-

2017 1H Business Results

Greetings and Summary

Good afternoon. My name is Peter Kwon, in charge of the IR department at KB Financial Group. We will now start the earnings conference call for our first half results. Thank you very much for joining us today. First, we will start off with a presentation by our CFO, Jae Keun Lee. Also, we have the executives in charge of major subsidiaries present as well to take your questions. Following the presentation by our CFO, we will take your questions.

Now our CFO, Jae Keun Lee, will give you our first half results.

Good afternoon. This is Jae Keun Lee, CFO of KB Financial Group. Before we go over the first half results, I would like to give you a brief business update. In Q2, the financial sector saw favorable business conditions overall with continued Fed rate hikes as announced from end of last year and the KOSPI hitting historical highs supported by better earnings and expectations of an economic recovery.

Meanwhile, in Korea, the new President took office last May and now we are starting to gain better visibility of a new administration's comprehensive policies regarding household debt, which is a potential destabilizing risk for the Korean economy, regulations for the real estate market, which is overheating and showing signs of speculative movements as well as policies to protect the financially vulnerable layers.

We believe such efforts will provide a strong foundation from virtuous cycle and balanced growth for the Korean economy.

As the leading financial group in Korea, KB Financial Group will remain dedicated to its social responsibility and continue its contributions for sound growth. At the same time, we will achieve continuous profitability improvement and efficient capital utilization to deliver greater shareholder value.

