-

2017 1Q Business Results Presentation

Greetings and Summary

Greetings. I am Peter Kwon, IR manager of KBFG. We will now begin 2017 Q1 business results presentation of KBFG. We express our deepest gratitude to all participants. We have here with us our Group CFO, Lee Jae Keun; as well as group executives. First, our CFO, Lee Jae Keun, will give a presentation on 2017 Q1 business results, and then we will have a Q&A session.

Now I will invite our CFO to deliver presentation on Q1 earnings release.

Good afternoon. I am Lee Jae Keun, CFO of KB Financial Group. Before going into Q1 2017 earnings results, let me present on the overall business highlights. In Q1, despite a bit of a slowdown in loan growth led by household loans, driven by aggressive NIM improvements and core marketing with newly launched KB Securities, core income displayed sound growth. Thanks to a series of ERP and corporate-wide cost controls, G&A was kept at a sound level, with overall asset quality and credit cost within the expected stable range.

Also, last Friday, as you know, the BOD resolved to conduct tender offerings and share swap for acquisition of outstanding shares in KB Insurance and KB Capital. Once this process is complete under an accountable management of the majority shareholder, both companies' business activities will become more efficient, which we expect will lead to better group-level profitability and synergies across subsidiaries.

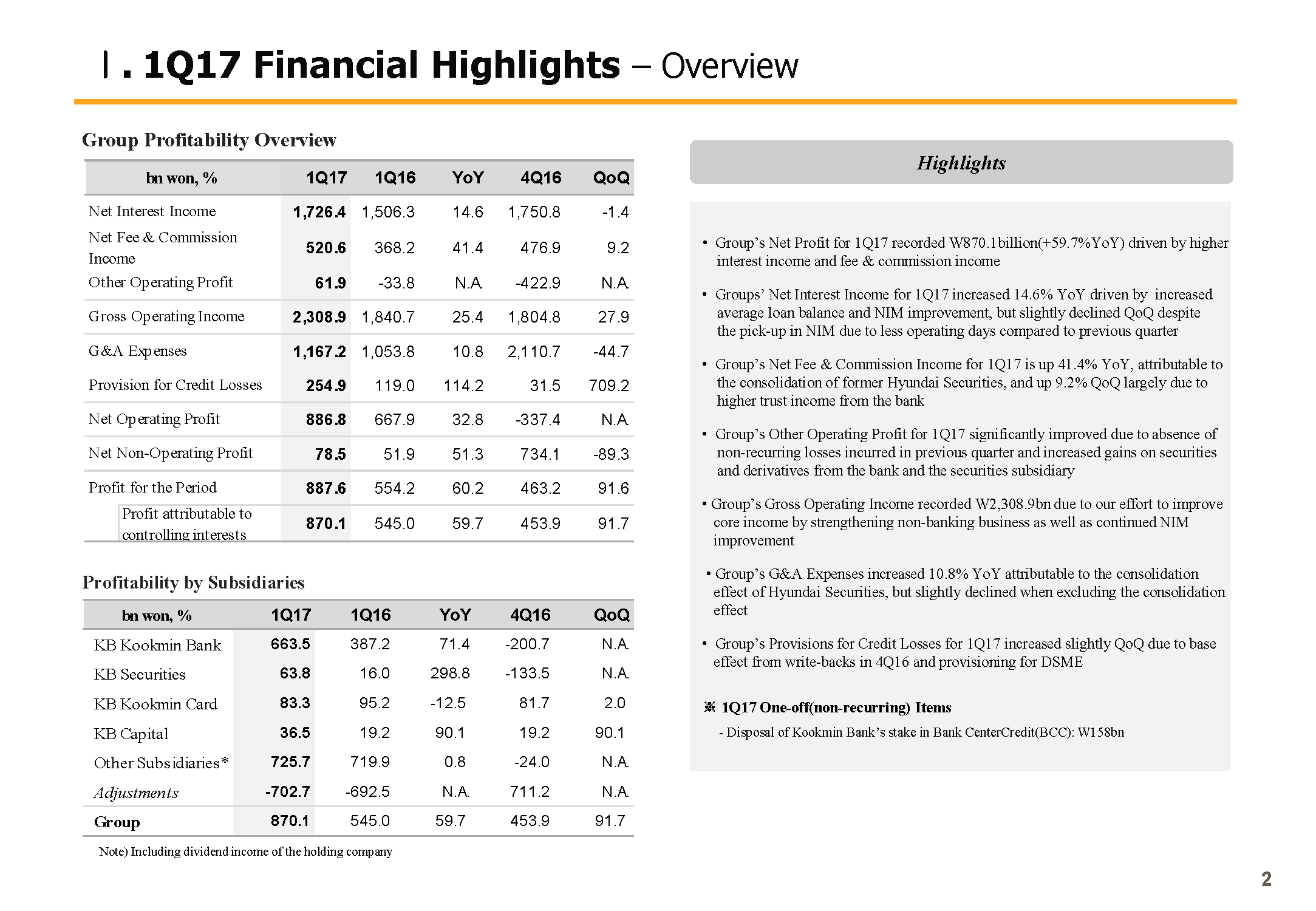

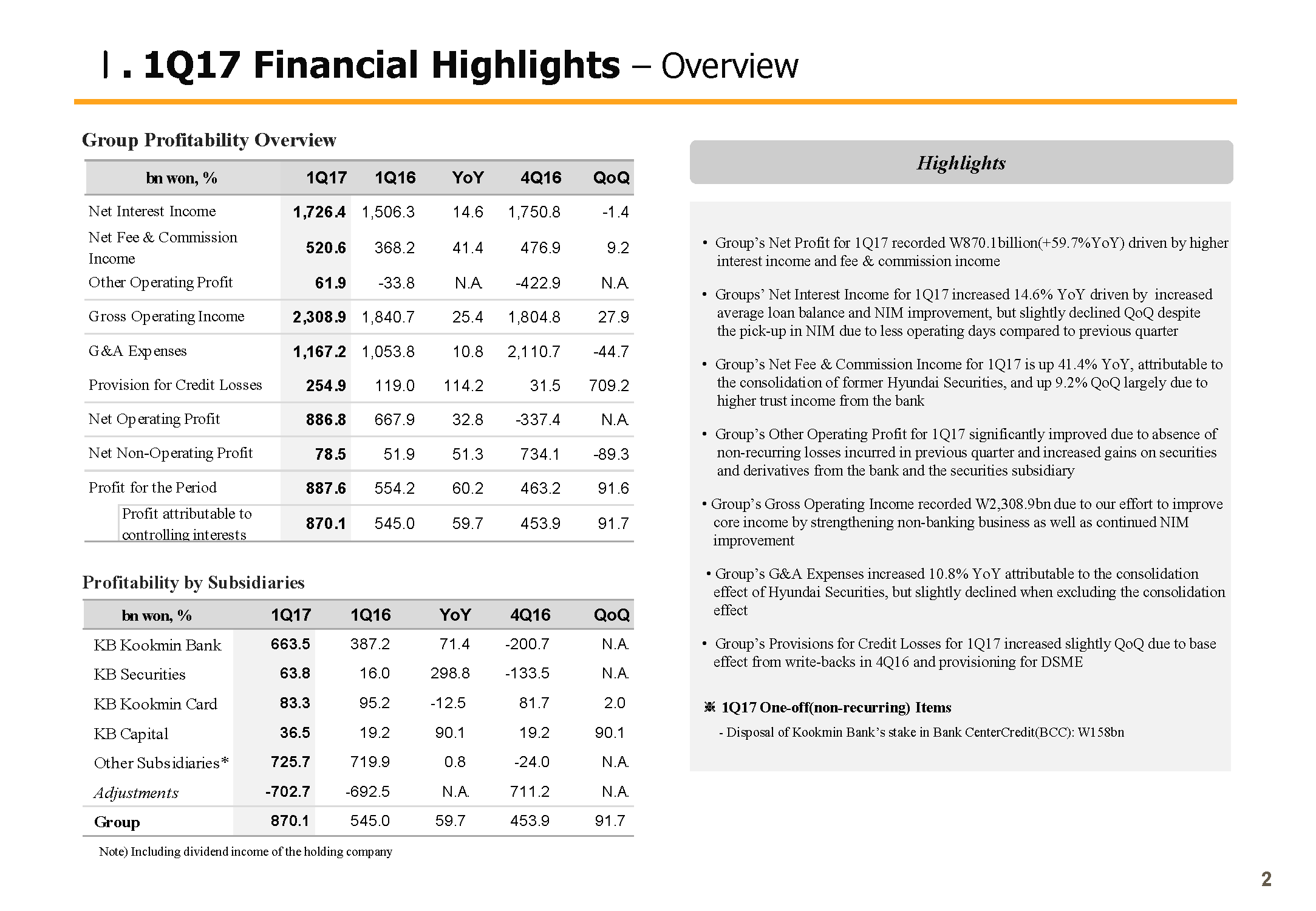

(2p) 1Q17 Highlights

With that, let me move on to Q1 2017 earnings results. Please refer to Page 2. KB Financial Group's Q1 2017 net profit was KRW 870.1 billion. This is 59.7% higher year-over-year, driven by growth in net interest income on the back of NIM improvement and growth in fees and commissions income from the consolidation effect of Hyundai Securities. On a quarter-over-quarter basis, the increase was 91.7%. There was significant improvement in noninterest income, driven by fees and commissions and other operating income. G&A also normalized, and in Q1, there was one-off factor from BCC sales, all leading to higher performance than market expectation.

