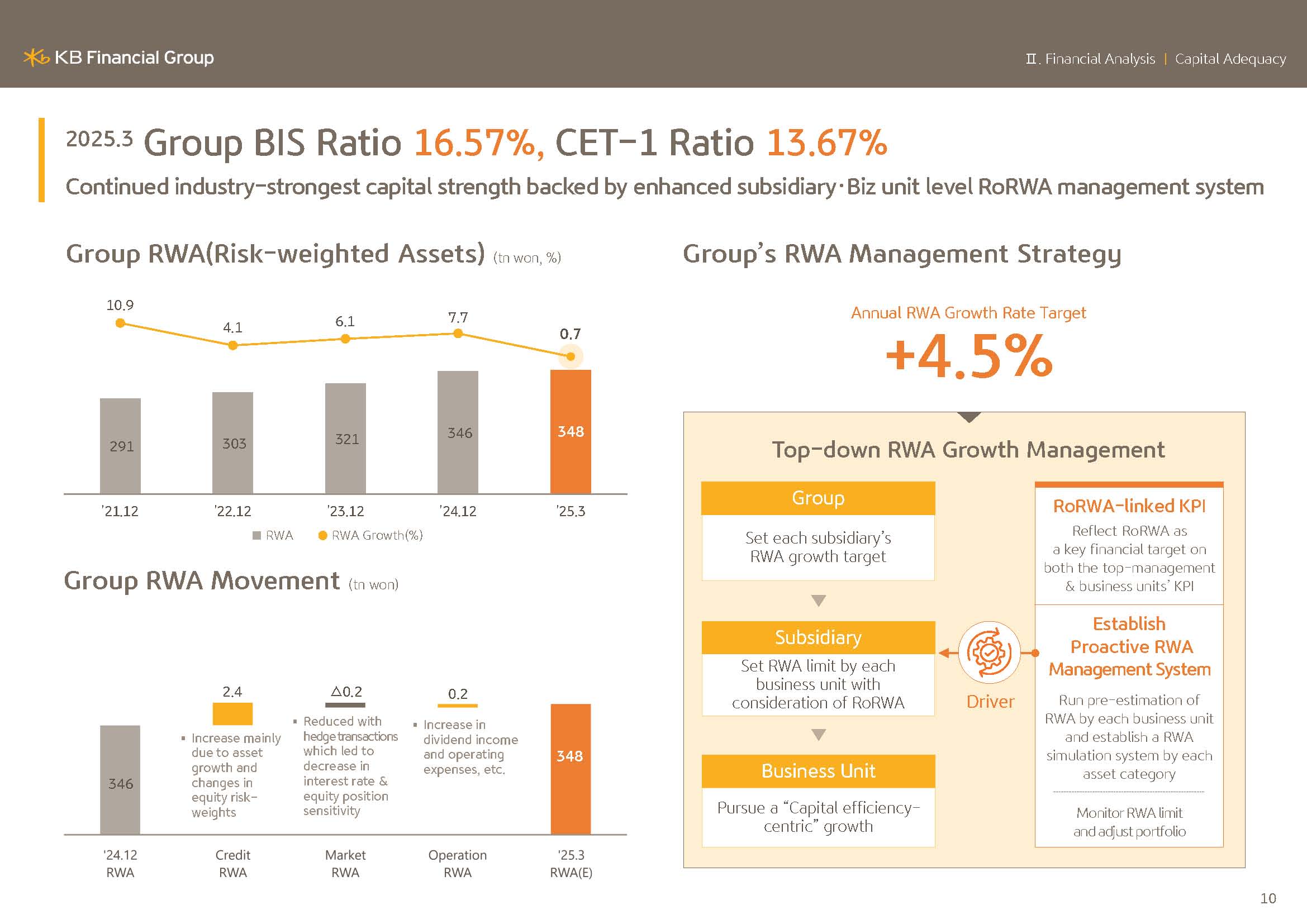

Finally, let me discuss the group's capital ratio.

As mentioned earlier, thanks to the group's efforts in managing risk-weighted assets and a solid increase in net income, the group's [tentative] BIS ratio as of the end of March 2025 was 16.57% and the CET1 ratio was 13.67%.

Now please refer to the next page.

This year, our target for the annual growth rate of risk-weighted asset is 4.5%. And to achieve this, the group is strengthening its RoRWA management system for each subsidiary and business segment and is making every effort to achieve efficient asset growth from a comprehensive profitability perspective.

At the same time, one of our management strategies for achieving a stable capital ratio is not solely focused on unconditionally reducing the growth rate of risk-weighted assets. Rather, the risk-weighted assets are also the customer base of KB Financial Group and are assets that guarantee our sustainable strength.

We believe that the most important goal is to generate appropriate returns for the asset through efficient capital allocation while ensuring stable growth. From the next page onwards, you will find detailed materials related to the performance that I've just explained, so please refer to them at your leisure.

With that, let me conclude the KB Financial Group's Q1 2025 management performance report.

Thank you very much for your attention.