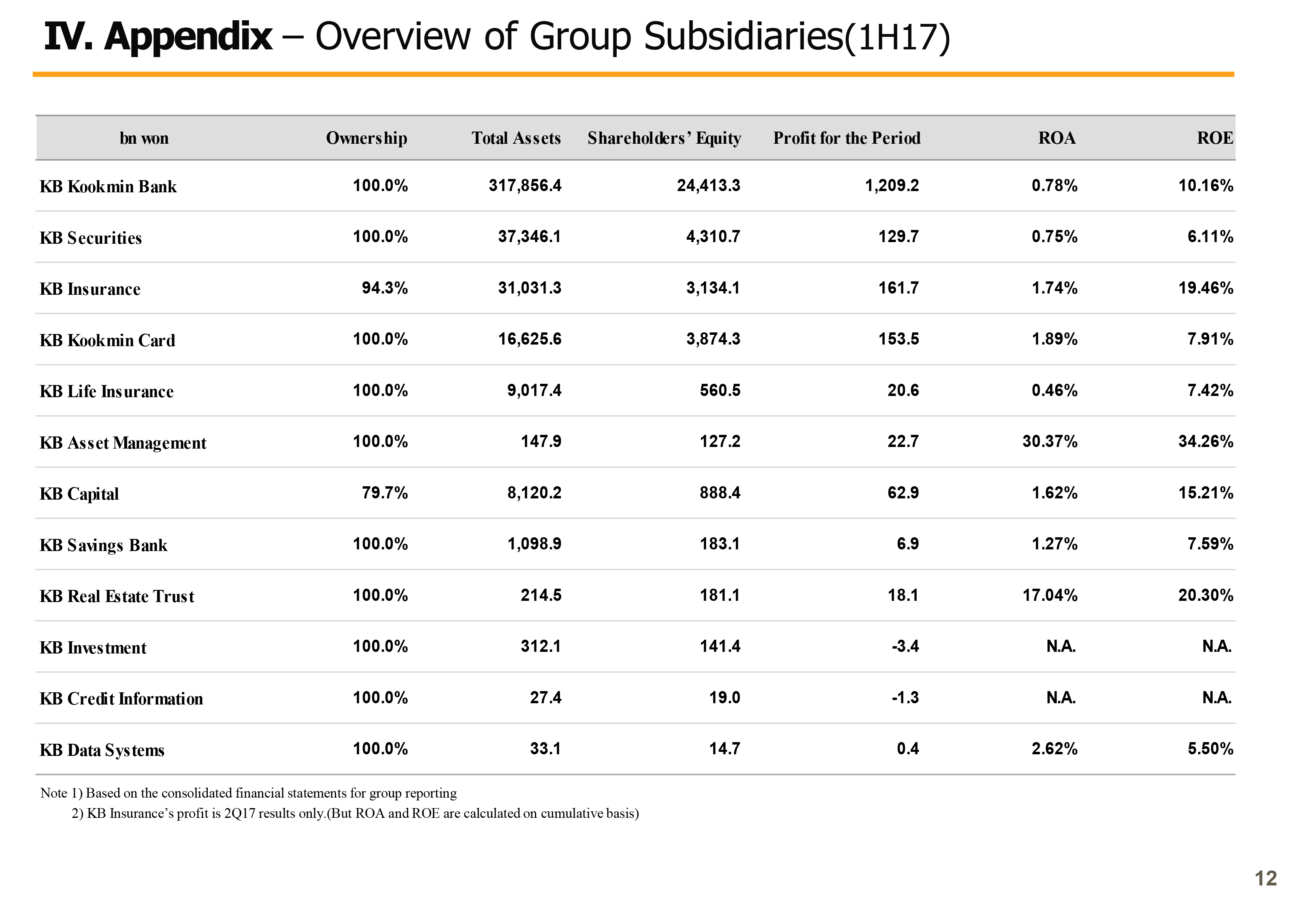

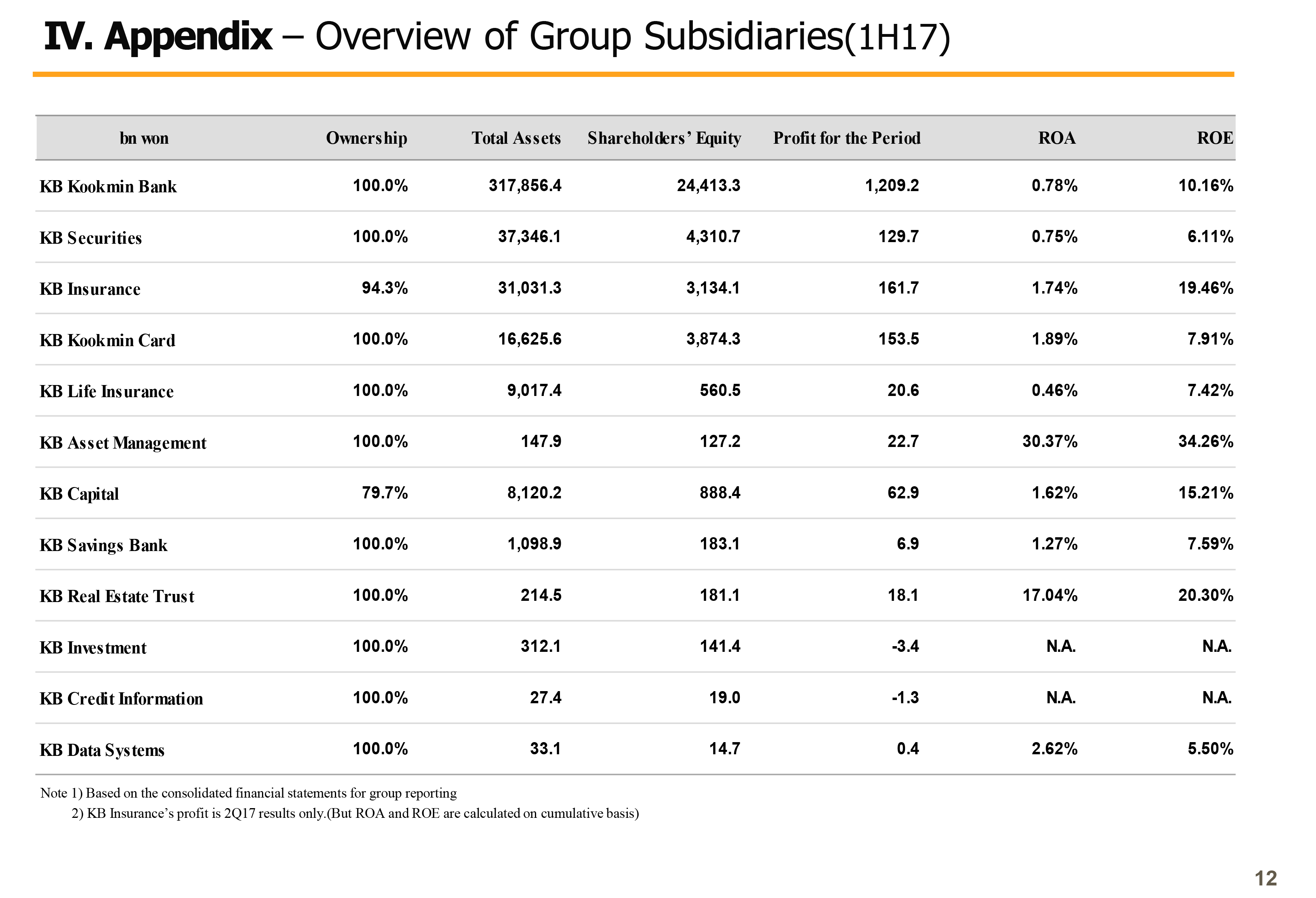

As part of such effort, KB Financial Group started the process of converting KB Insurance and KB Capital into a wholly owned subsidiary since last April. And thanks to the overwhelming support of shareholders of the 2 subsidiaries and KB Financial Group, we have successfully completed purchase of the remaining shares and we were able to complete a more balanced business portfolio and a stable structure for future profitability. KB Insurance has been consolidated into the business results of KB Financial Group from Q2.