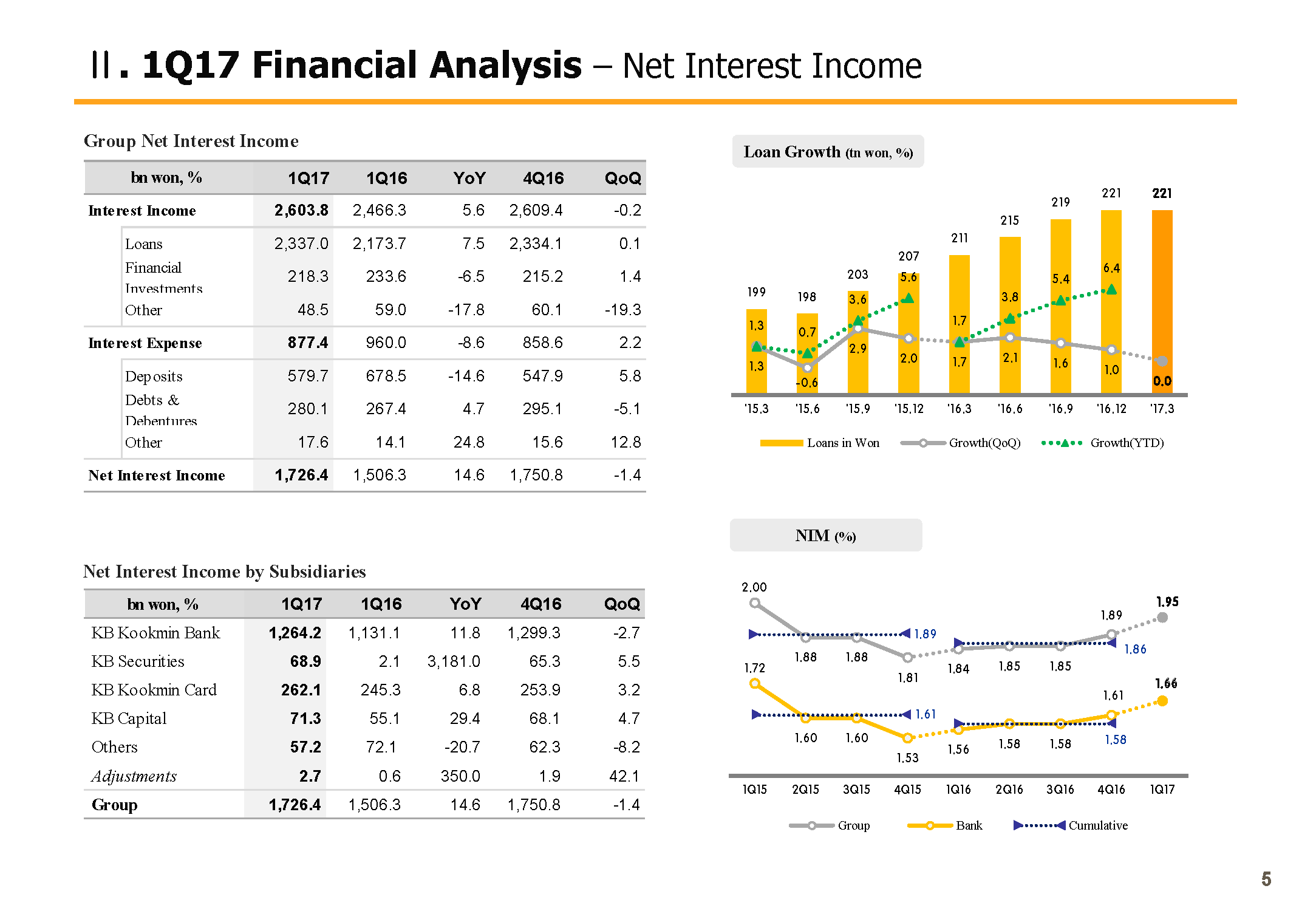

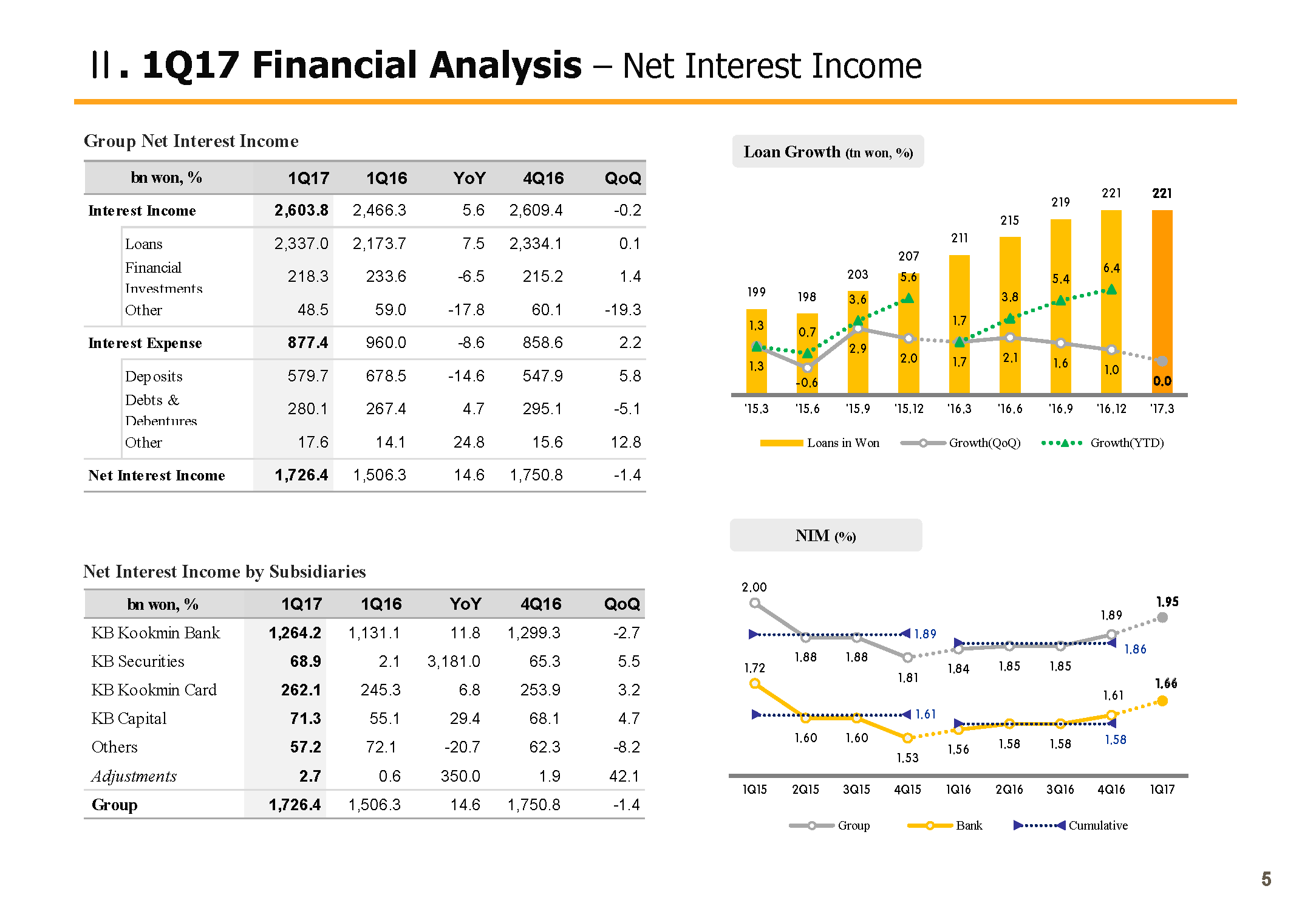

Looking at the line item, Q1 net interest income was KRW 1,726.4 billion. Underpinned by asset growth and better margin, the growth was 14.6% year-over-year. On a Q-on-Q basis, despite NIM growth, net interest income fell 1.4%. The reason for the decline is higher interest expense for the principal preservation trust from fluctuations in market rate and its overall slow asset growth and less absolute number of days.

