ESG Governance

We will realize banking that changes the world by promoting environmentally and socially responsible management and good governance.

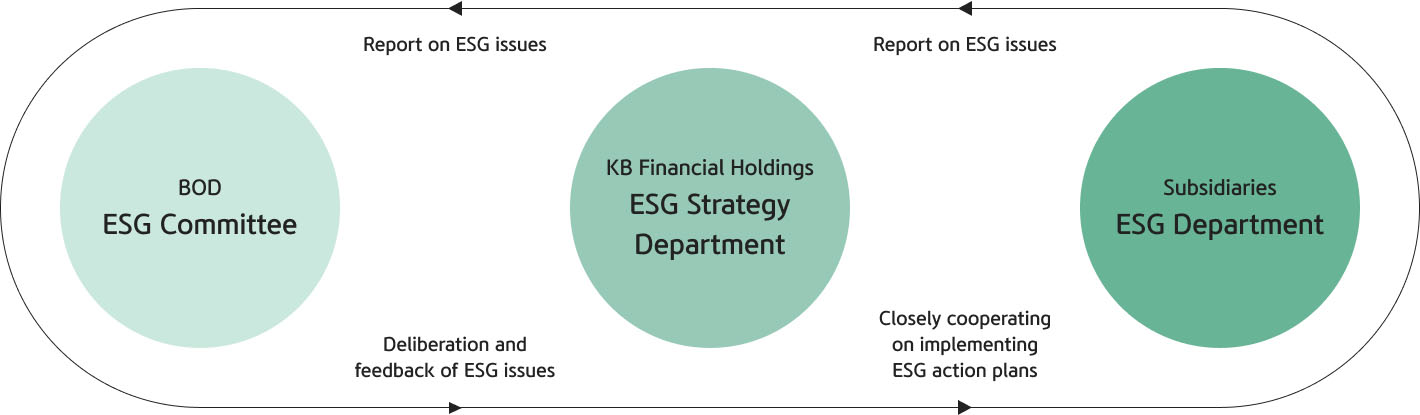

KB Financial Group has established a group ESG governance system to ensure that ESG management is fully internalized and implemented.

In 2020, KB Financial Holding became the first company in the financial sector with an ESG Committee under the Board of Directors and is further developing ESG management through organic communication with each affiliate's ESG council. Furthermore, KB Financial Group has established an ESG organization for each affiliate to assist each company in ESG management.

The ESG Committee is the highest executive authority for the Group's ESG management with members composed of all directors on the Board. The ESG Committee establishes Group strategies and policies on non-financial factors (environmental, social, and governance) that impacts our corporate value and sustainability. The ESG Committee also sets operational limits for annual contributions and manages and supervises the implementation of ESG strategies and policies to facilitate practical ESG management.

The ESG Council is an organization that supervises the ESG management of each affiliate, establishes the ESG strategic direction of each company, and pursues collaboration with related departments for the effective implementation of strategic tasks. In addition, it periodically monitors the implementation progress of ESG strategic tasks and discusses major activities such as ESG products and investments for each company. Furthermore, the ESG Council voluntarily reports to the BODs of each affiliate at least once a year on the major status and report the ESG implementation status of affiliates to the 'Group Expansion Management Committee' on a quarterly basis to share the status of ESG implementation among affiliates and strengthen group-wide ESG management.

KB Financial Holdings and its 11 affiliates have formed ESG organizations to support the BOD and ESG committees.