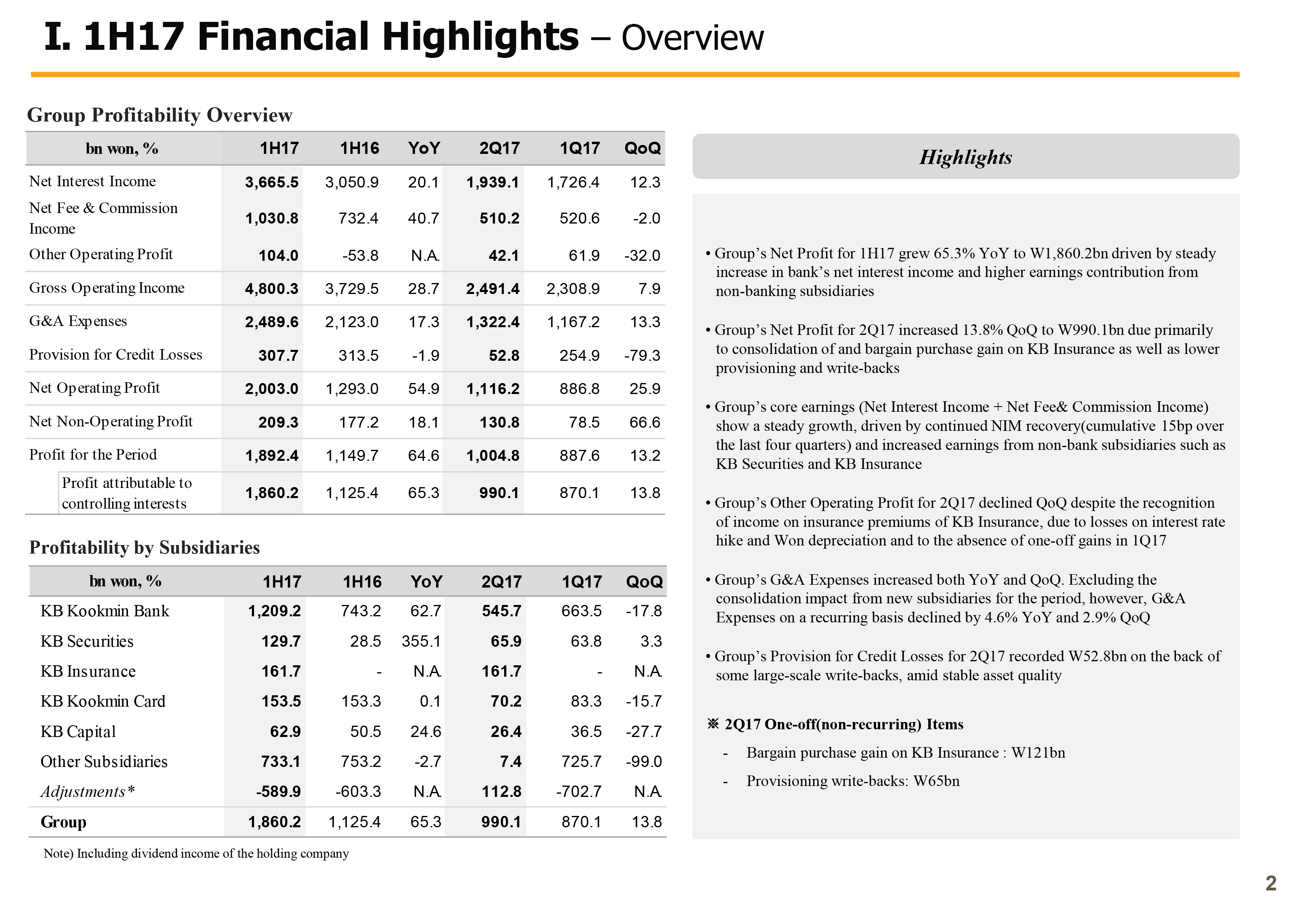

(2p) 1H17 Highlights

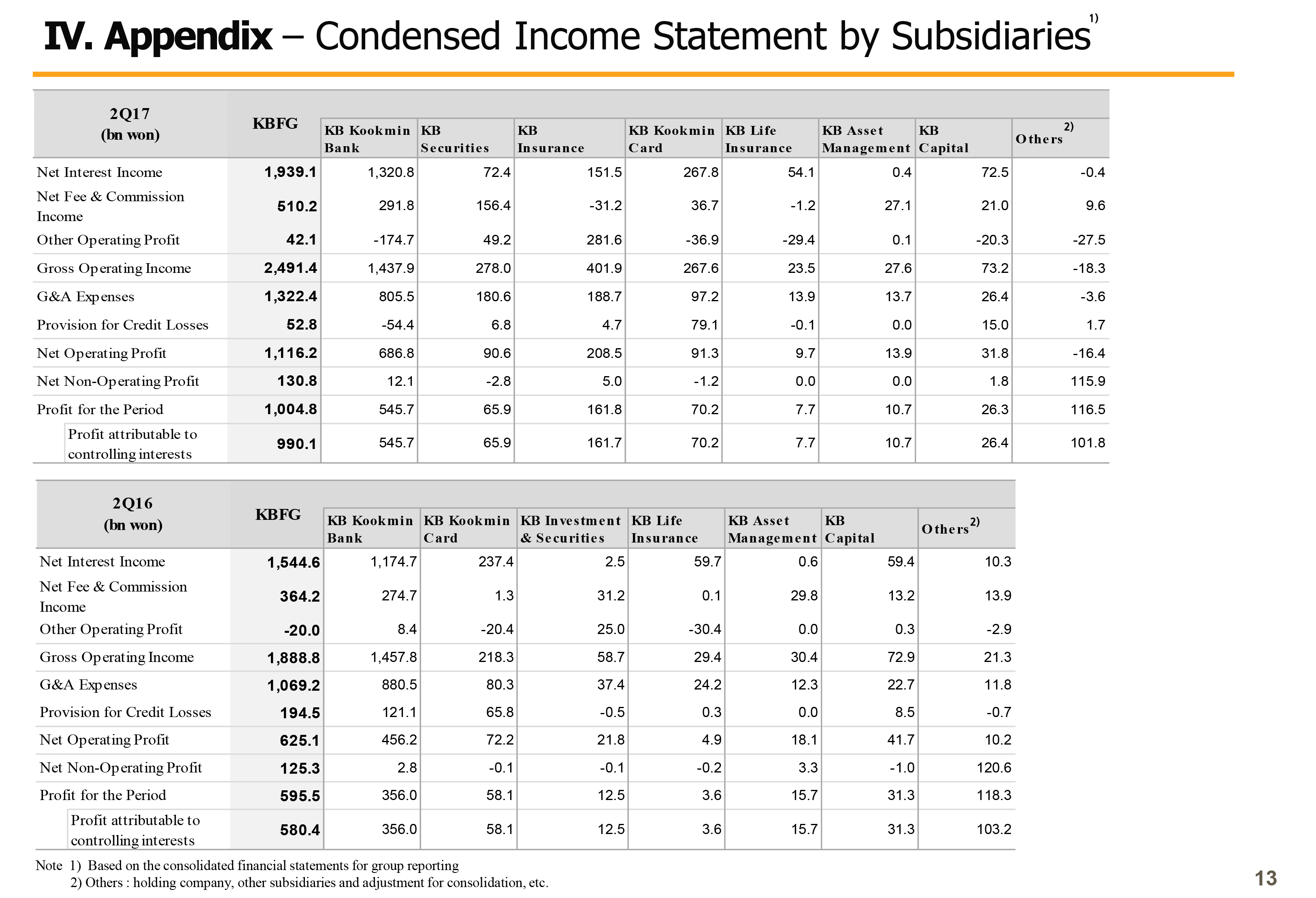

Now let's look at our first half business results. KB Financial Group's 2017 first half net income was KRW 1,860.2 billion, which is the highest half-year performance in the group's history. This is a 65.3% increase year-on-year and this is mainly due to the consolidation of Hyundai Securities and more recently, KB Insurance which has greatly helped boost nonbank income as well as increased bank interest income, driven by improved net interest margin. Net income in Q2 was KRW 990.1 billion, which is a 13.8% increase compared to Q1 which recorded KRW 870.1 billion.