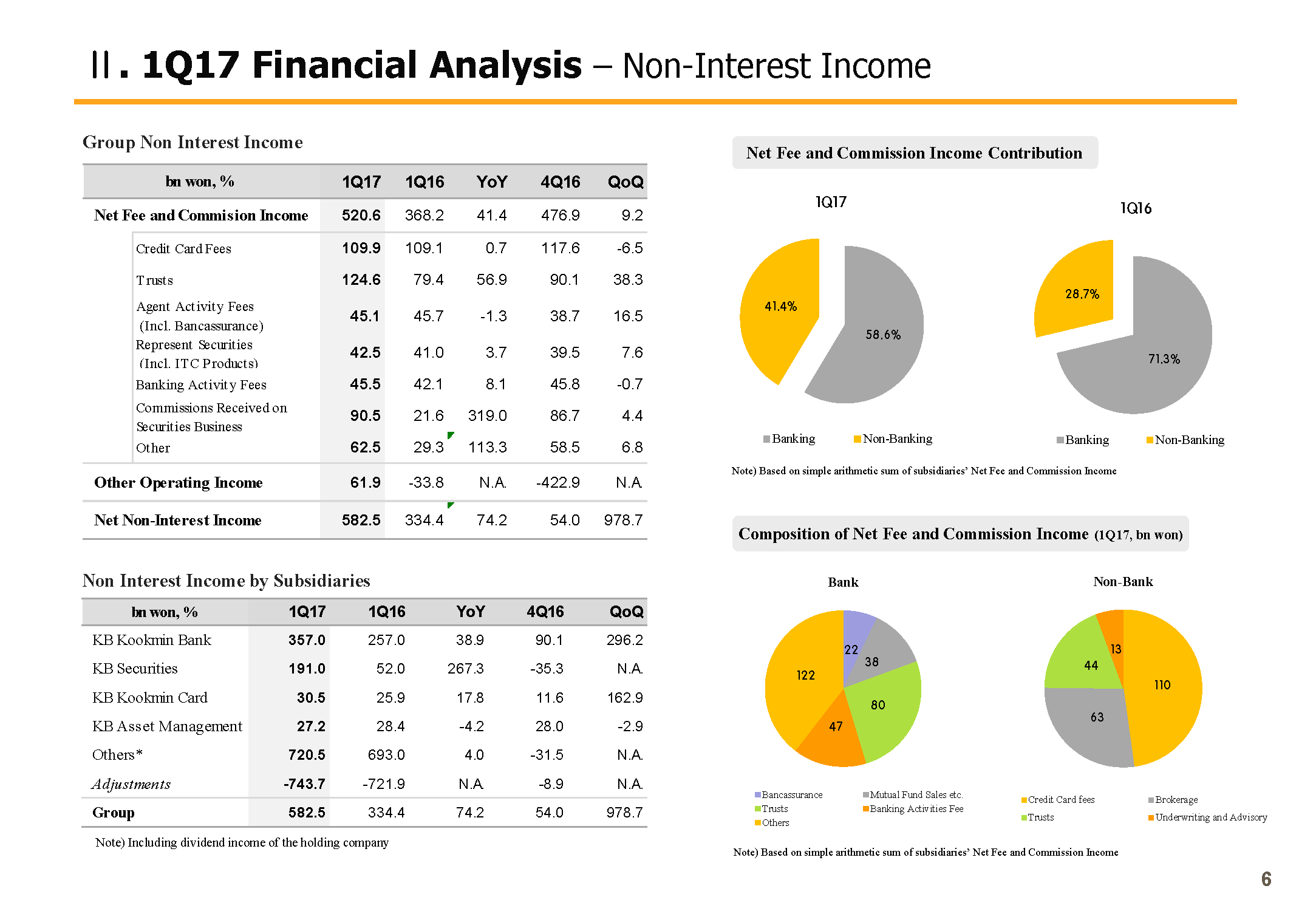

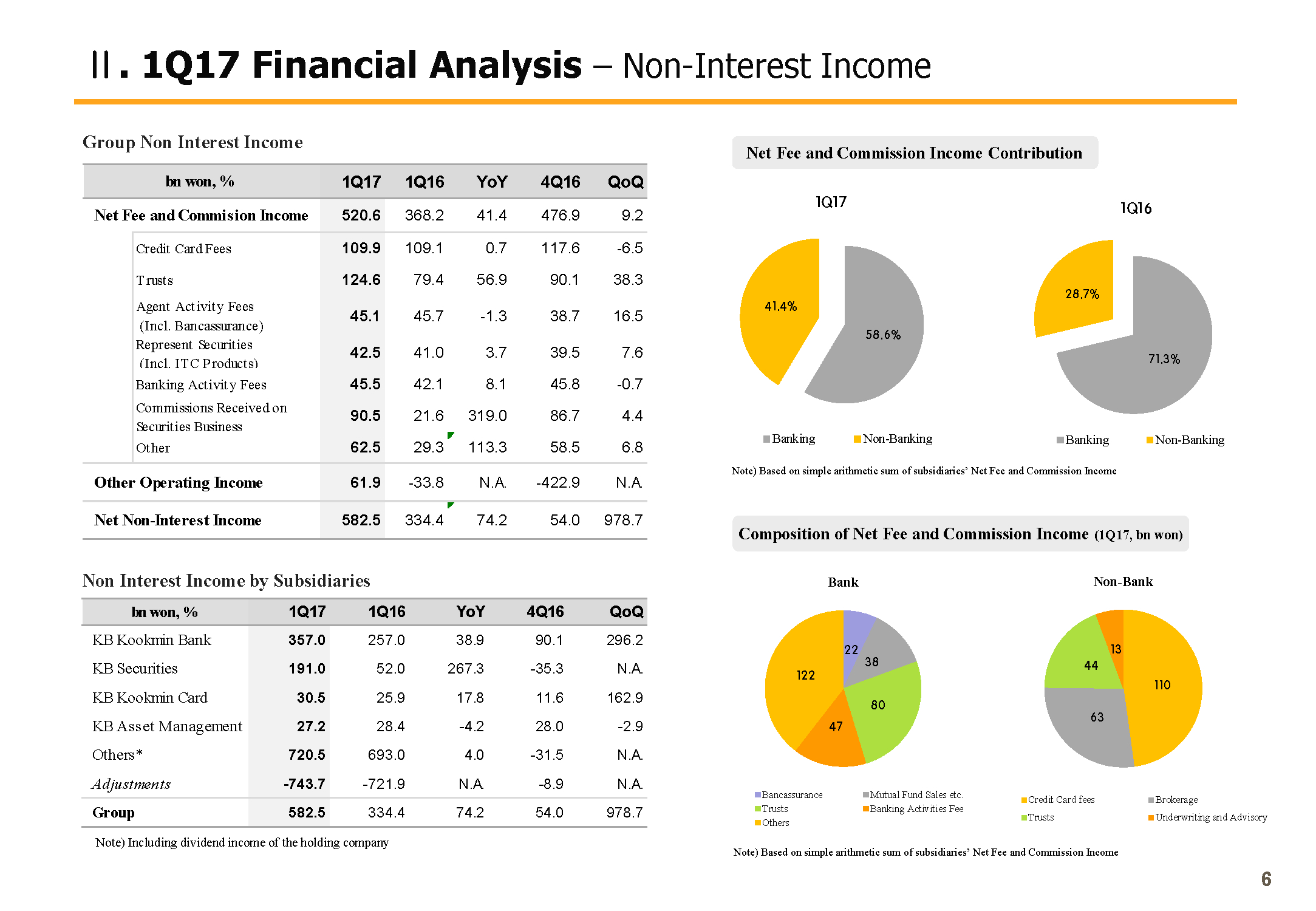

Q1 net fees and commissions income was KRW 520.6 billion, up 41.4% year-over-year on consolidation effect of Hyundai Securities among others. On a Q-on-Q basis, the growth was 9.2%, mostly on higher ELS sales from the bank, which led to higher trust fees, as well as overall improvement in fees and commissions from fund, Bancassurance and brokerage services.

Q1 other operating profit was KRW 61.9 billion, improving significantly year-over-year and Q-on-Q, especially due to one-off factors. There was sizable loss last quarter, but we've seen significant improvement this quarter. There was dissipation of one-off loss factors such as integration cost for valuation model for derivatives and higher gains related to securities. And with lower FX rate, there was increase in gains from derivatives for the bank and the securities subsidiaries.

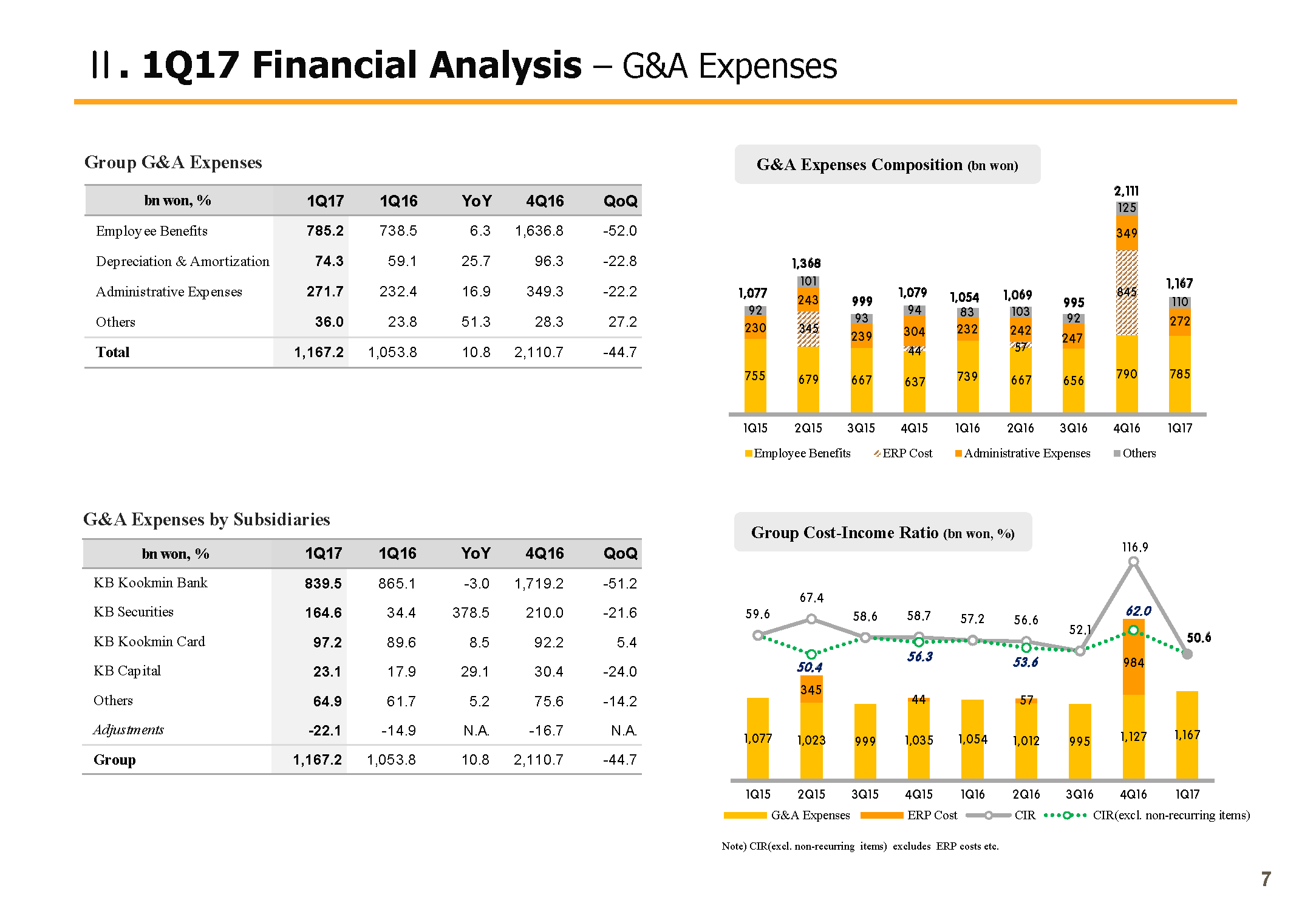

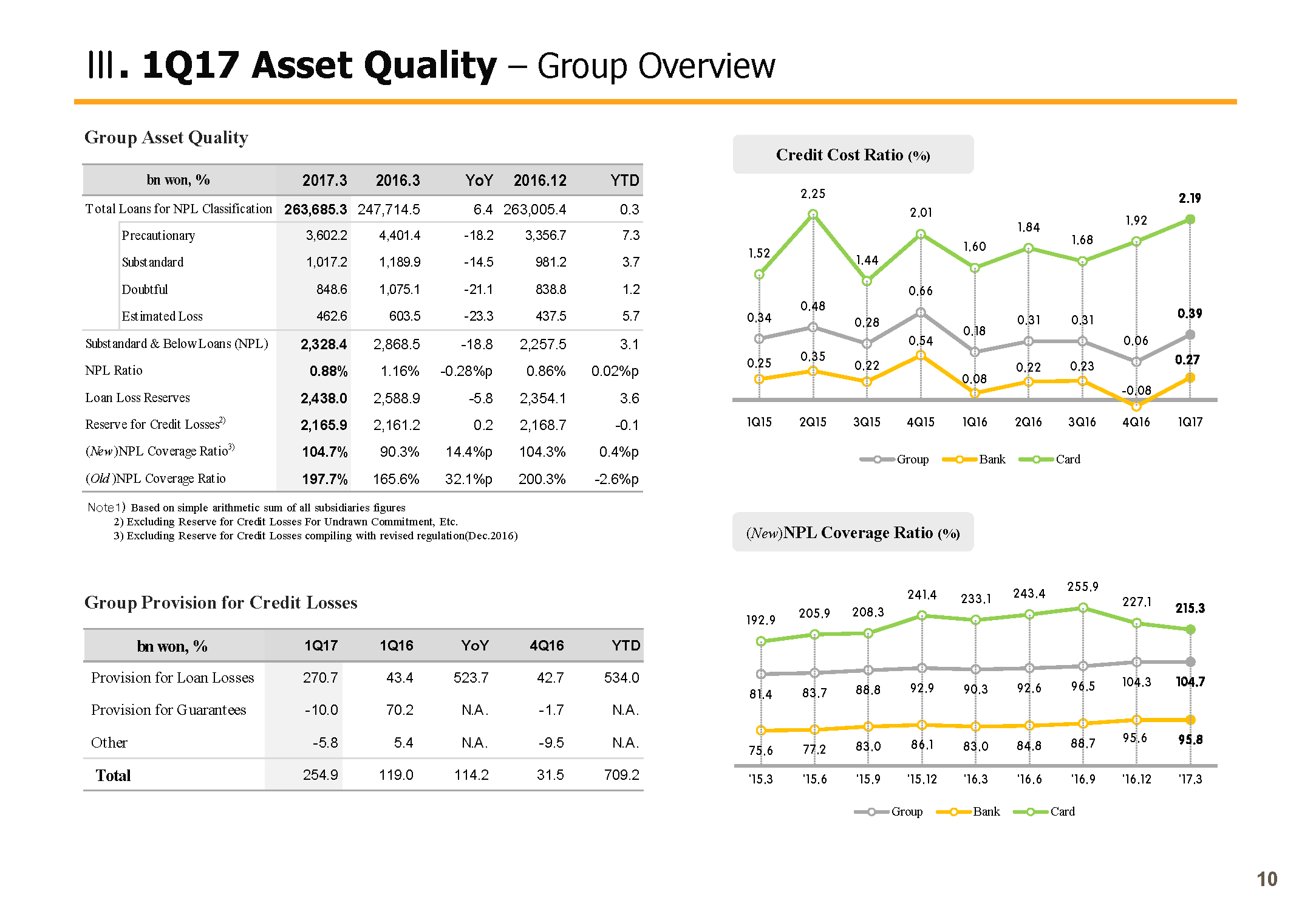

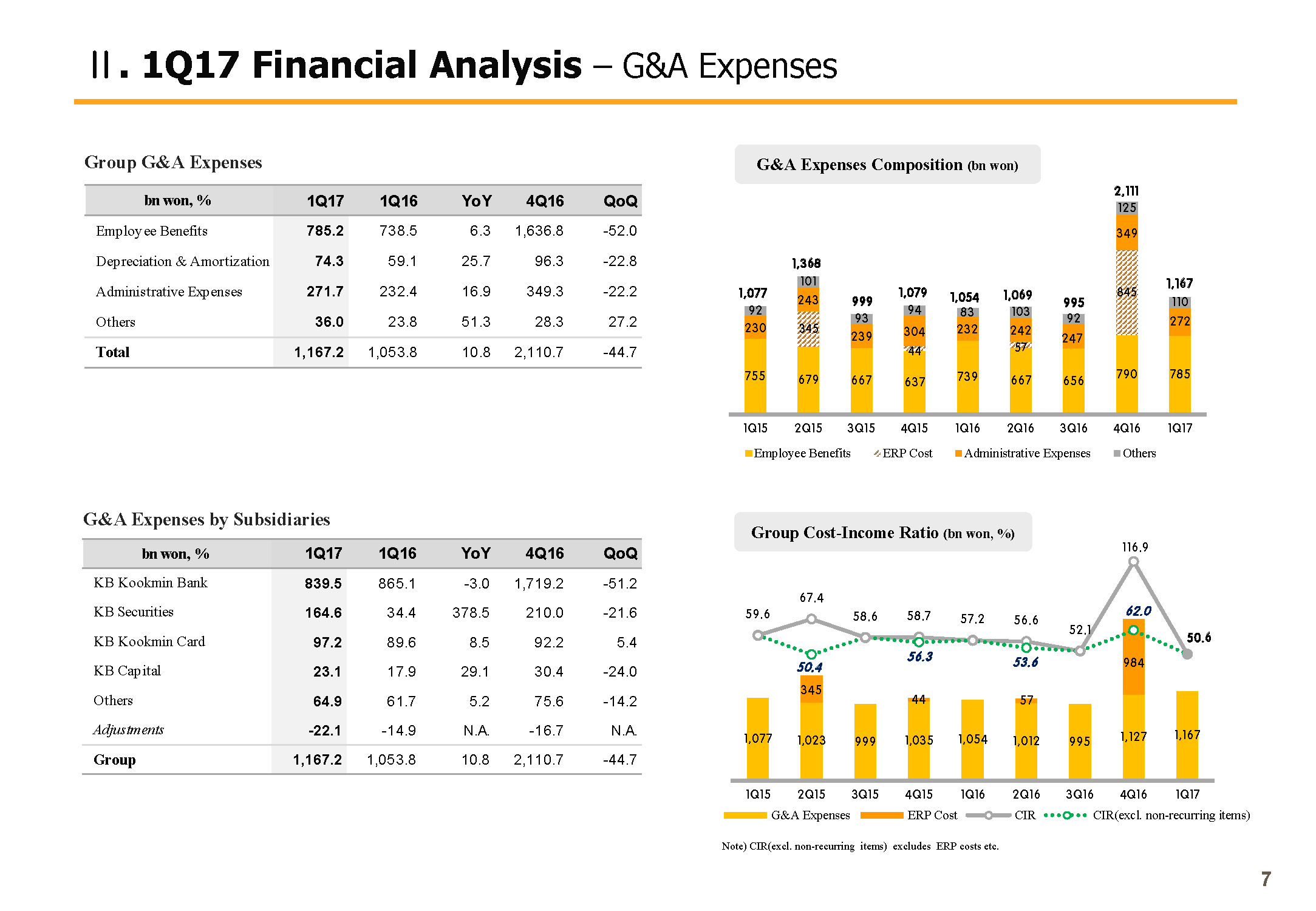

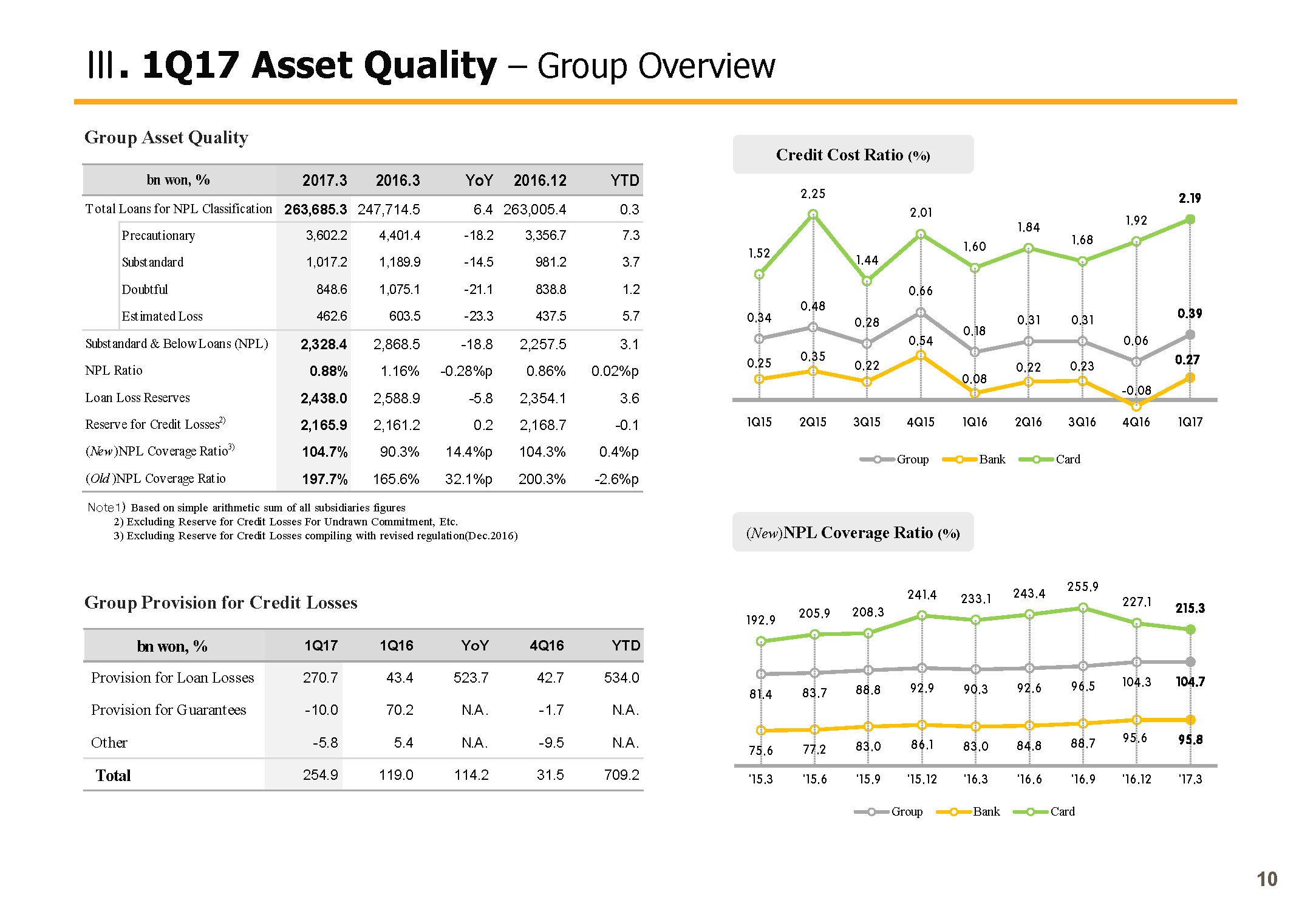

Q1 G&A was KRW 1,167.2 billion, up 10.8% year-over-year due to consolidation effects of Hyundai Securities. But with this factor excluded, there was decline driven by labor cost savings from ERP. Q1 CIR, thanks to even growth in interest and noninterest items, gross operating income recovered above KRW 2 trillion level. And with good control over G&A, cost income ratio came in at 50.6%. Q1 PCL provisioning was KRW 254.9 billion, somewhat of an increase compared to previous year, where there was a sizable reversal from accounting standard changes as well as compared to the previous quarter when there were write-backs for certain companies, which pushed down the PCL level significantly. One factor to note for Q1 is provisioning of mid-KRW 60 billion in relation to DSME.

Nonoperating income recorded KRW 78.5 billion in Q1. It declined from the previous quarter when gain from bargain purchase took place.