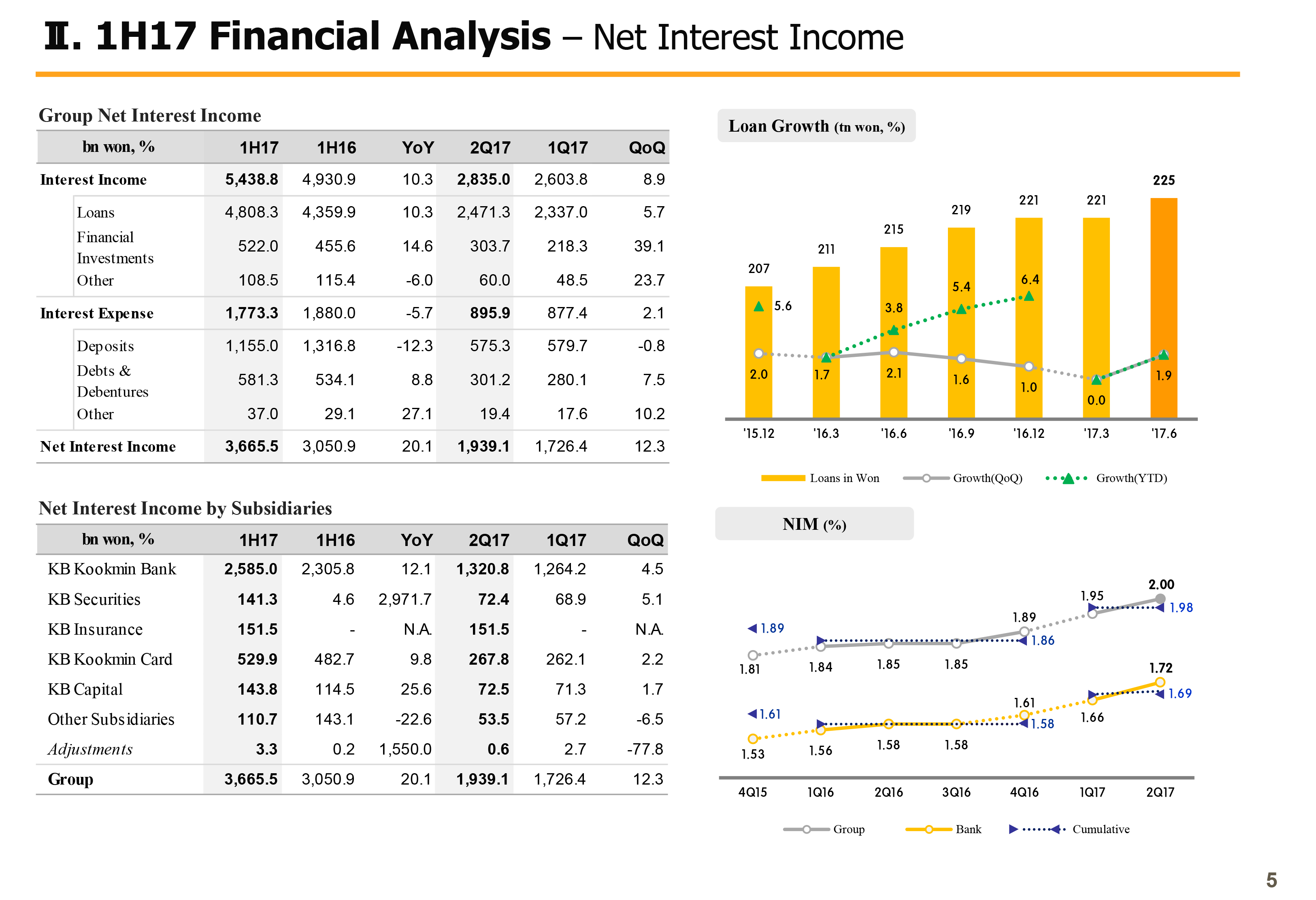

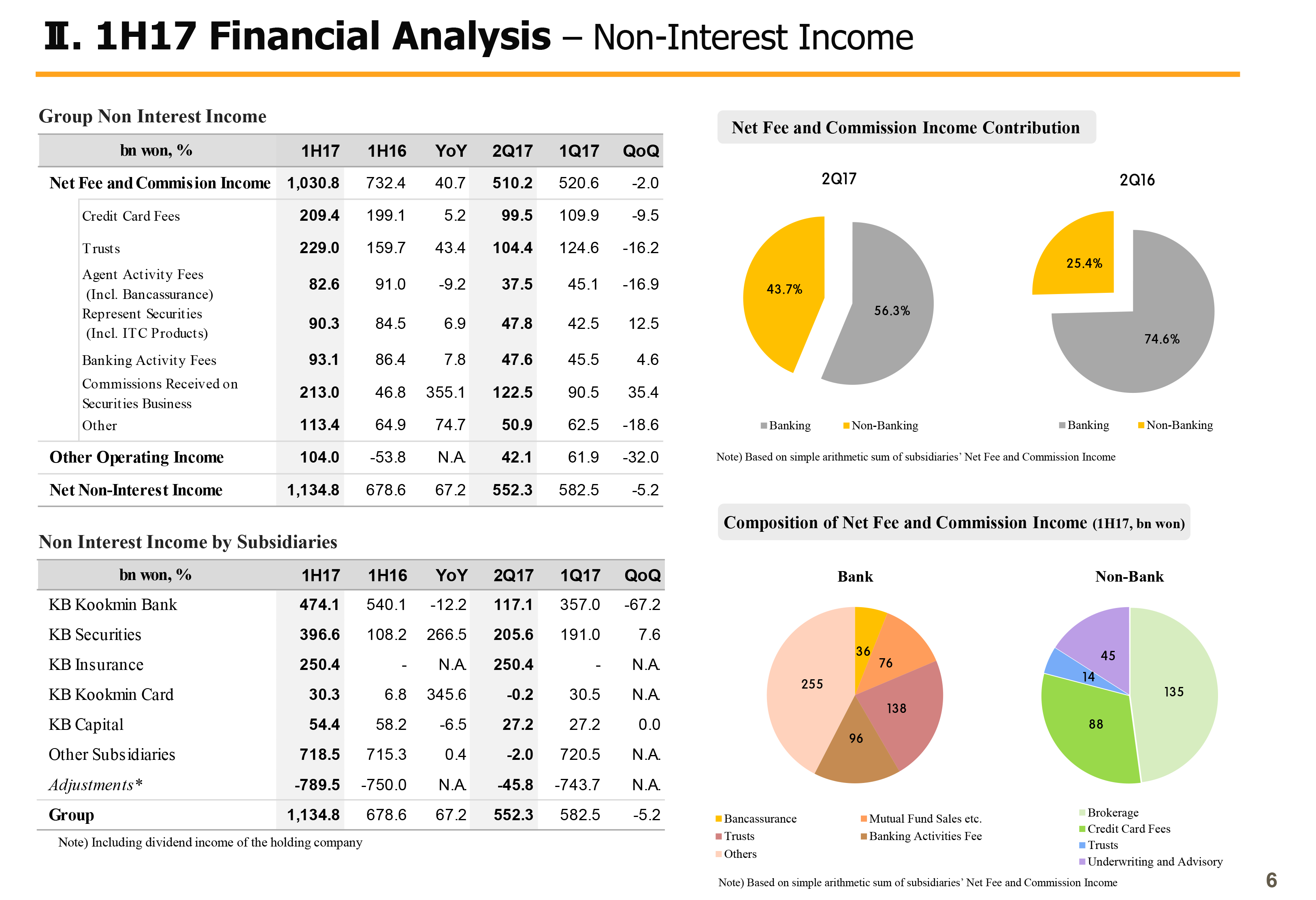

In terms of type of income, Net interest income in first half was KRW 3,665.5 billion, which is a 20.1% increase year-on-year. Net interest income was KRW 1,939.1 billion in Q2, which is 12.3% increase q-on-q. Bank loans in won continued sound growth coupled with continuous improvement in NIM. This also reflects interest income earned by assets owned by KB Insurance. For your reference, bank loans in won growth, which was a bit sluggish in Q1 was 1.9% q-on-q driven by gradual improvements in mortgage-related demand up from Q2, as well as SOHO loans and high-quality SME loans. Fee and commission income was KRW 1,030.8 billion in the first half, which is a 40.7% increase year-on-year.