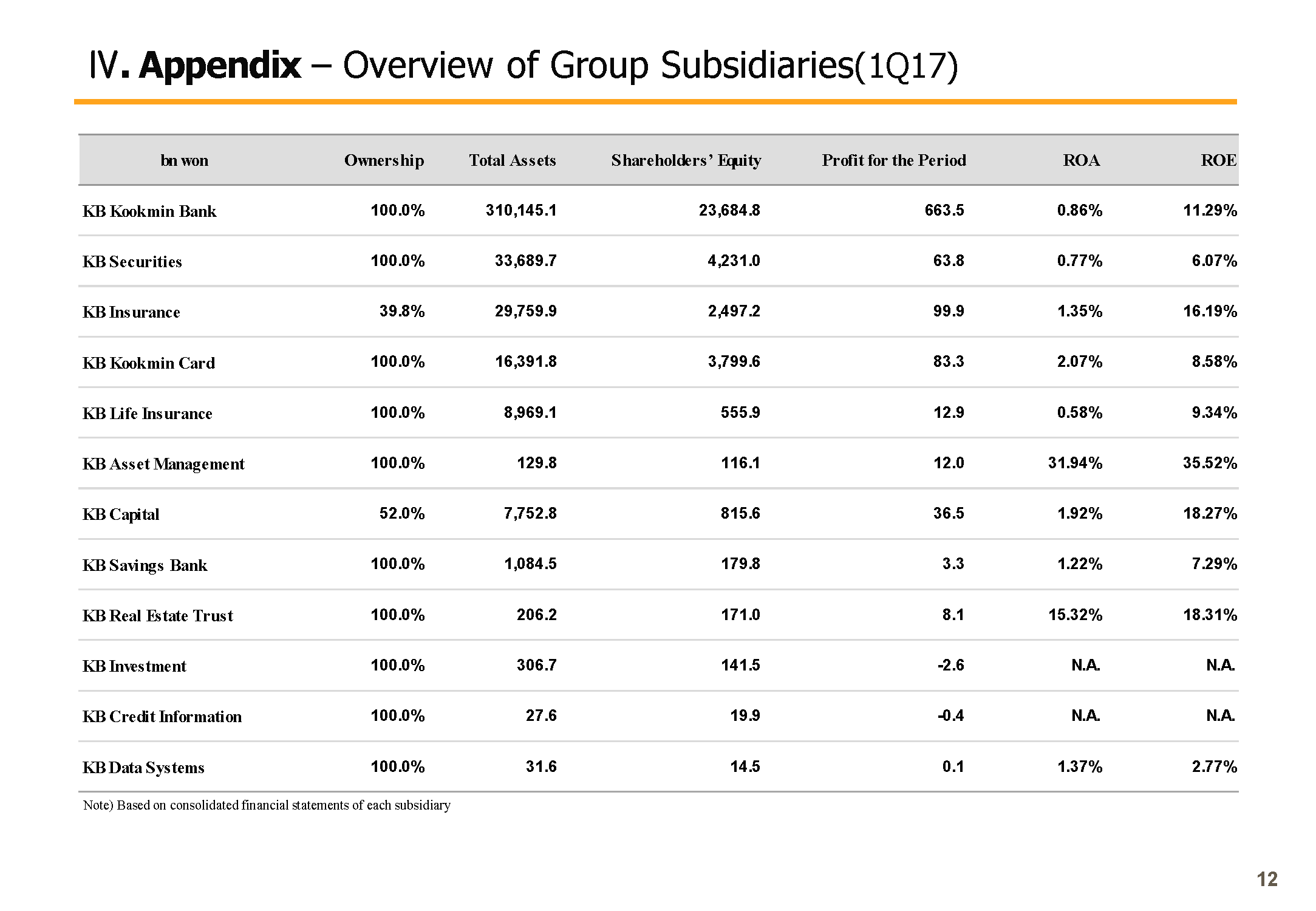

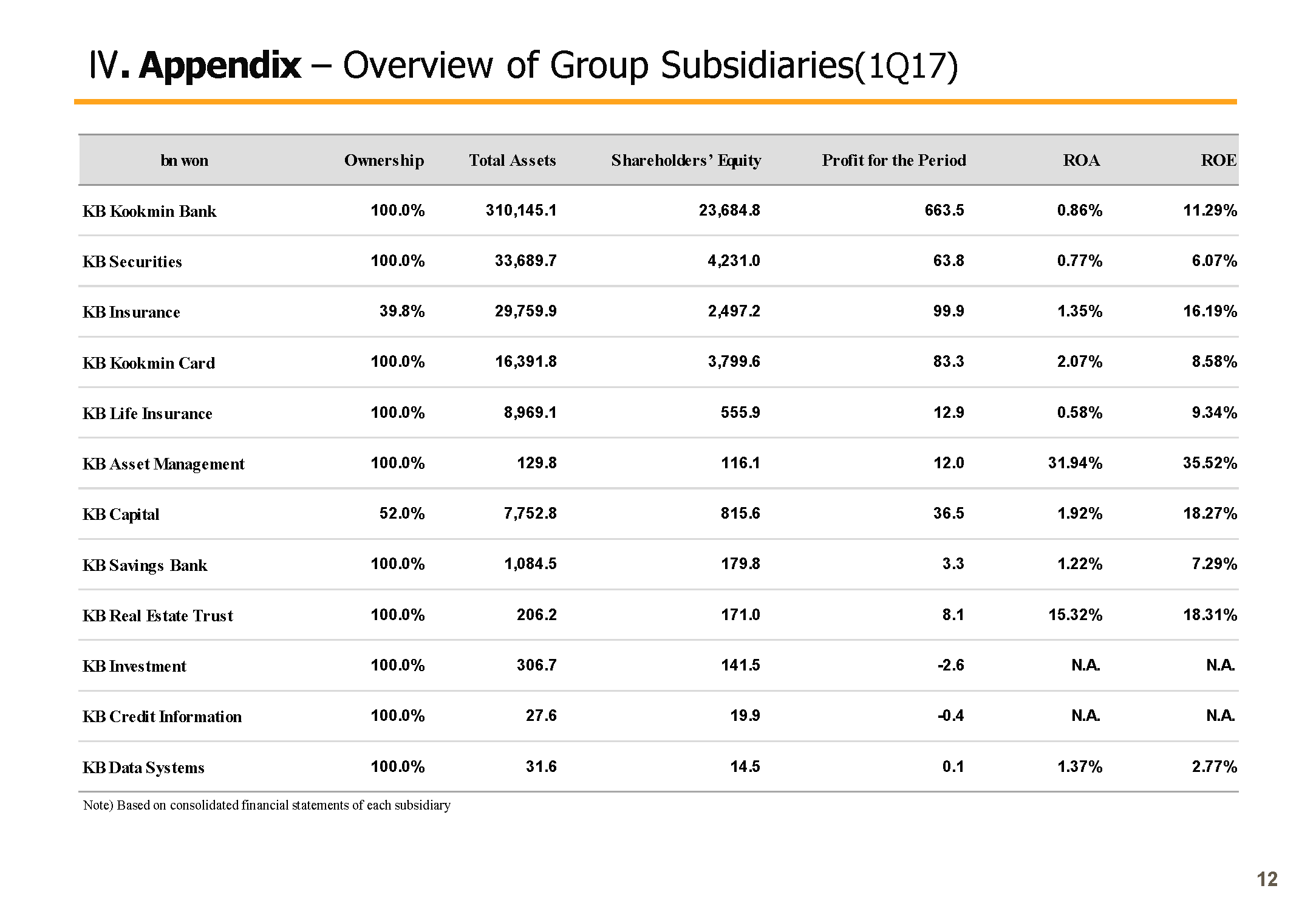

You can find the profitability by major subsidiaries on the bottom left side of the page. KB Securities, which was launched early this year as disclosed today, posted KRW 108.8 billion of net profit in Q1 based on own consolidated financial statement basis. It is quickly adjusting to the collaboration system within the group and improving sales performance. However, KB Securities results are included based on KB Group's consolidated financial statements and recorded as KRW 63.8 billion, so please take this into account for this earnings release.

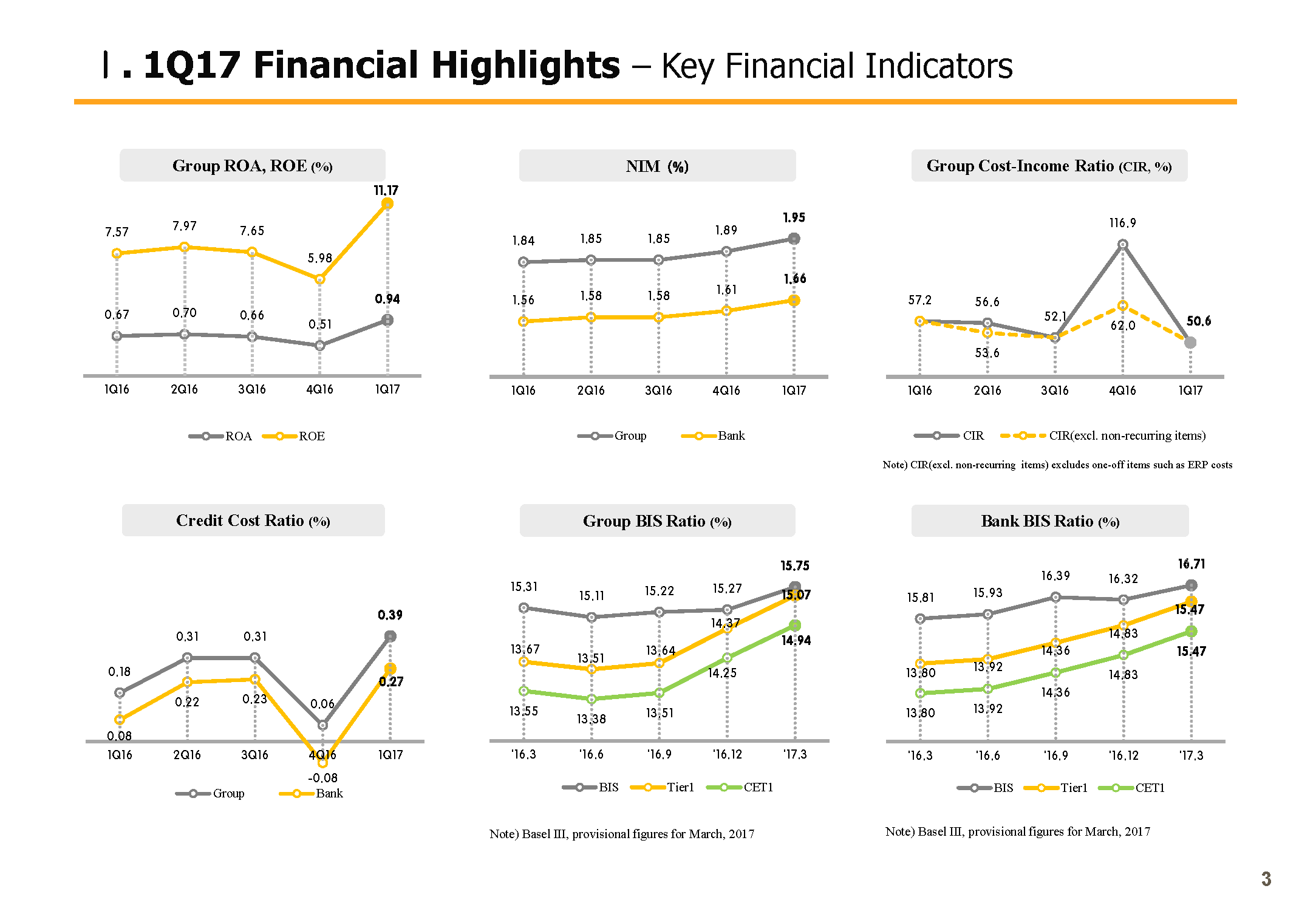

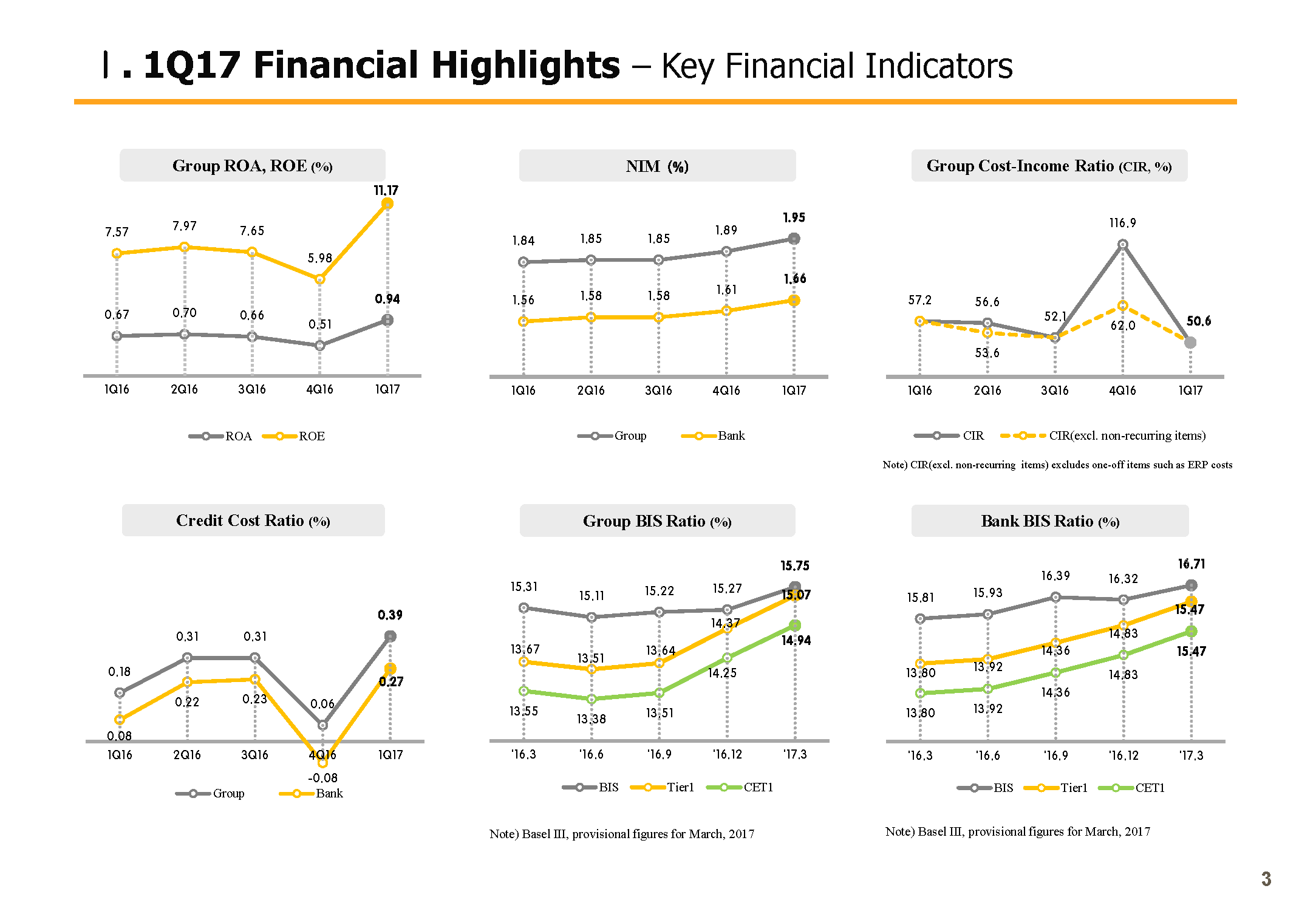

(3p) Financial Highlights

Let me cover the key financial indicators from Page 3. 2017 Q1 group ROE posted 11.17% and 0.94%, respectively. As mentioned previously, it recorded a high level attributable to the noninterest income profitability improvement and one-off factors including BCC stake disposal.

NIM, the main indicator of interest income in Q1, posted 1.95% for the group and 1.66% for the bank, respectively, and rose 6bp and 5bp Q-on-Q, respectively. With the market interest rate edging up gradually, NIM has been steadily edging up each quarter and is supporting the interest income upward trend. KB Group will keep on pursuing growth backed by strong profitability going forward and will steadily strive for appropriate level of margin growth.

Looking at the cost income ratio on the upper right-hand side, you can see the improvement with 50.6% posted in Q1. This is a result of realization of stable top line growth and cost-cutting effect from ERP. We plan to strive to a level lower than 50% mid to long term.

Next, credit cost ratio on the bottom left side. Groups credit cost ratio compared to the group total loans posted 39 bp in Q1 and rose slightly Y-o-Y. But excluding the Daewoo Shipping and Marine Engineering or DSME effect, last year's sound asset quality trend seems to be continuing.

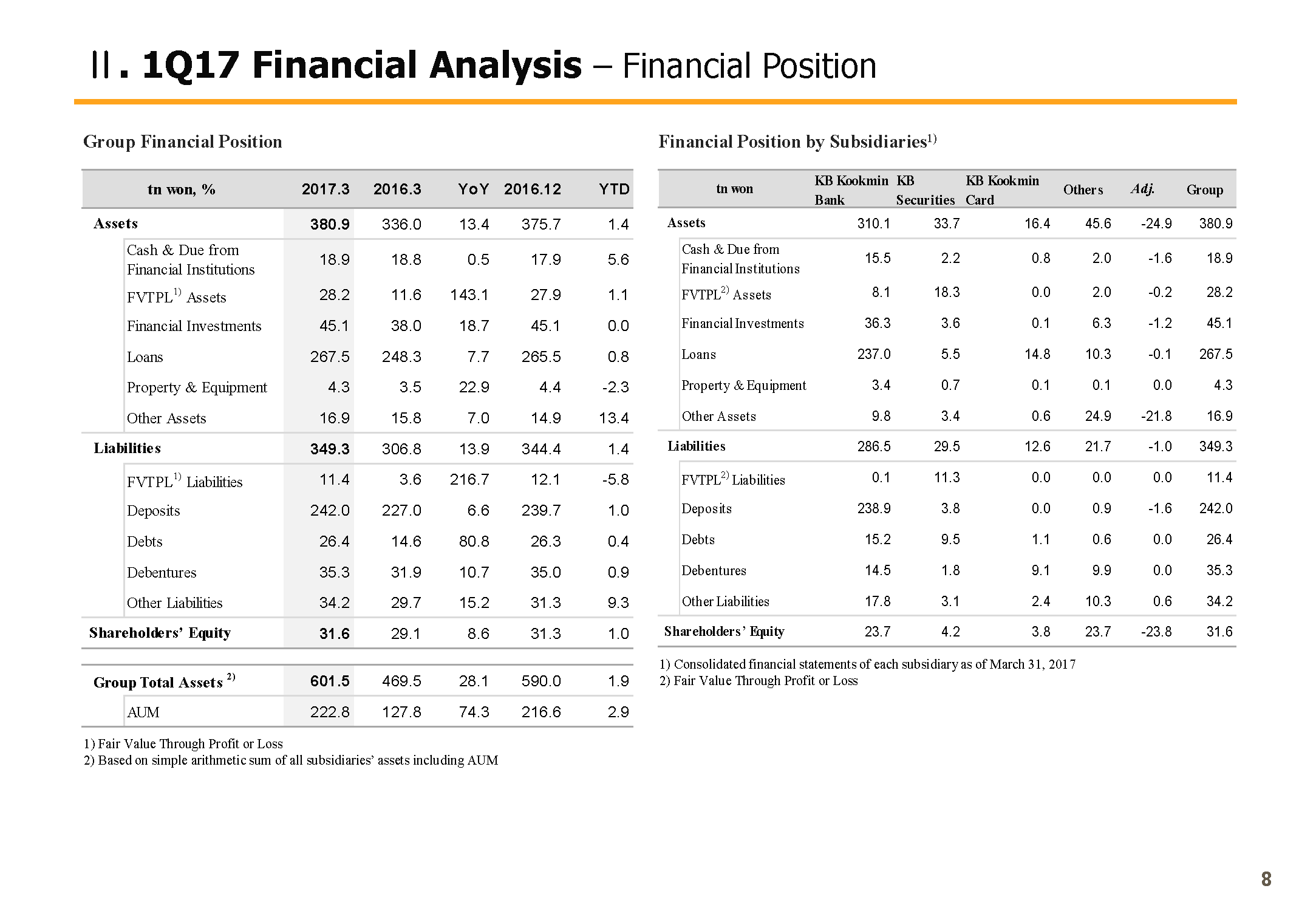

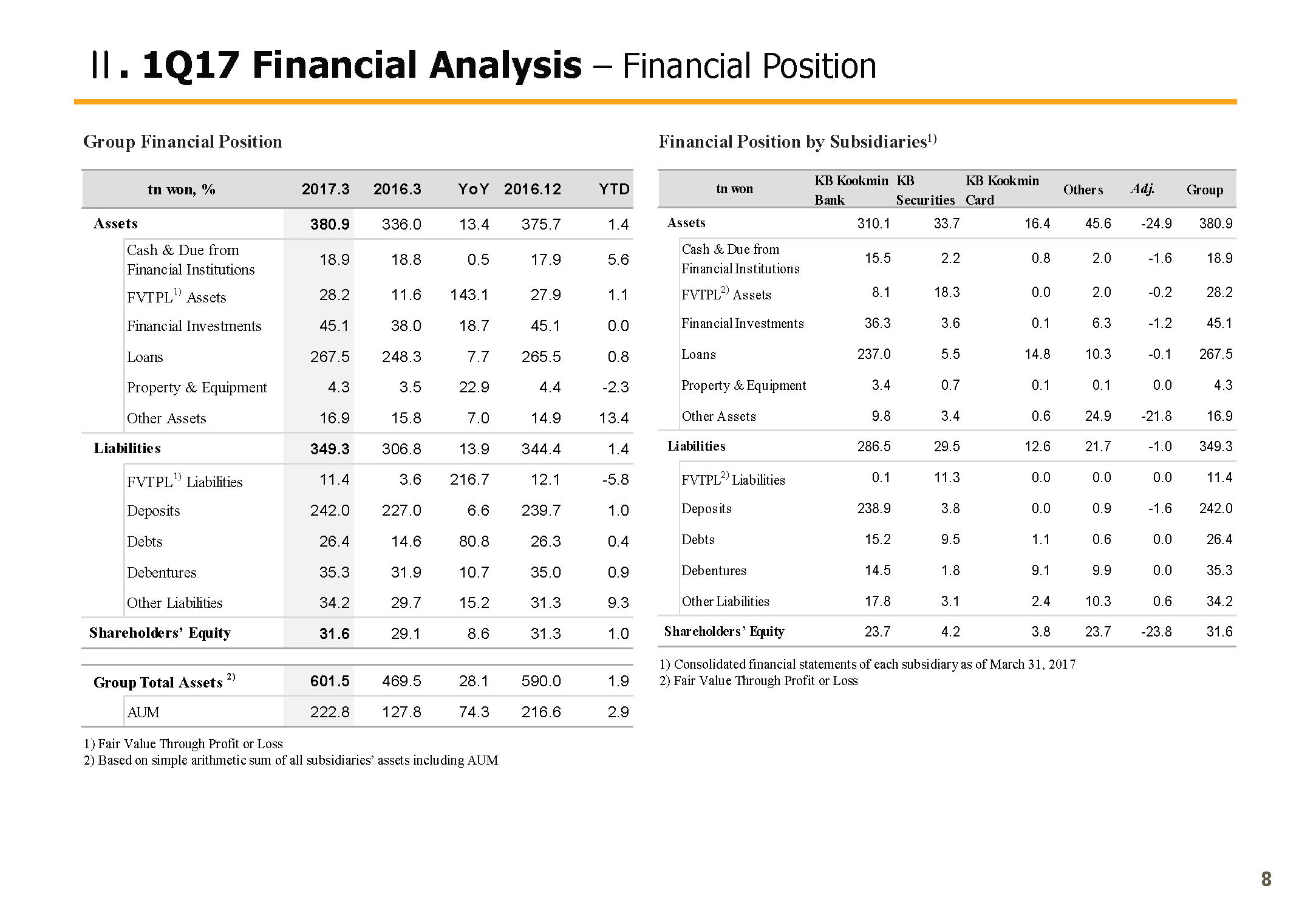

Group and March BIS ratio and CET1 ratio posted 15.75% and 14.94%, respectively. The bank also recorded 16.71% and 15.47%, respectively, an increase compared to the previous year and still maintaining the highest level of capital adequacy in the financial market.