ELS sales by bank increased supported by rising global equity markets also the launch of the integrated KB Securities. Since that, synergies among group affiliates have increased helping increase security business related fee income such as IB Fees and Trust fees. However, in Q2 despite the continued increase in securities business related fees, sales of bank trust products somewhat became subdued compared to the rapid increase at the start of the year. Also, the consolidation of KB Insurance has added new fee expenses to be recognized, which resulted in fee and commission income decreasing slightly q-on-q.

The group's other operating profit in first half and Q2 was KRW 104.0 billion in the first half, KRW 42.1 billion for the Q2, respectively. In particular, in Q2, consolidation of KB Insurance helped increase insurance-related profits by a significant size. But on the other hand, increase in interest rates and exchange rates increased securities and derivative related losses.

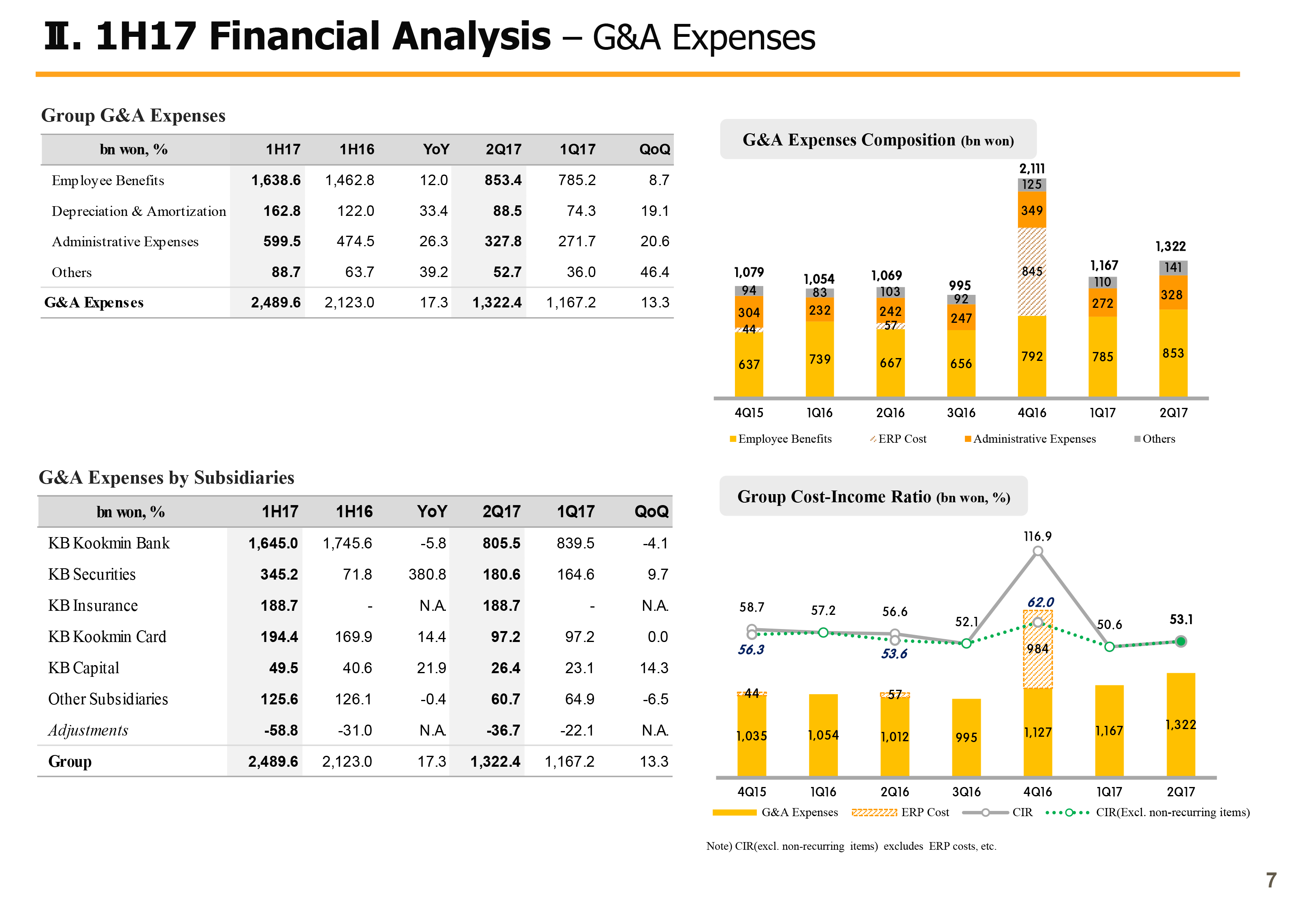

Also in G&A, the first half was KRW 2,489.6 billion, which is a 17.3% increase year-on-year mainly due to increased fixed costs related with integration of non-bank subsidiaries. G&A during Q2 increased by 13.3% compared to the previous quarter but while the effects of KB Insurance are excluded, G&A actually decreased slightly q-on-q reflecting our cost saving efforts such as ERP programs.

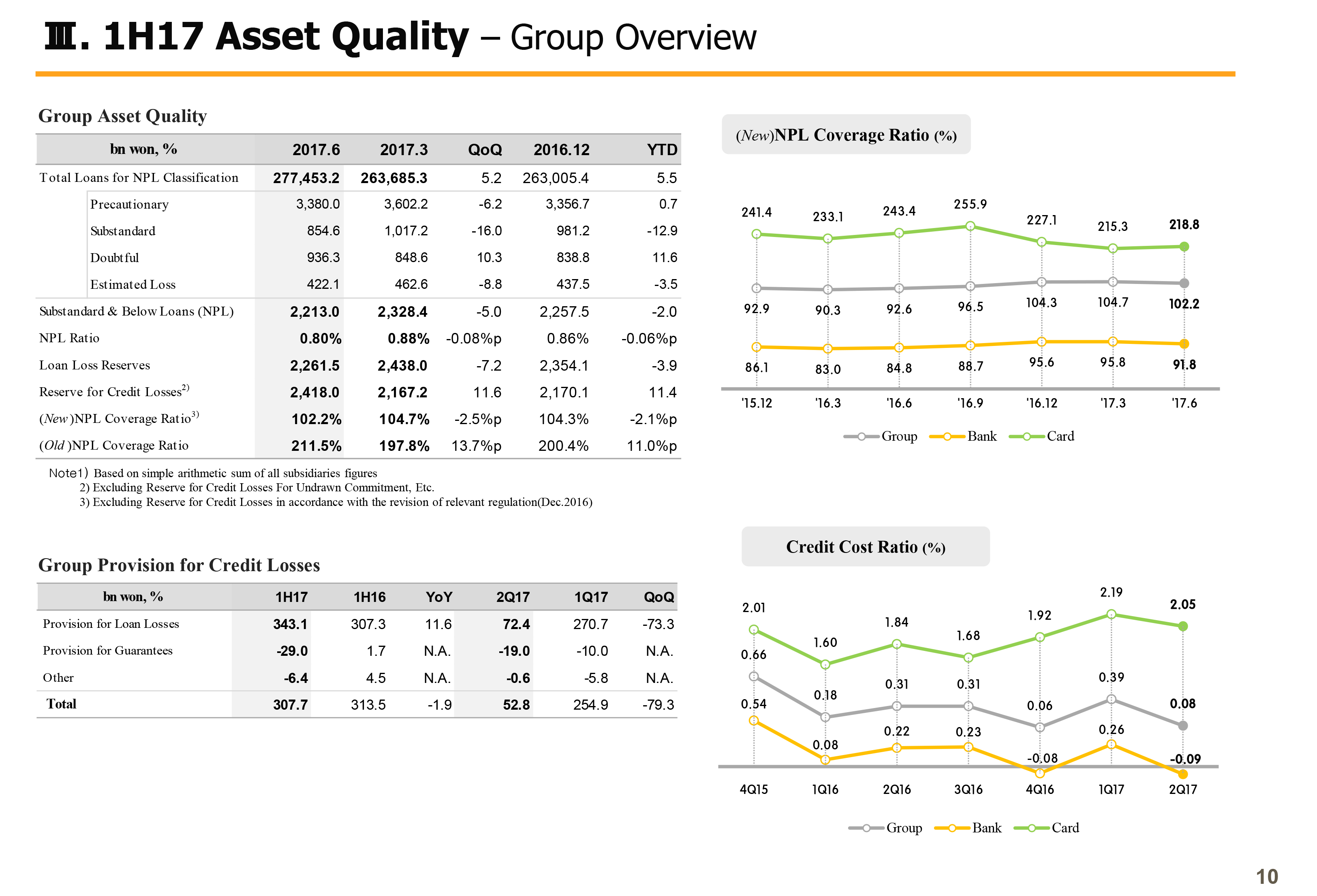

PCL for the first half was KRW 307.7 billion, flat year-over-year but considering the sizable reversal from the accounting standard changes in Q1 last year, this is a significant improvement. Q2 PCL was KRW 52.8 billion with overall stability in asset quality and some write backs including recovery of NPLs. The figure was quite low.

Q2 non-operating income, driven by gains from bargain purchase in additional KB Insurance share acquisitions was up 66.6% q-on-q.

(3p) Financial Highlights

Next on Page 3, I will talk about key financials. 2017 first half ROA and ROE group cumulative were 0.96% and 11.76%, respectively, improving significantly year-over-year. This is due to NIM improvements and falling credit cost leading to sizable improvements in bank profitability and higher nonbanking gains on the back of acquisition of Hyundai Securities and its higher shareholding in KB Insurance.

NIM, which is a key profitability measure, was 2.00% for the group and 1.72% for the bank in the second quarter, improving 5 basis points and 6 basis points q-on-q. With the focus on low-cost deposits and growth mainly around high yielding assets and more sophisticated pricing, we saw spread improvements with constructive quarterly trends continuing. KB Financial Group will continue to endeavor to secure appropriate level of margin through profit-driven growth.

On the top right, you will see the cost income ratio coming in at 53.1% in Q2, slight rise q-on-q. However, this is due to higher G&A, driven by consolidation effect from KB Insurance and losses from securities and derivatives on interest rates and exchange rate rises. Apart from such factors, group recurring basis CIR is maintained at a quite stable level.