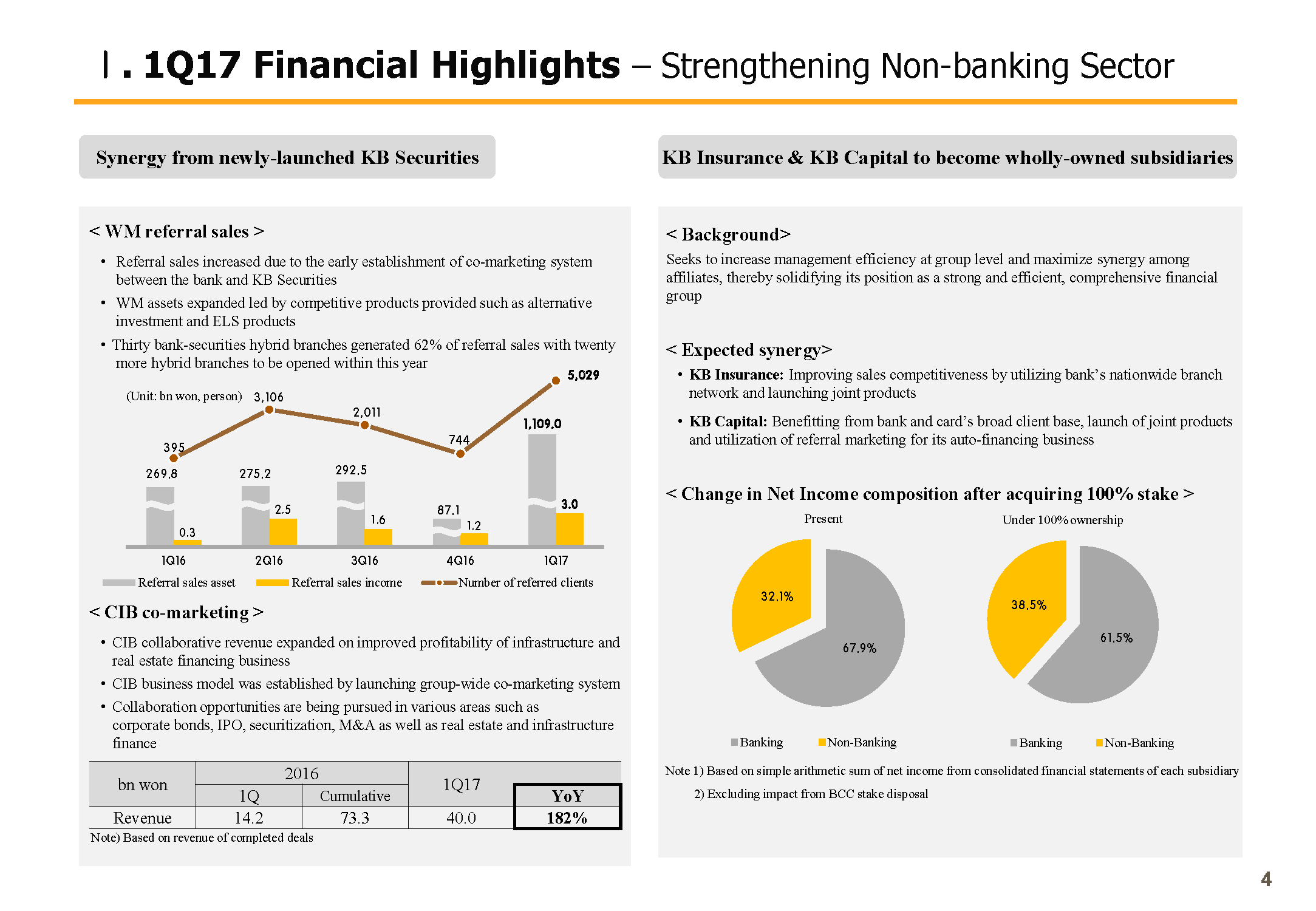

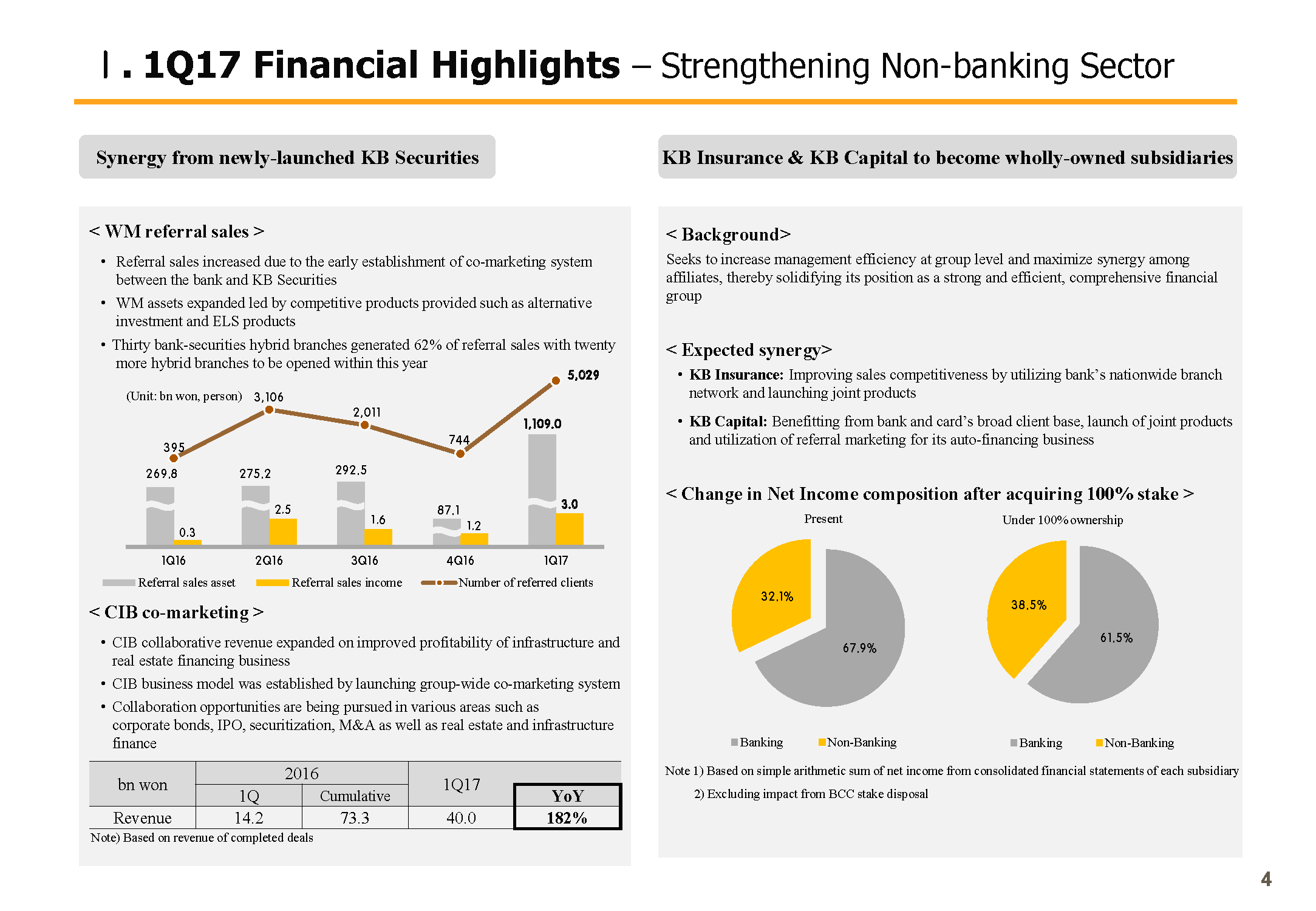

(4p) Strengthening Non-banking Sector

From Page 4, I will elaborate on KB Securities' synergy results and the background behind KB Insurance and KB Capital becoming wholly owned subsidiaries. When you see the synergy creation after KB Securities' consolidation on the top left-hand side, you can see very encouraging results.

First, in WM, you can see the WM referral sales from collaboration between the bank and KB Securities. Referral sales are cases when a customer that was referred by the bank branch buys securities products such as securities, bonds, ELS or fund products from a securities branch for the first time. As you can see on the graph, the assets increased through referral sales in Q1 surpassed KRW 1 trillion, already exceeding last year's annual performance and the numbers of clients and sales income is steadily increasing.

CIB collaboration is also showing high performance centering on infrastructure investment and real estate financing. Successful collaboration in various sectors including corporate bonds, IPOs, securitization is taking place, contributing to synergy generation. Going forward, more efforts to expand synergy will be made through expansion of hybrid branches and a closer collaboration or co-marketing system.

You can see the background and current status behind the 100% stake acquisition of KB Insurance and KB Capital on the right side of the slide. When both subsidiaries become wholly owned subsidiaries, the nonbank portion of the group's net income will reach 39% level from 32% level in Q1. It will be expanded. We will do our best to improve profitability by completing a more balanced group portfolio going forward.

From the next page, I will not be covering them because the contents have been mostly covered in my presentation.

This ends my presentation for KB Financial Group's 2017 Q1 earnings release.

Thank you for listening.