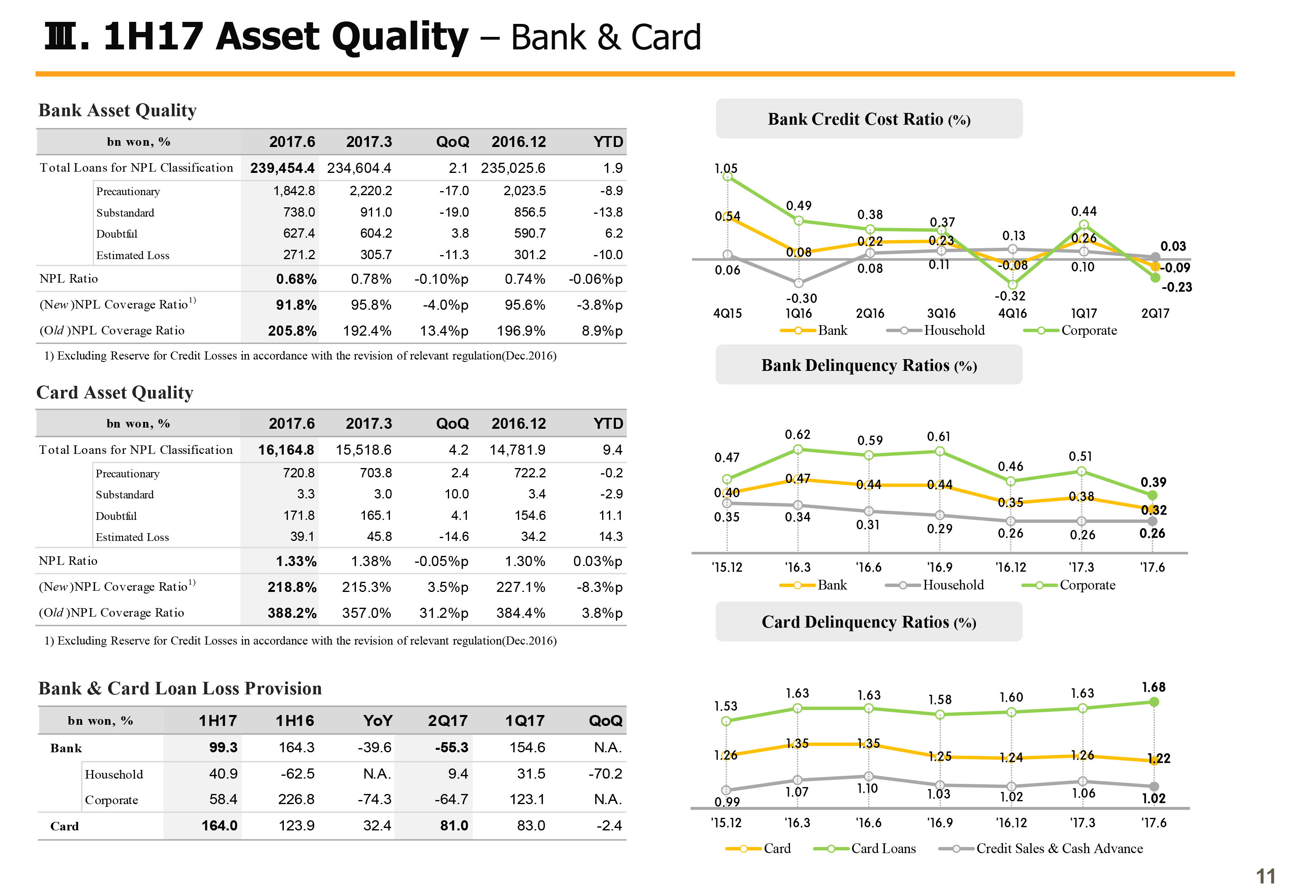

On the bottom left is loan loss provision. Q2 LLP against a base of total loans was 8 basis points for the group and negative 9 basis points for the bank posting an improvement q-on-q. And even excluding the one-off reversals, it still continues to show a steady trend.

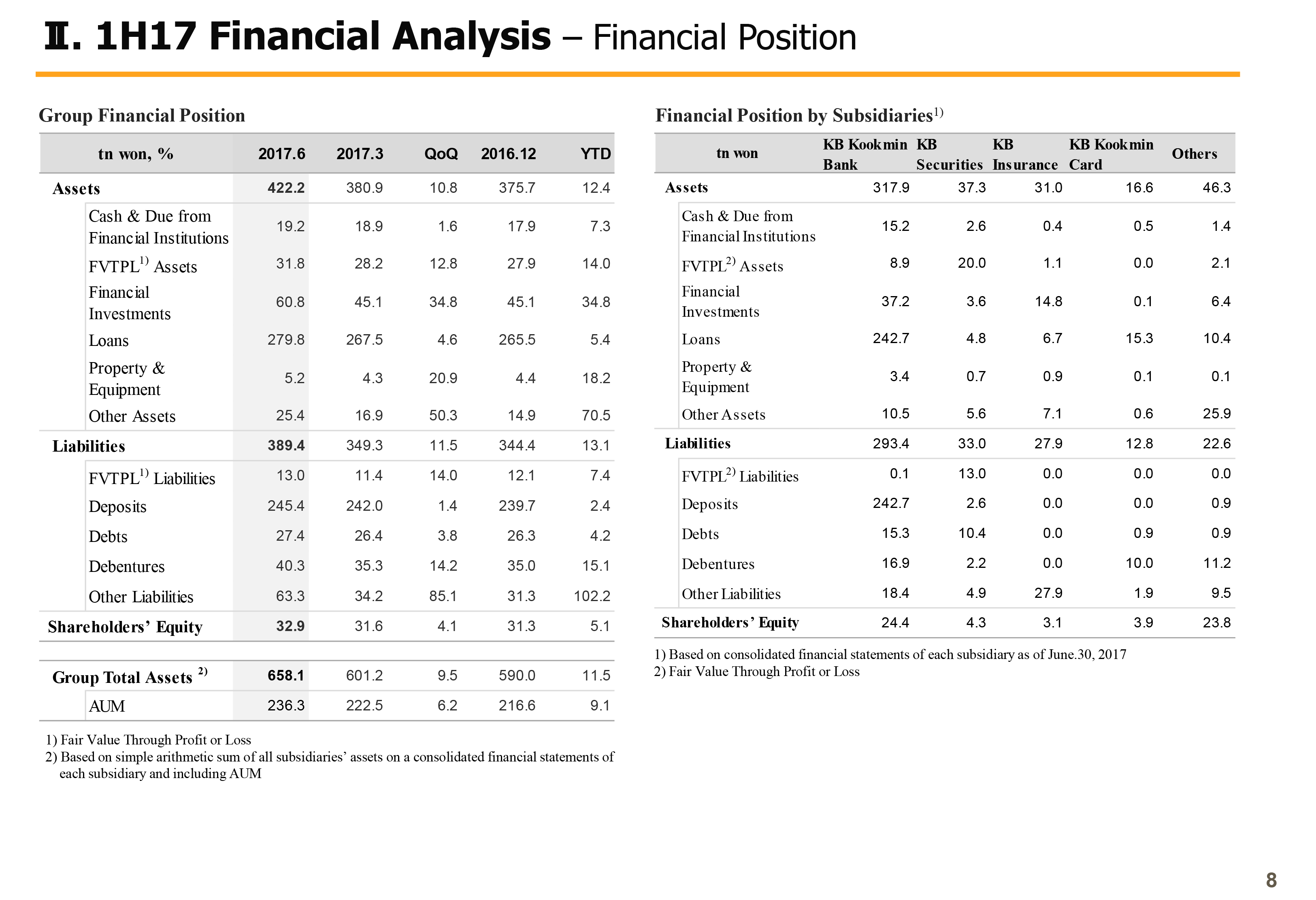

Group BIS ratio and CET1 ratios were 15.47% and 14.77%, respectively as of end of June. Despite group's net profit increased with the increases in risk-weighted assets and KB Insurance shareholding increased the ratio dipped marginally q-on-q. For the bank due to the rise in RWA, driven by loan growth, its capital ratios dipped slightly but it's still keeping to the indices highest capital adequacy level.

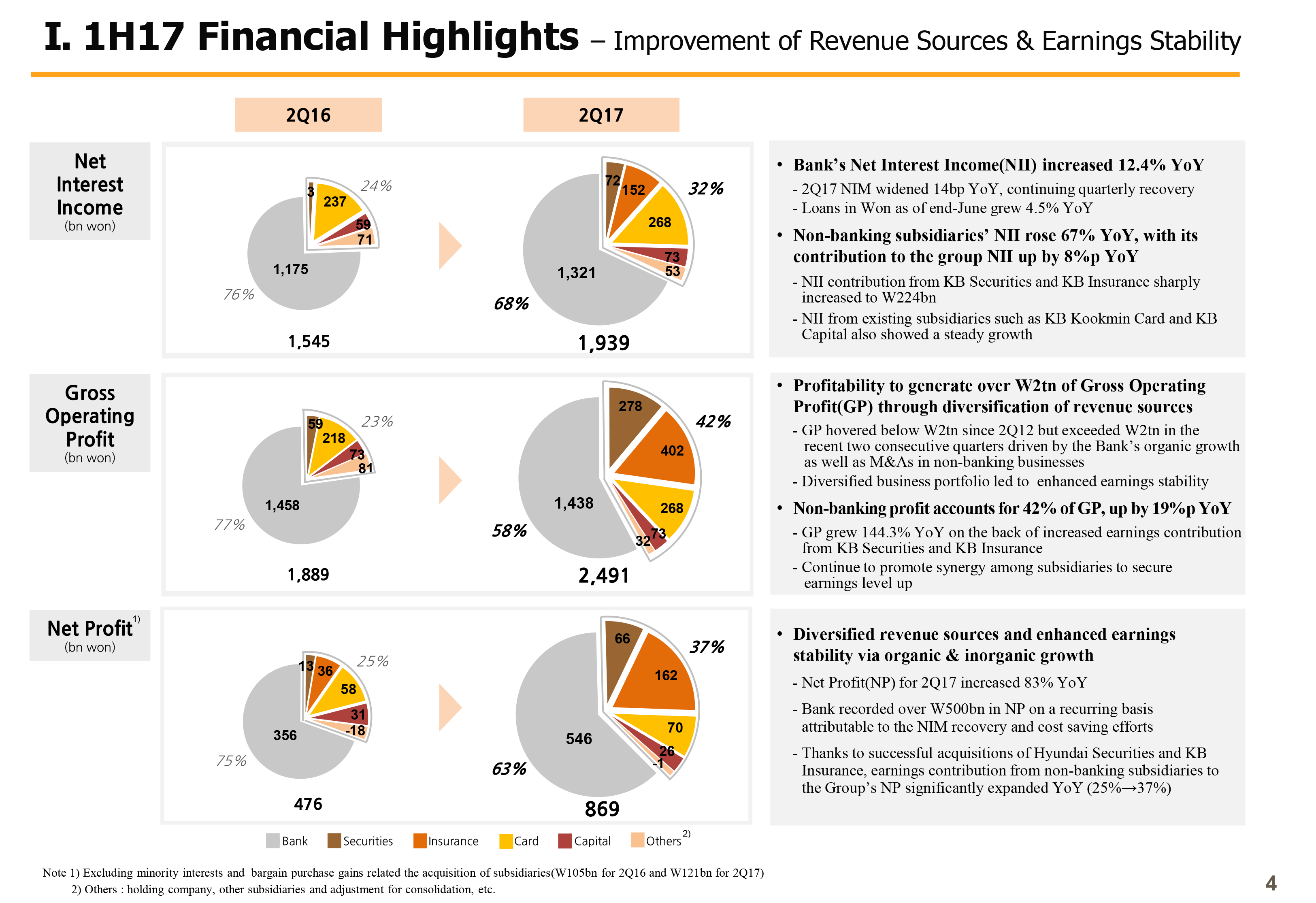

(4p) Improvement of Revenue Sources & Earnings Stability

Page 4 compares key metrics across bank and non-bank affiliates and key P&L line items between Q2 of 2016 and Q2 of 2017. It shows our efforts so far to diversify revenue sources and improve stability in profit are bringing visible results. First is on net interest income. Q2 2016 NII was around KRW 1,555 billion and the Group's net interest income in Q2 2017 was around KRW 1,939 billion, rising 26%. This is thanks to sound loan growth and our continuous efforts to enhance NIM, align the banks to regain its core capacity in generating interest income and also from the consolidation effects from securities and P&C insurance affiliates, the steady interest income growth from existing affiliates of KB Card and KB Capital. For your information, bank's NIM over the recent 4 quarters displayed sustained improvement and in a cumulative basis increased a total of 14 basis points.

Q2 Group’s operating profit increased significantly year-over-year outperforming quarterly size of KRW 2 trillion. Gross operating profit rise was driven mainly by improvements in interest income and bigger contributions from non-bank affiliates. Nonbanks portion out of the total operating income showed meaningful increase from 23% in Q2 of 2016 to 42% in Q2 of 2017.

Last item is on the group's net profit. We took out the gain from bargain purchase impact for comparison purposes. The graph shows Q2 2017 net profit of KRW 869 billion, a sizable rise year-over-year from last year's KRW 476 billion. Nonbank's contribution in the mix increased meaningfully from 25% to 37%.

With the profitability improvement, cost cutting and asset quality control efforts of the bank, we brought organic growth opportunities, realizing recurring net profit level of KRW 500 billion. On the non-bank side, the Hyundai Securities acquisition increased shareholding of the Insurance and KB Capital, through such strategic approaches, we attained inorganic growth.

KB Financial Group will continue to look through our business portfolio to diversify profit sources and bring organic and inorganic growth opportunities so as to enhance profitability and stability in earnings. Please refer to the following pages as they set out the details to what I have just explained. That brings me to the end of first half 2017 earnings presentation for KB Financial Group. Thank you very much.